Is Billion FX safe?

Business

License

Is Billion FX A Scam?

Introduction

Billion FX is an online forex broker that has emerged in the trading landscape, claiming to provide a platform for trading various financial instruments, including forex, commodities, indices, and cryptocurrencies. However, the increasing number of unregulated brokers has made it essential for traders to exercise caution when choosing a trading platform. The absence of proper regulatory oversight can lead to potential risks, including the loss of funds and lack of recourse in case of disputes. In this article, we will investigate the legitimacy of Billion FX, utilizing multiple sources and reviews to provide a comprehensive evaluation of its safety and trustworthiness.

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor in determining its legitimacy and safety. Billion FX operates without any valid regulatory licenses, which raises significant concerns regarding its operations and the safety of client funds. The broker claims to be registered in the British Virgin Islands (BVI), a location often associated with lax regulations. However, a thorough search of the BVI Financial Services Commission's records reveals that Billion FX is not listed, indicating that it operates without proper oversight.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | British Virgin Islands | Unregulated |

The lack of regulation means that there is no authority overseeing Billion FX's operations, which can lead to a lack of transparency and security for traders. Moreover, the absence of regulatory compliance raises questions about the broker's ability to safeguard client funds and adhere to industry standards. This situation is particularly concerning given the high-risk nature of trading in financial markets.

Company Background Investigation

Billion FX is operated by a company purportedly named Talent Master Enterprises Limited, registered in the British Virgin Islands. However, details about the company's history, ownership structure, and management team are scarce. The limited information available raises red flags regarding the broker's transparency. A lack of clear information about the individuals behind the company can be indicative of potential scams, as it makes it difficult for clients to ascertain accountability.

The management team's background is also crucial in assessing a broker's credibility. Unfortunately, there is no verifiable information regarding the qualifications or experience of the individuals managing Billion FX. This lack of transparency can lead to significant risks for investors, as they may not know who is handling their funds or making critical trading decisions on their behalf.

Trading Conditions Analysis

When evaluating a broker, it is essential to analyze the trading conditions they offer, including costs associated with trading. Billion FX claims to provide competitive trading conditions, but the absence of detailed information about spreads, commissions, and other fees raises concerns.

| Fee Type | Billion FX | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | N/A | 0.1 - 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of transparency regarding trading costs can lead to unexpected expenses for traders. Furthermore, the broker's high leverage of up to 1:1000 is alarming, as it can amplify both gains and losses, potentially leading to significant financial losses for inexperienced traders. The lack of information about trading conditions suggests that traders should proceed with caution when considering Billion FX.

Client Fund Security

The safety of client funds is a paramount concern when choosing a forex broker. Billion FX does not provide any information regarding fund segregation, investor protection, or negative balance protection. The absence of these safety measures means that client funds could be at risk in the event of the broker's insolvency or financial mismanagement.

Without proper regulatory oversight, there is no guarantee that client funds are held in segregated accounts, which is a standard practice among reputable brokers to protect traders' investments. Moreover, the lack of historical data regarding any past security issues raises further concerns about the broker's reliability.

Customer Experience and Complaints

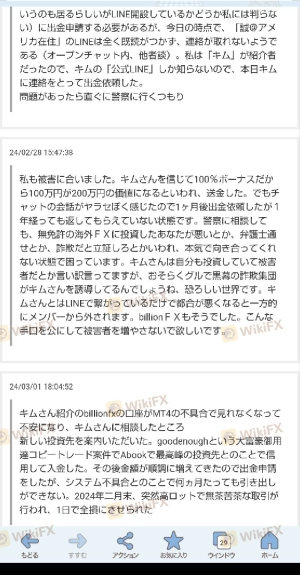

Customer feedback is a vital aspect of evaluating a broker's reputation. Reviews and complaints from existing or former clients can provide insights into the broker's reliability and customer service quality. Many reviews of Billion FX indicate a pattern of negative experiences, including difficulties in withdrawing funds, lack of communication, and aggressive sales tactics.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Communication | Medium | Poor |

| Misleading Promotions | High | Poor |

Typical complaints involve clients being unable to withdraw their funds, often after being pressured to invest more. This pattern of behavior is commonly associated with unregulated brokers and raises significant concerns about the legitimacy of Billion FX.

Platform and Trade Execution

The trading platform offered by Billion FX is another critical factor in assessing its reliability. A stable and user-friendly trading platform is essential for executing trades effectively. However, many users report issues with the platform's performance, including slow execution speeds and difficulties in accessing the trading terminal.

Concerns about order execution quality, including slippage and order rejections, are prevalent among users. Reports of potential platform manipulation further exacerbate these concerns, suggesting that traders may be at risk when using Billion FX for their trading activities.

Risk Assessment

Trading with an unregulated broker like Billion FX involves several inherent risks. The absence of regulatory oversight, coupled with the broker's questionable practices, creates a high-risk trading environment.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Potential loss of client funds |

| Operational Risk | Medium | Platform performance issues |

| Withdrawal Risk | High | Difficulties in accessing funds |

To mitigate these risks, traders should conduct thorough research and consider investing with regulated brokers that provide transparency, security, and customer protection.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Billion FX is not a safe trading option. The lack of regulation, transparency, and customer complaints indicate significant risks associated with this broker. Prospective traders should be wary of engaging with Billion FX, as the potential for fraud and financial loss is high.

For those seeking to trade in the forex market, it is advisable to consider regulated alternatives that offer better security and transparency. Reputable brokers with established track records can provide a safer trading environment and protect investors' interests.

Is Billion FX a scam, or is it legit?

The latest exposure and evaluation content of Billion FX brokers.

Billion FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Billion FX latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.