Is Elpari Markets safe?

Business

License

Is Elpari Markets A Scam?

Introduction

Elpari Markets is a relatively new player in the forex trading landscape, aiming to cater to both novice and seasoned traders. As the forex market continues to grow, traders are presented with a plethora of brokerage options, making it crucial to choose a trustworthy and reliable partner. Given the high stakes involved in forex trading, it becomes essential for traders to exercise caution and conduct thorough evaluations of potential brokers. This article utilizes a comprehensive investigative approach, analyzing various aspects of Elpari Markets, including its regulatory status, company background, trading conditions, customer experiences, and overall safety measures.

Regulation and Legitimacy

The regulatory framework within which a forex broker operates is a critical factor in determining its legitimacy and trustworthiness. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices designed to protect clients. Elpari Markets, however, has faced scrutiny regarding its regulatory status.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

As shown in the table, Elpari Markets currently lacks any valid regulatory oversight from recognized financial authorities. This absence of regulation raises red flags, as it implies that the broker may not be subject to the stringent compliance requirements typically enforced by regulatory bodies. The lack of oversight can lead to potential risks for traders, including issues related to fund security and transparency.

Historically, the absence of regulation has been a common concern among traders, as it can lead to fraudulent practices and mismanagement of client funds. Therefore, when evaluating whether Elpari Markets is safe, it is essential to consider the implications of operating without regulatory oversight.

Company Background Investigation

Elpari Markets was established relatively recently, and its ownership structure remains somewhat opaque. Unlike more established brokers with clear ownership and management teams, Elpari Markets has not provided detailed information about its founders or key personnel. This lack of transparency can be concerning for potential clients, as it raises questions about the broker's accountability and operational integrity.

The company's operational history is limited, and there are no significant milestones or achievements to highlight. Without a proven track record, traders may find it challenging to trust Elpari Markets as a reliable trading partner. The absence of comprehensive information about the management team and their professional backgrounds further compounds these concerns.

In terms of transparency, Elpari Markets does not appear to have a robust information disclosure policy. Traders often rely on a broker's willingness to share relevant information, such as financial reports and operational practices, as indicators of trustworthiness. The lack of such disclosures from Elpari Markets may leave potential clients feeling uncertain about the broker's commitment to ethical practices and client protection.

Trading Conditions Analysis

When assessing whether Elpari Markets is safe, it is imperative to examine its trading conditions, including fees, spreads, and commissions. A broker's fee structure can significantly impact a trader's profitability and overall trading experience. Elpari Markets presents a varied fee structure, which is essential to understand before committing funds.

| Fee Type | Elpari Markets | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 1.2 pips | 0.8 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | Varies | Varies |

From the table, it is evident that Elpari Markets' spreads for major currency pairs are relatively higher than the industry average. This may indicate that traders could incur additional costs when trading, which could diminish their overall returns. Furthermore, the absence of clear information regarding commission structures raises concerns about potential hidden costs that may not be immediately apparent to traders.

Unusual fees or policies can be a red flag for traders, as they may indicate a lack of transparency or ethical practices. If a broker's fee structure is convoluted or laden with hidden charges, it could lead to dissatisfaction among clients. Therefore, potential traders should carefully consider these aspects when evaluating whether Elpari Markets is safe.

Customer Funds Security

The security of customer funds is a paramount concern for any trader. A reputable broker should implement robust measures to protect clients' investments. Elpari Markets' approach to fund security remains unclear, which raises concerns regarding the safety of customer deposits.

Typically, reputable brokers employ measures such as segregated accounts, ensuring that client funds are kept separate from the broker's operational funds. This practice safeguards clients' investments in the event of the broker's insolvency. Additionally, the implementation of investor protection schemes can provide further assurance to traders.

However, without clear information from Elpari Markets regarding its fund security measures, it is challenging to ascertain whether the broker prioritizes customer safety. The absence of such information could imply that potential clients may be at risk if they choose to trade with Elpari Markets.

Furthermore, any historical incidents involving fund security issues or disputes should be taken into account when evaluating the broker's reliability. Traders should be cautious and conduct thorough research before entrusting their funds to a broker with insufficient safety measures.

