Is Goldmans Global safe?

Pros

Cons

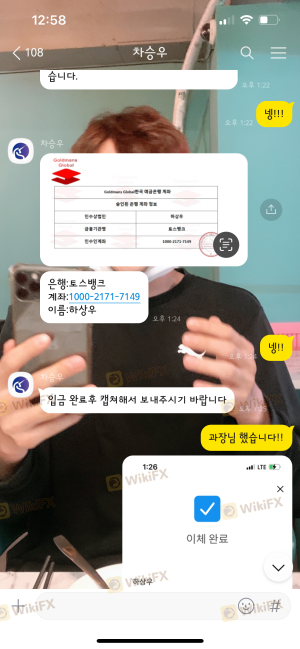

Is Goldmans Global A Scam?

Introduction

Goldmans Global is a forex broker that has positioned itself as a player in the online trading market, offering a range of financial instruments including currencies, commodities, and indices. As the forex market continues to grow, the number of brokers has surged, making it crucial for traders to carefully evaluate their options. Is Goldmans Global safe? This question looms large for potential investors, as the risks associated with trading can be substantial. The aim of this article is to provide a thorough analysis of Goldmans Global, assessing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our investigation is based on a comprehensive review of online sources, regulatory databases, and user feedback to determine whether Goldmans Global is a legitimate broker or a potential scam.

Regulation and Legitimacy

When assessing any broker, the first step is to evaluate its regulatory status. Regulation provides a layer of security for traders, ensuring that brokers adhere to certain standards of conduct. Goldmans Global claims to be regulated by multiple authorities, including the International Financial Services Commission (IFSC) of Belize and the Cyprus Securities and Exchange Commission (CySEC). However, upon closer inspection, these claims appear to be misleading.

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| IFSC | Not Found | Belize | Not Verified |

| CySEC | Not Found | Cyprus | Not Verified |

| ASIC | Not Found | Australia | Not Verified |

The lack of verification for these claims raises significant concerns about the broker's legitimacy. A search on the IFSC and CySEC websites reveals that Goldmans Global is not listed as a licensed entity. This absence of regulation means that traders have little recourse in the event of disputes or issues with fund safety. Given that the broker operates in a high-risk jurisdiction, the question remains: Is Goldmans Global safe? The evidence suggests otherwise.

Company Background Investigation

Goldmans Global claims to be based in Belize, a jurisdiction known for its lenient regulatory environment. However, a search of the Belize Companies House reveals no registration information for the company, suggesting that its claims of legitimacy may be unfounded. The company's domain was registered in October 2023, indicating that it is relatively new to the market. This short history raises further questions about the broker's reliability and operational transparency.

The management team behind Goldmans Global has not been publicly disclosed, which is another red flag. A lack of information about the team can indicate a lack of accountability and transparency. In a well-regulated environment, brokers are typically required to disclose information about their management and ownership structure to build trust with their clients. Unfortunately, Goldmans Global does not meet this standard, making it difficult for traders to assess the credibility of the individuals behind the broker.

Trading Conditions Analysis

The trading conditions offered by Goldmans Global are another area of concern. The broker advertises attractive features such as high leverage ratios and low spreads, but these claims warrant scrutiny. A detailed analysis of the fee structure reveals potential pitfalls that traders should be aware of.

| Fee Type | Goldmans Global | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.5 pips | 1.0 pips |

| Commission Model | Hidden Fees | Transparent |

| Overnight Interest Range | 3% - 5% | 1% - 2% |

The spreads offered by Goldmans Global are significantly higher than the industry average, which could erode traders' profits. Additionally, the broker's commission structure is not clearly defined, suggesting that there may be hidden fees that could catch traders off guard. This lack of transparency raises further doubts about the broker's integrity and whether Goldmans Global is safe for trading.

Client Fund Safety

One of the most critical aspects of any broker is the safety of client funds. Goldmans Global claims to implement various security measures, but the absence of regulation means that these claims cannot be independently verified. The broker does not provide clear information about fund segregation or any investor protection schemes, which are standard practices among reputable brokers.

Traders should be particularly cautious if a broker does not offer negative balance protection, as this can lead to significant financial losses. Given the high-risk nature of forex trading, the lack of such safeguards raises serious concerns about the safety of funds with Goldmans Global. The question remains: Is Goldmans Global safe? Based on the available information, it appears that the broker does not prioritize client fund safety.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing the reliability of a broker. Reviews of Goldmans Global reveal a mixed bag of experiences, with many users reporting issues related to account management, withdrawal delays, and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Account Blocking | Medium | No Resolution |

| Poor Customer Support | High | Unresponsive |

Many traders have reported that their accounts were blocked without warning, making it difficult to access their funds. This pattern of complaints suggests a troubling trend that potential clients should consider before opening an account. If a broker cannot effectively manage customer relationships, it raises questions about its overall reliability. Therefore, the inquiry into whether Goldmans Global is safe becomes increasingly relevant.

Platform and Execution Quality

The trading platform offered by Goldmans Global is another crucial factor to consider. While the broker promotes a user-friendly interface, many users have reported issues with platform stability and execution quality. High slippage rates and frequent rejections of orders can significantly impact trading performance.

Moreover, there are allegations of potential manipulation within the platform, which could further compromise the integrity of trades. A reliable broker should provide a robust trading environment that allows for smooth execution and minimal disruptions. Given the feedback from users, it appears that Goldmans Global may not meet these standards.

Risk Assessment

Using Goldmans Global presents several inherent risks that traders should be aware of. The lack of regulation, combined with a problematic history of customer complaints and unclear trading conditions, paints a concerning picture.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No verified regulation or oversight |

| Fund Safety Risk | High | Lack of transparency in fund protection |

| Execution Risk | Medium | Reports of slippage and order rejections |

To mitigate these risks, potential traders should proceed with caution. It is advisable to conduct thorough research and consider alternative brokers that have established regulatory oversight and a solid reputation in the industry.

Conclusion and Recommendations

In summary, the evidence suggests that Goldmans Global exhibits several red flags that indicate it may not be a safe trading option. The lack of regulatory verification, combined with poor customer feedback and questionable trading conditions, raises serious concerns about the broker's legitimacy.

For traders considering whether Goldmans Global is safe, the answer appears to lean toward caution. It is recommended that traders seek alternatives that are regulated by reputable authorities and have demonstrated a commitment to transparency and customer service. Brokers such as FXTM, IG, or OANDA offer well-established platforms with robust regulatory frameworks, providing a safer trading environment for investors.

In conclusion, while the allure of high leverage and low spreads may be tempting, the risks associated with trading with Goldmans Global far outweigh the potential benefits. Always prioritize safety and regulatory compliance when selecting a broker.

Is Goldmans Global a scam, or is it legit?

The latest exposure and evaluation content of Goldmans Global brokers.

Goldmans Global Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Goldmans Global latest industry rating score is 1.36, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.36 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.