Imperial Trade 2025 Review: Everything You Need to Know

Executive Summary

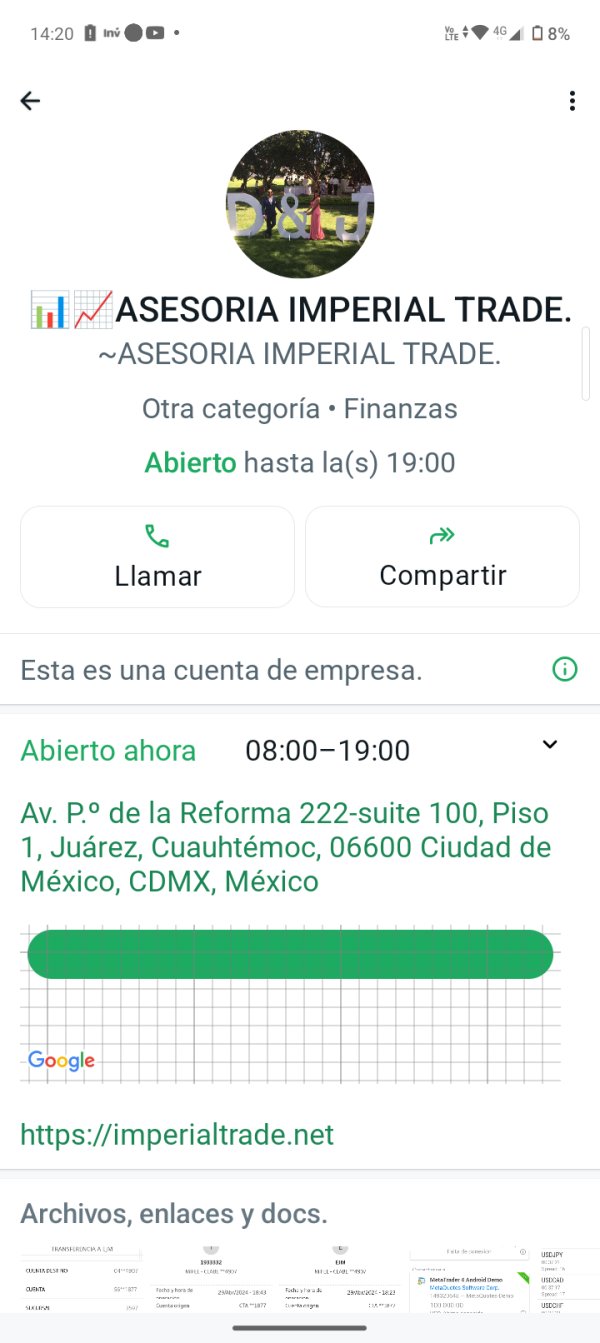

This imperial trade review presents a comprehensive analysis of a broker that has generated significant concern within the trading community. Imperial Trade was established in 2017 and is headquartered in Spain, operating as a forex broker offering multiple asset classes including indices, cryptocurrencies, precious metals, stocks, commodities, and CFDs. However, the broker's performance record raises serious red flags for potential investors.

Based on available user feedback, Imperial Trade receives a concerning overall rating of 2.5 out of 10 from 42 reviews. Only 38% of reviewers recommend the platform. This substantially below-average performance indicates widespread user dissatisfaction across multiple service areas. While the broker targets investors seeking diversified asset trading opportunities, the overwhelming negative feedback suggests that traders should exercise extreme caution when considering this platform.

The broker's primary appeal lies in its multi-asset offering. This potentially attracts traders interested in diversifying their portfolios across various financial instruments. However, the poor user satisfaction metrics and limited transparency regarding regulatory oversight significantly undermine its credibility in the competitive forex brokerage landscape.

Important Notice

This imperial trade review is based on publicly available user feedback and limited company information. Readers should note that specific details regarding regulatory status, trading conditions, and operational procedures are not comprehensively documented in available sources. The evaluation methodology relies primarily on user testimonials and basic company data. This may not provide a complete picture of the broker's current operations.

The analysis presented here reflects information available at the time of writing. It may not capture recent changes in the broker's services or regulatory status. Potential clients should conduct independent verification of all trading conditions and regulatory compliance before making any investment decisions.