Customer Experience and Complaints

Analyzing customer feedback is a crucial component in determining the overall experience with a broker. Traders often share their experiences, highlighting both positive and negative aspects of their interactions with the broker.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

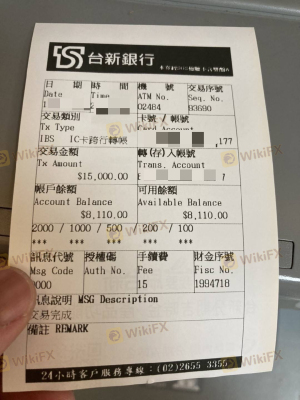

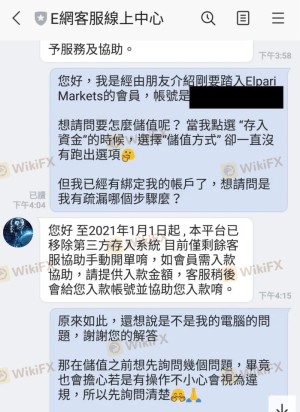

| Withdrawal Issues | High | Slow Response |

| Poor Customer Support | Medium | Inconsistent |

| High Spreads | Medium | Acknowledged |

The table above summarizes common complaints associated with Elpari Markets. Many users have reported challenges related to withdrawal processes, citing delays and difficulties in accessing their funds. These complaints can significantly impact a trader's experience, leading to frustration and dissatisfaction.

Moreover, the quality of customer support has been criticized, with reports indicating that responses may be slow or inadequate. Such issues can deter potential clients from choosing Elpari Markets as their trading partner, as responsive and effective customer support is crucial in the fast-paced world of forex trading.

Reviewing specific user cases can provide additional insights into the broker's performance. For instance, a trader may report a positive experience with the trading platform but express frustration over withdrawal delays. This mixed feedback can create uncertainty for potential clients considering whether Elpari Markets is safe.

Platform and Execution

The performance and reliability of a trading platform are vital factors in a trader's success. Elpari Markets offers the widely recognized MetaTrader 4 and MetaTrader 5 platforms, which are known for their user-friendly interfaces and advanced trading features. However, the overall performance of these platforms, including order execution quality and potential slippage, remains to be evaluated.

Traders often seek brokers that provide swift order execution and minimal slippage. Any signs of manipulation or execution issues can severely affect a trader's profitability. Therefore, potential clients should investigate user reviews regarding the execution quality at Elpari Markets to determine whether it meets their expectations.

Risk Assessment

Using any broker involves inherent risks, and Elpari Markets is no exception. A comprehensive risk assessment should encompass various factors, including regulatory status, customer feedback, and overall trading conditions.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of regulation raises concerns. |

| Financial Risk | Medium | Higher spreads could impact profitability. |

| Operational Risk | Medium | Customer complaints about withdrawals. |

The risk assessment highlights significant concerns associated with trading through Elpari Markets. The lack of regulatory oversight poses a considerable risk to traders, as they may not have adequate recourse in the event of disputes or issues. Additionally, the potential for financial losses due to high spreads and operational challenges related to withdrawals adds to the overall risk profile.

To mitigate these risks, traders should consider implementing robust risk management strategies, including setting stop-loss orders and diversifying their trading portfolios.

Conclusion and Recommendations

In conclusion, the evidence suggests that Elpari Markets presents several red flags that may warrant caution from potential traders. The absence of regulatory oversight, coupled with customer complaints regarding withdrawal issues and high spreads, raises concerns about the broker's reliability and trustworthiness.

While Elpari Markets offers a range of trading instruments and utilizes well-known trading platforms, the lack of transparency and accountability in its operations may deter traders from engaging with this broker. Therefore, it is crucial for potential clients to conduct thorough research and consider alternative brokers that demonstrate a stronger commitment to regulatory compliance and customer protection.

For traders seeking reliable alternatives, brokers such as Alpari, which has a long-standing reputation and regulatory oversight, may present more favorable options. Always prioritize safety and transparency when selecting a forex broker to ensure a secure and successful trading experience.

Is Elpari Markets a scam, or is it legit?

The latest exposure and evaluation content of Elpari Markets brokers.

Elpari Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Elpari Markets latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.