Regarding the legitimacy of Lonny forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is Lonny safe?

Pros

Cons

Is Lonny markets regulated?

The regulatory license is the strongest proof.

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Alchemy Prime Limited

Effective Date: Change Record

2014-08-05Email Address of Licensed Institution:

info@alchemyprime.uk, ricardo.dytz@alchemyprime.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.alchemyprime.ukExpiration Time:

--Address of Licensed Institution:

5th Floor 142 Central Street Clerkenwell London EC1V 8AR UNITED KINGDOMPhone Number of Licensed Institution:

+442070978794Licensed Institution Certified Documents:

Is Lonny Safe or a Scam?

Introduction

Lonny is a relatively new player in the forex market, having been established in 2021. It positions itself as a broker for retail traders, offering a variety of financial instruments, including currency pairs, commodities, and indices. However, the emergence of numerous unregulated brokers in the forex space raises concerns among traders about the safety and legitimacy of their chosen platforms. Given the potential for fraud and financial loss, it is crucial for traders to conduct thorough evaluations of forex brokers before committing their funds.

This article aims to assess whether Lonny is safe or a scam by examining its regulatory status, company background, trading conditions, customer fund safety measures, user experiences, platform performance, and overall risk profile. The assessment is based on various online reviews, regulatory databases, and user feedback gathered through a structured investigative approach.

Regulation and Legitimacy

One of the most critical aspects of evaluating a forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices that protect clients' interests. Lonny operates under the name Lonny Prime Limited but has been flagged as a suspicious clone by regulatory authorities.

Regulatory Information

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA (UK) | N/A | United Kingdom | Suspicious Clone |

The Financial Conduct Authority (FCA) in the UK, which is known for its stringent regulatory requirements, has not provided a license to Lonny. The designation of Lonny as a "suspicious clone" raises red flags, indicating that it may be imitating a legitimate broker to deceive traders. The lack of a valid regulatory license is a significant concern, as it suggests that Lonny operates outside the protective framework that regulated brokers must follow.

In summary, the quality of regulation is paramount when assessing broker safety, and the absence of appropriate licensing for Lonny suggests potential risks for traders. Therefore, it is essential to proceed with caution when considering this broker.

Company Background Investigation

Understanding the company behind a broker is essential for determining its legitimacy. Lonny is registered as Lonny Prime Limited and was established in 2021. However, there is limited publicly available information regarding its ownership structure and management team, which raises concerns about transparency.

While the broker claims to offer a range of trading services, the lack of detailed information about its founders or key executives makes it difficult to assess their qualifications and experience in the financial industry. Transparency in ownership and management is crucial for building trust with clients, and the absence of this information can lead to skepticism.

Furthermore, a thorough investigation into the company's history reveals no significant milestones or achievements that would indicate a reputable background in the forex industry. This lack of a robust company profile further contributes to the uncertainty surrounding the legitimacy of Lonny.

In conclusion, the limited information about Lonny's management and ownership structure, combined with its short operational history, raises questions about its credibility and reliability as a forex broker.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience and profitability. Lonny claims to provide competitive trading conditions, but it is essential to analyze its fee structure and any unusual policies that may affect traders.

Trading Cost Comparison

| Fee Type | Lonny | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | 2% - 5% |

Unfortunately, specific details about Lonny's trading fees and conditions are not readily available, making it challenging to conduct a comprehensive analysis. However, the absence of transparent information regarding spreads, commissions, and overnight interest rates can be a warning sign, as reputable brokers typically provide clear details about their fee structures.

Moreover, traders should be wary of any hidden fees or unusual charges that could erode their profits. If a broker's fee structure is not clearly defined, it may indicate a lack of transparency or even potential exploitation of traders.

In summary, the lack of detailed information regarding trading conditions at Lonny raises concerns about its overall reliability and transparency. Traders should exercise caution and consider brokers with well-defined and competitive trading conditions.

Customer Fund Safety

The safety of customer funds is a top priority for any forex trader. A reputable broker should implement robust security measures to protect clients' deposits and ensure that their investments are safeguarded.

Lonny's website does not provide clear information regarding its policies on fund safety, including whether client funds are held in segregated accounts, which is a best practice in the industry. Segregated accounts ensure that clients' funds are kept separate from the broker's operational funds, providing an additional layer of protection in case of insolvency.

Moreover, it is crucial to assess whether Lonny offers any investor protection mechanisms, such as negative balance protection, which prevents clients from losing more money than they have deposited. The absence of such policies can expose traders to significant financial risk.

