HTFX 2025 Review: Everything You Need to Know

Executive Summary

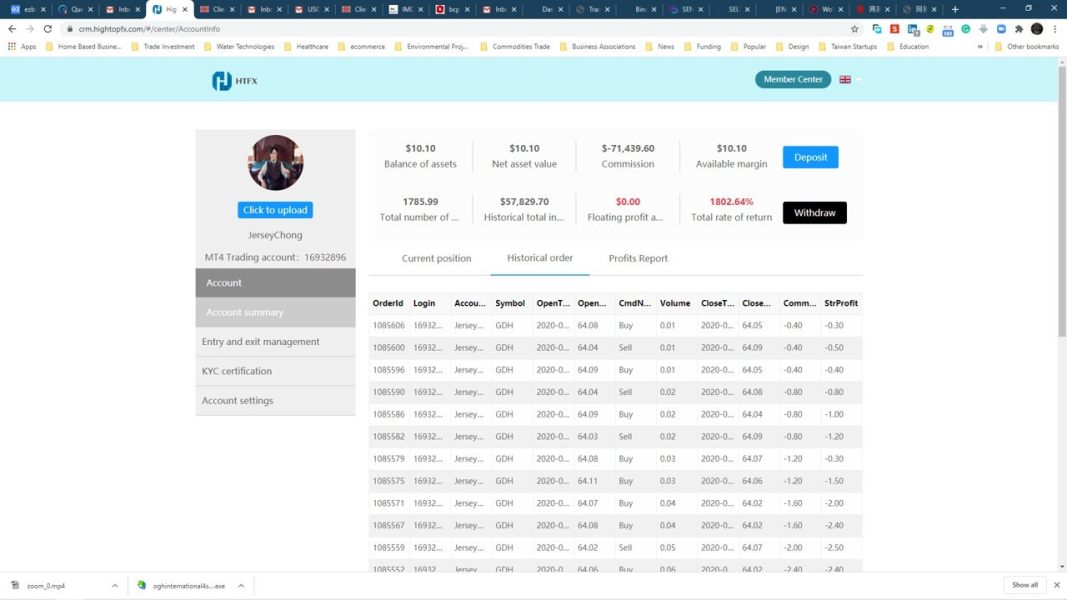

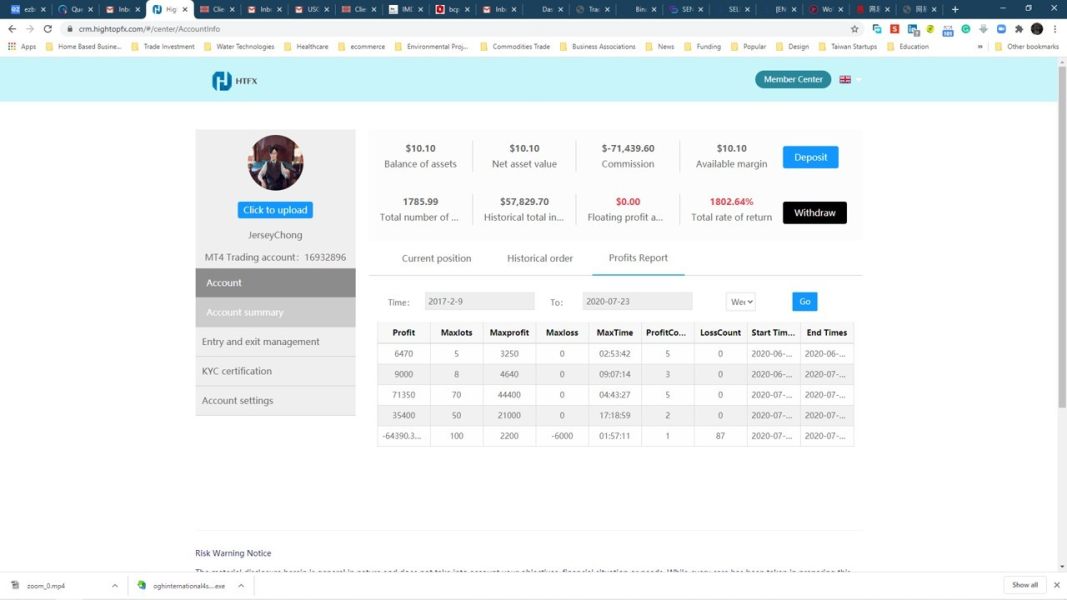

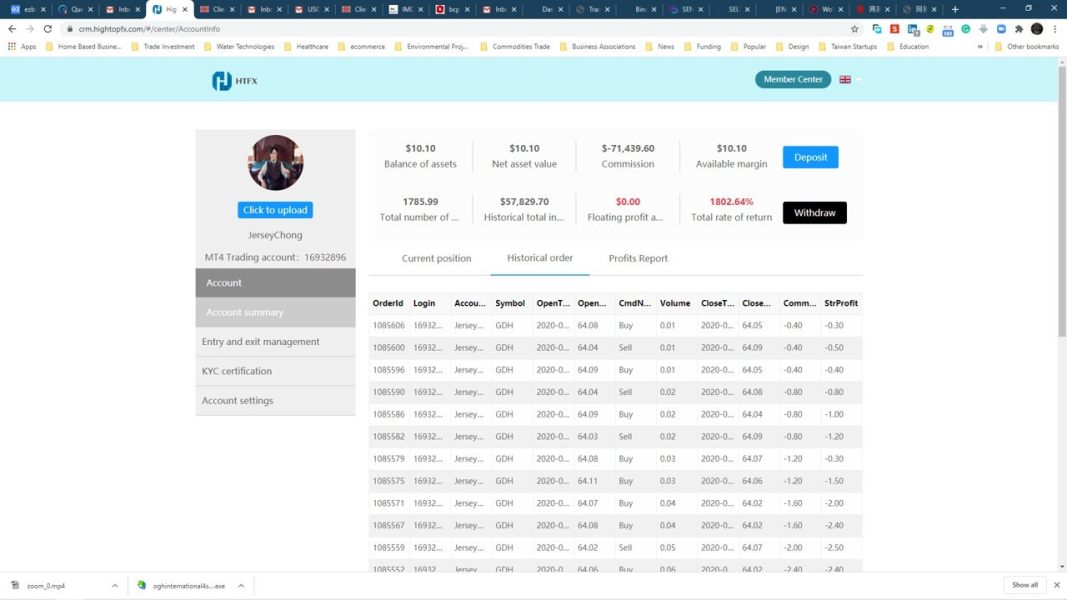

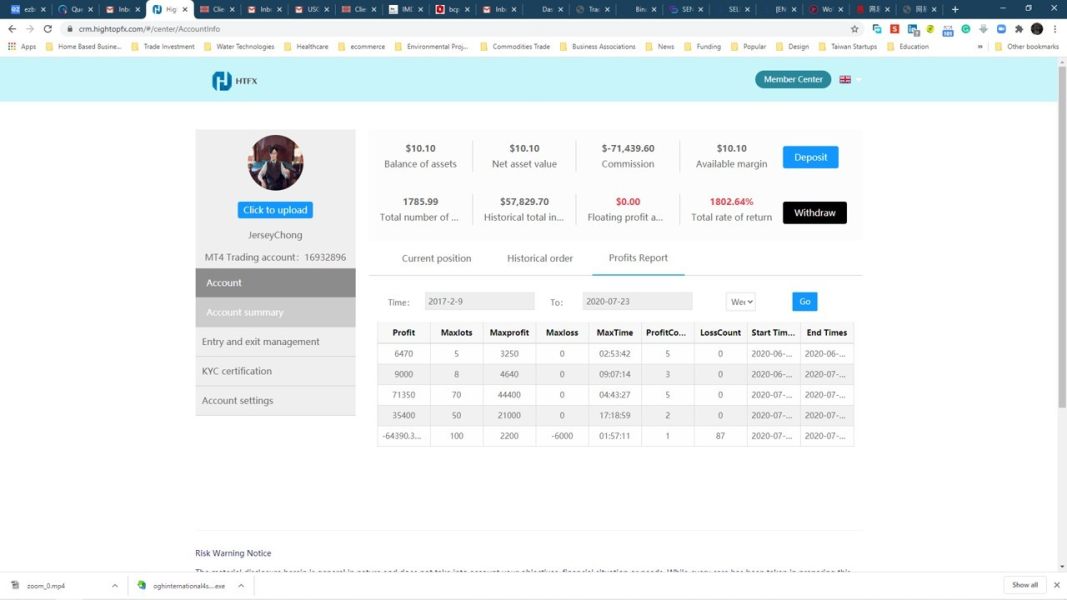

This HTFX review looks at a forex broker that has caught attention in the trading community. The reception has been mixed. HTFX says it is a non-dealing desk broker that uses a Straight Through Processing model, and it mainly targets B2B and institutional market participants. User feedback shows the broker offers very fast deposit and withdrawal processing times. This stands as one of its key strengths.