Rating Framework

Based on available information and user feedback, Imperial Trade receives the following scores across key evaluation criteria:

Broker Overview

Imperial Trade entered the forex brokerage market in 2017. The company positioned itself as a Spain-based trading platform. The company has attempted to establish itself in the competitive online trading sector by offering access to multiple financial markets. However, the broker's seven-year operational history has been marked by consistently poor user feedback and limited market recognition.

The broker operates under a business model that provides traders with access to various asset classes. These include traditional forex pairs, stock indices, precious metals, and emerging cryptocurrency markets. This diversified approach appears designed to attract traders seeking comprehensive market exposure through a single platform. However, the implementation of these services has apparently fallen short of user expectations.

According to available information, Imperial Trade offers trading in indices, cryptocurrencies, precious metals, stocks, commodities, and contracts for difference. This broad asset selection potentially appeals to traders looking to diversify their portfolios across multiple market sectors. However, specific details about trading platforms, execution methods, and technological infrastructure remain unclear from available sources. This contributes to uncertainty about the broker's operational capabilities.

Regulatory Status: Available information does not provide clear details about Imperial Trade's regulatory oversight. This lack of transparency regarding licensing and regulatory compliance represents a significant concern for potential clients seeking secure trading environments.

Deposit and Withdrawal Methods: Specific information about funding options, processing times, and associated fees is not detailed in available sources. This information gap makes it difficult for traders to assess the convenience and cost-effectiveness of financial transactions.

Minimum Deposit Requirements: The broker's minimum deposit thresholds are not specified in available documentation. This prevents accurate assessment of accessibility for different trader segments.

Promotional Offers: Details about bonus structures, promotional campaigns, or incentive programs are not documented in reviewed sources.

Tradeable Assets: Imperial Trade offers access to indices, cryptocurrencies, precious metals, stocks, commodities, and CFDs. This diversified asset selection represents one of the few positive aspects identified in this imperial trade review.

Cost Structure: Specific information about spreads, commissions, overnight fees, and other trading costs is not available in reviewed sources. This makes cost comparison with competitors impossible.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in available documentation.

