Is XNZT safe?

Pros

Cons

Is Xnzt Safe or Scam?

Introduction

Xnzt is a forex broker that has emerged in the competitive landscape of online trading, aiming to provide various financial instruments and trading services to a diverse clientele. As with any broker in the forex market, it is crucial for traders to exercise caution and conduct thorough evaluations before committing their funds. The forex trading environment is often fraught with potential risks, including fraud, mismanagement, and regulatory non-compliance, making it imperative for traders to assess the legitimacy and safety of their chosen broker. This article investigates the safety and reliability of Xnzt by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

A broker's regulatory status is a critical factor in determining its safety and legitimacy. Xnzt operates without valid regulatory oversight, which raises significant concerns about its operations and the protection of client funds. The absence of regulation can expose traders to various risks, including potential fraud and mismanagement of funds. Below is a summary of the regulatory information concerning Xnzt:

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of any regulatory authority overseeing Xnzt indicates a high level of risk for traders. Regulatory bodies are essential as they enforce strict guidelines that protect investors, ensure fair trading practices, and promote transparency. The absence of regulation means that Xnzt is not held accountable for its actions, potentially leading to exploitative practices. Furthermore, the broker has received multiple complaints from users regarding its services, further underscoring the need for caution when considering trading with Xnzt.

Company Background Investigation

Xnzt is operated by HX Worldwide Company Limited, which is registered in the Virgin Islands. The company has been in operation for approximately 2 to 5 years, but its history lacks transparency and detailed information about its ownership structure. The management team's background is also unclear, which raises questions about their qualifications and experience in the financial industry. A lack of transparency in company operations and management can lead to mistrust among traders, as it becomes difficult to ascertain the broker's credibility and reliability.

The information available about Xnzt suggests that the company has not established a strong reputation in the forex market. Without a clear history of compliance or a commitment to ethical trading practices, traders may find it challenging to trust Xnzt with their investments. Therefore, the company's opaque background should be a significant consideration for anyone contemplating trading with this broker.

Trading Conditions Analysis

When evaluating a broker's trading conditions, it is essential to consider the overall fee structure and any unusual or problematic policies. Xnzt offers a range of trading options, including forex, shares, options, futures, and warrants. However, the fees associated with trading on Xnzt can be concerning. Below is a comparison of Xnzt's core trading costs against industry averages:

| Fee Type | Xnzt | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 3 pips (standard) | 1-2 pips |

| Commission Structure | $0.07 per side (standard) | $0.01-$0.02 per side |

| Overnight Interest Range | Varies | Varies |

The spreads offered by Xnzt appear to be higher than the industry average, which can significantly impact a trader's profitability. Additionally, the commission structure for standard accounts is relatively high compared to other brokers, which may deter potential clients. Such high costs can be indicative of a broker that may not prioritize competitive pricing and could suggest a lack of commitment to providing value to its clients.

Client Fund Safety

The safety of client funds is another critical aspect to examine when determining if Xnzt is safe or a scam. Xnzt has not provided clear information regarding its fund safety measures, including whether client funds are kept in segregated accounts or if there are any investor protection schemes in place. This lack of transparency raises concerns about the security of traders' funds.

Moreover, without regulatory oversight, there is no assurance that client funds are protected in the event of the broker's insolvency or financial mismanagement. Traders should be particularly wary if a broker does not have robust measures in place to safeguard their investments. Historically, brokers without such protections have been known to face financial difficulties, leaving clients with little recourse to recover their funds.

Customer Experience and Complaints

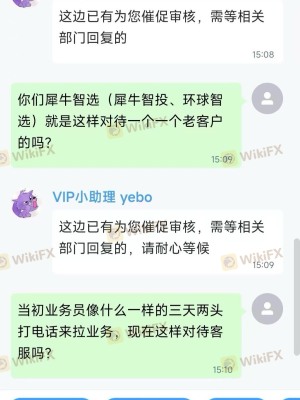

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of Xnzt reveal a concerning trend of complaints and negative experiences from users. Common issues reported by clients include account bans, difficulties in withdrawing funds, and a lack of effective communication from customer support. Below is a summary of the primary complaint types and their severity assessment:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Account Bans | High | Poor |

| Withdrawal Issues | High | Poor |

| Communication Difficulties | Medium | Poor |

Several users have reported being banned from their accounts without clear explanations or resolutions. Additionally, complaints regarding withdrawal issues highlight a significant risk for traders, as difficulties in accessing funds can lead to substantial financial losses. The overall response from Xnzt to these complaints has been inadequate, further diminishing trust in the broker.

Platform and Trade Execution

The trading platform's performance is crucial for a seamless trading experience. Xnzt utilizes the popular MetaTrader 4 (MT4) platform, which is generally well-regarded among traders for its user-friendly interface and extensive features. However, there are concerns regarding order execution quality, slippage, and the potential for manipulation.

Traders have reported instances of slippage and order rejections, which can negatively impact trading outcomes. If a broker's platform shows signs of manipulation or poor execution quality, it can raise red flags about the broker's integrity. Therefore, it is vital to assess the overall performance and reliability of Xnzt's trading platform before committing funds.

Risk Assessment

Using Xnzt presents several risks for traders, primarily due to its lack of regulation and negative user feedback. Below is a risk scorecard summarizing the key risk areas associated with trading through Xnzt:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight. |

| Financial Risk | High | Complaints about withdrawal issues. |

| Operational Risk | Medium | Concerns about platform execution quality. |

To mitigate these risks, traders should consider using a regulated broker with a solid reputation and a history of positive user experiences. Additionally, it is advisable to start with a smaller investment and thoroughly test the broker's services before committing larger amounts.

Conclusion and Recommendations

In conclusion, the evidence suggests that Xnzt operates without valid regulatory oversight and has received numerous complaints regarding its services. The lack of transparency and accountability raises significant red flags, indicating that traders should exercise extreme caution when considering this broker. Given the potential risks associated with Xnzt, it is advisable for traders to seek out more reputable alternatives that prioritize client safety and regulatory compliance.

For traders looking for reliable options, consider brokers that are regulated by reputable authorities and have a proven track record of positive customer experiences. By doing thorough research and selecting a trusted broker, traders can significantly reduce their risk exposure while engaging in the forex market. In summary, is Xnzt safe? The evidence points to a high level of risk, and potential clients should be wary of engaging with this broker.

Is XNZT a scam, or is it legit?

The latest exposure and evaluation content of XNZT brokers.

XNZT Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

XNZT latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.