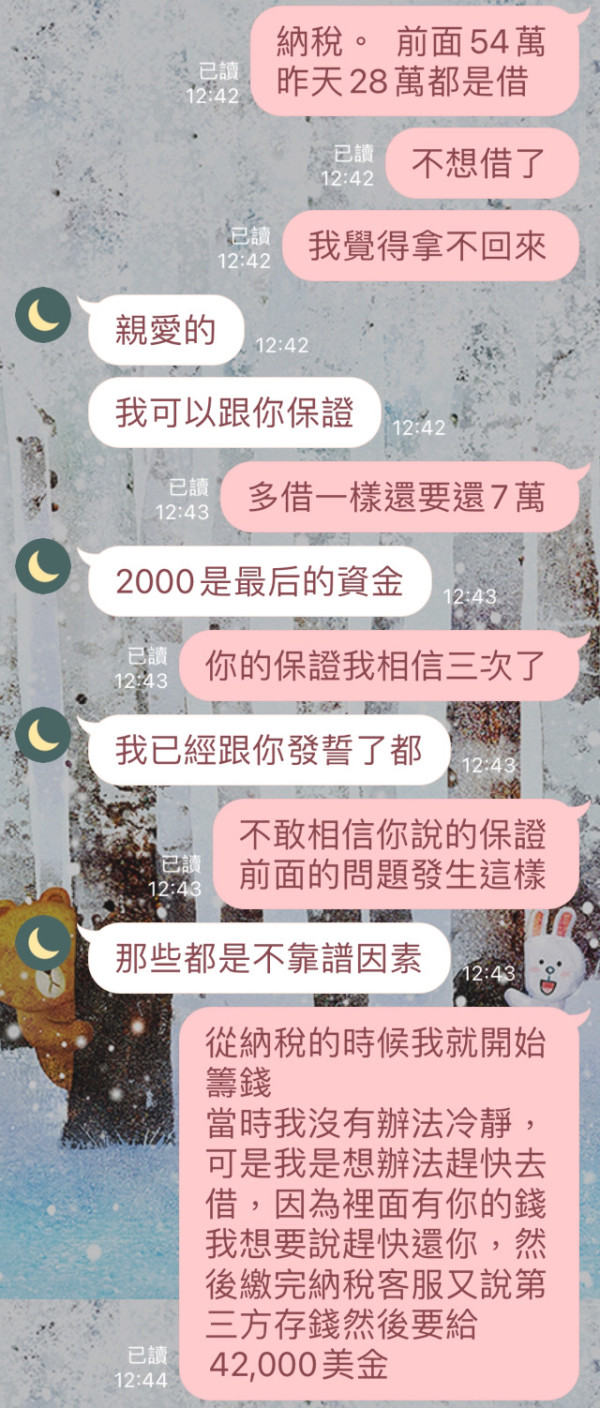

However, traders should be very careful when thinking about HTFX. Many sources have raised serious concerns about whether the broker is legitimate, and some platforms have detected it as a possible scam operation. User reviews show two very different sides - some traders report good experiences with quick fund processing, while others have warned about fraudulent activities. The broker focuses on institutional and B2B markets, which may make it less appealing to retail traders, and the lack of clear regulatory transparency makes its operations even more uncertain.

The trading environment at HTFX seems to offer average leverage and spreads based on user reports. The overall risk profile of this broker stays high because of trust and safety concerns that potential clients must carefully think about.

Important Notice

Regulatory Variations: Information about HTFX's regulatory status across different areas is not fully detailed in available sources. Traders should check the broker's regulatory standing in their specific region on their own before using the platform.

Review Methodology: This assessment uses available user feedback, public information, and industry reports. Since there is limited comprehensive data about HTFX's operations, some evaluations are based on user experiences rather than verified operational metrics.

