Regarding the legitimacy of MahiMarkets forex brokers, it provides ASIC, FMA, FCA and WikiBit, (also has a graphic survey regarding security).

Is MahiMarkets safe?

Business

License

Is MahiMarkets markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

EC MARKETS FINANCIAL LIMITED

Effective Date: Change Record

2012-02-17Email Address of Licensed Institution:

sargon.e@ecmarkets.com.auSharing Status:

No SharingWebsite of Licensed Institution:

https://ecmarkets.com.au/Expiration Time:

--Address of Licensed Institution:

LEVEL 13, 1 ALBERT ST AUCKLAND CENTRAL AUCKLAND 1010 NEW ZEALANDPhone Number of Licensed Institution:

+64 9 302 0798Licensed Institution Certified Documents:

FMA Market Making License (MM)

Financial Markets Authority

Financial Markets Authority

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

EC MARKETS FINANCIAL LIMITED

Effective Date: Change Record

2012-02-14Email Address of Licensed Institution:

info@ecmarkets.co.nzSharing Status:

No SharingWebsite of Licensed Institution:

www.ctrlinvestments.com, www.ecmarkets.co.nzExpiration Time:

--Address of Licensed Institution:

Level 1, 1 Albert Street, Auckland Central, Auckland, 1010, New ZealandPhone Number of Licensed Institution:

+093020798, +64 09 3020798Licensed Institution Certified Documents:

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Scale Capital Limited

Effective Date:

2017-03-16Email Address of Licensed Institution:

bonnie.cassidy@mahifx.com, info@scale-capital.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

https://www.scale-capital.co.uk/Expiration Time:

2022-05-15Address of Licensed Institution:

70 Gracechurch Street London EC3V 0HRE C 3 V 0 H R UNITED KINGDOM, 70 Gracechurch Street, London, EC3V 0HRPhone Number of Licensed Institution:

4402037639220, +4402039687886Licensed Institution Certified Documents:

Is MahiMarkets A Scam?

Introduction

MahiMarkets positions itself as a player in the forex trading industry, claiming to provide a robust platform for traders seeking to engage in foreign exchange and other financial instruments. However, as the forex market is fraught with risks and potential scams, traders must exercise caution when selecting a broker. The importance of due diligence cannot be overstated, as the wrong choice can lead to significant financial losses. This article aims to provide a comprehensive analysis of MahiMarkets, evaluating its legitimacy and safety for potential traders. Our investigation is based on a review of multiple credible sources, including user reviews, regulatory information, and industry reports, to ensure a balanced perspective.

Regulation and Legitimacy

The regulatory framework surrounding a forex broker is crucial for determining its trustworthiness. A well-regulated broker typically adheres to strict standards that protect traders' interests. MahiMarkets claims to operate under various regulatory bodies, but the details are murky. Below is a summary of the regulatory status of MahiMarkets:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | United Kingdom | Unregulated |

| ASIC | N/A | Australia | Unregulated |

| FMA | N/A | New Zealand | Unregulated |

Despite its claims, MahiMarkets lacks concrete regulatory oversight, which raises significant concerns. The absence of a valid license from recognized authorities indicates that the broker may not be subject to the same scrutiny and accountability as regulated entities. Moreover, various reviews suggest that MahiMarkets has received numerous complaints regarding withdrawal issues and customer service, further questioning its legitimacy. In summary, the unregulated status of MahiMarkets is a major red flag, leading to the conclusion that MahiMarkets is not safe for traders.

Company Background Investigation

MahiMarkets was established in 2010, and while it has been in operation for over a decade, its history is riddled with ambiguity. The company's ownership structure is not clearly disclosed, which raises concerns about transparency. The management team, while experienced in trading and technology, has not been prominently featured in industry discussions, leading to further skepticism about the companys credibility.

The lack of information regarding the companys background and its operational history can be alarming for potential investors. A reputable broker typically provides detailed information about its founders, management team, and operational history, allowing traders to gauge the firm's reliability. In contrast, MahiMarkets has failed to provide sufficient details, making it difficult for traders to trust the platform fully. The opacity surrounding its corporate structure and the absence of clear ownership information contribute to the perception that MahiMarkets may not be safe for investors.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its suitability for traders. MahiMarkets claims to provide competitive trading conditions, but a closer examination reveals inconsistencies in its fee structure. The following table summarizes the core trading costs associated with MahiMarkets:

| Fee Type | MahiMarkets | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Variable | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | High | Low to Medium |

While MahiMarkets offers variable spreads, the lack of clarity regarding its commission structure raises concerns. Furthermore, reports indicate that the broker may impose excessive overnight interest rates, which could significantly impact the profitability of trades. The overall fee structure appears less favorable compared to industry standards, suggesting that traders may incur higher costs than anticipated. Therefore, it is crucial for potential clients to consider these factors carefully, as they may indicate that MahiMarkets is not a safe choice.

