Is FOREX CRYPTO TRADERS safe?

Business

License

Is Forex Crypto Traders A Scam?

Introduction

Forex Crypto Traders has emerged as a notable player in the foreign exchange market, offering a blend of traditional forex trading and cryptocurrency options. With the increasing popularity of cryptocurrencies, many traders are exploring platforms that provide access to both asset classes. However, the rise of online trading has also seen a surge in fraudulent activities, making it essential for traders to carefully evaluate the legitimacy of brokers before committing their funds. This article aims to analyze whether Forex Crypto Traders is a safe trading platform or a potential scam. Our investigation is based on a thorough review of its regulatory compliance, company background, trading conditions, customer feedback, and security measures.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors that determine its legitimacy. Forex Crypto Traders claims to operate under various regulatory frameworks, but there is limited transparency regarding its licensing. Below is a summary of the core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Not specified | N/A | N/A | Unverified |

The lack of a clear regulatory framework raises concerns about the broker's compliance with industry standards. Regulated brokers are required to adhere to strict rules designed to protect traders, including maintaining segregated accounts and providing investor protection mechanisms. In contrast, unregulated brokers operate with minimal oversight, increasing the risk of fraud and mismanagement. Therefore, the absence of credible regulatory oversight for Forex Crypto Traders is a significant red flag. Traders should be cautious when dealing with a broker that lacks proper licensing, as this could indicate a higher likelihood of encountering issues such as fund misappropriation or difficulty in withdrawing funds.

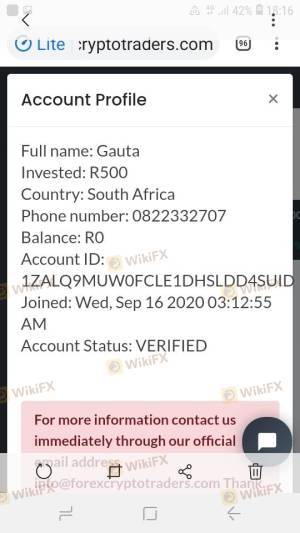

Company Background Investigation

A comprehensive background check on Forex Crypto Traders reveals limited information regarding its history, development, and ownership structure. The company claims to have been established recently, but there is little evidence to substantiate its claims. Additionally, the identities of key personnel and management remain undisclosed, which is unusual for a reputable broker. A transparent broker typically provides information about its founders and management team, showcasing their qualifications and experience in the financial industry.

The level of transparency regarding operational practices and company structure is crucial for building trust with potential clients. Forex Crypto Traders appears to lack this transparency, which could lead to skepticism among traders. The absence of detailed information about the company's history and management can be interpreted as an attempt to obscure its operations and limit accountability. Therefore, potential investors should exercise caution and consider brokers with a well-documented history and transparent ownership structures.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions it offers is paramount. Forex Crypto Traders presents a range of trading options, but the overall fee structure and any unusual charges warrant scrutiny. The following table summarizes the core trading costs associated with Forex Crypto Traders:

| Fee Type | Forex Crypto Traders | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable (not disclosed) | 1.0 pips |

| Commission Model | Not specified | $3 - $7 per lot |

| Overnight Interest Range | Not disclosed | 0.5 - 2.0% |

The lack of transparency regarding spreads and commissions raises concerns. Traders are often deterred by brokers that do not clearly outline their fee structures, as hidden fees can significantly impact profitability. Additionally, the absence of information about overnight interest rates could indicate unfavorable trading conditions. A reputable broker typically provides clear and competitive pricing structures, allowing traders to make informed decisions. Therefore, the vague fee structure of Forex Crypto Traders could be a potential warning sign for traders considering this platform.

Client Fund Security

The safety of client funds is a crucial aspect of any trading platform. Forex Crypto Traders claims to implement various security measures to protect client funds, but specific details on these measures are scarce. A thorough analysis reveals the following:

Segregated Accounts: It is essential for brokers to maintain segregated accounts to ensure that client funds are kept separate from the company's operational funds. However, there is no confirmation that Forex Crypto Traders adheres to this practice.

Investor Protection: Many regulated brokers provide investor protection schemes, which compensate clients in the event of a broker's insolvency. The absence of such information for Forex Crypto Traders raises concerns about the safety of client investments.

Negative Balance Protection: This feature prevents clients from losing more money than they have deposited. Without clear policies on negative balance protection, traders may be exposed to significant financial risks.

The lack of transparency regarding these critical security measures is alarming. Traders should prioritize brokers that offer robust fund protection policies and comply with industry standards. The absence of such assurances from Forex Crypto Traders may indicate potential vulnerabilities in its operations.

