Is GoldForex safe?

Pros

Cons

Is Goldforex Safe or a Scam?

Introduction

Goldforex, a relatively new entrant in the forex trading market, presents itself as a platform for trading currencies, commodities, and other financial instruments. Positioned as a user-friendly broker, it aims to attract both novice and experienced traders. However, the increasing number of scams in the forex industry necessitates that traders exercise caution when selecting a broker. Evaluating the credibility of a broker like Goldforex is crucial, as it can significantly impact the safety of traders' funds and their overall trading experience. In this article, we will conduct a thorough investigation into Goldforex, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our analysis will be based on data collected from various reputable sources, including user reviews and expert assessments, ensuring a comprehensive understanding of whether Goldforex is safe or a scam.

Regulation and Legitimacy

The regulatory environment in which a broker operates is a critical factor in determining its legitimacy. Regulatory bodies oversee brokers to ensure they adhere to strict financial standards, safeguarding traders' interests. In the case of Goldforex, it has been reported that the broker lacks proper regulation from any recognized financial authority. This absence of regulation raises significant concerns about the safety of funds and the broker's operational integrity.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of regulatory oversight means that Goldforex is not subject to the same stringent requirements as regulated brokers, such as maintaining segregated accounts for clients' funds or providing investor protection schemes. This raises red flags, particularly for traders who prioritize the safety of their investments. Furthermore, the historical compliance record of Goldforex is questionable, as there are no records indicating adherence to regulatory standards. The absence of a regulatory framework can lead to operational malpractices, making it imperative for traders to approach Goldforex with caution.

Company Background Investigation

Goldforex appears to be a relatively new brokerage, having been established in the last few years. However, details regarding its ownership structure and management team are sparse. The lack of transparency about the company's background is concerning, as it is essential for traders to know who is managing their investments and what experience they bring to the table.

The management teams professional background can significantly influence a broker's reputation and reliability. Unfortunately, information about the team behind Goldforex is limited, which further compounds the uncertainty surrounding the broker. Transparency in business operations is vital, and the absence of clear information can be indicative of potential issues.

Moreover, the company's website has been reported to be difficult to navigate, with limited information available about its services and operations. This lack of clarity can deter potential clients from engaging with the broker, as it raises questions about the company's commitment to providing a secure trading environment. Without a solid foundation of trust and transparency, it becomes challenging for traders to ascertain whether Goldforex is safe or a scam.

Trading Conditions Analysis

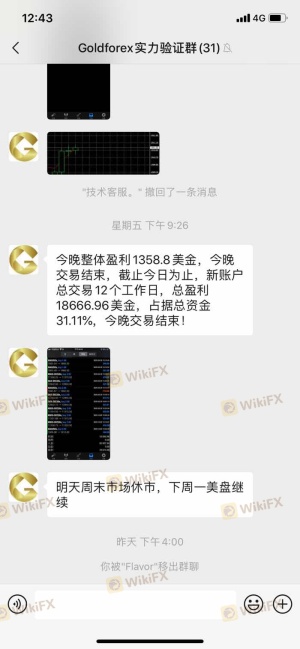

An essential aspect of any forex broker is its trading conditions, which include fees, spreads, and overall cost structure. Goldforex claims to offer competitive trading conditions; however, user reviews suggest otherwise. Traders have reported hidden fees and unclear commission structures, which can significantly impact overall profitability.

| Fee Type | Goldforex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clear information regarding spreads and commissions is alarming. Traders typically expect to find detailed information about costs upfront, allowing them to make informed decisions. The lack of transparency in Goldforex's pricing model suggests that traders may encounter unexpected costs, which could lead to significant financial losses.

Additionally, the broker's overall fee structure appears to be inconsistent with industry standards. Traders have reported difficulties in understanding the cost implications of their trades, which raises concerns about the broker's intentions. A lack of clarity in fees can be a tactic used by unscrupulous brokers to exploit clients, further supporting the notion that Goldforex may not be safe.

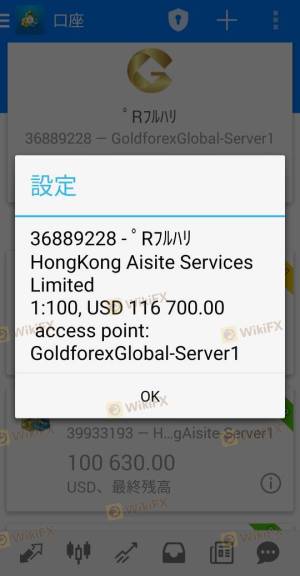

Customer Fund Security

The safety of customer funds is paramount for any forex broker. Goldforex's approach to fund security is another area of concern. Reports indicate that the broker does not provide sufficient information about its fund protection measures, such as segregated accounts or investor compensation schemes.

