Regarding the legitimacy of KVB forex brokers, it provides SFC, ASIC and WikiBit, (also has a graphic survey regarding security).

Is KVB safe?

Pros

Cons

Is KVB markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RevokedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

KVB Kunlun Securities (HK) Limited

Effective Date:

2008-07-02Email Address of Licensed Institution:

hksec@kvbkunlun.comSharing Status:

No SharingWebsite of Licensed Institution:

www.kvbsec.comExpiration Time:

--Address of Licensed Institution:

香港九龍柯士甸道西1號環球貿易廣場68樓6801室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

ASIC Forex Execution License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

ETORO ASSET MANAGEMENT LIMITED

Effective Date: Change Record

2008-06-19Email Address of Licensed Institution:

celestemu@etoro.comSharing Status:

No SharingWebsite of Licensed Institution:

http://www.kvbamc.com.auExpiration Time:

--Address of Licensed Institution:

TRACY BYRNE 'L19' 9-13 HUNTER ST SYDNEY NSW 2000 AUSTRALIAPhone Number of Licensed Institution:

0266109876Licensed Institution Certified Documents:

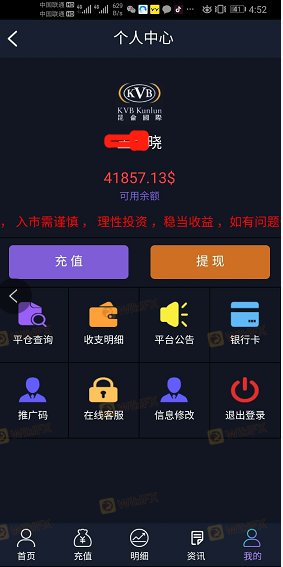

Is KVB Safe or Scam?

Introduction

KVB, a forex broker with a presence in various financial markets, has garnered attention for its diverse trading services and global operations. Established in 2001, KVB has positioned itself as a player in the forex market, offering trading in currency pairs, commodities, and indices. However, as with any financial institution, traders must exercise caution and conduct thorough evaluations before committing their funds. The forex market is rife with risks, and the choice of broker significantly impacts a trader's experience and financial security. This article aims to provide a comprehensive assessment of KVB by examining its regulatory status, company background, trading conditions, and customer feedback. The evaluation relies on information sourced from various reputable financial platforms and regulatory bodies.

Regulation and Legality

Understanding the regulatory status of KVB is crucial in assessing its legitimacy. A well-regulated broker typically offers a higher level of trust and security for traders. KVB claims to be regulated by several authorities; however, the effectiveness and credibility of these licenses warrant a closer look.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 334293 | Australia | Exceeded |

| SFC | N/A | Hong Kong | Revoked |

| FSPR | 1782 | New Zealand | Exceeded |

KVB's regulatory status reveals several red flags. The Australian Securities and Investments Commission (ASIC) has marked KVB's license as "exceeded," indicating that the broker may not be operating within the regulatory framework set forth by this authority. Moreover, the Securities and Futures Commission (SFC) in Hong Kong has revoked KVB's license for leveraged foreign exchange trading, which raises significant concerns regarding the broker's compliance with local laws. While KVB holds a license from the Financial Service Providers Register (FSPR) in New Zealand, the "exceeded" status suggests that it may not be compliant with New Zealand's regulations either. Given these circumstances, potential investors should approach KVB with caution, as the lack of robust regulatory oversight could expose them to significant risks.

Company Background Investigation

KVB's history and ownership structure play an essential role in evaluating its credibility. Founded in 2001, KVB has expanded its operations across various jurisdictions, including Australia, New Zealand, and Hong Kong. Despite its long-standing presence in the market, the broker's ownership structure remains somewhat opaque, which can lead to skepticism among potential clients.

The management team at KVB comprises individuals with extensive experience in finance and trading; however, detailed information regarding their backgrounds and qualifications is limited. A transparent broker typically provides comprehensive information about its management team, financial health, and operational practices. The lack of such information raises concerns about accountability and trustworthiness.

Moreover, KVB's transparency regarding its business practices and financial disclosures is critical for potential investors. While the broker claims to adhere to high standards of operation, the absence of detailed financial reports and ownership disclosures may deter cautious investors. In light of these factors, it is imperative for traders to conduct thorough due diligence before engaging with KVB, as the company's transparency and accountability are key indicators of its reliability.

Trading Conditions Analysis

KVB offers a range of trading conditions, including various account types and competitive spreads. However, the overall fee structure and potential hidden costs warrant careful examination.