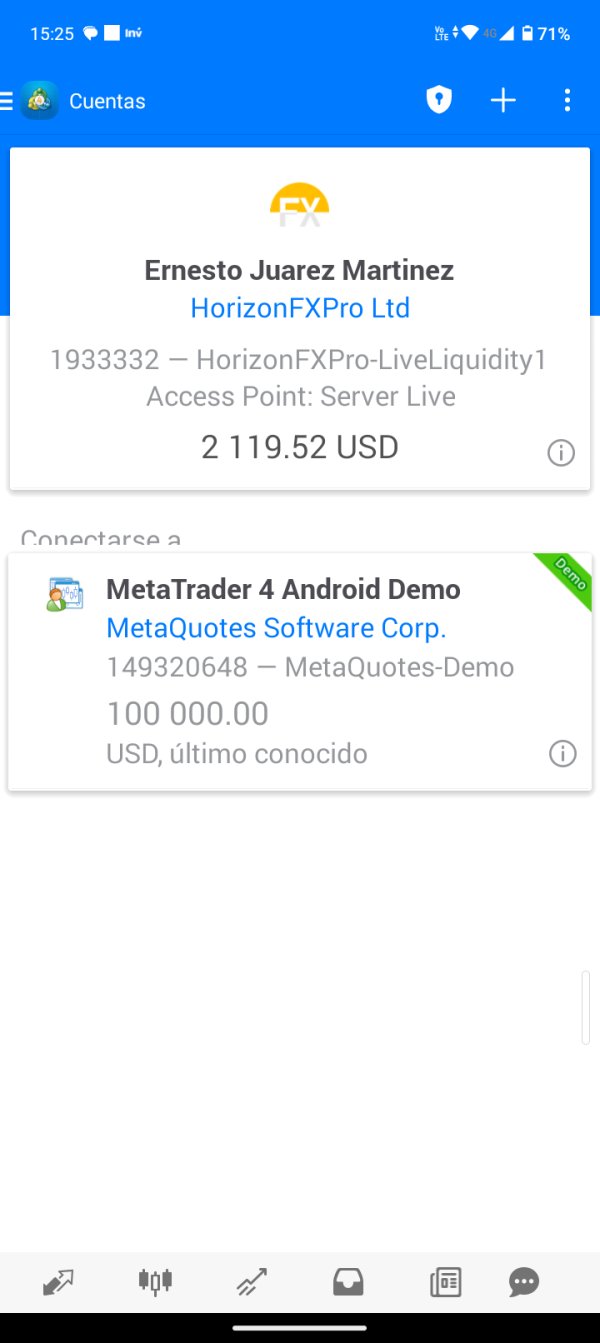

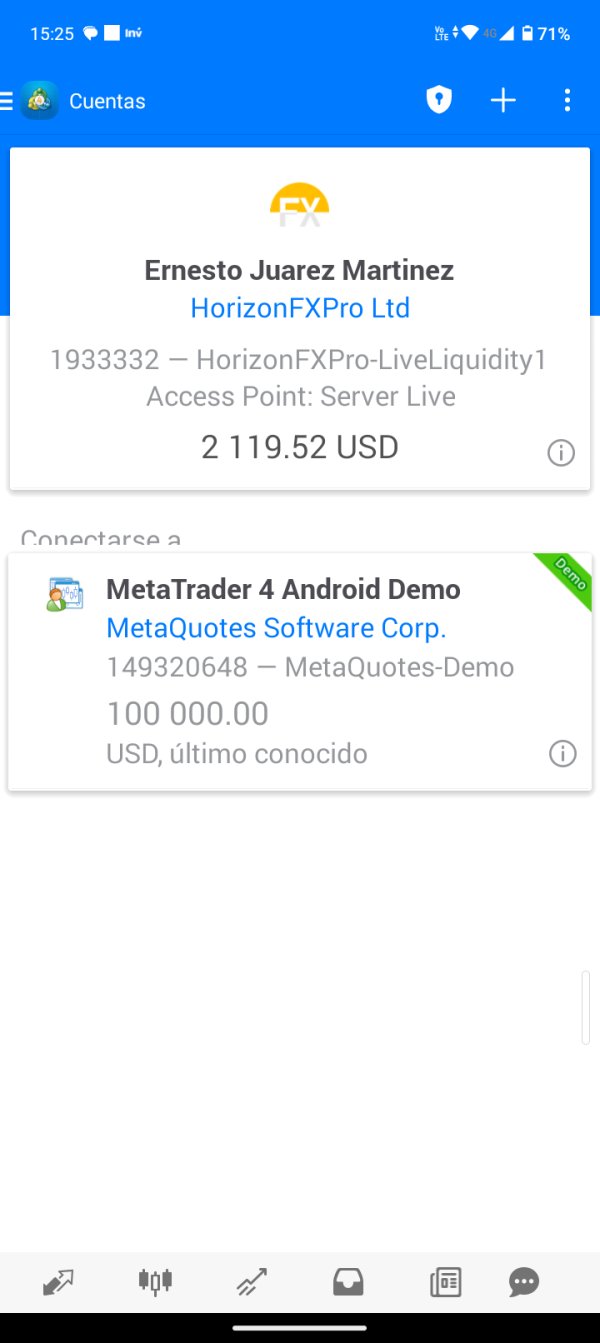

Platform Options: The trading platforms offered by Imperial Trade are not detailed in available sources. This leaves questions about technological capabilities and user interface quality.

Geographic Restrictions: Information about regional limitations or restricted territories is not provided in reviewed materials.

Customer Support Languages: Available support languages and communication channels are not specified in documented sources.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Imperial Trade's account conditions reveals significant information gaps that contribute to the low 4/10 rating. Available sources do not provide details about account types, tier structures, or specific features that might differentiate various account levels. This lack of transparency makes it impossible for potential clients to understand what services and conditions they can expect.

The absence of information regarding minimum deposit requirements, account maintenance fees, or special features such as Islamic accounts further complicates the assessment process. User feedback suggests general dissatisfaction with account-related services. However, specific complaints are not detailed in available sources.

When compared to established brokers in the market, Imperial Trade's lack of clear account information represents a significant disadvantage. Reputable brokers typically provide comprehensive details about their account structures. The absence of such information is particularly concerning. This imperial trade review cannot recommend the broker's account conditions due to insufficient transparency and poor user feedback regarding overall service quality.

The limited information available suggests that potential clients may encounter difficulties in understanding their rights, obligations, and available services. This could lead to misunderstandings and disputes during the trading relationship.

Imperial Trade's tools and resources receive a moderate 5/10 rating. This is based primarily on the variety of asset classes offered rather than the quality of trading tools provided. The broker provides access to multiple markets including indices, cryptocurrencies, precious metals, stocks, and commodities. This could potentially serve diversification strategies.

