Is FOREXMARKETING safe?

Business

License

Is Forexmarketing Safe or Scam?

Introduction

Forexmarketing positions itself as an online platform for forex trading, claiming to provide traders with access to a wide array of trading instruments and services. As the forex market continues to grow in popularity, the need for traders to carefully evaluate their brokers becomes increasingly crucial. With numerous stories of scams and fraudulent activities in the forex industry, it is essential for traders to conduct thorough research before committing their funds to any trading platform. This article aims to analyze the safety and legitimacy of Forexmarketing by examining its regulatory status, company background, trading conditions, customer experience, and risk factors. The evaluation will be based on a comprehensive review of available resources, including user feedback, regulatory information, and expert analyses.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in assessing its safety and reliability. Forexmarketing's lack of regulation raises significant concerns regarding its legitimacy. Unregulated brokers can operate without oversight, making it difficult for traders to seek recourse in case of disputes or financial losses. Below is a summary of Forexmarketing's regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulatory oversight means that Forexmarketing does not adhere to the stringent guidelines that protect traders' interests. Regulated brokers are typically required to maintain segregated accounts, ensuring that client funds are kept separate from the broker's operational funds. This practice is crucial in safeguarding traders' investments. In contrast, Forexmarketing's unregulated status implies that it may not offer the same level of protection, leaving traders vulnerable to potential financial mishaps.

Furthermore, the lack of a regulatory history raises questions about Forexmarketing's commitment to compliance and ethical trading practices. Traders must be cautious when dealing with unregulated platforms, as they often lack transparency and accountability. The absence of oversight can lead to issues such as withdrawal problems, sudden account closures, and even potential scams. Therefore, it is imperative for traders to consider these factors when evaluating whether Forexmarketing is safe.

Company Background Investigation

To further understand the legitimacy of Forexmarketing, it is essential to investigate its company background, ownership structure, and management team. Unfortunately, detailed information about Forexmarketing's history and ownership is sparse, which is a red flag for potential investors. A lack of transparency regarding the company's origins and operational history can indicate that it may not be a trustworthy entity.

The management team's background and expertise also play a significant role in a broker's credibility. A reputable forex broker typically has experienced professionals in leadership positions, ensuring that the platform operates efficiently and ethically. In the case of Forexmarketing, there is limited information available about its management team, which raises concerns about their qualifications and ability to provide reliable services.

Moreover, the absence of clear information about the company's transparency and disclosure practices makes it challenging for potential clients to assess the risks associated with trading on the platform. Traders should be wary of platforms that do not openly share their operational details, as this can be indicative of a lack of accountability.

Trading Conditions Analysis

Understanding the trading conditions offered by Forexmarketing is crucial for assessing its overall viability as a trading platform. A thorough examination of the fee structure and trading costs is essential for determining whether the broker provides competitive and fair trading conditions. Below is a comparative analysis of Forexmarketing's trading costs:

| Cost Type | Forexmarketing | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of specific information regarding Forexmarketing's trading costs is concerning. Traders should expect transparency regarding spreads, commissions, and any additional fees associated with trading. Unusual or hidden fees can significantly impact a trader's profitability and overall experience.

Furthermore, competitive spreads and a clear commission structure are essential for traders, especially in the highly competitive forex market. If Forexmarketing imposes excessive fees or lacks clarity in its pricing, it may not be the best choice for traders seeking to maximize their returns.

Customer Funds Security

The security of customer funds is a paramount concern for any trader. A reputable forex broker should implement robust measures to protect client investments. In the case of Forexmarketing, the absence of regulatory oversight raises serious concerns about the safety of customer funds.

Without proper regulation, there is no guarantee that Forexmarketing employs secure measures such as segregated accounts or investor protection schemes. Segregated accounts ensure that client funds are kept separate from the broker's operational funds, reducing the risk of loss in the event of financial difficulties.

Additionally, the lack of historical data regarding Forexmarketing's handling of customer funds is alarming. Traders should be cautious of platforms that do not provide clear information about their fund security policies, as this can indicate a potential risk to their investments.