Rating Framework

Broker Overview

HTFX works as a forex broker with a specific focus on serving B2B and institutional market segments. The company says it is a non-dealing desk broker, using a Straight Through Processing model that theoretically provides direct market access without broker intervention in trade execution. This approach typically appeals to professional traders and institutions seeking transparent pricing and execution.

The broker's business model seems designed to serve larger volume traders rather than retail clients. This may explain why there is limited information about standard retail trading conditions. User feedback shows HTFX has demonstrated abilities in processing deposits and withdrawals with notable speed, which suggests some level of operational efficiency in fund management systems.

However, the broker's background information stays limited in available sources. Important details such as founding date, company headquarters location, and comprehensive corporate structure are not clearly documented in accessible materials. This lack of transparency raises questions about the broker's commitment to openness and regulatory compliance, which are increasingly important factors in today's forex trading environment where regulatory scrutiny continues to intensify across major financial markets.

Regulatory Status: Specific regulatory information for HTFX is not detailed in available sources. This presents a significant concern for potential traders. The absence of clear regulatory oversight information makes it difficult to assess the broker's compliance with industry standards.

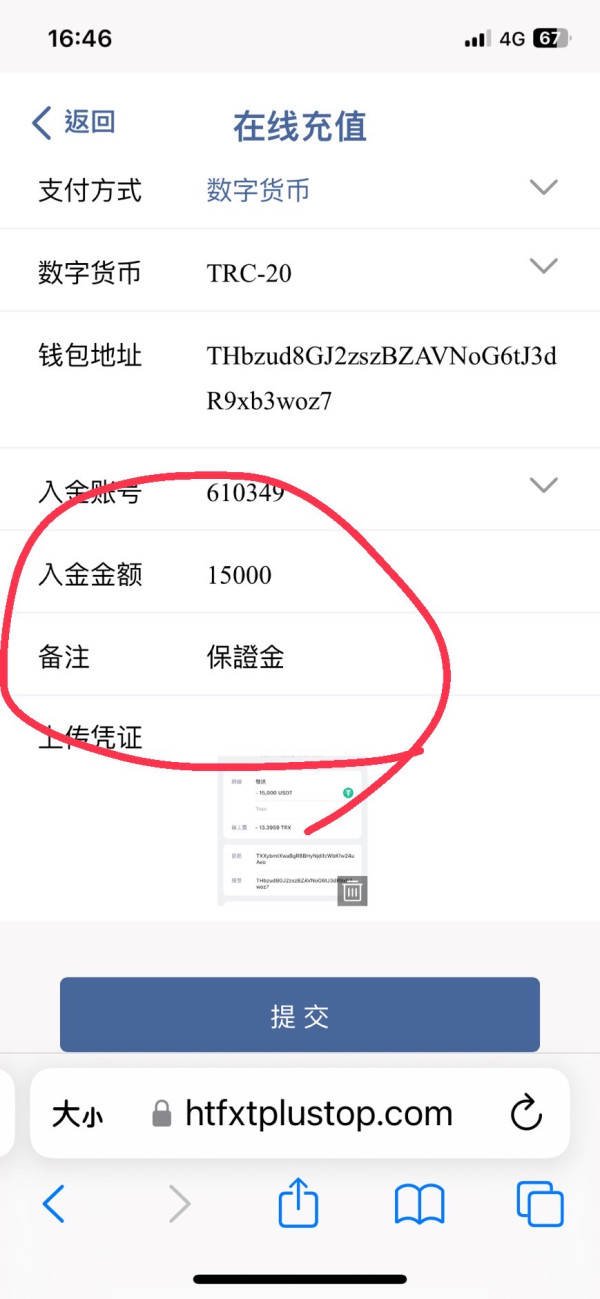

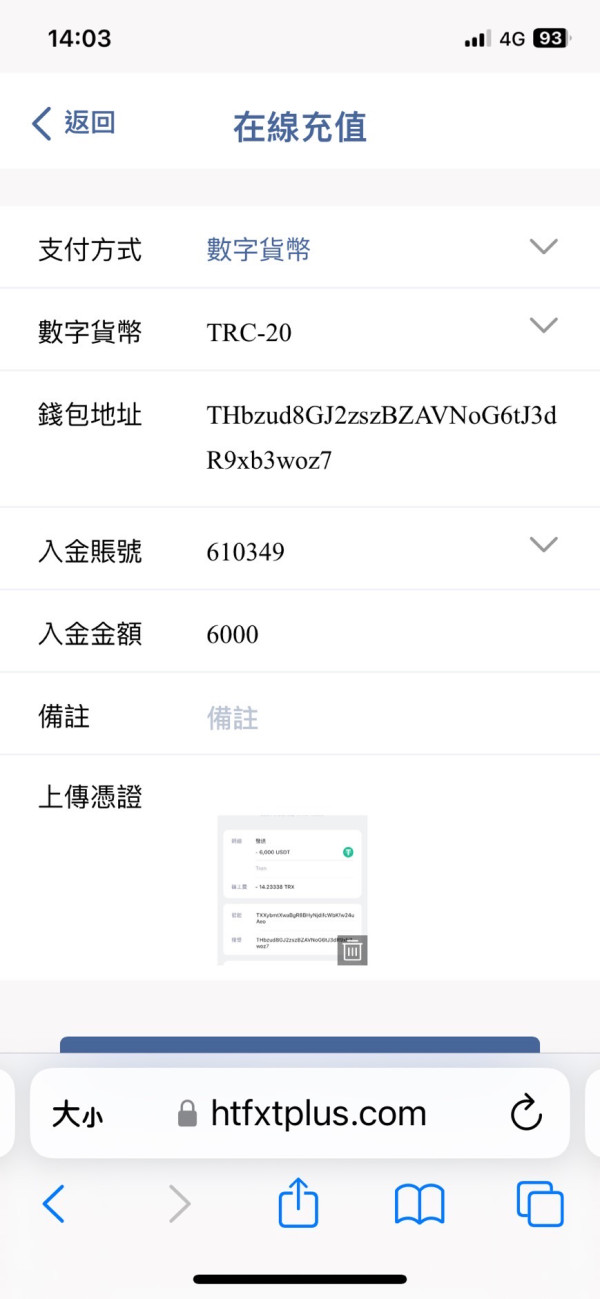

Deposit and Withdrawal Methods: User feedback indicates fast processing times for deposits and withdrawals, but specific payment methods and processing procedures are not detailed in available information.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in available sources. The broker's focus on B2B and institutional markets suggests potentially higher entry requirements than typical retail brokers.

Promotional Offers: Information about bonuses, promotions, or special offers is not mentioned in available sources.

Tradeable Assets: Specific details about available trading instruments, asset classes, and market coverage are not comprehensively outlined in accessible materials.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not provided in available sources. User feedback mentions "average leverage and spread" without specific numerical details.

