Regarding the legitimacy of FAKE HTFX forex brokers, it provides ASIC and WikiBit, .

Is FAKE HTFX safe?

Business

License

Is FAKE HTFX markets regulated?

The regulatory license is the strongest proof.

ASIC Forex Execution License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Neptune Securities LTD

Effective Date: Change Record

2009-06-11Email Address of Licensed Institution:

roger.mullan@ogfx.com.auSharing Status:

No SharingWebsite of Licensed Institution:

www.ogforex.com.auExpiration Time:

2024-01-19Address of Licensed Institution:

Suite 706, 1-5 Railway Street, CHATSWOOD NSW 2067, Suite 706,1-5 Railway Street Chatswood NSW 2067 AustraliaPhone Number of Licensed Institution:

401 282864Licensed Institution Certified Documents:

Is HTFX Safe or Scam?

Introduction

HTFX is a forex broker that has emerged on the trading scene, claiming to offer a range of services including trading in forex, cryptocurrencies, and commodities. As with any financial institution, it is crucial for traders to conduct thorough due diligence before engaging with HTFX. The forex market, while offering lucrative opportunities, is also fraught with risks, particularly when dealing with unregulated or poorly regulated brokers. This article aims to explore the safety and legitimacy of HTFX by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and associated risks. Our investigation is based on multiple credible sources, including regulatory bodies and user reviews, to provide a comprehensive evaluation of whether HTFX is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its safety. HTFX claims to be regulated by several authorities, including the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) in the UK. However, it has been flagged as a suspicious clone by various sources, which raises concerns about its legitimacy.

Here is a summary of HTFX's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 332890 | Australia | Suspicious Clone |

| FCA | N/A | United Kingdom | Not Authorized |

| CySEC | N/A | Cyprus | Registered |

The claims of regulation by ASIC and FCA have been met with skepticism, as HTFX has been identified as a suspicious clone of a legitimate entity. This lack of credible regulation is a significant red flag, indicating that traders' funds may not be adequately protected. The importance of regulation cannot be overstated; it ensures that brokers adhere to strict financial standards and provides a level of recourse for traders in case of disputes. Given HTFX's questionable regulatory status, potential investors should exercise extreme caution when considering this broker.

Company Background Investigation

HTFX positions itself as a global forex broker, but its corporate structure and ownership details are often vague. The company claims to have been established in Australia, but its operational history is unclear. There is a lack of transparency regarding its ownership and management team, which is concerning for potential clients.

A thorough analysis of the management team's background reveals a mix of experience in the financial industry, but specific details about their qualifications and track records are often not disclosed. This lack of transparency can lead to skepticism about the broker's operations and intentions. Furthermore, the absence of clear information about the company's physical address and registration details raises questions about its legitimacy.

In terms of information disclosure, HTFX does not provide sufficient insights into its operational practices or the identities of its key personnel. This lack of clarity can make it difficult for traders to trust the broker and assess its reliability. Given these factors, it is essential for traders to approach HTFX with caution, as the lack of transparency could be indicative of deeper issues related to the broker's integrity.

Trading Conditions Analysis

HTFX offers a variety of trading accounts, each with different minimum deposits and leverage options. However, the overall fee structure and trading conditions appear to be less favorable compared to industry standards.

Heres a comparison of HTFX's trading costs against industry averages:

| Fee Type | HTFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.3 pips | 1.0 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | High | Moderate |

While HTFX advertises low spreads, the high minimum deposit requirements for certain accounts and the lack of clarity around commissions may deter potential traders. Additionally, the broker's fee structure appears to be inconsistent, which could lead to unexpected costs for traders. The presence of high overnight interest rates further complicates the cost of trading, making it imperative for traders to fully understand the fee structure before committing their funds.

Customer Fund Security

The safety of customer funds is a paramount concern for any trader. HTFX claims to implement several security measures, including segregated accounts and negative balance protection. However, the effectiveness of these measures is called into question due to the broker's unregulated status.