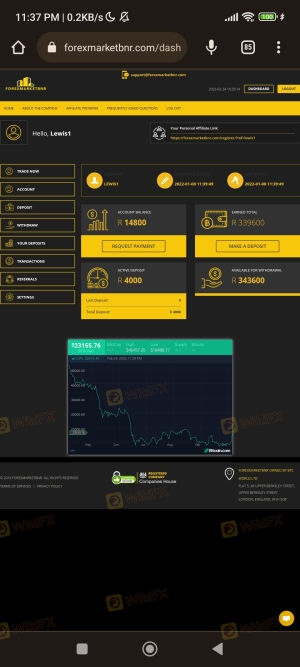

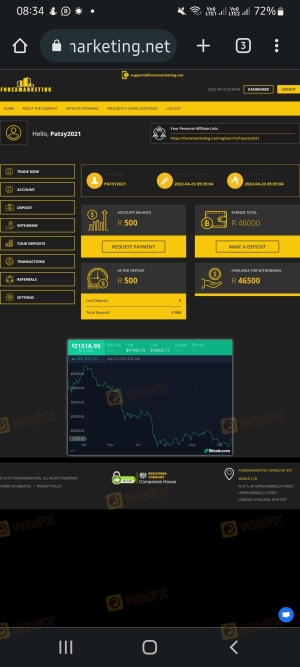

Customer Experience and Complaints

Analyzing customer feedback and experiences is crucial for understanding the overall reliability of Forexmarketing. Many traders report issues with unregulated brokers, including withdrawal problems, poor customer support, and a lack of responsiveness to complaints.

Below is a summary of common complaint types associated with Forexmarketing:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Poor Customer Support | Medium | Slow Response |

| Misleading Information | High | No Acknowledgment |

The prevalence of withdrawal issues is particularly concerning, as it indicates that traders may struggle to access their funds. Additionally, poor customer support can exacerbate these problems, leaving traders feeling frustrated and unsupported.

Typical cases of customer complaints often revolve around delays in processing withdrawals or difficulties in communicating with the support team. Such experiences can significantly impact a trader's confidence in the platform and may lead them to seek alternatives.

Platform and Trade Execution

The performance and reliability of a trading platform are critical for a positive trading experience. Traders expect a stable platform with efficient order execution and minimal slippage. In the case of Forexmarketing, there is limited information available regarding the platform's performance, which raises concerns.

Traders should be wary of platforms that exhibit signs of manipulation, such as excessive slippage or frequent order rejections. These issues can severely impact trading strategies and lead to significant financial losses.

Risk Assessment

Understanding the risks associated with using Forexmarketing is essential for making an informed decision. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Financial Risk | Medium | Lack of transparency in fees and conditions. |

| Customer Support Risk | High | Poor response to customer complaints. |

Traders should exercise caution when considering Forexmarketing as a trading platform. The high regulatory risk, coupled with concerns about customer support and financial transparency, indicates that using this broker may not be the safest option.

Conclusion and Recommendations

In conclusion, the analysis of Forexmarketing raises several red flags regarding its safety and legitimacy. The absence of regulation, limited transparency, and numerous customer complaints suggest that traders should approach this broker with caution. While it may offer certain trading features, the potential risks associated with using Forexmarketing outweigh the benefits.

Traders seeking a reliable forex broker should consider alternatives that are regulated and have a proven track record of customer satisfaction. Some reputable options include brokers with strong regulatory oversight and positive user feedback. Ultimately, it is crucial for traders to prioritize their safety and conduct thorough research before committing to any trading platform.

In summary, is Forexmarketing safe? The evidence suggests that it is not, and traders should be wary of potential scams associated with unregulated brokers.

Is FOREXMARKETING a scam, or is it legit?

The latest exposure and evaluation content of FOREXMARKETING brokers.

FOREXMARKETING Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FOREXMARKETING latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.