Leverage Ratios: User reports reference "average leverage," but specific maximum leverage ratios and their application across different instruments are not detailed.

Platform Options: The trading platforms offered by HTFX are not specified in available information sources.

Geographic Restrictions: Specific information about restricted countries or regions is not mentioned in available sources.

Customer Support Languages: Details about supported languages for customer service are not provided in accessible materials.

This HTFX review must note that the limited availability of detailed operational information itself raises concerns about transparency and regulatory compliance standards.

Account Conditions Analysis

The account conditions at HTFX remain largely undisclosed in available public information. This presents a significant challenge for potential traders attempting to evaluate the broker's offerings. The lack of detailed information about account types, minimum deposit requirements, and specific trading conditions suggests either a focus on private institutional arrangements or limited transparency in public communications.

User feedback indicates that the account opening process is relatively straightforward. Specific verification requirements and documentation needs are not detailed though. The broker's emphasis on B2B and institutional markets may mean that account conditions are negotiated individually rather than offered through standardized retail packages.

Traders cannot adequately assess whether HTFX's account structure meets their specific needs without clear information about account tiers, special features, or Islamic account availability. The absence of detailed spread schedules, commission structures, and account maintenance fees makes cost comparison with other brokers virtually impossible.

The limited transparency regarding account conditions, combined with user warnings about potential fraudulent activity, significantly impacts the overall evaluation of HTFX's account offerings. Professional traders typically require detailed information about trading conditions before committing funds, and the current lack of comprehensive data represents a substantial barrier to informed decision-making in this HTFX review.