Historically, if a broker has faced issues related to fund safety or client complaints regarding fund withdrawals, it can be a significant red flag. In the case of Lonny, the lack of transparency surrounding its fund safety measures raises concerns about whether clients' investments are adequately protected.

In conclusion, the absence of clear information about Lonny's customer fund safety measures is a cause for concern. Traders should prioritize brokers with established safety protocols to ensure their investments are secure.

Customer Experience and Complaints

Analyzing customer feedback and experiences can provide valuable insights into a broker's reliability and service quality. Lonny has received mixed reviews from users, with some expressing concerns about their experiences.

Complaint Types and Severity Assessment

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Support | Medium | Average |

| Misleading Information | High | Poor |

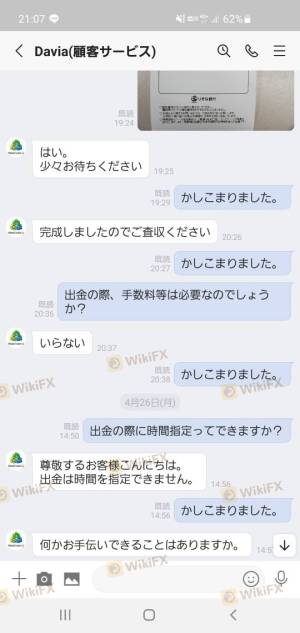

Common complaints about Lonny include difficulties with fund withdrawals and a lack of responsive customer support. Traders have reported challenges in accessing their funds, which is one of the most serious issues a broker can face. The inability to withdraw funds can indicate potential scams or financial instability.

Additionally, the quality of customer support is crucial for traders, especially when they encounter issues or have questions. A lack of timely and effective support can lead to frustration and dissatisfaction among clients.

A few case studies highlight these concerns. For instance, one user reported being unable to withdraw funds after multiple requests, leading to a prolonged and frustrating experience. Another trader expressed dissatisfaction with the lack of communication from the support team when seeking assistance.

In conclusion, the feedback from users regarding Lonny suggests several red flags, particularly concerning withdrawal issues and support responsiveness. Traders should carefully consider these factors before engaging with this broker.

Platform and Trade Execution

The trading platform is a critical component for any forex trader, as it directly affects the trading experience. Lonny claims to offer a user-friendly platform, but it is essential to evaluate its performance, stability, and execution quality.

Traders have reported mixed experiences with Lonny's trading platform. Some users have noted issues with platform stability, including frequent disconnections and slow execution times. These factors can significantly impact trading performance, especially for those relying on timely execution for their strategies.

Additionally, any signs of manipulation, such as excessive slippage or rejected orders, can be concerning. While some slippage is normal in fast-moving markets, excessive slippage or frequent order rejections can indicate potential issues with the broker's execution practices.

In summary, the experiences reported by users regarding Lonny's trading platform raise concerns about its reliability and execution quality. Traders should prioritize brokers with a proven track record of stable and efficient trading platforms.

Risk Assessment

When considering a broker, it is essential to evaluate the overall risk associated with using their services. Lonny presents several risks that traders should be aware of.

Risk Scorecard

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status |

| Fund Safety Risk | High | Lack of transparency on fund security |

| Customer Support Risk | Medium | Poor response to complaints |

| Trading Execution Risk | High | Reports of slippage and disconnections |

The high regulatory risk associated with Lonny is a significant concern, as it operates without proper oversight. This lack of regulation increases the likelihood of potential scams or unethical practices.

Additionally, the absence of clear fund safety measures further exacerbates the risk profile for traders. Without adequate protections in place, clients may find themselves exposed to financial losses.

To mitigate these risks, traders should conduct thorough research and consider using brokers with established regulatory frameworks, transparent fund safety protocols, and responsive customer support.

Conclusion and Recommendations

Based on the comprehensive analysis of Lonny, it is evident that several red flags raise concerns about its legitimacy. The lack of regulation, transparency in company operations, and numerous customer complaints suggest that Lonny may not be a safe choice for traders.

While it is essential to approach any broker with caution, the evidence presented indicates that traders should be wary of engaging with Lonny. For those seeking reliable and trustworthy forex brokers, it is advisable to consider alternatives that are regulated by reputable authorities and have a proven track record of client satisfaction.

In conclusion, is Lonny safe? The evidence suggests that it is prudent for traders to exercise caution and consider other options before committing their funds to this broker.

Is Lonny a scam, or is it legit?

The latest exposure and evaluation content of Lonny brokers.

Lonny Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Lonny latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.