Regarding the legitimacy of Invast Global forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is Invast Global safe?

Pros

Cons

Is Invast Global markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

26 DEGREES GLOBAL MARKETS PTY LTD

Effective Date:

2013-06-25Email Address of Licensed Institution:

cohben.mcmahon@invast.com.auSharing Status:

No SharingWebsite of Licensed Institution:

https://www.26degreesglobalmarkets.com/Expiration Time:

--Address of Licensed Institution:

TENANCY 2.03, BUILDING 2 SUB BASE PLATYPUS 120 HIGH STREET NORTH SYDNEY NSW 2060Phone Number of Licensed Institution:

0061290831333Licensed Institution Certified Documents:

Is Invast Global A Scam?

Introduction

Invast Global is a multi-asset prime brokerage firm based in Sydney, Australia, specializing in providing trading solutions primarily for institutional investors, hedge funds, and professional traders. Established in 2013, the firm has quickly positioned itself as a trusted player in the forex and CFD trading markets. However, as with any financial service provider, it is crucial for traders to carefully evaluate the credibility and reliability of the broker before committing their funds. The forex market is rife with potential risks and scams, making due diligence essential for safeguarding investments.

This article aims to provide a comprehensive analysis of Invast Global, focusing on its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and associated risks. The evaluation will utilize a combination of qualitative assessments and quantitative data drawn from various reputable sources to offer a balanced perspective on whether Invast Global is a trustworthy broker or a potential scam.

Regulation and Legitimacy

The regulatory framework under which a broker operates is a critical indicator of its legitimacy and reliability. Invast Global is regulated by the Australian Securities and Investments Commission (ASIC), a reputable authority known for its stringent regulatory requirements. This oversight ensures that the broker adheres to high standards of conduct, including the segregation of client funds and regular reporting of financial activities.

Regulatory Information Table

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 438283 | Australia | Verified |

ASIC's regulatory quality is considered top-tier, providing a robust layer of investor protection. The agency mandates that brokers maintain a minimum capital requirement, ensuring that they have sufficient funds to cover client deposits. Additionally, ASIC's history of enforcing compliance has resulted in a relatively low incidence of fraud among regulated entities, further enhancing the credibility of Invast Global.

Company Background Investigation

Invast Global is part of a larger corporate group, Invast Securities, which has a history of over 60 years in the financial services industry. The firms Japanese parent company has established a solid reputation in the securities brokerage sector, contributing to Invast Global's credibility in the Australian market.

The management team at Invast Global comprises seasoned professionals with extensive experience in trading and financial services. Their backgrounds include roles in top-tier investment banks, providing the firm with a wealth of knowledge and expertise. This diverse leadership enhances the company's operational transparency and reinforces its commitment to maintaining high standards of service.

In terms of transparency, Invast Global provides comprehensive information about its services, fees, and trading conditions on its website, allowing potential clients to make informed decisions. However, the absence of a demo account option may deter novice traders who wish to test the platform before committing real funds.

Trading Conditions Analysis

Invast Global offers competitive trading conditions, but it is essential to scrutinize the overall fee structure to understand the true cost of trading. The broker operates on a commission-based model, with spreads starting at 0.2 pips for major currency pairs, which is lower than the industry average. However, the minimum deposit requirement of AUD 5,000 is relatively high compared to other brokers, potentially limiting access for retail traders.

Core Trading Costs Comparison Table

| Cost Type | Invast Global | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.2 pips | 1.2 pips |

| Commission Model | $4 per lot | $7 per lot |

| Overnight Interest Range | Varies | Varies |

While Invast Global's spreads and commissions are competitive, traders should be aware of any additional fees that may apply, such as rollover fees for overnight positions. These costs can accumulate, impacting overall profitability, particularly for active traders.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Invast Global takes several measures to ensure the security of client deposits. As an ASIC-regulated entity, the broker is required to keep client funds in segregated accounts, separate from its operational funds. This practice minimizes the risk of client funds being misused or lost in the event of the broker's financial difficulties.

Additionally, Invast Global does not offer negative balance protection, which means that traders could potentially lose more than their initial deposit. This aspect is crucial for traders to consider, especially those who plan to use high leverage. Overall, the firm has not reported any significant fund safety issues or controversies, reinforcing its standing as a reliable broker.