HTFX's trading tools and educational resources are not comprehensively detailed in available information. This limits the ability to assess the broker's commitment to trader development and platform sophistication. The absence of specific information about analytical tools, charting capabilities, and research resources suggests either limited offerings or poor communication of available features.

Most established forex brokers provide detailed information about their trading platforms, technical analysis tools, economic calendars, and educational materials. The lack of such information for HTFX raises questions about the depth and quality of tools available to traders. Professional and institutional traders, who represent HTFX's stated target market, typically require sophisticated analytical capabilities and comprehensive market research.

The broker's STP model should theoretically provide access to institutional-grade liquidity and pricing. Without detailed information about technology infrastructure, API access, or advanced order types, traders cannot evaluate the platform's suitability for professional trading strategies.

Educational resources, market analysis, and trader development programs are not mentioned in available sources. This absence is particularly concerning given that even institutional traders benefit from ongoing market insights and platform training. The lack of detailed tool descriptions in this analysis reflects the limited public information available about HTFX's technological capabilities and trader support infrastructure.

Customer Service and Support Analysis

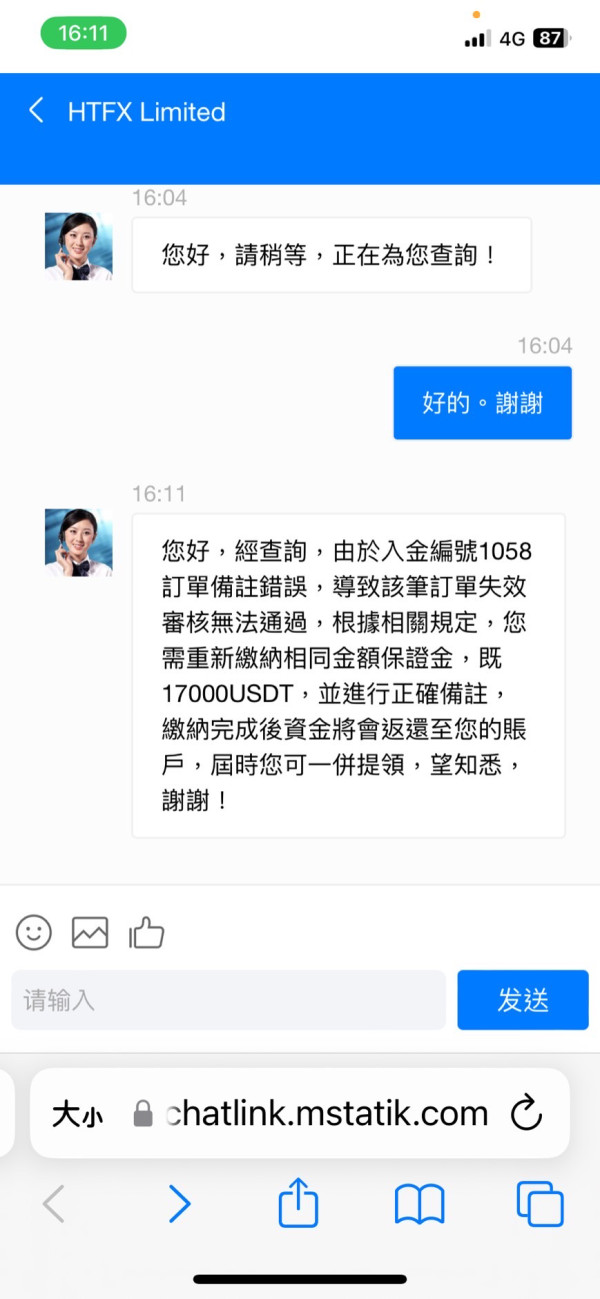

Customer service quality at HTFX receives mixed reviews from available user feedback. Some positive notes about response times are balanced against concerns about overall service quality. User reports suggest that the broker does provide relatively fast response times for certain inquiries, though the consistency and comprehensiveness of support remain questionable.

The available feedback indicates that while initial responses may be prompt, the quality of problem resolution and ongoing support may not meet professional trading standards. Given HTFX's focus on B2B and institutional markets, the expectation for customer service would typically be higher than for retail-focused brokers, as institutional clients require sophisticated support for complex trading operations.

Specific information about customer service channels, availability hours, and language support is not detailed in available sources. Professional traders typically require multiple communication channels including phone, email, and live chat support, often with dedicated account managers for larger accounts.

