Is LibBit safe?

Pros

Cons

Is Libbit Safe or Scam?

Introduction

Libbit is an online forex brokerage that positions itself within the competitive landscape of the foreign exchange market. With claims of offering a diverse range of assets including forex pairs, commodities, and cryptocurrencies, Libbit aims to attract traders looking for robust trading opportunities. However, assessing the reliability of a forex broker is crucial for traders, as the industry is rife with scams and unregulated entities. Traders need to ensure that their funds are safe and that they are dealing with a legitimate platform. This article employs a comprehensive evaluation framework, drawing from multiple sources, to determine whether Libbit is a trustworthy broker or a potential scam.

Regulation and Legitimacy

Regulation is a fundamental aspect of any financial service provider, particularly in the forex trading sector. A regulated broker is subject to oversight by a financial authority, which helps ensure that they adhere to strict operational standards. Unfortunately, Libbit has been identified as an unregulated entity, raising significant red flags for potential investors.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of valid regulatory oversight means that Libbit operates without the accountability that comes with being licensed by a recognized authority. This lack of regulation can expose traders to various risks, including the potential for fraud and the inability to recover funds in case of disputes. In the forex industry, regulatory quality is paramount; brokers regulated by reputable authorities like the FCA (UK), ASIC (Australia), or CySEC (Cyprus) offer a higher level of investor protection. Libbit's status as an unregulated broker should prompt traders to exercise extreme caution.

Company Background Investigation

Libbit claims to have been operational for several years, yet its history and ownership structure remain somewhat obscure. The broker's website lacks transparency regarding its founding and management team, which is a concerning aspect for potential investors. A credible broker typically provides detailed information about its history, ownership, and operational structure, fostering trust among its clientele.

The management team's professional background is another critical factor in assessing a broker's reliability. Regrettably, there is little information available on the qualifications or experience of Libbit's leadership, which raises questions about their ability to manage a financial services firm effectively. Furthermore, the broker's lack of transparency regarding its corporate structure and operational practices is troubling, as it limits investors' ability to make informed decisions.

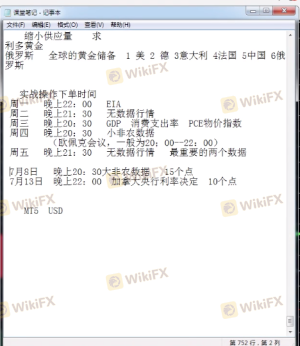

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is vital. Libbit offers various account types with differing minimum deposits and leverage options. However, the absence of detailed information regarding fees and commissions on its website leaves much to be desired.

| Fee Type | Libbit | Industry Average |

|---|---|---|

| Spread on Major Pairs | From 0.1 pips | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Rate | N/A | Varies |

The fee structure at Libbit appears to be competitive at first glance, especially with low spreads. However, the lack of clarity surrounding commissions and overnight interest rates could indicate hidden fees that traders may encounter. This ambiguity can lead to unexpected trading costs, making it essential for traders to clarify these details before committing their funds.

Client Funds Security

The safety of client funds is a paramount concern when selecting a forex broker. Libbit's website does not provide comprehensive information about its security measures, which raises concerns about how client funds are managed. The absence of segregation of client accounts, which is a standard practice among regulated brokers, is particularly alarming.

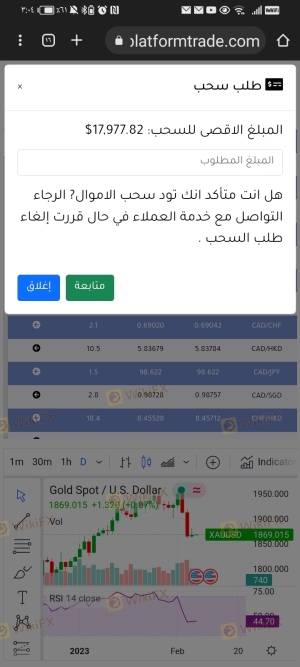

Additionally, the lack of information regarding investor protection schemes or negative balance protection policies further exacerbates concerns about the safety of funds deposited with Libbit. Historical complaints from users indicate that some have faced difficulties in withdrawing their funds, which is a significant warning sign for potential investors.

Customer Experience and Complaints

Customer feedback plays a crucial role in assessing the reliability of a broker. Reviews and complaints about Libbit reveal a troubling pattern of negative experiences. Many users have reported issues related to withdrawal difficulties, lack of responsive customer support, and problems accessing their accounts.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Access Problems | High | Poor |

| Customer Support Issues | Medium | Poor |

Typical cases include users claiming that their funds were not accessible after making deposits, with some alleging that Libbit's customer service was unhelpful in resolving their issues. Such complaints should not be taken lightly, as they highlight significant operational deficiencies within the brokerage.

Platform and Trade Execution

The trading platform's performance, stability, and user experience are critical components of a broker's offering. Libbit's platform has received mixed reviews, with some users reporting issues related to execution quality and slippage. The absence of well-known trading platforms like MetaTrader 4 or 5 raises questions about the reliability of their proprietary platform.

Concerns about order execution quality, including instances of slippage and rejected orders, have been reported by users. These issues can severely impact trading outcomes, making it essential for traders to consider the platform's reliability before investing.

Risk Assessment

Using Libbit as a forex broker presents several risks that potential investors should carefully consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases fraud risk. |

| Fund Security Risk | High | Lack of transparency regarding fund management. |

| Customer Service Risk | Medium | Poor response to complaints and withdrawal issues. |

To mitigate these risks, potential investors should conduct thorough due diligence, consider using regulated brokers, and avoid depositing large sums until they are confident in the broker's legitimacy.

Conclusion and Recommendations

In conclusion, the evidence suggests that Libbit is not a safe trading option, and there are significant indicators pointing towards it being a potential scam. The lack of regulation, poor customer feedback, and issues with fund withdrawals are all critical factors that raise alarms.

Traders should exercise extreme caution and consider alternative options that are regulated and have a proven track record of reliability. Recommended alternatives include brokers regulated by top-tier authorities such as the FCA or ASIC, which provide a higher level of investor protection and transparency.

In summary, it is advisable for traders to steer clear of Libbit and seek out safer, more reliable trading platforms to ensure the security of their investments.

Is LibBit a scam, or is it legit?

The latest exposure and evaluation content of LibBit brokers.

LibBit Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LibBit latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.