Is KUMO MARKETS safe?

Software Index

License

Is Kumo Markets Safe or a Scam?

Introduction

Kumo Markets is an online forex broker that positions itself as a global trading platform offering access to various financial instruments, including forex, commodities, and cryptocurrencies. As with any financial service, traders must exercise caution when evaluating brokers to ensure their investments are secure and legitimate. The forex market is rife with scams and unregulated entities, making it essential for traders to conduct thorough research before committing their funds. This article aims to provide an objective assessment of Kumo Markets, focusing on its regulatory status, company background, trading conditions, client safety measures, customer experiences, and overall risk profile. The analysis is based on recent reviews and data from multiple financial sources.

Regulation and Legitimacy

A broker's regulatory status is a critical factor in determining its legitimacy. Kumo Markets claims to be registered with the Financial Services Authority (FSA) of Saint Vincent and the Grenadines. However, it is essential to note that the FSA does not regulate forex trading, which raises significant concerns about the broker's credibility.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Authority (FSA) | 25875 BC 2020 | Saint Vincent and the Grenadines | Not Valid |

The lack of a robust regulatory framework is alarming, as it implies that Kumo Markets operates without the oversight necessary to protect client interests. Many reputable brokers are regulated by authorities such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC). These regulators impose strict compliance requirements that safeguard client funds and ensure fair trading practices. In contrast, Kumo Markets' association with an unregulated offshore entity raises red flags, suggesting that traders should be wary of potential risks involved in trading with this broker.

Company Background Investigation

Kumo Markets was established in 2020 and is owned by Kumo Markets Limited, based in Saint Vincent and the Grenadines. The company claims to provide a transparent trading environment, but the lack of detailed information about its ownership structure and management team raises concerns about transparency.

The absence of publicly available profiles for key executives is another factor that diminishes trust. In the financial industry, a credible broker typically discloses information about its management team, including their professional backgrounds and experience. This information helps build confidence among potential clients. Unfortunately, Kumo Markets does not provide such transparency, which is a significant drawback for traders considering its services.

Additionally, the company's history is relatively short, with only a few years in operation. This limited track record makes it challenging to assess its reliability and performance over time. A more established broker would typically have a history of client interactions, regulatory compliance, and an established reputation, which Kumo Markets lacks.

Trading Conditions Analysis

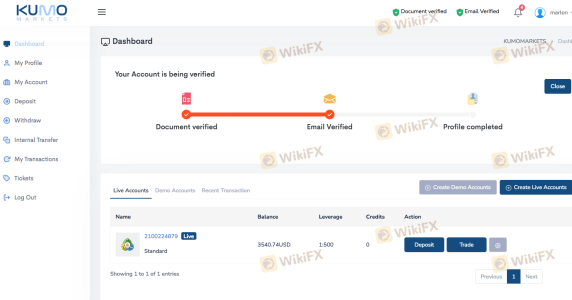

When evaluating whether Kumo Markets is safe, it's crucial to examine its trading conditions, including fees, spreads, and leverage. Kumo Markets offers a minimum deposit of $100 and provides high leverage of up to 1:500, which can be attractive to traders looking to maximize their potential returns. However, high leverage can also amplify risks, making it essential for traders to understand the implications.

The broker's spread for major currency pairs is reported to be around 2 pips, which is relatively standard in the industry. However, the absence of a clear commission structure can be concerning. Many reputable brokers offer transparent fee structures, while Kumo Markets does not provide sufficient details on additional costs that may arise during trading.

| Fee Type | Kumo Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2 pips | 1.5-2 pips |

| Commission Model | Not disclosed | Varies by broker |

| Overnight Interest Range | Not specified | Typically 1-3% |

The lack of clarity regarding fees and commissions can lead to unexpected costs for traders, which is a significant concern when assessing the overall safety of Kumo Markets. Traders should always seek brokers with transparent pricing models to avoid hidden fees that could erode their profits.

Client Funds Safety

The safety of client funds is paramount when evaluating any broker. Kumo Markets claims to implement various security measures, but the lack of regulatory oversight raises concerns about the effectiveness of these measures. The broker does not offer segregated accounts, which means client funds may not be kept separate from the company's operational funds. This lack of segregation can pose a risk in the event of financial difficulties faced by the broker.

Furthermore, Kumo Markets does not provide information about investor protection schemes or negative balance protection, which are essential features offered by regulated brokers. Investors should be cautious, as the absence of these protections can result in significant losses, especially during volatile market conditions.

In the past, several complaints have been reported regarding withdrawal issues and difficulties in accessing funds. Such incidents are alarming and raise questions about the broker's commitment to client safety and transparency. The inability to withdraw funds can be a significant indicator of potential fraud or operational inefficiencies.

Customer Experience and Complaints

Analyzing customer feedback is crucial in assessing whether Kumo Markets is safe. Reviews from traders reveal a mixed bag of experiences, with many users expressing dissatisfaction regarding withdrawal processes. Common complaints include difficulty in withdrawing funds, lack of responsive customer support, and issues with account verification.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times |

| Customer Support | Medium | Limited availability |

| Account Verification | Medium | Lengthy process |

One notable case involved a trader who reported being unable to withdraw their initial deposit and profits after several weeks of attempting to do so. The trader claimed that the broker continually requested additional documentation, leading to frustration and distrust. This type of experience is concerning and suggests that Kumo Markets may not prioritize customer satisfaction or support.

Platform and Trade Execution

The trading platform offered by Kumo Markets is MetaTrader 4 (MT4), a widely used platform in the forex industry known for its user-friendly interface and robust features. However, the performance of the platform, including execution quality and potential manipulation, is a critical aspect to consider.

Users have reported mixed experiences with trade execution, with some experiencing slippage and delays during high volatility periods. While slippage is common in forex trading, excessive slippage or frequent rejections of orders can indicate potential issues with the broker's operations. Traders should be cautious if they notice patterns of poor execution, as this can impact their trading outcomes.

Risk Assessment

Using Kumo Markets presents several risks that traders should be aware of. The lack of regulation, poor customer feedback, and withdrawal issues contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Financial Risk | High | Potential for fund mismanagement |

| Execution Risk | Medium | Reports of slippage and order rejections |

To mitigate risks, traders should consider diversifying their investments and not committing all their funds to Kumo Markets. It is also advisable to use risk management tools such as stop-loss orders to protect against significant losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that Kumo Markets poses several risks that may categorize it as an unsafe trading environment. The lack of regulatory oversight, transparency issues, and negative customer feedback raise significant concerns about the broker's legitimacy. While the trading conditions may appear attractive at first glance, the potential for hidden fees and withdrawal difficulties should not be overlooked.

Traders are advised to exercise caution and consider alternative brokers that are well-regulated and have a proven track record of reliability and customer satisfaction. Some recommended alternatives include brokers regulated by the FCA, ASIC, or CySEC, which provide better safety measures for client funds and a more transparent trading experience. Always prioritize safety and due diligence when selecting a forex broker to protect your investments.

Is KUMO MARKETS a scam, or is it legit?

The latest exposure and evaluation content of KUMO MARKETS brokers.

KUMO MARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KUMO MARKETS latest industry rating score is 2.13, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.13 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.