However, available information lacks details about specific trading tools, research capabilities, or analytical resources that traders typically expect from modern brokers. The absence of information about charting software, technical indicators, economic calendars, or market analysis reports represents a significant gap in the evaluation process.

Educational resources are crucial for trader development. They are not documented in available sources. Modern traders expect access to webinars, tutorials, market insights, and educational materials that can help improve their trading skills and market understanding.

User feedback regarding tools and resources appears generally negative. However, specific complaints about functionality or usability are not detailed in reviewed sources. The lack of positive user testimonials about trading tools or resources suggests that these aspects of the service may not meet contemporary market standards.

Customer Service and Support Analysis

Customer service receives the lowest rating of 3/10. This reflects serious concerns about Imperial Trade's support capabilities. User feedback indicates widespread dissatisfaction with customer service quality. However, specific details about response times, problem resolution, or communication effectiveness are not provided in available sources.

The poor user recommendation rate of only 38% strongly suggests that customer service experiences contribute significantly to overall dissatisfaction with the broker. In the competitive forex brokerage industry, customer service quality often determines client retention and satisfaction levels.

Available information does not specify customer support channels, operating hours, or language capabilities. This makes it impossible to assess accessibility and convenience for international clients. The absence of this basic information represents another transparency concern that may indicate inadequate customer service infrastructure.

Problem resolution capabilities, escalation procedures, and service quality standards are not documented in available sources. User feedback suggests that clients have experienced difficulties with customer support. However, the nature and scope of these problems are not detailed in reviewed materials.