Client Funds Security

The safety of client funds is a paramount concern for any forex trader. MahiMarkets claims to implement measures to protect client funds, but the effectiveness of these measures is questionable. The broker's website lacks specific information regarding fund segregation, investor protection schemes, and negative balance protection policies.

Without clear policies in place to safeguard client assets, traders may find themselves at risk of losing their investments in the event of financial difficulties faced by the broker. Historical complaints from users regarding withdrawal issues further exacerbate concerns about the safety of funds held with MahiMarkets. Given these factors, it is evident that MahiMarkets does not provide a secure environment for client funds, reinforcing the notion that the broker may not be safe for trading.

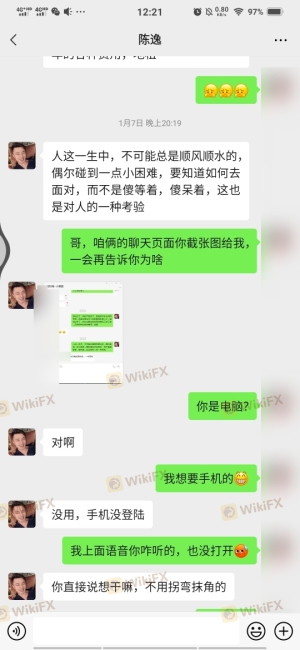

Customer Experience and Complaints

Customer feedback is a critical indicator of a broker's reliability. MahiMarkets has received a plethora of negative reviews, primarily centered around withdrawal issues and poor customer service. Many users have reported difficulties in accessing their funds, leading to frustration and distrust. The following table outlines the primary types of complaints received:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/no response |

| Customer Service Quality | Medium | Inconsistent support |

| Account Management Problems | High | Unresolved issues |

Case studies reveal that some clients have experienced significant delays in fund withdrawals, with some unable to access their capital altogether. These patterns of complaints are alarming and indicate a systemic issue within the company. The lack of timely and effective responses from MahiMarkets further exacerbates the situation, leading to a growing sentiment that MahiMarkets is a scam rather than a legitimate trading platform.

Platform and Trade Execution

The performance of a trading platform is crucial for the overall trading experience. MahiMarkets utilizes the MetaTrader 4 platform, which is generally well-regarded in the industry. However, user reviews suggest that the platform suffers from stability issues, including frequent downtimes and lagging execution times.

Moreover, reports of slippage and order rejections have been noted, raising concerns about the integrity of trade execution. Such issues could severely impact a trader's ability to capitalize on market opportunities, leading to potential financial losses. The presence of these problems further supports the argument that MahiMarkets may not be a safe platform for traders, as poor execution can undermine the trading experience.

Risk Assessment

Using MahiMarkets presents several risks that potential traders should be aware of. The following risk assessment summarizes the key risk areas:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns about oversight. |

| Financial Risk | High | Complaints about withdrawal issues and fund security. |

| Operational Risk | Medium | Platform stability and execution issues reported. |

Given the high levels of regulatory and financial risk associated with MahiMarkets, it is advisable for potential traders to exercise extreme caution. To mitigate these risks, traders should consider using well-regulated brokers with transparent practices and strong reputations.

Conclusion and Recommendations

In conclusion, the evidence presented suggests that MahiMarkets is not a safe broker for forex trading. The lack of regulatory oversight, coupled with numerous complaints regarding fund security and customer service, paints a concerning picture. Additionally, the unfavorable trading conditions and platform execution issues further reinforce the notion that potential clients should be wary of engaging with this broker.

For traders seeking reliable options, it is advisable to consider well-established and regulated brokers that prioritize client safety and transparency. Some recommended alternatives include brokers that are regulated by reputable authorities and have a proven track record of customer satisfaction. By choosing a trustworthy broker, traders can significantly reduce their risk and enhance their trading experience.

Is MahiMarkets a scam, or is it legit?

The latest exposure and evaluation content of MahiMarkets brokers.

MahiMarkets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MahiMarkets latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.