MahiMarkets 2025 Review: Everything You Need to Know

Executive Summary

MahiMarkets presents itself as a technology-focused trading solutions provider. The company has generated mixed reactions from the trading community over the years. This mahimarkets review reveals a company that positions itself as an electronic trading technology provider specializing in multi-asset solutions for brokers. However, it faces significant concerns regarding customer service and withdrawal processes that cannot be ignored.

Based on available information, MahiMarkets operates as a UK-registered technology company. The company has been in business for approximately 5-10 years and continues to grow its presence. The company's primary focus appears to be providing trading infrastructure and risk management tools to smaller A-book and B-book brokers through their MFXTradeHaven trading solution. While some users have expressed satisfaction with the company's educational webinars, concerning reports about withdrawal difficulties and customer service issues have raised questions about the broker's operational reliability in recent months.

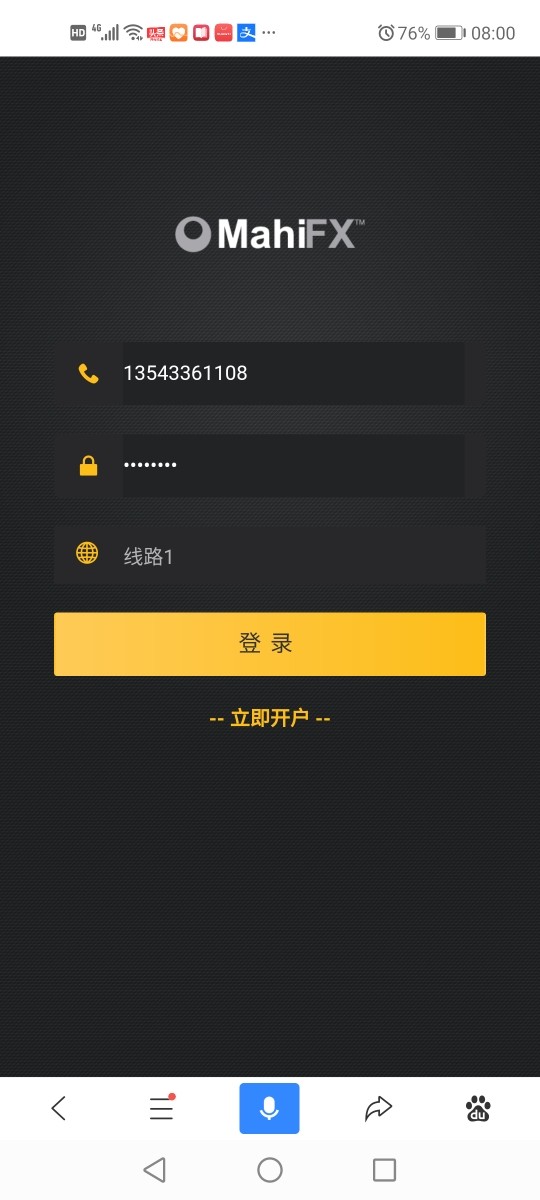

The platform offers MT4 trading capabilities. It markets itself as providing "full autonomy" over CFD pricing for brokerage firms across multiple markets. However, the lack of clear regulatory oversight and persistent user complaints about fund accessibility present significant red flags for potential clients. This review aims to provide a comprehensive analysis of MahiMarkets' offerings while highlighting both its technological capabilities and operational concerns that users should consider.

Important Notice

This review is based on publicly available information and user feedback collected from various sources. MahiMarkets operates as a UK-registered entity, though specific regulatory oversight details remain unclear in available documentation that we have reviewed. Different jurisdictions may have varying regulatory requirements, and potential users should verify current regulatory status independently before making any commitments.

Our assessment methodology incorporates user testimonials, company-provided information, and third-party evaluations where available. Given the limited transparency in some operational areas, readers should exercise due diligence and consider multiple sources when evaluating this broker for their trading needs and financial goals.

Rating Overview

Broker Overview

MahiMarkets was established approximately 5-10 years ago as a UK-registered technology company. The company specializes in electronic trading solutions for the financial services industry and has built a reputation in this specific niche. The company positions itself as a provider of cross-asset trading solutions, focusing primarily on serving small to medium-sized brokerage firms rather than individual retail traders. According to available information, MahiMarkets has developed a technology-driven business model that emphasizes customized trading platforms and risk management tools for its clients.

The company's headquarters are located in the United Kingdom. It operates as a registered technology provider in this jurisdiction and maintains its primary operations there. MahiMarkets' business approach centers on offering infrastructure solutions that allow brokerage firms to achieve what the company terms "full autonomy" over CFD pricing and execution. This positioning suggests the company operates more as a B2B technology provider than a traditional retail forex broker, which explains some of the differences in their service approach.

MahiMarkets offers trading through the MetaTrader 4 platform. MT4 remains one of the most widely used trading platforms in the forex industry and provides users with familiar functionality. The company provides multi-asset pricing, risk management, and execution technology, though specific details about the range of tradeable instruments remain limited in available documentation. The absence of clear regulatory oversight information in public materials represents a significant gap in transparency that potential users should carefully consider before proceeding.

Regulatory Status: Available information does not clearly specify which regulatory authorities oversee MahiMarkets' operations. This occurs despite its UK registration status and creates uncertainty for potential users. This lack of regulatory transparency represents a significant concern for potential users who value regulatory protection.