The lack of detailed information about customer service infrastructure, combined with mixed user feedback about service quality, suggests that HTFX may not provide the level of support expected by professional traders. The absence of clear escalation procedures, dedicated institutional support teams, or comprehensive service level agreements raises concerns about the broker's ability to handle complex client needs effectively.

Trading Experience Analysis

The trading experience at HTFX presents a complex picture based on available user feedback. Several traders report positive experiences with execution speed, noting that the broker delivers fast order processing which is crucial for professional trading strategies. The STP model implementation appears to provide reasonable execution quality, though specific performance metrics are not available for verification.

User feedback indicates that while execution speeds are satisfactory, other aspects of the trading environment may need improvement. Reports mention that spreads and liquidity conditions are "average," which may not meet the expectations of institutional traders who typically require premium trading conditions. The absence of detailed information about slippage rates, execution statistics, and platform stability makes it difficult to assess the consistency of the trading environment.

Mobile trading experience and platform functionality details are not specified in available sources. This is concerning given that modern traders require comprehensive multi-platform access. The lack of information about advanced order types, algorithmic trading support, and API access limits the assessment of HTFX's suitability for sophisticated trading strategies.

Most significantly, the trading experience evaluation must consider the serious warnings about potential fraudulent activity. Even if technical execution is satisfactory, concerns about the broker's legitimacy fundamentally impact the overall trading experience assessment. This HTFX review must emphasize that trading experience quality becomes irrelevant if fund security cannot be guaranteed.

Trust and Safety Analysis

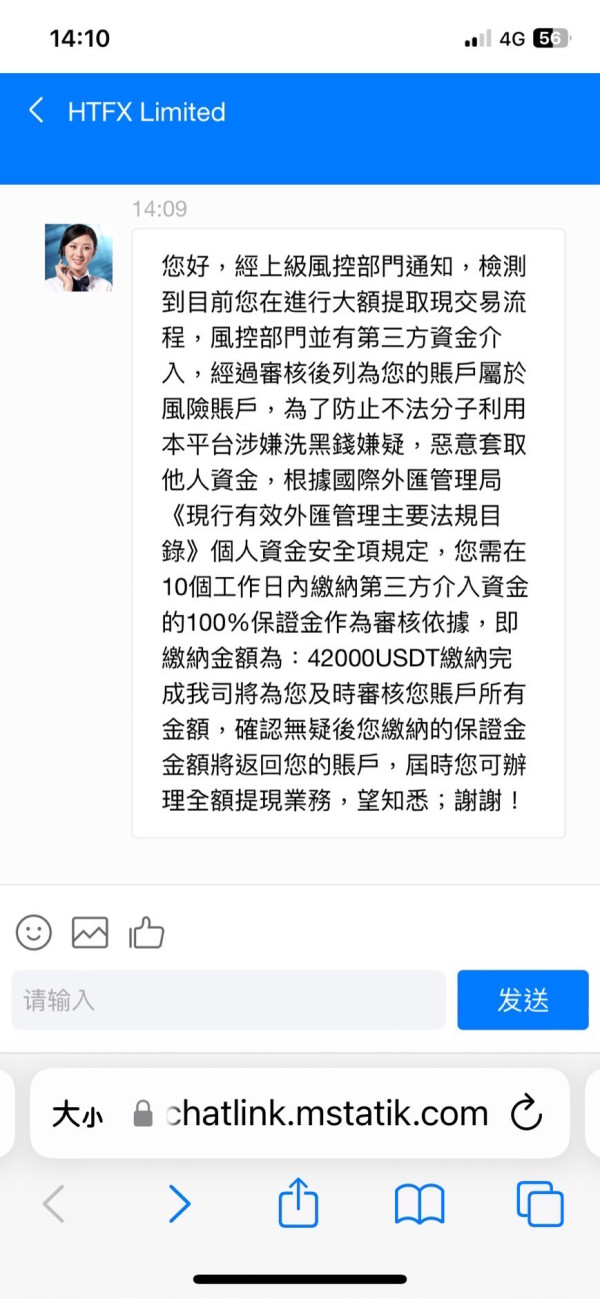

Trust and safety represent the most critical concerns in this HTFX evaluation. Multiple sources have raised serious red flags about the broker's legitimacy, with some platforms specifically detecting HTFX as a potential scam operation. These warnings represent fundamental risks that overshadow any positive operational aspects the broker might offer.