The broker provides multiple account types, each with different minimum deposit requirements and trading conditions. While KVB claims to offer low spreads, the actual trading costs can vary significantly based on the account type and market conditions.

| Cost Type | KVB | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.3 pips | 1.0 pips |

| Commission Model | Variable Spread | Varies |

| Overnight Interest Range | Varies | Varies |

KVB's spreads for major currency pairs, such as EUR/USD, are reported to be around 1.3 pips, which is higher than the industry average of 1.0 pips. This discrepancy may indicate that traders could incur higher trading costs with KVB compared to other brokers. Furthermore, the commission model employed by KVB is based on variable spreads, which could introduce unpredictability in trading costs.

Traders should also be wary of any potential hidden fees associated with withdrawals or account maintenance, as these can significantly impact overall profitability. A transparent broker typically provides a clear breakdown of all potential costs, and any ambiguity in KVB's fee structure should be viewed with caution.

Client Fund Safety

The safety of client funds is paramount when selecting a forex broker. KVB claims to implement various safety measures to protect client investments, including segregating client funds from its operational funds. However, the effectiveness of these measures is contingent upon the broker's regulatory compliance.

KVB does not appear to offer a negative balance protection policy, which can expose traders to significant risks, particularly in volatile market conditions. Additionally, the revocation of its SFC license raises concerns about the broker's commitment to safeguarding client funds. Historical reports of clients experiencing difficulties in withdrawing their funds further exacerbate these concerns, indicating potential systemic issues within the brokerage.

Given these factors, potential investors should carefully assess KVB's fund safety measures and consider the implications of any negative feedback regarding fund withdrawals. A broker with a solid reputation for fund safety is crucial for traders looking to protect their investments, and KVBs track record in this area may raise red flags for cautious investors.

Customer Experience and Complaints

Customer feedback is a vital component in assessing the reliability of any broker. Reviews of KVB reveal a mixed bag of experiences, with some users reporting satisfactory trading conditions while others have raised serious concerns regarding withdrawal difficulties and inadequate customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response, multiple excuses |

| Customer Service Issues | Medium | Long wait times, inadequate support |

Common complaints against KVB include withdrawal issues, where clients have reported being unable to access their funds, often citing various excuses from the broker. For instance, one user mentioned that after several attempts to withdraw funds, they were met with repeated rejections and requests for additional deposits. Such experiences can severely undermine trust in the broker and should be taken into account by potential clients.

In contrast, some users have praised KVB for its efficient trading platform and quick execution speeds. However, the overall sentiment remains mixed, with numerous reports of dissatisfaction regarding customer service and withdrawal processes. As such, traders should weigh these factors carefully when considering KVB as their broker.

Platform and Trade Execution

KVB offers multiple trading platforms, including its proprietary Forex Star platform and the popular MetaTrader 4 (MT4). The performance, stability, and user experience of these platforms are crucial for traders, as they directly impact trade execution quality.

Feedback regarding KVBs platforms indicates a generally positive experience, with users appreciating the intuitive interface and range of tools. However, concerns have been raised regarding order execution quality, including instances of slippage and order rejections during high volatility periods. Such issues can lead to frustration and potential losses for traders.

Additionally, there have been allegations of platform manipulation, particularly concerning slippage during important news events. Traders should be vigilant for any signs of such practices, as they could indicate a lack of transparency and fairness in the broker's operations.

Risk Assessment

Engaging with KVB carries several risks that potential clients should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Revoked licenses raise concerns about oversight. |

| Fund Safety Risk | High | Historical withdrawal issues indicate potential fund safety concerns. |

| Customer Service Risk | Medium | Mixed feedback on support quality may affect user experience. |

To mitigate these risks, traders should conduct thorough due diligence before engaging with KVB. It is advisable to start with a small investment, monitor the platform's performance, and maintain clear records of all transactions and communications with the broker. Additionally, traders should consider the potential risks associated with KVB's regulatory standing and customer feedback before making any commitments.

Conclusion and Recommendations

In conclusion, while KVB presents itself as a legitimate broker with competitive trading conditions, significant red flags warrant caution. The revocation of its SFC license, issues surrounding fund safety, and mixed customer feedback indicate that potential clients should approach this broker with skepticism.

For traders seeking a reliable forex broker, it is advisable to consider alternatives with robust regulatory oversight and positive customer reviews. Brokers such as IG, OANDA, or Forex.com have established reputations and comprehensive regulatory frameworks that provide greater peace of mind. Ultimately, traders must prioritize their safety and due diligence when selecting a broker, ensuring that they are well-informed and prepared to navigate the complexities of the forex market.

In summary, is KVB safe? The evidence suggests that while KVB may offer certain trading advantages, the potential risks associated with its regulatory status and customer experiences should prompt traders to proceed with caution.

Is KVB a scam, or is it legit?

The latest exposure and evaluation content of KVB brokers.

KVB Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KVB latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.