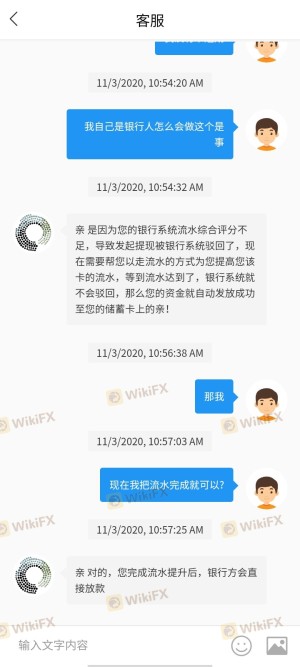

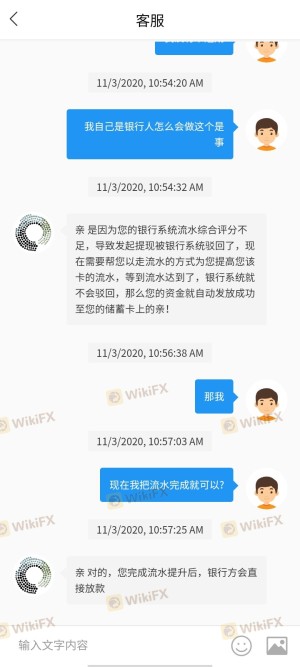

Customer Experience and Complaints

Customer feedback is an important indicator of a broker's reliability and service quality. Reviews of Invast Global generally highlight positive experiences, particularly in terms of customer support and trading conditions. However, some common complaints have emerged, including the high minimum deposit requirement and the lack of a demo account for practice.

Complaint Types and Severity Assessment Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| High Minimum Deposit | Moderate | Addressed in FAQs |

| Lack of Demo Account | Low | Not addressed |

| Withdrawal Processing Delays | Moderate | Generally prompt |

Typical case studies indicate that while clients appreciate the competitive spreads and responsive customer support, some have expressed frustration over the lack of flexibility for new traders. The company generally responds to inquiries and complaints promptly, which is a positive sign of its commitment to customer satisfaction.

Platform and Execution Assessment

Invast Global provides several advanced trading platforms, including MetaTrader 4, MetaTrader 5, and Iress. These platforms are known for their user-friendly interfaces and comprehensive trading tools. However, the execution quality has been a point of contention for some users, with reports of occasional slippage and order rejections during volatile market conditions.

Overall, the platforms offer a stable trading environment, but traders should remain vigilant and monitor execution quality, particularly during significant market events. The absence of any reported manipulation or unethical practices further supports the broker's credibility.

Risk Assessment

Engaging with Invast Global entails several risks, primarily associated with the high minimum deposit and the lack of negative balance protection. Traders should also be aware of the potential for losses due to market volatility, particularly when using leverage.

Risk Rating Summary Table

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | Low | Strong regulatory oversight by ASIC |

| Fund Safety | Low | Segregated accounts protect client funds |

| Trading Costs | Medium | High minimum deposit and potential hidden fees |

| Execution Quality | Medium | Possible slippage during high volatility |

To mitigate these risks, traders are advised to thoroughly understand the trading conditions and employ risk management strategies, such as setting stop-loss orders and avoiding excessive leverage.

Conclusion and Recommendations

In summary, Invast Global is not a scam; it is a legitimate broker regulated by ASIC, which provides a secure trading environment. The firm has a solid background, competitive trading conditions, and a commitment to client fund safety. However, potential clients should be cautious of the high minimum deposit requirement and the absence of negative balance protection.

For experienced traders and institutional clients, Invast Global offers a robust trading platform and favorable trading conditions. However, novice traders may want to explore alternative brokers that offer lower minimum deposits and demo accounts for practice.

If you are looking for reliable alternatives, consider brokers like AvaTrade, IC Markets, or Pepperstone, which provide flexible trading conditions and comprehensive support for traders at various experience levels. Always ensure to conduct thorough research and consider your trading needs before selecting a broker.

Is Invast Global a scam, or is it legit?

The latest exposure and evaluation content of Invast Global brokers.

Invast Global Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Invast Global latest industry rating score is 1.64, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.64 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.