Is HD Markets safe?

Pros

Cons

Is HD Markets Safe or a Scam?

Introduction

HD Markets positions itself as a forex and CFD broker based in South Africa, offering a variety of trading instruments including currency pairs, commodities, indices, and cryptocurrencies. As the forex market continues to grow, the need for traders to carefully evaluate brokers becomes increasingly critical. The potential for scams and unregulated entities poses significant risks to investors, making it essential to conduct thorough due diligence before committing funds to any trading platform. This article aims to investigate the safety and legitimacy of HD Markets by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks.

Regulation and Legitimacy

The regulatory status of a broker is a fundamental aspect to consider when assessing its safety. Regulatory bodies ensure that brokers adhere to strict guidelines designed to protect traders and maintain market integrity. In the case of HD Markets, it claims to be regulated under the FAIS Act, but numerous reviews indicate a lack of valid regulatory licensing from the Financial Sector Conduct Authority (FSCA) in South Africa.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FAIS | N/A | South Africa | Unverified |

Despite its claims, a search through the FSCA registry yields no results for HD Markets, raising serious concerns about its legitimacy. The absence of regulation not only undermines the broker's credibility but also exposes traders to heightened risks, including the potential for fraud. Regulatory oversight is crucial as it provides a framework for accountability and recourse in the event of disputes. In summary, the lack of a valid license and regulatory oversight suggests that HD Markets is not a safe option for traders.

Company Background Investigation

HD Markets was established in 2017 and claims to operate out of Rosebank, Gauteng, South Africa. However, the company‘s ownership structure remains unclear, with no publicly available information about its founders or management team. This lack of transparency raises red flags about the broker’s credibility and operational practices. A trustworthy broker typically provides detailed information about its leadership and corporate structure, enabling potential clients to assess the expertise and experience of those managing their funds.

Furthermore, the company‘s website has faced accessibility issues, with reports indicating that the site has been down for extended periods. Such technical difficulties can deter potential clients and cast doubt on the broker’s reliability. Without a clear understanding of the management teams qualifications and a transparent operational history, traders may find it challenging to trust HD Markets with their investments.

Trading Conditions Analysis

When evaluating a broker's safety, understanding its trading conditions is vital. HD Markets offers a minimum deposit requirement of $20, which is relatively low compared to industry standards. However, the broker's fee structure has raised concerns among traders. Reports suggest that while HD Markets advertises competitive spreads, actual trading conditions may differ significantly.

| Fee Type | HD Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.7 pips | 1.5 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spread for major currency pairs, such as EUR/USD, is reported at 1.7 pips, which is higher than the industry average. Additionally, the lack of clarity regarding commissions and other fees may lead to unexpected costs for traders. This opacity in fee structures can be a sign of potential exploitation, making it imperative for traders to fully understand the costs associated with trading on the platform.

Client Fund Security

The security of client funds is a paramount concern for any trader. HD Markets does not provide clear information on whether it employs measures such as segregated accounts or negative balance protection. These practices are essential for safeguarding traders' investments and ensuring that they are not left liable for losses exceeding their deposits.

Moreover, the absence of any documented fund security measures raises alarms about the safety of investments with HD Markets. Historical accounts of financial misconduct or fund mismanagement can further exacerbate the risks associated with trading on unregulated platforms. Given the potential for significant losses, it is crucial for traders to consider whether their chosen broker has a proven track record of protecting client funds.

Customer Experience and Complaints

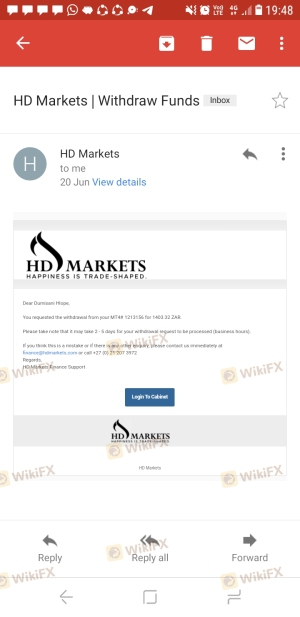

Customer feedback plays a vital role in assessing a broker's reliability. Reviews of HD Markets reveal a concerning pattern of complaints, primarily regarding withdrawal issues and unresponsive customer support. Many users have reported difficulties in accessing their funds or receiving timely assistance, which can be indicative of deeper operational problems.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

For instance, one trader reported being unable to withdraw funds after multiple attempts, with the broker's customer service failing to provide satisfactory resolutions. Such complaints not only reflect poorly on the broker's commitment to customer service but also suggest potential operational inefficiencies that could jeopardize the financial well-being of traders.

Platform and Execution

The trading experience on HD Markets is facilitated through the widely-used MetaTrader 4 (MT4) platform. While MT4 is known for its robust features and user-friendly interface, reviews indicate that clients have experienced issues with order execution, including slippage and delayed trade confirmations.

The quality of order execution is critical, as delays can lead to significant losses, especially in a volatile market. Reports of high slippage rates and rejected orders further underscore concerns about the broker's reliability and operational integrity.

Risk Assessment

Engaging with HD Markets presents several risks that traders should be aware of. The lack of regulation, unclear fee structures, and troubling customer feedback contribute to an overall high-risk profile.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid license or oversight |

| Financial Risk | High | Potential for fund mismanagement |

| Operational Risk | Medium | Complaints regarding execution issues |

To mitigate these risks, traders are advised to conduct thorough research and consider trading with regulated brokers that offer greater transparency and protection for client funds.

Conclusion and Recommendations

In conclusion, the evidence suggests that HD Markets is not a safe trading option. The absence of regulatory oversight, coupled with numerous complaints regarding customer service and fund security, raises significant red flags. Traders should exercise extreme caution and thoroughly evaluate their options before engaging with this broker.

For those seeking alternatives, it is advisable to consider well-regulated brokers that provide clear information on fees, customer support, and fund protection measures. Brokers with established reputations and transparent operational practices are likely to offer a more secure trading environment. Ultimately, prioritizing safety and due diligence is essential for successful trading in the forex market.

Is HD Markets a scam, or is it legit?

The latest exposure and evaluation content of HD Markets brokers.

HD Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HD Markets latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.