Is Prime Coin safe?

Pros

Cons

Is Prime Coin Safe or a Scam?

Introduction

In the ever-evolving landscape of the foreign exchange (forex) market, understanding the credibility of trading platforms is paramount for investors. Prime Coin is a relatively new player in this arena, positioning itself as a broker for forex, cryptocurrencies, and contracts for difference (CFDs). With the rise of online trading, the need for traders to evaluate the safety and reliability of brokers has become increasingly critical. Many traders fall victim to scams or unreliable platforms, often leading to significant financial losses. This article aims to dissect the operational integrity of Prime Coin by examining its regulatory status, company background, trading conditions, customer experience, and overall risk factors. Our investigation draws from various online sources, including user reviews, regulatory databases, and expert analyses, to provide a comprehensive overview of whether Prime Coin is safe or a potential scam.

Regulation and Legitimacy

The regulatory framework within which a broker operates is a key indicator of its legitimacy. Prime Coin claims to offer trading services without any discernible regulatory oversight, raising immediate red flags. Regulation is crucial as it ensures that brokers adhere to certain standards, providing a safety net for traders. The absence of regulation can expose traders to risks such as fund mismanagement and lack of recourse in disputes.

Here‘s a table summarizing Prime Coin’s regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The lack of a regulatory license is a significant concern, as it indicates that Prime Coin is not subject to the oversight of any recognized financial authority. This absence can lead to a myriad of issues, including the potential for fraudulent activities. Regulatory bodies like the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the USA impose strict compliance requirements on brokers to protect traders. Without such oversight, the question of whether Prime Coin is safe becomes increasingly complicated.

Company Background Investigation

Prime Coin was established in 2022, and little information is available regarding its ownership structure or the backgrounds of its management team. Transparency is a critical component of a trustworthy broker; however, Prime Coin's website provides scant details about its operational history or the individuals behind the company. This lack of information raises concerns about the broker's reliability and accountability.

A credible trading platform typically discloses information about its founders and management, including their qualifications and experience in the financial sector. The absence of such details can lead to skepticism among potential investors. Prime Coin's failure to provide verifiable information about its management team further complicates the assessment of its safety.

Moreover, the company's website lacks a physical address, which is another hallmark of a potentially fraudulent operation. Legitimate brokers usually have a physical presence in their operating regions, which facilitates accountability and trust. Without this transparency, it is challenging to ascertain whether Prime Coin is safe or operating under dubious circumstances.

Trading Conditions Analysis

When evaluating the credibility of a broker, understanding its trading conditions is essential. Prime Coin offers a variety of trading instruments, including forex, cryptocurrencies, and CFDs. However, the broker's fee structure appears opaque, with limited information available on spreads, commissions, and overnight fees.

Heres a comparison table of the core trading costs associated with Prime Coin:

| Fee Type | Prime Coin | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | Typically 1-2 pips |

| Commission Model | N/A | Varies, often $5 per lot |

| Overnight Interest Range | N/A | Varies by broker |

The lack of clarity regarding fees is concerning. Traders should expect transparent pricing structures, especially when dealing with unregulated brokers. Unusual fees or hidden costs can significantly impact a trader's profitability. The absence of information on Prime Coins website regarding these costs raises questions about whether Prime Coin is safe for trading.

Client Fund Security

The safety of client funds is a paramount concern for any trader. Prime Coin's lack of regulatory oversight raises significant questions about its fund security measures. A reputable broker typically employs strict measures to protect client funds, including segregated accounts and investor compensation schemes.

Prime Coin does not appear to offer such protections, which could expose traders to the risk of losing their funds without any recourse. The absence of negative balance protection is another red flag; this feature ensures that traders cannot lose more money than they initially deposited, safeguarding them from excessive losses.

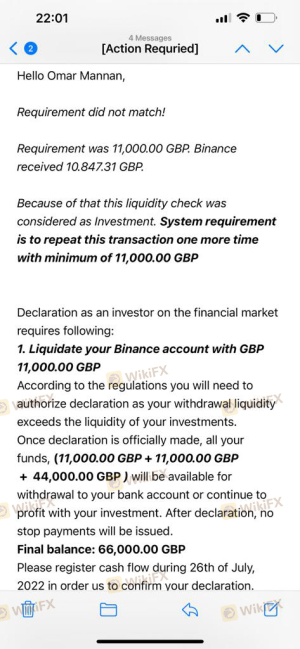

Historically, unregulated brokers have been known to engage in practices that jeopardize client funds, such as misappropriation or refusal to process withdrawal requests. Without a solid framework for fund protection, it is imperative for potential investors to seriously consider whether Prime Coin is safe for their trading activities.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. Reviews of Prime Coin reveal a mixed bag of experiences, with numerous complaints regarding withdrawal issues and unresponsive customer support. Common complaints include difficulties in accessing funds and delayed responses from the support team.

Heres a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Poor |

| Lack of Transparency | High | None |

For instance, several users have reported being unable to withdraw their funds after making deposits, a classic sign of a potential scam. Such complaints, combined with inadequate company responses, further question the safety of trading with Prime Coin.

Platform and Trade Execution

The trading platform provided by Prime Coin is another critical aspect to consider. Users have reported that while the platform offers basic functionalities, it lacks the sophistication and reliability of industry-standard platforms like MetaTrader 4 or 5. The quality of order execution, including slippage and rejection rates, is also vital for traders looking to execute strategies effectively.

A reliable platform should ensure quick and efficient order execution without excessive slippage. Reports of high slippage or order rejections can indicate underlying issues with the broker's liquidity or operational integrity, raising further concerns about whether Prime Coin is safe.

Risk Assessment

Using Prime Coin carries inherent risks, primarily due to its unregulated status and lack of transparency. Heres a risk scorecard summarizing key risk areas:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight from recognized authorities |

| Fund Security Risk | High | Lack of protections for client funds |

| Transparency Risk | Medium | Insufficient information about operations |

| Customer Service Risk | High | Poor response to client complaints |

To mitigate these risks, potential clients should conduct thorough research, avoid depositing large sums, and consider using regulated alternatives.

Conclusion and Recommendations

In conclusion, the analysis of Prime Coin raises significant concerns regarding its safety and reliability as a trading platform. The absence of regulatory oversight, lack of transparency, and numerous customer complaints strongly suggest that Prime Coin is not safe for trading.

For traders seeking reliable platforms, it is advisable to consider brokers that are well-regulated and have established reputations in the industry. Alternatives such as brokers regulated by the FCA, ASIC, or other reputable authorities offer a safer trading environment and better protection for client funds.

Ultimately, while the allure of high returns may be tempting, the risks associated with unregulated brokers like Prime Coin far outweigh potential benefits. Always prioritize safety and due diligence when choosing a trading platform.

Is Prime Coin a scam, or is it legit?

The latest exposure and evaluation content of Prime Coin brokers.

Prime Coin Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Prime Coin latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.