Trading Experience Analysis

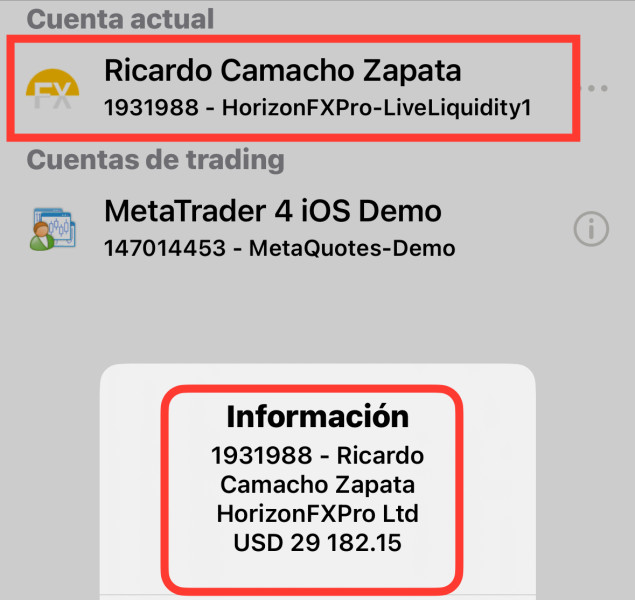

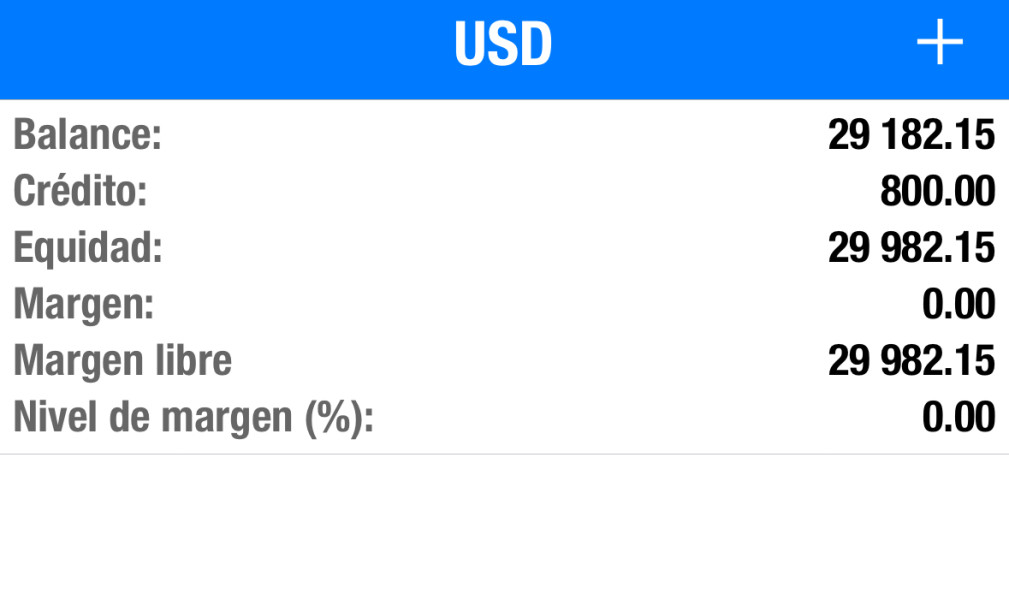

The trading experience evaluation yields a 4/10 rating. This is primarily based on user feedback indicating platform instability and general dissatisfaction with trading conditions. While specific technical performance data is not available, user reviews suggest that the trading environment may not meet contemporary standards for reliability and functionality.

Platform stability concerns are particularly significant in forex trading. Execution speed and reliability directly impact trading outcomes. User reports indicating platform issues suggest that Imperial Trade may struggle to provide the consistent performance that active traders require.

Order execution quality is crucial for trading success. It is not specifically documented in available sources. However, the poor overall user ratings suggest that execution standards may not meet market expectations for speed, accuracy, and transparency.

Mobile trading capabilities are essential in today's trading environment. They are not detailed in available information. The absence of mobile platform information represents a significant gap, as most modern traders expect seamless mobile access to their accounts and trading tools.

This imperial trade review cannot provide a positive assessment of the trading experience based on available user feedback and the lack of specific performance data or technical specifications.

Trust and Safety Analysis

Trust and safety receive the lowest rating of 2/10. This is primarily due to the absence of clear regulatory information and poor user confidence indicators. The lack of documented regulatory oversight represents a fundamental concern for traders seeking secure and protected trading environments.

Regulatory compliance is crucial in the forex industry. It provides legal protection for client funds and ensures adherence to operational standards. The absence of clear regulatory information in available sources raises serious questions about client fund protection and operational oversight.

Fund security measures are not documented in reviewed sources. These include segregated account arrangements, deposit insurance, or compensation schemes. This information gap prevents assessment of financial protection levels that clients might expect in case of operational difficulties.

Company transparency is not adequately documented in available sources. This includes corporate structure, ownership details, and operational procedures. This lack of transparency contributes to reduced confidence in the broker's legitimacy and operational standards.

Industry reputation appears poor based on user feedback and low recommendation rates. The absence of positive third-party endorsements or industry recognition further undermines confidence in the broker's credibility and operational standards.

User Experience Analysis

User experience receives a 3/10 rating. This reflects the poor user satisfaction metrics and low recommendation rates documented in available sources. With only 38% of users recommending Imperial Trade and an overall rating of 2.5 out of 10, the user experience clearly falls short of market standards.

Overall user satisfaction appears significantly below industry averages. This suggests systematic issues with service delivery across multiple areas. The low recommendation rate indicates that most users would not suggest the broker to other traders. This represents a serious credibility concern.

Interface design and usability information is not available in reviewed sources. This prevents assessment of platform user-friendliness and navigation efficiency. However, poor overall ratings suggest that user interface quality may contribute to negative experiences.

Registration and verification processes are not detailed in available documentation. User feedback suggests general dissatisfaction with administrative procedures. Account opening efficiency and document processing capabilities appear to be areas of concern based on overall user sentiment.

Common user complaints are not specifically documented in available sources. However, the consistently poor ratings across multiple review categories suggest widespread dissatisfaction with various aspects of the service. The lack of positive user testimonials further reinforces concerns about service quality and user satisfaction levels.

Conclusion

This comprehensive imperial trade review reveals significant concerns about the broker's service quality, transparency, and user satisfaction levels. With a user rating of only 2.5 out of 10 and a recommendation rate of just 38%, Imperial Trade demonstrates substantial deficiencies across multiple service areas.

The broker offers access to diverse asset classes including indices, cryptocurrencies, precious metals, stocks, and commodities. However, this variety cannot compensate for the fundamental issues identified in user feedback and operational transparency. The lack of clear regulatory information, combined with poor customer service ratings and platform stability concerns, creates an environment of significant risk for potential clients.

Imperial Trade may theoretically appeal to traders seeking diversified asset exposure. However, the overwhelming negative user feedback and lack of transparency make it impossible to recommend this broker. Traders would be better served by selecting established, well-regulated brokers with proven track records of customer satisfaction and operational excellence.