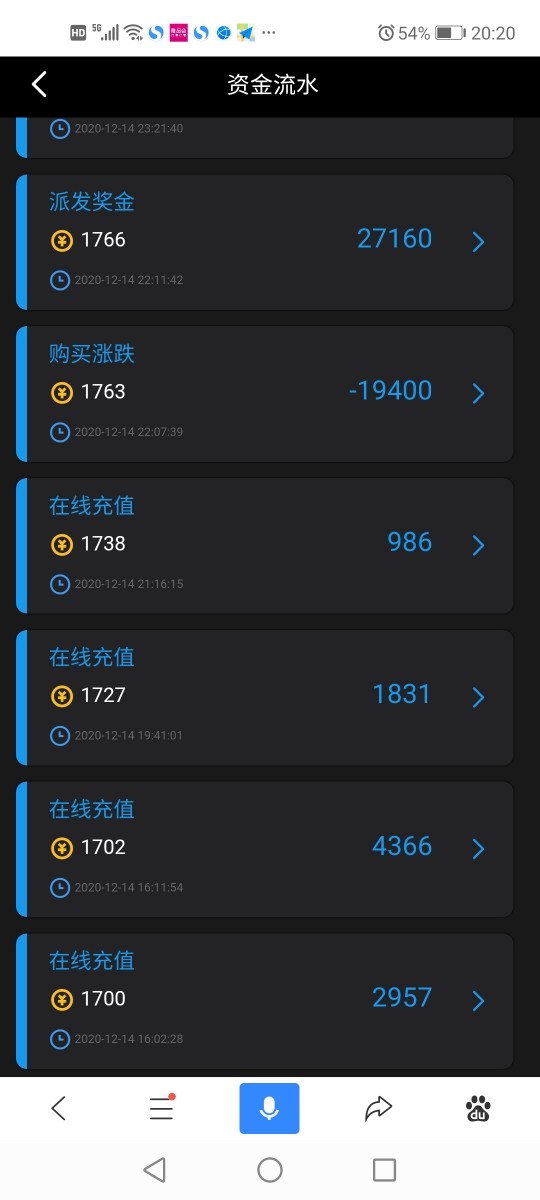

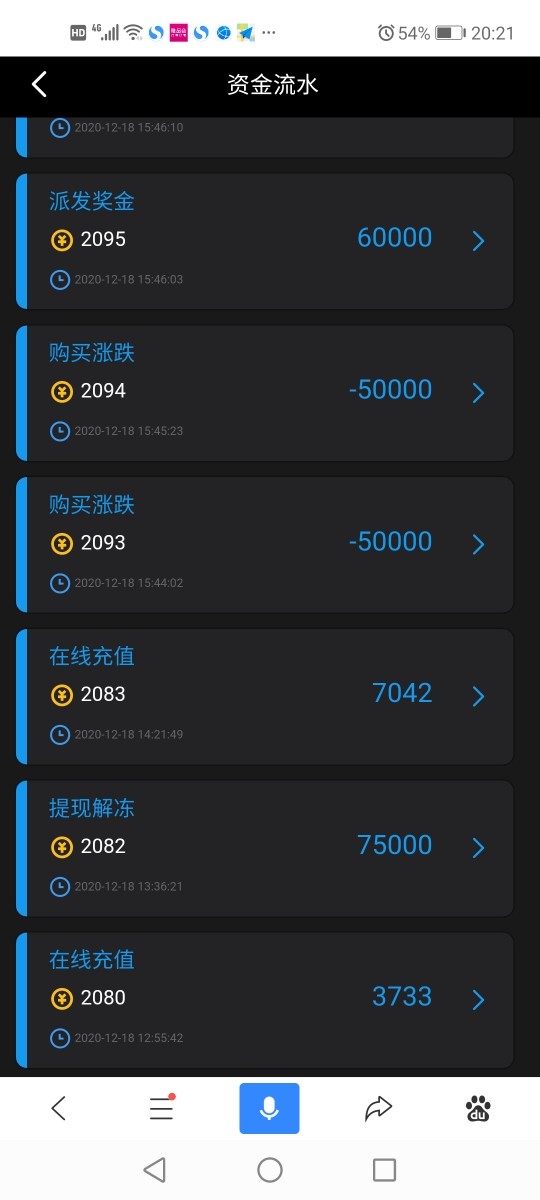

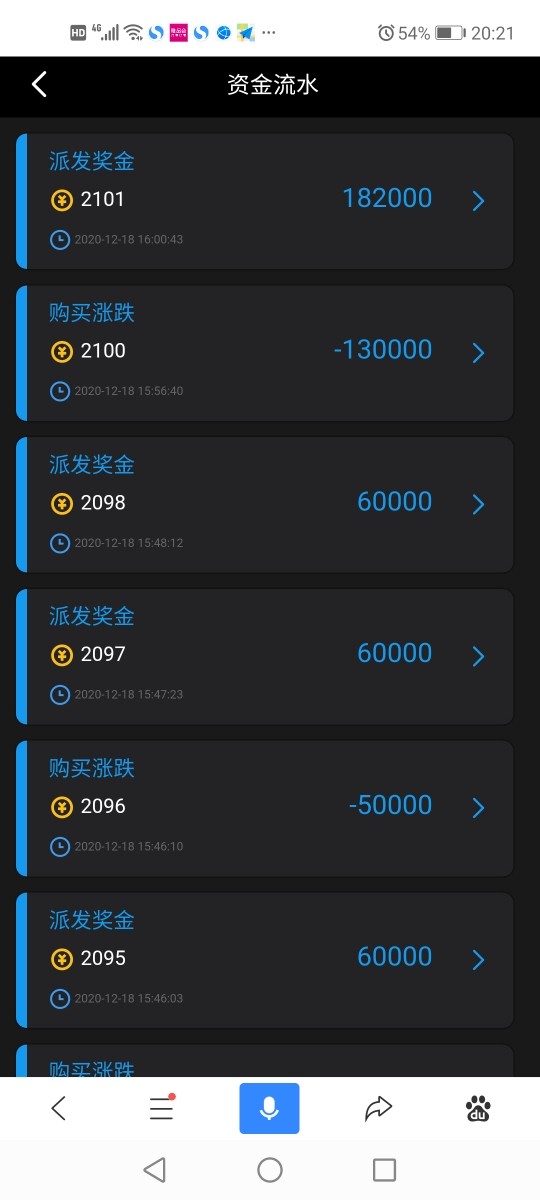

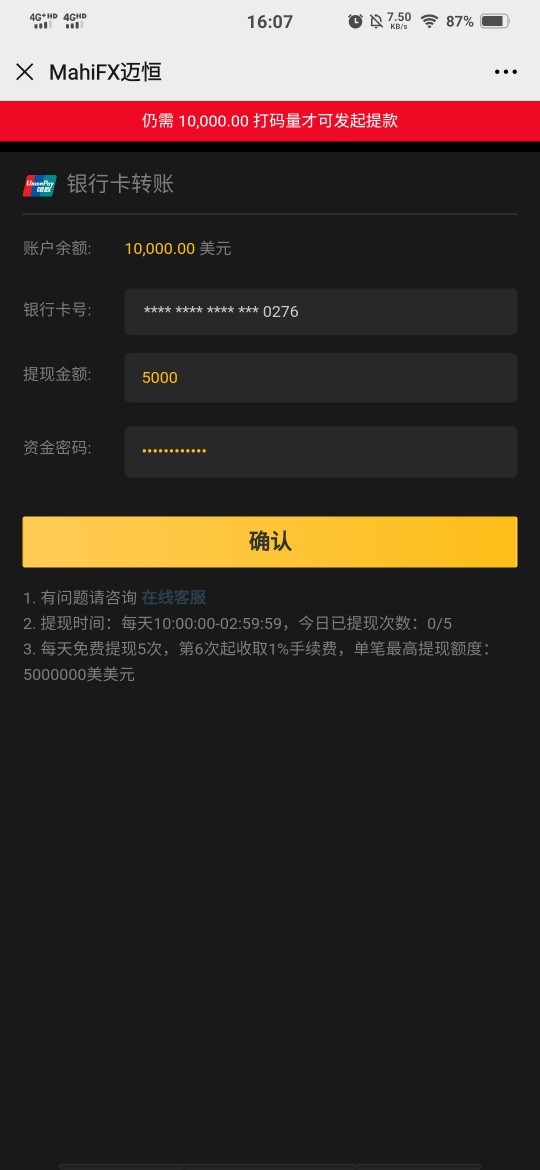

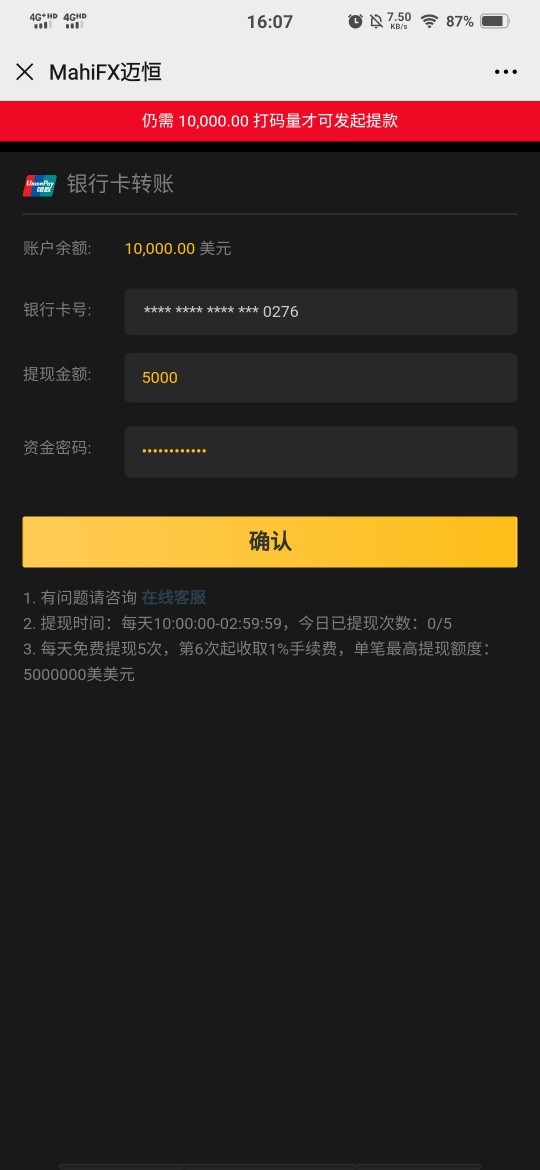

Deposit and Withdrawal Methods: Specific information about supported payment methods is not detailed in available sources. User complaints about withdrawal difficulties suggest limitations in the withdrawal process that may affect user experience. This mahimarkets review notes the importance of clarifying payment options before account opening.

Minimum Deposit Requirements: Minimum deposit amounts are not specified in accessible documentation. This indicates potential variability based on account types or individual arrangements with the company. Users should inquire directly about deposit requirements during the account opening process.

