Regarding the legitimacy of KAWASE forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is KAWASE safe?

Pros

Cons

Is KAWASE markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

Clone FirmLicense Type:

Market Making License (MM)

Licensed Entity:

Topfx Ltd

Effective Date:

2011-04-19Email Address of Licensed Institution:

info@topfx.comSharing Status:

No SharingWebsite of Licensed Institution:

www.topfx.comExpiration Time:

--Address of Licensed Institution:

KSENOS BUILDING, Office No.502, Troodous 2, Agios Athanasios, 4105, Limassol, CyprusPhone Number of Licensed Institution:

+357 25 352 244Licensed Institution Certified Documents:

Is Kawase Safe or Scam?

Introduction

Kawase, a forex broker established in 2011, has positioned itself as a notable player in the online trading landscape. Operating under the umbrella of TopFX Ltd, Kawase offers a range of trading services and instruments, catering to both novice and experienced traders alike. However, the forex market is fraught with risks, and traders must exercise caution when selecting a broker. With numerous reports of scams and unscrupulous practices in the industry, it is imperative for traders to thoroughly evaluate the legitimacy and reliability of brokers like Kawase. This article aims to provide an objective assessment of Kawases safety and legitimacy by examining its regulatory status, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

Kawase's regulatory framework is a crucial aspect of its legitimacy. The broker is regulated by several reputable authorities, including the Cyprus Securities and Exchange Commission (CySEC), the Financial Conduct Authority (FCA), and the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin). These regulatory bodies enforce strict guidelines to ensure that brokers operate transparently and maintain high standards of financial conduct.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 138/11 | Cyprus | Verified |

| FCA | N/A | UK | Verified |

| BaFin | N/A | Germany | Verified |

The presence of multiple regulatory licenses indicates that Kawase adheres to stringent compliance standards. CySEC, for instance, requires brokers to maintain segregated accounts for clients' funds, ensuring that traders' money is kept separate from the broker's operational funds. Furthermore, the FCA and BaFin provide additional layers of oversight, reinforcing the broker's commitment to safeguarding traders' interests. Overall, Kawase's regulatory standing is a positive indicator of its safety and reliability, suggesting that it is not a scam.

Company Background Investigation

Kawase was founded as a response to the growing demand for transparent and efficient trading solutions. The company has evolved significantly since its inception, expanding its offerings and improving its trading technology to meet the needs of its diverse client base. The ownership structure of Kawase is associated with TopFX Ltd, a firm known for its liquidity provision and institutional brokerage services.

The management team at Kawase comprises experienced professionals with extensive backgrounds in finance and trading. This expertise is critical in navigating the complexities of the forex market and ensuring that the broker operates effectively and ethically. Additionally, Kawase emphasizes transparency, providing clients with clear information regarding its operations, fees, and trading conditions. This level of openness is essential for building trust with clients and is a key factor in determining whether Kawase is safe to trade with.

Trading Conditions Analysis

Kawase offers competitive trading conditions, which are vital for attracting and retaining clients. The broker employs a transparent pricing model, with no hidden fees, allowing traders to understand the costs associated with their trades. However, it is essential to scrutinize the fee structure to identify any potential red flags.

| Fee Type | Kawase | Industry Average |

|---|---|---|

| Spread for Major Pairs | 0.1 pips | 0.3 pips |

| Commission Model | $3.5 per lot | $5 per lot |

| Overnight Interest Range | Varies | Varies |

Kawases spreads are notably competitive, particularly for major currency pairs, which can enhance trading profitability. The commission structure is also favorable, especially for high-volume traders who may benefit from reduced fees based on their trading activity. However, traders should be aware of any unusual fees that may apply, such as withdrawal fees, which can vary depending on the payment method used. Overall, the trading conditions at Kawase suggest that it is a legitimate broker, with no immediate signs of predatory practices.

Customer Funds Security

The safety of customer funds is a paramount concern for any trader. Kawase implements several measures to protect traders' investments. Client funds are kept in segregated accounts at reputable financial institutions, ensuring that they are not mingled with the broker's operational funds. This practice is vital in the event of financial difficulties faced by the broker.

Additionally, Kawase offers negative balance protection, which prevents traders from losing more than their initial investment. This feature is particularly important in the volatile forex market, where rapid fluctuations can lead to significant losses. Historical reviews and reports indicate that Kawase has maintained a solid track record regarding fund safety, with no major incidents reported. This reinforces the notion that Kawase is a safe option for traders looking to enter the forex market.

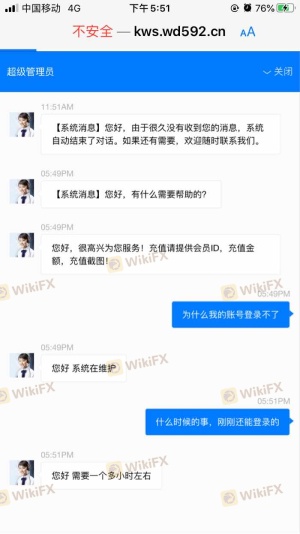

Customer Experience and Complaints

Customer feedback is an essential component in assessing the reliability of a broker. Reviews of Kawase indicate a mixed bag of experiences. While many users praise the broker for its intuitive platform and efficient customer service, others have raised concerns regarding the handling of complaints and the resolution of issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Timely response |

| Account Termination Issues | High | Slow resolution |

Common complaints include delays in withdrawals and issues related to account terminations, particularly for traders who engage in high-frequency trading. Some users have reported that their accounts were closed without adequate explanation, leading to frustration and concern. However, Kawase has generally been responsive to inquiries, with many clients noting that customer support is accessible and helpful. This aspect is crucial in determining whether Kawase is safe, as effective customer service can mitigate many potential issues.

Platform and Execution

Kawase utilizes the cTrader platform, which is known for its robust performance and user-friendly interface. The platform provides traders with a range of tools and features designed to enhance their trading experience. Users have reported that the platform is stable, with fast order execution and minimal slippage.

However, concerns have been raised regarding the potential for platform manipulation. Some traders have reported instances where their orders were not executed at the expected prices, leading to suspicions about the broker's practices. While these claims are not universally accepted, they highlight the importance of transparency and trust in a trading platform. Overall, the platform's performance and execution quality suggest that Kawase is a legitimate broker, but traders should remain vigilant.

Risk Assessment

Trading with Kawase, like any forex broker, carries inherent risks. It is essential for traders to understand these risks and take appropriate measures to mitigate them.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Subject to changes in regulations |

| Market Volatility | High | Potential for significant losses |

| Customer Support Issues | Medium | Possible delays in issue resolution |

To mitigate these risks, traders should conduct thorough research before trading, ensure they understand the trading platform, and maintain a disciplined approach to risk management. Implementing stop-loss orders and avoiding over-leveraging can also help protect against adverse market movements.

Conclusion and Recommendations

In conclusion, the evidence suggests that Kawase is not a scam and operates as a legitimate forex broker. Its regulatory status, competitive trading conditions, and commitment to fund safety indicate that it is a safe choice for traders. However, potential clients should be aware of the mixed customer feedback regarding support and withdrawal issues.

For traders considering Kawase, it is advisable to start with a demo account to familiarize themselves with the platform and its features before committing significant funds. Additionally, those seeking alternative brokers may consider options like IG or OANDA, which also have strong regulatory oversight and positive reputations in the industry. Overall, Kawase presents a viable option for forex trading, but due diligence is crucial to ensure a positive trading experience.

Is KAWASE a scam, or is it legit?

The latest exposure and evaluation content of KAWASE brokers.

KAWASE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KAWASE latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.