Is Imperial Trade safe?

Pros

Cons

Is Imperial Trade A Scam?

Introduction

In the ever-evolving landscape of the foreign exchange (forex) market, brokers play a crucial role in facilitating trades for individual and institutional investors. One such broker is Imperial Trade, which has garnered attention for its services in forex and cryptocurrency trading. However, the increasing number of reports and complaints surrounding this broker raises significant concerns about its legitimacy. As a trader, it is imperative to thoroughly evaluate any broker before committing funds, as the forex market is rife with scams and unregulated entities. This article aims to analyze the credibility of Imperial Trade by investigating its regulatory status, company background, trading conditions, and customer experiences. Our evaluation will rely on information gathered from various online sources, including user reviews and regulatory databases, to provide a comprehensive assessment of whether Imperial Trade is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is one of the most significant indicators of its legitimacy. Regulated brokers are subject to oversight by financial authorities, which helps ensure transparency and protect investors. Unfortunately, Imperial Trade has been flagged as unregulated, raising red flags for potential clients.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The lack of regulation means that Imperial Trade operates without the scrutiny of a governing body, which is a major concern for investors. Regulatory bodies like the Financial Conduct Authority (FCA) in the UK and the Securities and Exchange Commission (SEC) in the U.S. enforce strict compliance standards to protect investors from fraud. Without such oversight, traders are left vulnerable to potential misconduct. Additionally, reports indicate that Imperial Trade has received warnings from consumer protection sites, further solidifying its status as a risky option for trading.

Company Background Investigation

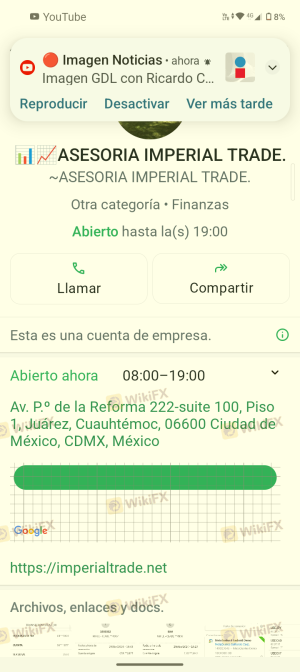

Understanding the background of a broker is essential for assessing its trustworthiness. Imperial Trade appears to lack transparency regarding its ownership structure and operational history. The company has not provided clear information about its founders or management team, which raises concerns about accountability and trust.

A review of the available information reveals that Imperial Trade was established in 2023, making it a relatively new player in the forex market. This short history, coupled with the absence of a physical address and contact details, suggests a lack of commitment to long-term operations. Furthermore, the anonymity surrounding the company's management team and its lack of a verifiable track record make it difficult for potential clients to gauge the broker's reliability. In light of these factors, it is prudent to question whether Imperial Trade is safe for trading.

Trading Conditions Analysis

When evaluating a broker, it is crucial to understand its trading conditions, including fees and spreads. Imperial Trade presents itself as a competitive option in terms of trading costs, but a closer look reveals potential issues.

| Fee Type | Imperial Trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clear information regarding spreads and commissions is concerning. Many users have reported hidden fees and unexpected charges, which can significantly impact profitability. Such practices are often associated with unregulated brokers seeking to exploit traders. If a broker is not transparent about its fee structure, it raises the question of whether Imperial Trade is safe for serious traders.

Client Funds Safety

The safety of client funds is paramount when choosing a broker. Imperial Trade's lack of regulatory oversight means it is not required to implement investor protection measures commonly found in regulated firms. This absence of regulation translates to potential risks for clients' funds.

Unregulated brokers like Imperial Trade often do not segregate client funds from their operational accounts, which can lead to financial mismanagement. Additionally, there are no guarantees regarding negative balance protection or investor compensation schemes, leaving traders exposed to significant losses. Historical reports have indicated that clients have faced difficulties withdrawing funds, a common issue with unregulated brokers. Given these factors, it is evident that Imperial Trade is not safe for investors concerned about the security of their capital.

Customer Experience and Complaints

Customer feedback provides valuable insights into a broker's reliability. A review of user experiences with Imperial Trade reveals a pattern of complaints regarding withdrawal issues and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Communication | Medium | Poor |

| Misleading Information | High | Poor |

Numerous clients have reported being unable to withdraw their funds, often citing excessive fees or arbitrary conditions imposed by the broker. In some cases, users have claimed that their accounts were frozen without explanation. The company's slow response to these complaints further exacerbates the situation, leading many to label Imperial Trade as a scam.

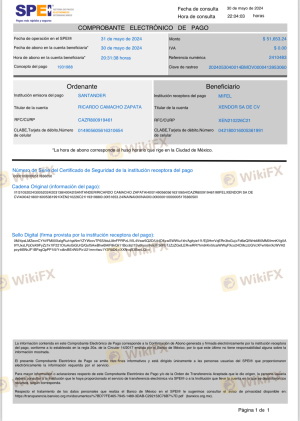

For instance, one user reported investing $5,500 only to be asked for additional fees before they could access their profits. After multiple attempts to communicate with customer support, the user was eventually blocked, highlighting the lack of accountability exhibited by the broker.

Platform and Execution

A broker's trading platform is critical to the trading experience. Imperial Trade's platform has been described as unstable, with users reporting issues related to order execution and slippage. Many traders have expressed frustration with the platform's performance during volatile market conditions, which can lead to missed opportunities or unexpected losses.

The quality of order execution is another area of concern. Reports of high slippage and rejected orders suggest that the platform may not be operating optimally, raising questions about its reliability. Such issues can significantly impact trading outcomes, making it essential for traders to consider whether Imperial Trade is safe for their trading activities.

Risk Assessment

Using Imperial Trade comes with inherent risks, primarily due to its unregulated status and poor customer feedback.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection |

| Fund Security Risk | High | Lack of fund segregation and protection |

| Execution Risk | Medium | Issues with order execution and slippage |

To mitigate these risks, potential clients should conduct thorough research and consider using regulated brokers with established reputations. It is advisable to start with smaller investments or demo accounts to gauge the broker's reliability before committing larger sums.

Conclusion and Recommendations

In conclusion, the evidence suggests that Imperial Trade is not a safe broker for forex and cryptocurrency trading. Its unregulated status, lack of transparency, and numerous customer complaints point towards a high level of risk for potential investors. Traders seeking a reliable trading environment should exercise caution and consider alternatives that are regulated and have a proven track record.

For those considering entering the forex market, it is recommended to explore established brokers with solid regulatory frameworks, such as those regulated by the FCA or ASIC. These brokers offer greater security for client funds and a more transparent trading experience. Ultimately, it is crucial to prioritize safety and due diligence when selecting a trading partner to avoid falling victim to scams like Imperial Trade.

Is Imperial Trade a scam, or is it legit?

The latest exposure and evaluation content of Imperial Trade brokers.

Imperial Trade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Imperial Trade latest industry rating score is 1.34, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.34 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.