Segregated accounts are essential as they ensure that client funds are kept separate from the broker's operational funds, protecting them in case of insolvency. The absence of such measures means that traders may be at risk of losing their investments if the broker encounters financial difficulties.

Moreover, there have been anecdotal reports of difficulties in withdrawing funds from Goldforex. Traders have expressed frustration over delayed withdrawal requests and inadequate customer support, which raises further questions about the broker's reliability and commitment to safeguarding clients' assets. Historical issues related to fund security can severely damage a broker's reputation, making it crucial for traders to consider these factors when evaluating whether Goldforex is safe or a scam.

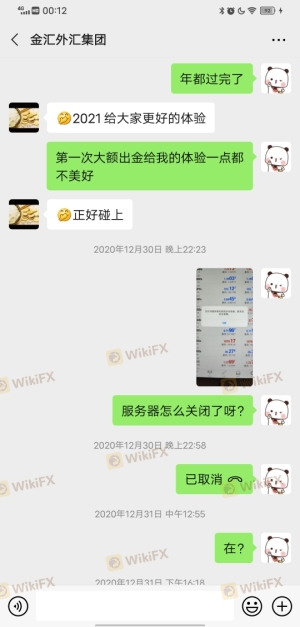

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. In the case of Goldforex, numerous user reviews highlight a range of complaints, primarily revolving around withdrawal issues and poor customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Support | Medium | Poor |

| Unclear Fees | High | Poor |

Traders have reported being unable to withdraw their funds, with some stating that their requests remained pending for weeks. This lack of responsiveness can be particularly alarming for traders who need access to their funds quickly. Additionally, the company's response to complaints appears to be inadequate, indicating a lack of commitment to customer service.

A few notable cases have emerged where traders claimed they were unable to contact customer support, leading to unresolved issues and financial losses. These experiences contribute to the growing perception that Goldforex may not be a trustworthy broker. The high severity of complaints, coupled with poor company responses, underscores the need for potential clients to exercise caution when considering Goldforex as their trading platform.

Platform and Trade Execution

The performance and reliability of a trading platform are critical for traders. Goldforex offers a trading platform that is purportedly user-friendly; however, user experiences suggest otherwise. Reports indicate that the platform may suffer from stability issues, leading to disruptions during trading sessions.

Furthermore, the quality of order execution, including slippage and rejection rates, is crucial for traders looking to capitalize on market movements. Users have expressed concerns about delays in order execution, which can result in missed trading opportunities and financial losses. Such inefficiencies can be particularly detrimental in fast-moving markets like forex.

The potential for platform manipulation is also a concern. If a broker engages in practices that unfairly influence trade execution, it can severely undermine the trading experience and lead to significant financial repercussions for clients. As such, the reliability of Goldforex's platform remains questionable, leading to further doubts about whether Goldforex is safe or a scam.

Risk Assessment

Using Goldforex involves several risks that traders must consider. The lack of regulation, unclear trading conditions, and negative customer feedback all contribute to a higher risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation in place |

| Financial Risk | High | Lack of fund protection |

| Service Risk | Medium | Poor customer support |

| Operational Risk | High | Platform instability |

To mitigate these risks, traders should conduct thorough research before engaging with Goldforex. It is advisable to start with a small investment, utilize risk management strategies such as stop-loss orders, and consider alternative brokers with a more robust regulatory framework.

Conclusion and Recommendations

In conclusion, the evidence suggests that Goldforex is not a safe broker. The lack of regulation, questionable company practices, and numerous customer complaints indicate a high level of risk for potential traders. While some may be attracted to the broker's offers, it is crucial to weigh these against the significant concerns raised throughout this analysis.

For traders seeking a reliable forex trading experience, it is advisable to consider alternative brokers that are well-regulated and have a proven track record of customer satisfaction. Brokers such as FP Markets, IC Markets, and Pepperstone are recommended for their strong regulatory frameworks, transparent trading conditions, and positive user experiences. By choosing a reputable broker, traders can protect their investments and enhance their overall trading success.

Is GoldForex a scam, or is it legit?

The latest exposure and evaluation content of GoldForex brokers.

GoldForex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GoldForex latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.