Is FAREACH safe?

Business

License

Is Fareach Safe or Scam?

Introduction

Fareach is a forex broker that has recently gained attention in the trading community. Positioned as a platform for retail traders, it claims to offer a range of trading services across various asset classes. However, as with any financial service provider, it is crucial for traders to exercise caution and conduct thorough evaluations before committing their funds. The forex market, while lucrative, is also rife with potential scams and unregulated entities. Therefore, assessing a broker's legitimacy and safety is paramount. This article will investigate the safety of Fareach by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

A broker's regulatory status is one of the most critical indicators of its safety. Regulations serve to protect traders by ensuring that brokers adhere to specific operational standards. Unfortunately, Fareach appears to operate without valid regulation, which raises significant concerns regarding its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | No valid regulation |

The absence of regulatory oversight means that Fareach is not accountable to any financial authority, which is a major red flag for potential investors. Regulatory bodies are designed to enforce compliance, protect client funds, and provide a framework for dispute resolution. Without such oversight, traders face heightened risks, including potential loss of funds and lack of recourse in case of disputes. The lack of a regulatory history further complicates the assessment of Fareach's operational integrity, making it essential for traders to consider these factors seriously when asking, "Is Fareach safe?"

Company Background Investigation

Fareach Group Limited, the entity behind the Fareach trading platform, has a limited history in the financial markets. Established in Hong Kong, the company has not provided extensive information regarding its ownership structure or operational history. A transparent company typically shares its founding story, milestones, and key personnel details, which can help build trust with potential clients.

The management teams background is also critical in evaluating a broker's credibility. Unfortunately, details about the executives at Fareach are scarce, making it difficult to assess their experience and qualifications in the financial services sector. This lack of transparency can lead to skepticism among traders regarding the company's intentions and operational practices. In a field where trust is paramount, the question remains: Is Fareach safe, given its opaque corporate structure?

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is vital. Fareach claims to have competitive spreads and a variety of trading instruments. However, without clear information on their fee structure, it becomes challenging to ascertain whether these claims hold true.

| Fee Type | Fareach | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The absence of specific details regarding spreads, commissions, and other trading costs can be a cause for concern. Traders should be wary of brokers that do not provide transparent information about their fees, as hidden costs can significantly impact trading profitability. Furthermore, if Fareach employs unusual fee policies or practices, it could indicate a lack of integrity in their operations. Therefore, it is crucial for potential clients to consider whether they can trust Fareach with their trading activities and funds.

Client Fund Safety

The safety of client funds is a top priority for any broker. Traders need to know that their deposits are secure and that the broker has measures in place to protect their investments. Unfortunately, there is little information available regarding Fareach's fund security protocols.

In the absence of regulatory oversight, it is unclear if Fareach employs segregation of client funds, investor protection mechanisms, or negative balance protection policies. These are essential features that reputable brokers typically offer to ensure that clients' funds are safeguarded against potential losses. Historical issues related to fund security, such as withdrawal difficulties or fraud allegations, can also indicate a broker's reliability.

Given the lack of clear information about Fareach's fund safety measures, potential clients should carefully consider the risks involved. The question of "Is Fareach safe?" remains pertinent, especially in light of the broker's questionable transparency regarding client fund security.

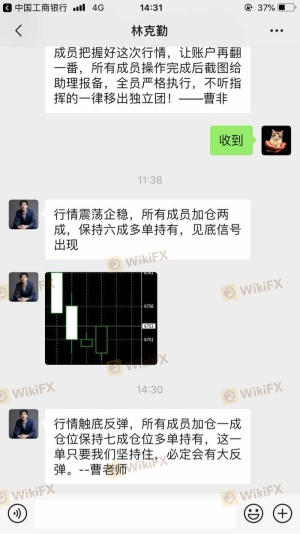

Customer Experience and Complaints

Customer feedback is invaluable when assessing a broker's reputation. A review of online forums and trading communities reveals a mixed bag of experiences with Fareach. While some users report satisfactory trading experiences, others have raised concerns about withdrawal issues and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Customer Support | Medium | Slow response |

Common complaint patterns include difficulties in withdrawing funds and a lack of timely responses from customer service. Such issues can significantly impact a trader's experience and trust in the broker. For example, one user reported being unable to withdraw funds after experiencing significant losses, which raises alarms about Fareach's operational practices. These complaints highlight the importance of considering user experiences when asking, "Is Fareach safe?"

Platform and Trade Execution

The performance of a trading platform can greatly influence a trader's success. Fareach claims to offer a robust trading platform, but user reviews suggest mixed experiences regarding its stability and execution quality. Issues such as slippage, order rejections, and platform downtime can hinder trading performance and affect profitability.

Traders should also be aware of any signs of potential platform manipulation, which can occur when brokers engage in practices that disadvantage clients. A thorough evaluation of the platform's performance, including execution speed and reliability, is essential for assessing whether Fareach can be trusted for trading activities.

Risk Assessment

Using Fareach as a trading platform comes with inherent risks that potential clients should consider. Given the broker's lack of regulation, opacity in company operations, and customer complaints, the overall risk profile can be classified as high.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation or oversight |

| Fund Security Risk | High | Lack of transparency in fund safety |

| Customer Service Risk | Medium | Reports of unresponsive support |

To mitigate these risks, traders are advised to conduct thorough research, consider starting with a small investment, and remain vigilant regarding their trading activities. For those who are risk-averse or seeking a more secure trading environment, exploring alternative brokers with established reputations may be prudent.

Conclusion and Recommendations

In conclusion, the investigation into Fareach raises several red flags regarding its safety and legitimacy. The absence of regulatory oversight, coupled with a lack of transparency in company operations and customer complaints about fund withdrawals, suggests that traders should exercise caution.

For those wondering, "Is Fareach safe?" the evidence points to potential risks that may outweigh the benefits of trading with this broker. Therefore, it is advisable for traders to consider more reputable alternatives that are regulated and have a proven track record of customer satisfaction. Brokers with strong regulatory frameworks, transparent fee structures, and positive user experiences should be prioritized to ensure a safer trading environment.

Is FAREACH a scam, or is it legit?

The latest exposure and evaluation content of FAREACH brokers.

FAREACH Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FAREACH latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.