Bonuses and Promotions: No specific information about promotional offers or bonus programs is available in current materials. The company may offer promotions that are not publicly advertised or may focus on technology services rather than traditional trading bonuses. Potential users should ask about any available promotional offers when contacting the company.

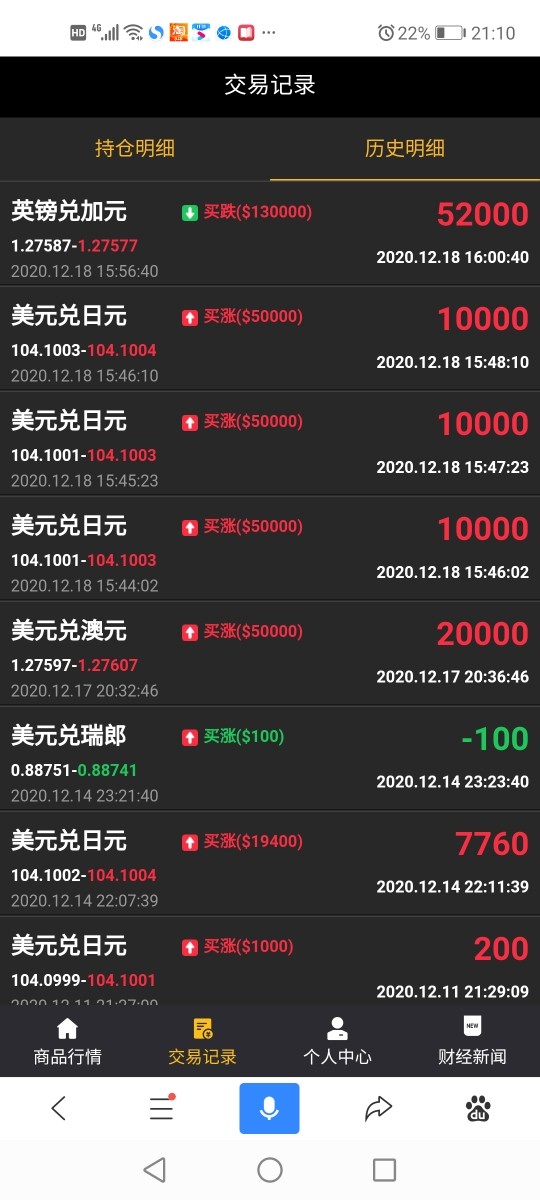

Available Trading Assets: The company emphasizes multi-asset pricing capabilities. This suggests support for various instrument types, though specific asset categories and numbers are not detailed in available sources. Users interested in specific trading instruments should verify availability directly with the company.