Traders should be aware that without proper regulation, the assurance of fund safety is significantly weakened. Furthermore, there have been reports of withdrawal issues and other disputes related to fund access, which raises concerns about HTFX's commitment to protecting its clients' investments.

Historically, unregulated brokers have been known to engage in practices that jeopardize customer funds, such as refusing withdrawals or mismanaging client accounts. Given the lack of credible oversight for HTFX, traders must be cautious and consider the potential risks of engaging with this broker.

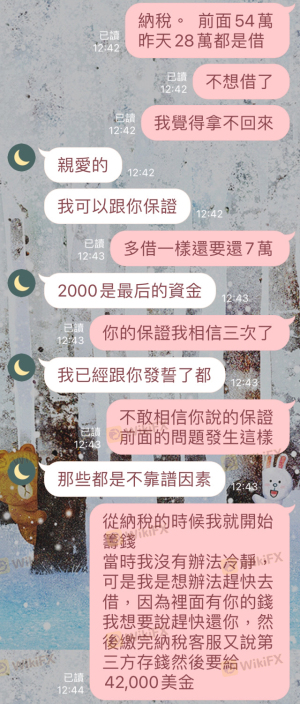

Customer Experience and Complaints

User feedback is a vital indicator of a broker's reliability. Reviews of HTFX reveal a mixed bag of experiences, with many users reporting difficulties in withdrawing their funds and inadequate customer support.

Heres a summary of common complaints:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/No Response |

| Poor Customer Support | Medium | Inconsistent |

| Misleading Information | High | No Clarification |

Typical cases include users who have attempted to withdraw funds only to face delays or, in some instances, complete inaccessibility to their accounts. These patterns of complaints suggest systemic issues within HTFX's operations, further supporting the notion that traders should be cautious when engaging with this broker.

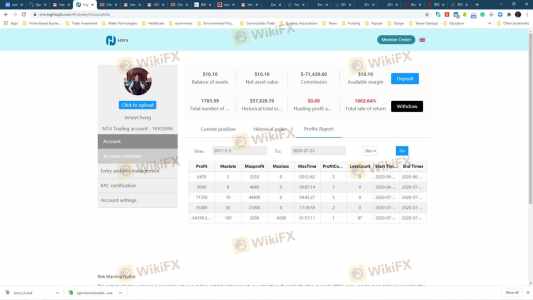

Platform and Execution

The trading platform offered by HTFX is based on MetaTrader 4, a well-regarded platform in the forex industry. However, user experiences with execution quality and stability have been mixed. Reports of slippage and rejected orders have surfaced, which can significantly impact trading performance.

The execution quality is a critical factor for traders, as delays or errors can lead to substantial financial losses. Instances of platform manipulation or technical glitches have been noted, raising concerns about the broker's operational integrity. Traders should be vigilant and consider these factors when evaluating HTFX as a trading option.

Risk Assessment

Engaging with HTFX carries a range of risks that traders should carefully consider. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of credible regulatory oversight |

| Fund Safety Risk | High | Potential for fund mismanagement |

| Execution Risk | Medium | Reports of slippage and rejected orders |

| Customer Service Risk | High | Inconsistent support and withdrawal issues |

To mitigate these risks, traders are advised to conduct thorough research, consider using regulated brokers, and avoid investing more than they can afford to lose.

Conclusion and Recommendations

In conclusion, the evidence suggests that HTFX presents significant risks for traders. With its questionable regulatory status, lack of transparency, and numerous user complaints, it is prudent to approach this broker with caution. While HTFX may offer attractive trading conditions on the surface, the underlying issues raise concerns about its legitimacy and reliability.

For traders seeking a safer trading environment, it is advisable to consider regulated alternatives with verified track records and transparent operations. Brokers that are regulated by reputable authorities such as the FCA or ASIC provide a greater level of security and recourse for traders. In light of the findings, it is clear that HTFX may not be the safest choice for forex trading, and potential users should carefully weigh their options before proceeding.

Is FAKE HTFX a scam, or is it legit?

The latest exposure and evaluation content of FAKE HTFX brokers.

FAKE HTFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FAKE HTFX latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.