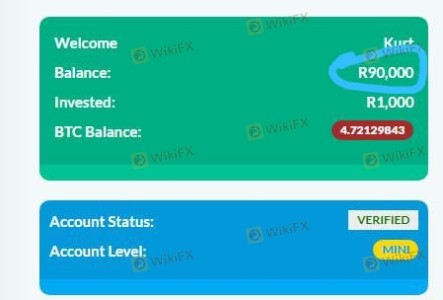

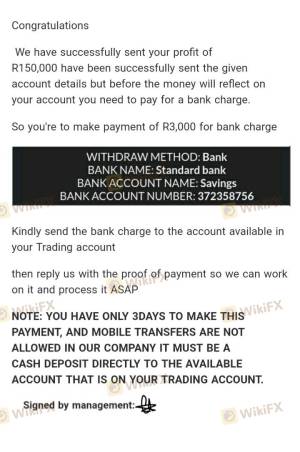

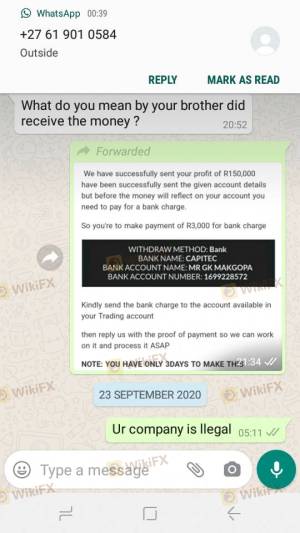

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding the overall experience with a broker. Reviews of Forex Crypto Traders reveal a mix of opinions, with some users reporting positive experiences, while others express frustration over withdrawal issues and customer support responsiveness. The following table outlines the main types of complaints received:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Lack of Customer Support | Medium | Inconsistent |

| Unclear Fee Structure | High | Limited explanation |

Common complaints include difficulties in withdrawing funds, which is a significant concern for traders. A broker's ability to process withdrawals in a timely manner is a vital aspect of its credibility. Additionally, the inconsistency in customer support responses raises questions about the broker's commitment to addressing client concerns. Traders should be wary of brokers with a history of unresolved complaints, as this may indicate deeper operational issues.

Platform and Trade Execution

The performance of the trading platform is another critical factor for traders. Forex Crypto Traders claims to offer a user-friendly platform, but there are concerns regarding its stability and execution quality. Traders have reported instances of slippage and order rejections, which can negatively impact trading outcomes.

A reliable trading platform should provide fast execution speeds and minimal slippage, especially in volatile markets like cryptocurrencies. Any signs of manipulation, such as frequent rejections of orders or unexplained delays, can be indicative of a problematic trading environment. Traders must ensure that they choose brokers with proven track records for executing trades efficiently and transparently.

Risk Assessment

Using Forex Crypto Traders involves various risks that traders should be aware of. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of credible regulation raises concerns. |

| Fund Security Risk | High | Insufficient information on fund protection measures. |

| Customer Support Risk | Medium | Inconsistent support may lead to unresolved issues. |

| Trading Environment Risk | High | Vague fee structure and potential execution issues. |

To mitigate these risks, traders should conduct thorough research and consider alternative brokers with stronger regulatory oversight and transparent operational practices. It is advisable to start with smaller investments until they gain confidence in the broker's reliability.

Conclusion and Recommendations

In conclusion, the analysis of Forex Crypto Traders raises several red flags regarding its legitimacy and safety. The lack of clear regulatory oversight, transparency in trading conditions, and customer complaints about fund withdrawals and support responsiveness suggest that traders should approach this broker with caution.

For those considering trading with Forex Crypto Traders, it is essential to weigh the potential risks against their trading goals. Traders may find it beneficial to explore alternative brokers that offer robust regulatory frameworks, transparent fee structures, and a proven commitment to customer service. Some reputable alternatives include brokers like FP Markets, Octa, and Exness, which have established themselves as reliable platforms in the forex and cryptocurrency trading space.

Ultimately, the decision to use Forex Crypto Traders should be based on a careful evaluation of the risks and available alternatives. Traders must prioritize their financial security and ensure they are working with a broker that meets their trading needs while providing a safe and transparent trading environment.

Is FOREX CRYPTO TRADERS a scam, or is it legit?

The latest exposure and evaluation content of FOREX CRYPTO TRADERS brokers.

FOREX CRYPTO TRADERS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FOREX CRYPTO TRADERS latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.