Cost Structure: Trading costs, spreads, and commission structures are not clearly outlined in accessible information. This represents another area where transparency could be improved to help users make informed decisions. Potential clients should request detailed pricing information before opening accounts.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in available documentation. Different account types may offer varying leverage options that are not publicly disclosed. Users should clarify leverage availability based on their trading needs and risk tolerance.

Platform Options: MahiMarkets primarily offers the MT4 trading platform according to available information. Additional platform options may exist but are not clearly documented in public materials. The MT4 platform provides comprehensive trading functionality for most user needs.

Geographic Restrictions: Specific information about restricted territories or regional limitations is not detailed in current sources. Users from different countries should verify their eligibility before attempting to open accounts. Regulatory requirements may vary by jurisdiction and affect service availability.

Customer Support Languages: Available support languages are not specified in accessible materials. This mahimarkets review notes the importance of clarifying communication options before account opening to ensure adequate support availability. Users should verify language support based on their communication preferences.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of MahiMarkets' account conditions proves challenging due to limited publicly available information. Unlike many established brokers who provide detailed account specifications, MahiMarkets appears to focus more on its technology infrastructure offerings than traditional retail account structures. Available sources do not specify different account tiers, minimum balance requirements, or account-specific features such as Islamic account options.

This lack of transparency in account condition details makes it difficult for potential users to understand what they can expect. The absence of clear account opening procedures and verification requirements in public materials suggests that these details may be provided on a case-by-case basis. For a mahimarkets review to be comprehensive, more detailed information about account structures would be beneficial.

The company's focus on serving other brokerage firms rather than individual traders may explain this information gap. It nevertheless creates uncertainty for potential retail clients who might be considering the platform for their trading needs. The scoring of 6/10 reflects this information scarcity while acknowledging that the company may offer reasonable account conditions.

These conditions simply aren't well-documented in public materials that users can access easily.

MahiMarkets demonstrates strength in its technological offerings. The company particularly excels through its provision of the MT4 trading platform and its focus on multi-asset trading solutions. The company's development of the MFXTradeHaven trading solution indicates significant investment in creating comprehensive trading infrastructure for brokerage firms.

The MT4 platform integration provides users with access to standard technical analysis tools. It also offers charting capabilities and automated trading options that are characteristic of this widely-adopted platform. According to available information, MahiMarkets has positioned itself as providing "full autonomy" over CFD pricing, suggesting sophisticated pricing and risk management tools.

User feedback indicates positive reception of the company's educational resources. Educational webinars have received particularly favorable reviews from users. One user review specifically mentioned satisfaction with "MahiMarkets broker webinars," indicating that the company invests in educational content that provides value to its users.

The company's technology-focused approach and multi-asset capabilities represent significant strengths. More detailed information about specific tools, research resources, and educational materials would strengthen this assessment. The 8/10 rating reflects the apparent technological sophistication while noting the need for more comprehensive resource documentation.