The absence of clear regulatory information compounds trust concerns significantly. Established forex brokers typically provide comprehensive details about their regulatory status, license numbers, and compliance frameworks. HTFX's lack of transparent regulatory information suggests either operation outside established regulatory frameworks or insufficient commitment to regulatory compliance.

Fund security measures, segregated account policies, and investor protection schemes are not detailed in available information. Professional traders and institutions require explicit guarantees about fund safety, including details about client money segregation, insurance coverage, and regulatory protection schemes. The absence of such information represents a critical gap in trust establishment.

The combination of scam warnings from detection platforms and lack of regulatory transparency creates a high-risk profile. This would typically disqualify a broker from consideration by professional traders. Industry best practices require comprehensive due diligence on broker legitimacy before fund commitment, and current available information does not support a positive trust assessment for HTFX.

User Experience Analysis

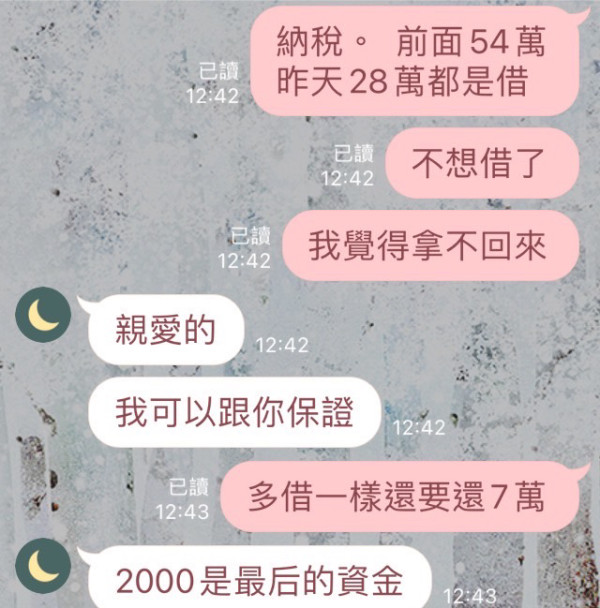

User experience with HTFX presents a polarized picture that reflects the broader concerns about this broker's operations. Positive feedback focuses primarily on operational efficiency, particularly regarding deposit and withdrawal processing speeds. Users who report satisfactory experiences highlight the broker's ability to handle fund transfers quickly, which represents a basic operational competency.

However, the overall user experience is significantly impacted by widespread concerns about the broker's legitimacy. The presence of scam warnings and negative reviews creates an environment of uncertainty that affects every aspect of the user journey, from initial registration through ongoing trading activities.

The account opening process is described as relatively simple by some users. Detailed verification procedures and documentation requirements are not comprehensively outlined though. Professional traders typically require clear information about onboarding processes, compliance requirements, and account activation timelines.

Interface design and platform usability information is not available in current sources. This makes it impossible to assess the quality of user interaction with trading platforms and account management systems. The absence of detailed user interface descriptions or platform screenshots limits the ability to evaluate the practical aspects of daily trading operations.

The most significant factor affecting user experience remains the trust and safety concerns. Even efficient operational processes lose value when users question the fundamental legitimacy of the broker, creating an environment where positive operational experiences are overshadowed by security concerns.

Conclusion

This HTFX review reveals a broker with significant operational concerns that outweigh any potential benefits. While some users report satisfactory experiences with deposit and withdrawal processing speeds, the serious warnings about potential fraudulent activity and lack of regulatory transparency create an unacceptable risk profile for most traders.

HTFX may appeal to traders specifically seeking B2B or institutional market access. The absence of comprehensive regulatory information and the presence of scam detection warnings make it unsuitable for risk-conscious traders. The broker's STP model and focus on institutional markets could theoretically provide value, but these potential advantages are negated by fundamental trust and safety concerns.

The primary disadvantages include lack of regulatory transparency, serious legitimacy concerns raised by multiple sources, and insufficient operational information for informed decision-making. The limited advantages of fast fund processing are insufficient to offset these significant risks. Traders are advised to consider well-regulated, transparent brokers with established track records rather than risking capital with platforms that have raised red flags in the trading community.