Is JS safe?

Pros

Cons

Is JS Safe or Scam?

Introduction

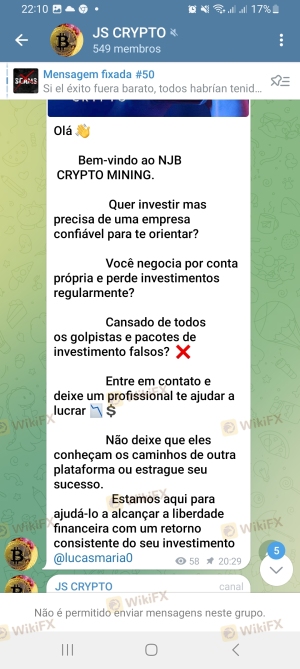

JS is a forex broker that has emerged in the trading landscape, providing various financial services to traders looking to engage in currency trading, CFDs, and other investment opportunities. As the forex market continues to attract a growing number of participants, the importance of evaluating the credibility and safety of brokers cannot be overstated. Traders are often lured by promises of high returns, but without proper due diligence, they may fall victim to scams. This article aims to provide a comprehensive analysis of JS, examining its regulatory status, company background, trading conditions, customer safety measures, and overall reputation in the industry. The investigation is based on a review of multiple sources, including expert analyses and user experiences, to determine whether JS is safe for traders.

Regulation and Legitimacy

The regulatory environment in which a broker operates is crucial for establishing its legitimacy. Regulated brokers are required to adhere to strict standards that protect investors, while unregulated brokers can pose significant risks. In the case of JS, the findings indicate a troubling lack of regulation.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

JS claims to be regulated; however, it fails to provide any verifiable licensing information. The absence of a regulatory license raises serious concerns about the broker's compliance with industry standards. Furthermore, multiple sources have identified JS as a clone firm, operating under the guise of a legitimate entity. The Financial Conduct Authority (FCA) has issued warnings regarding JS, indicating that it operates outside the legal framework, which is a significant red flag. In essence, JS is not safe, as traders cannot rely on any legal protections to safeguard their funds.

Company Background Investigation

A thorough background check on a broker can reveal much about its trustworthiness. JS's history appears to be murky, with limited information available regarding its establishment and ownership structure. The broker claims to be based in the UK, but the lack of transparency surrounding its actual operations and management team raises concerns.

The company's website does not provide substantial details about its founders or the management team, which is critical for assessing the expertise behind the broker. A reputable broker typically showcases the qualifications and experience of its leadership, providing potential clients with confidence in their capabilities. Unfortunately, JS lacks this transparency, making it difficult for investors to ascertain who is managing their funds.

Moreover, the absence of clear information about the companys operational history and its regulatory compliance further diminishes its credibility. This lack of transparency suggests that JS is not safe, and potential investors should approach with caution.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions it offers is essential. JS claims to provide a competitive trading environment, but the lack of detailed information raises concerns about its fee structure and trading conditions.

| Fee Type | JS | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | N/A | 0.1 - 0.5% |

| Overnight Interest Range | High | Low to Moderate |

The spread on major currency pairs is reported to be variable, which can be a disadvantage for traders looking for stability in their trading costs. Additionally, the absence of a clear commission structure raises questions about any hidden fees that might be applied during trading. Traders have reported difficulties in withdrawing funds, which can be indicative of problematic fee policies and operational transparency.

Overall, the trading conditions at JS do not align with industry standards, leading to concerns that JS is not safe for traders seeking a reliable and transparent trading experience.

Customer Funds Security

The safety of customer funds is paramount when selecting a broker. JS claims to implement measures to secure clients' funds; however, the absence of regulation significantly undermines these claims.

Investors should expect brokers to have robust fund segregation policies, ensuring that client funds are kept separate from the broker's operational funds. Additionally, the presence of negative balance protection is crucial to prevent traders from losing more than their initial investment. Unfortunately, JS does not provide clear information regarding these critical safety measures.

The lack of investor protection mechanisms raises alarms about the security of funds held with JS. Historical reports of withdrawal difficulties and unresponsive customer service further exacerbate concerns about the safety of client funds. Given these factors, it is reasonable to conclude that JS is not safe, and potential investors should be wary of entrusting their funds to this broker.

Customer Experience and Complaints

Customer feedback is an invaluable resource when assessing a broker's reputation. Reviews of JS reveal a pattern of complaints, particularly concerning withdrawal issues and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Poor |

| Customer Support Issues | Moderate | Poor |

Many users have reported that after achieving profits, they faced excuses and delays when attempting to withdraw their funds. This pattern of complaints suggests systemic issues within the broker's operations. One user reported a significant delay in receiving a profit of $15,000, with the broker citing various reasons for the hold-up, which is a common red flag in the industry.

Overall, the negative customer experiences associated with JS indicate that JS is not safe, as traders may encounter significant challenges when trying to access their funds.

Platform and Execution

Evaluating the trading platform's performance is critical for understanding the overall trading experience. JS claims to offer a user-friendly platform; however, user experiences indicate otherwise. Reports of slippage, order rejections, and overall platform instability raise concerns about the broker's reliability.

Traders have noted that during high volatility periods, the execution quality deteriorates, leading to unexpected losses. These issues can significantly impact a trader's ability to manage risks effectively. The lack of transparency regarding the platform's operational integrity further supports the conclusion that JS is not safe for traders seeking a dependable trading environment.

Risk Assessment

Investing with a broker like JS involves various risks that traders must consider. The following risk assessment summarizes the key risk areas associated with JS:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Withdrawal Risk | High | Numerous complaints regarding fund access. |

| Transparency Risk | High | Lack of information about operations and fees. |

Given these risks, traders should exercise extreme caution when considering JS as a trading partner. To mitigate potential losses, it is advisable to conduct thorough research and consider alternative, regulated brokers that offer greater transparency and security.

Conclusion and Recommendations

In conclusion, the investigation into JS reveals several concerning factors that suggest it may not be a safe choice for traders. The lack of regulation, negative customer experiences, and transparency issues raise significant red flags. Therefore, it is prudent for traders to avoid engaging with JS and seek out brokers that are fully regulated and have a proven track record of reliability.

For traders looking for safer alternatives, consider reputable brokers that are regulated by top-tier authorities, such as the FCA or ASIC. These brokers typically offer greater transparency, robust customer support, and better protection for client funds. In summary, JS is not safe, and potential investors should be cautious and seek out more trustworthy options in the forex market.

Is JS a scam, or is it legit?

The latest exposure and evaluation content of JS brokers.

JS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

JS latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.