Customer Service and Support Analysis

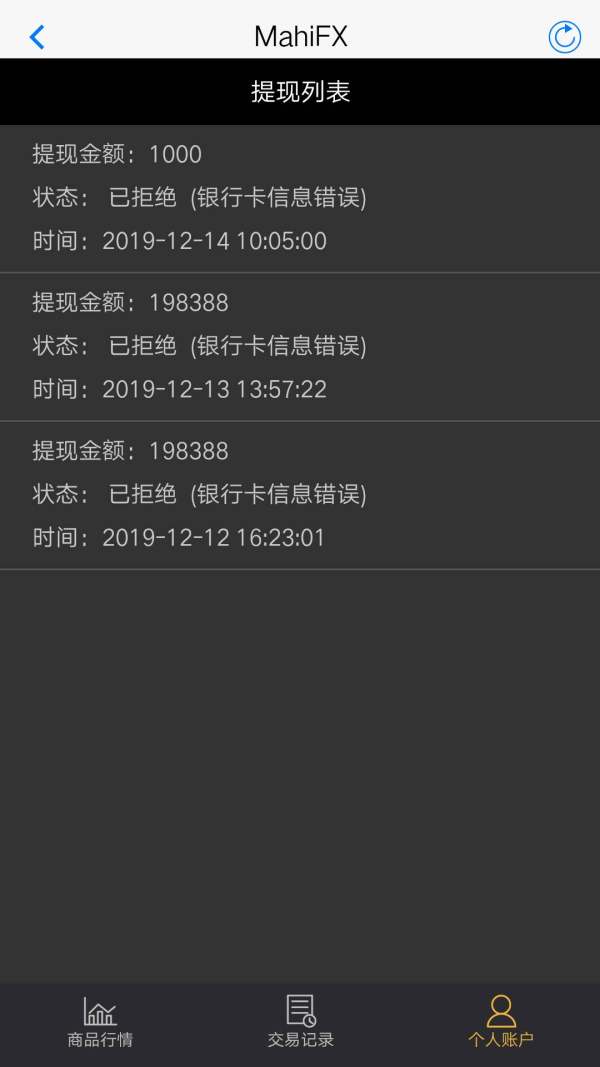

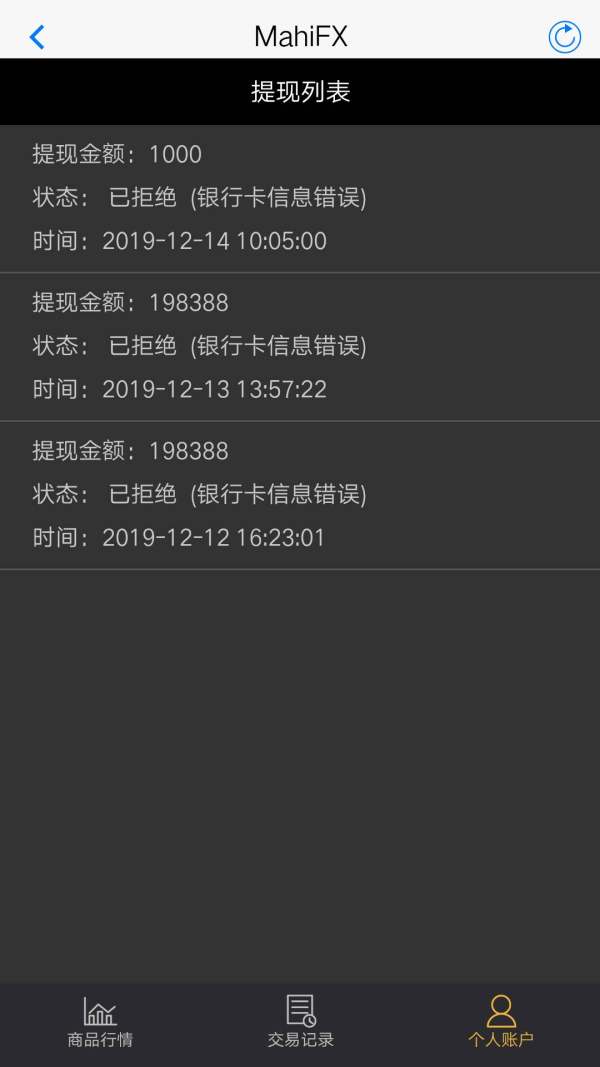

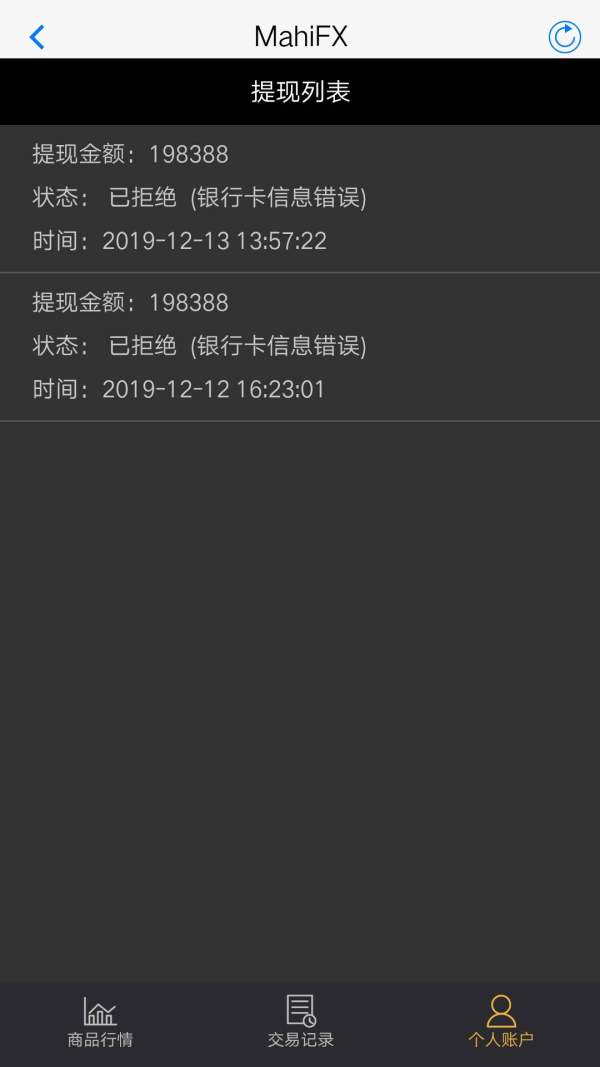

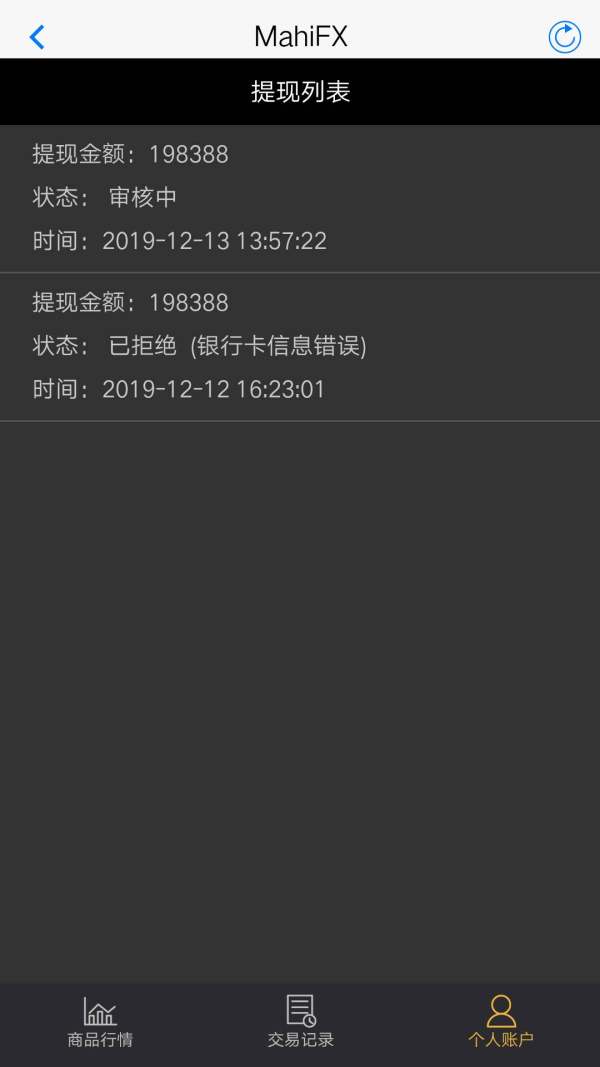

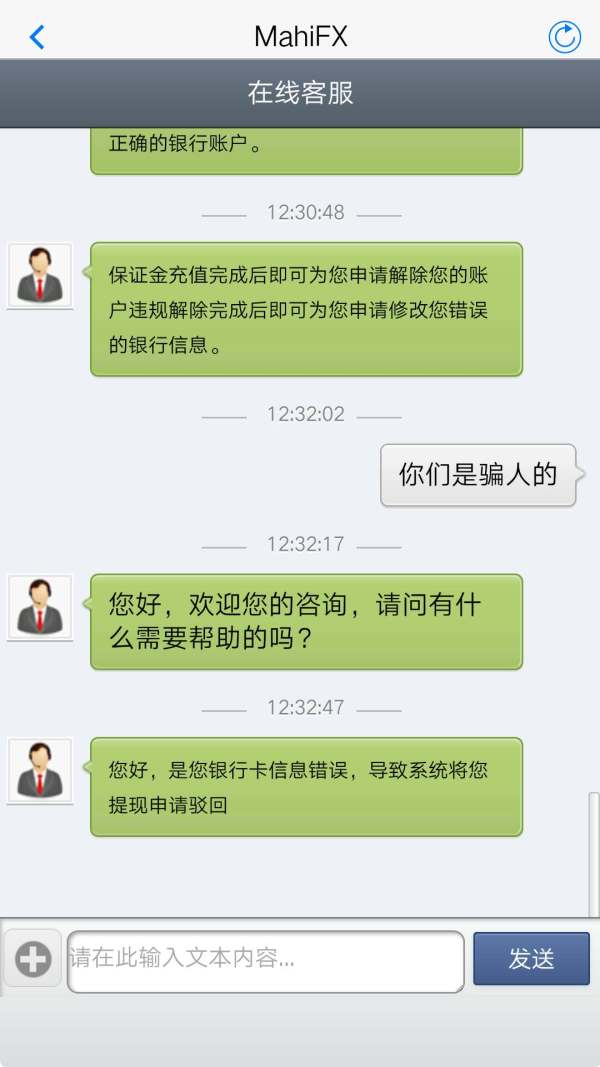

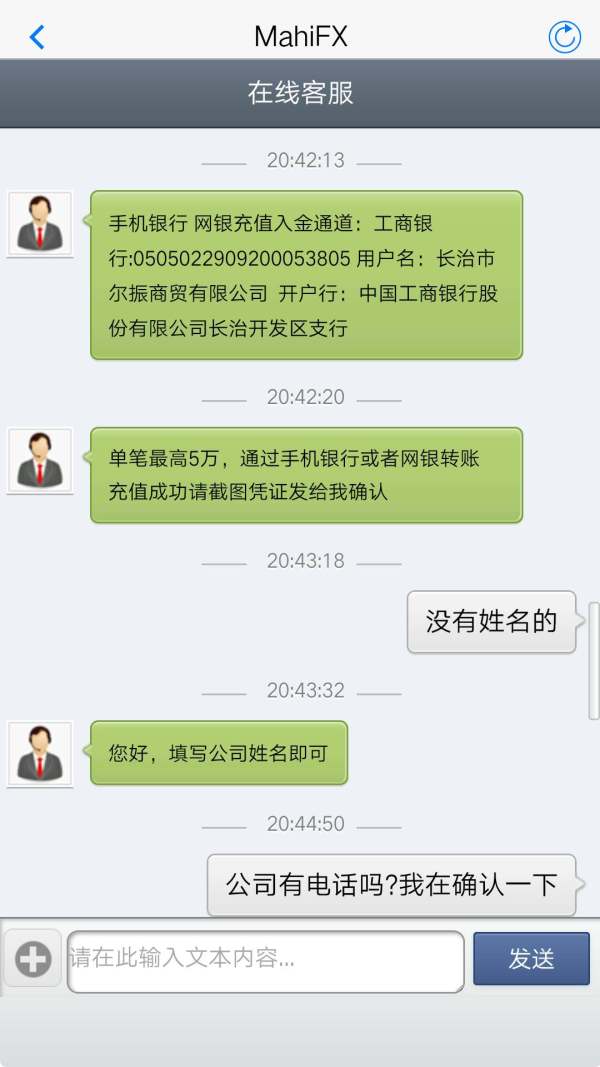

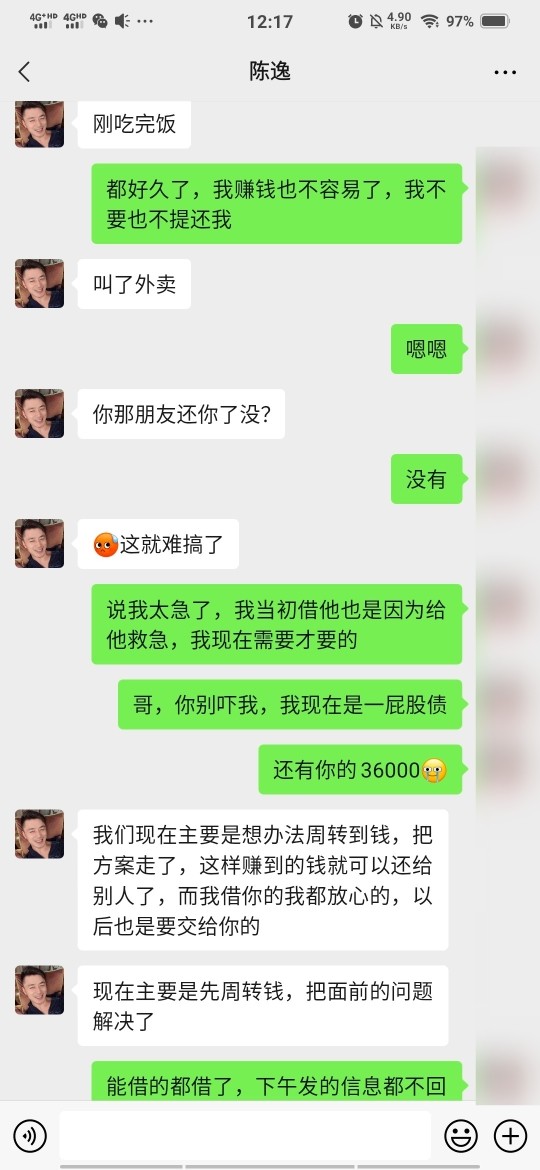

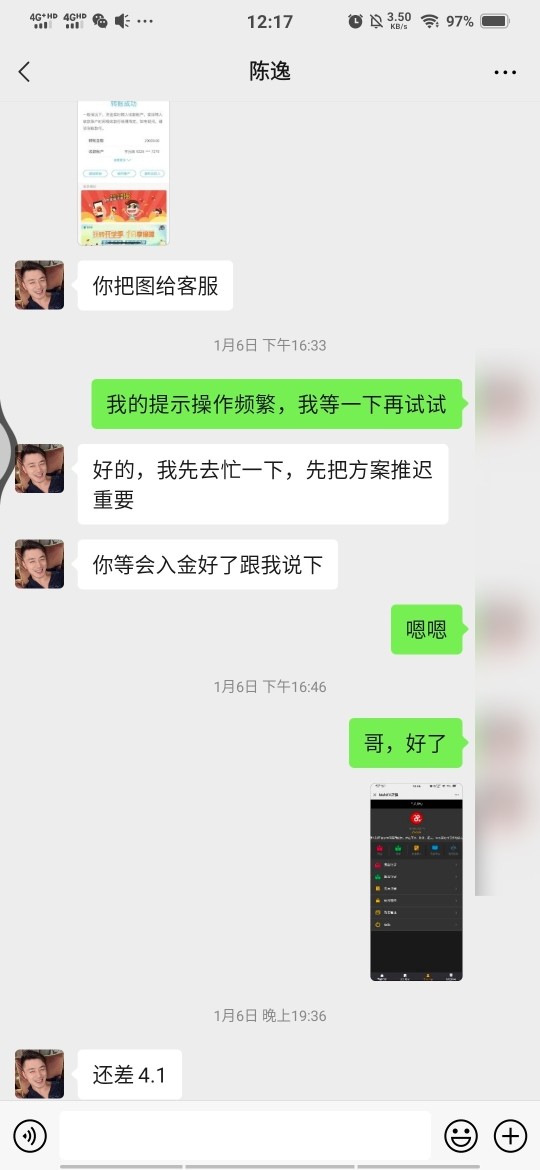

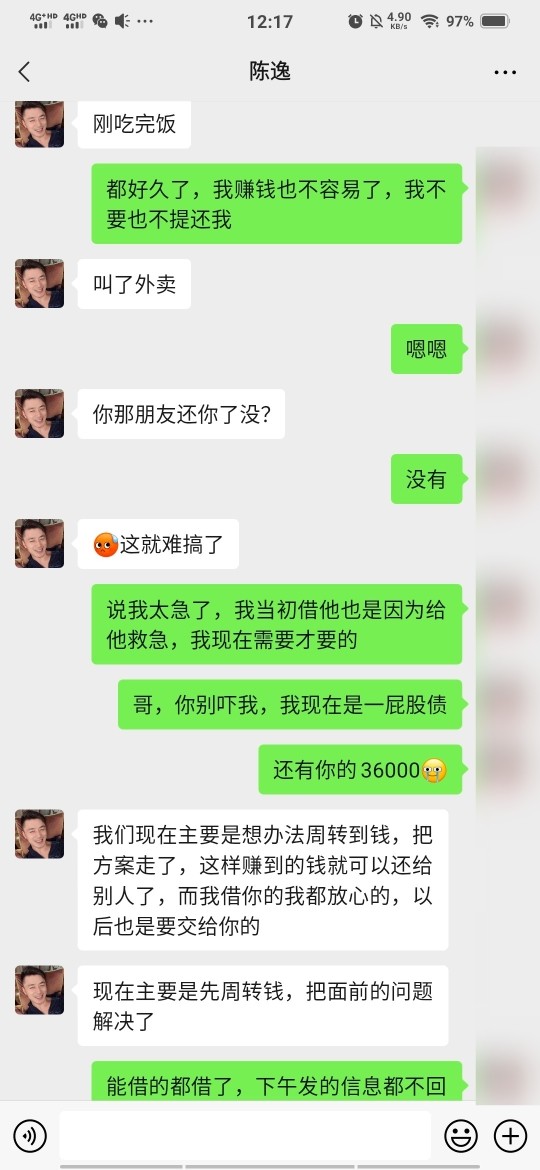

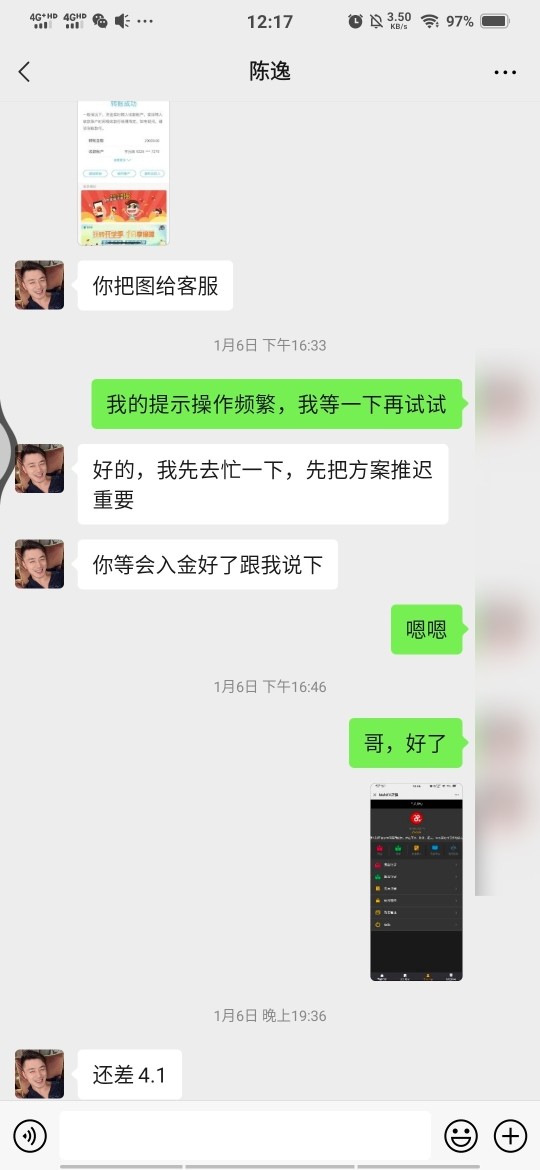

Customer service represents one of the most concerning aspects of MahiMarkets' operations. Multiple sources indicate persistent issues with customer support responsiveness and problem resolution, particularly regarding withdrawal processes and account management concerns. User reports suggest difficulties in reaching customer service representatives and obtaining satisfactory responses to inquiries about account operations and fund withdrawals.

The lack of clearly specified customer service channels, operating hours, and support language options compounds these concerns. Withdrawal-related complaints appear particularly prevalent, with users expressing frustration about delays and difficulties in accessing their funds. These issues have contributed to questions about the company's operational reliability and commitment to customer service excellence.

The absence of detailed customer service information creates additional challenges for users seeking support. Combined with negative user feedback about support quality, this creates a significant concern for potential users who value responsive and professional customer assistance. The 4/10 rating reflects these documented service issues while acknowledging that individual experiences may vary.

Trading Experience Analysis

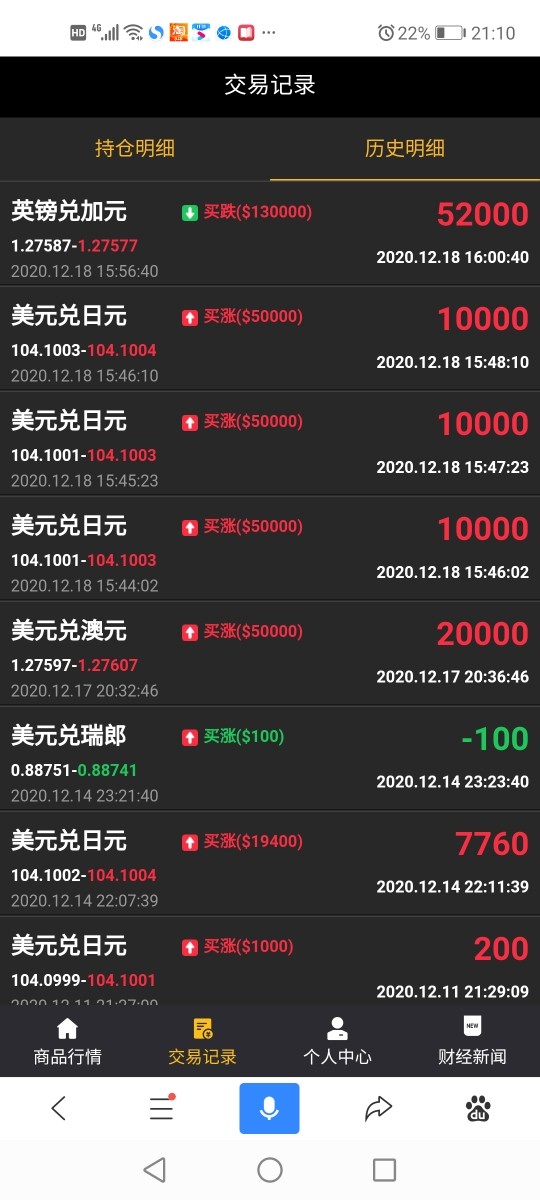

The trading experience evaluation for MahiMarkets centers primarily on the MT4 platform offering. MT4 provides users with familiar functionality and technical capabilities that many traders recognize and appreciate. MT4's established reputation for stability and comprehensive trading tools offers a solid foundation for trading activities.

However, limited user feedback about actual trading conditions, execution quality, and platform performance makes comprehensive assessment challenging. The company's focus on providing technology solutions to other brokers suggests underlying technical competency, but direct user experience data remains scarce. Platform stability, order execution speed, and slippage characteristics are not well-documented in available sources.

This represents important information gaps for potential users who need to understand trading conditions. The absence of mobile trading application details and advanced platform features beyond standard MT4 capabilities limits the assessment scope. This mahimarkets review notes that while the MT4 platform provides standardized functionality, the overall trading experience depends heavily on execution quality and platform reliability.

These are areas where more user feedback would be valuable for potential clients. The 6/10 rating reflects the solid MT4 foundation while acknowledging the lack of comprehensive trading experience data.

Trust and Reliability Analysis

Trust and reliability concerns represent significant challenges for MahiMarkets based on available information. The most substantial issue involves the lack of clear regulatory oversight documentation, which creates uncertainty about consumer protection and operational standards. User reports about withdrawal difficulties raise serious questions about fund security and the company's commitment to honoring client fund requests.

These concerns are compounded by the absence of detailed information about client fund segregation. Deposit protection schemes and regulatory compliance measures are also not clearly documented, creating additional uncertainty for users. The company's UK registration provides some level of legitimacy, but without clear regulatory authority oversight, users lack the protection typically associated with properly regulated financial services providers.

This regulatory ambiguity represents a significant risk factor for potential clients. Negative user feedback about operational issues, combined with limited transparency about regulatory compliance and fund protection measures, creates substantial trust concerns. The 4/10 rating reflects these documented reliability issues while noting that regulatory status may have changed since available information was published.

User Experience Analysis

User experience with MahiMarkets presents a mixed picture. Positive feedback in some areas is offset by significant operational concerns that affect overall satisfaction. Educational content, particularly webinars, has received favorable user reviews, indicating that the company provides valuable learning resources for its clients.

However, the overall user experience is significantly impacted by reported difficulties with withdrawal processes. Customer service interactions also create challenges that affect user satisfaction and confidence in the platform. These operational issues appear to overshadow positive aspects of the service offering and create frustration for users attempting to access their funds or resolve account issues.

The lack of detailed information about user interface design limits comprehensive assessment. Account management tools and overall platform usability information are also not readily available for review. Registration and verification processes are not well-documented, making it unclear what users can expect when opening accounts.

User satisfaction appears heavily influenced by the company's ability to process withdrawals and provide responsive customer support. These are areas where current feedback suggests significant room for improvement that could enhance overall user experience. The 5/10 rating reflects this mixed user experience, balancing positive educational content against operational concerns.

Conclusion

MahiMarkets presents a complex picture as a trading technology provider. The company shows both notable strengths and significant concerns that potential users should carefully consider. While the company demonstrates technological competency through its MT4 platform integration and multi-asset trading solutions, persistent issues with customer service and withdrawal processes raise important questions about operational reliability.

The company appears best suited for users who prioritize technological infrastructure and educational resources. These users should also be prepared to navigate potential customer service challenges that may arise during their trading experience. Small to medium-sized brokerage firms seeking trading technology solutions may find value in MahiMarkets' offerings, though individual retail traders should carefully consider the documented operational concerns.

Key strengths include the company's technology focus and educational content quality. Primary weaknesses center on customer service responsiveness and withdrawal processing reliability that have been documented by multiple users. The lack of clear regulatory oversight adds an additional layer of risk that potential users must carefully evaluate against their risk tolerance and trading requirements.