Regarding the legitimacy of Hengda forex brokers, it provides ASIC, FCA, HKGX, FSPR and WikiBit, (also has a graphic survey regarding security).

Is Hengda safe?

Pros

Cons

Is Hengda markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

Clone FirmLicense Type:

Market Making License (MM)

Licensed Entity:

Hantec Markets (Australia) Pty Limited

Effective Date: Change Record

2008-08-27Email Address of Licensed Institution:

joanne_ding@hantecmarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

www.hantecmarkets.comExpiration Time:

--Address of Licensed Institution:

HANTEC MARKETS (AUSTRALIA) PTY LTD SE 206 L 2 68 YORK ST SYDNEY NSW 2000Phone Number of Licensed Institution:

0280178091Licensed Institution Certified Documents:

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

Clone FirmLicense Type:

Market Making License (MM)

Licensed Entity:

Hantec Markets Limited

Effective Date:

2010-06-16Email Address of Licensed Institution:

compliance-uk@hmarkets.co.uk, v.maasik@hmarkets.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.hmarkets.comExpiration Time:

--Address of Licensed Institution:

5-6 Newbury Street London EC1A 7HU UNITED KINGDOMPhone Number of Licensed Institution:

+442070360850Licensed Institution Certified Documents:

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

Clone FirmLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

亨達金銀投資有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.bullionhantec.comExpiration Time:

--Address of Licensed Institution:

香港皇后大道中183號中遠大廈46樓4609室Phone Number of Licensed Institution:

22144288Licensed Institution Certified Documents:

FSPR Inst Forex Execution (STP)

Financial Service Providers Register

Financial Service Providers Register

Current Status:

Clone FirmLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

HANTEC (NZ) COMPANY LIMITED

Effective Date:

2011-07-05Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

www.hantec.comExpiration Time:

--Address of Licensed Institution:

Level 2, Building A, Millennium Centre - Phase I I 600 Great South Road Ellerslie, Auckland 1051Phone Number of Licensed Institution:

09 5315388Licensed Institution Certified Documents:

Is Hengda Safe or Scam?

Introduction

Hengda is a forex broker based in China, known for offering trading services to a wide range of clients interested in the foreign exchange market. As the forex industry continues to evolve, traders are increasingly faced with a plethora of options, making it essential to carefully evaluate the legitimacy and safety of brokers before committing any funds. The potential for scams in the forex sector is significant, with numerous reports of fraudulent activities and unregulated operations. Therefore, it is crucial for traders to conduct thorough research on brokers like Hengda to ensure they are making informed decisions. This article will investigate Hengda's regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk assessment to determine whether Hengda is safe or a scam.

Regulation and Legitimacy

One of the first factors to consider when evaluating a forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to established financial standards and practices. Unfortunately, Hengda is classified as an unregulated entity, raising significant concerns about its legitimacy and the protection it provides to its clients.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that Hengda operates without oversight from any major financial authorities. This lack of regulatory framework increases the risk for traders, as there are no guarantees regarding the safety of their funds or the ethical conduct of the broker. Furthermore, the official website of Hengda is currently inaccessible, leading to speculation about the broker's operational status and raising red flags about its credibility. In summary, the lack of regulation and the unavailability of the broker's website indicate that Hengda may not be a safe option for traders.

Company Background Investigation

Hengda's history and ownership structure provide further insight into its reliability as a forex broker. The company appears to be a relatively new entrant in the forex market, and limited information is available regarding its establishment and growth. This lack of transparency can be concerning for potential clients. Additionally, the absence of a clear management team profile raises questions about the expertise and experience of those running the operation.

In terms of transparency, Hengda's failure to provide comprehensive information about its operations, management, and financial standing is troubling. A reputable broker typically discloses details about its ownership structure and management team, which helps build trust with clients. Without such information, traders may find it difficult to assess the broker's credibility and reliability. Overall, the company's lack of transparency and the limited information available contribute to the perception that Hengda may not be a trustworthy broker.

Trading Conditions Analysis

When evaluating a forex broker, it is essential to understand its trading conditions, including fees, spreads, and commissions. Hengda's fee structure has raised concerns among clients, particularly regarding the lack of clarity on potential hidden fees or unusual policies.

| Fee Type | Hengda | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies | 1.0 - 2.0 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of specific information on spreads and commissions is a major red flag. Traders should be cautious of brokers that do not provide transparent pricing structures, as this can lead to unexpected costs and reduced profitability. Moreover, the absence of a clear commission model may indicate that Hengda could impose additional fees that are not disclosed upfront. Overall, the ambiguous trading conditions and potential hidden fees associated with Hengda further contribute to the assessment that it may not be a safe option for traders.

Client Fund Security

The safety of client funds is a crucial consideration when evaluating a forex broker. Hengda's lack of regulatory oversight raises significant concerns regarding its client fund security measures. Without proper regulation, there are no guarantees that client funds are adequately protected or segregated from the broker's operational funds.

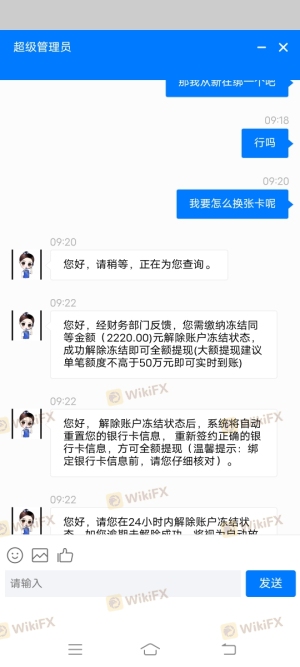

Additionally, there is no available information on Hengda's policies regarding negative balance protection, which is essential for safeguarding clients from incurring debts beyond their initial investments. Historical issues related to fund security, such as reports of clients being unable to withdraw their funds, further exacerbate concerns about the broker's reliability. Overall, the absence of robust fund security measures and the lack of transparency regarding these policies suggest that Hengda may not provide a safe environment for traders' investments.

Customer Experience and Complaints

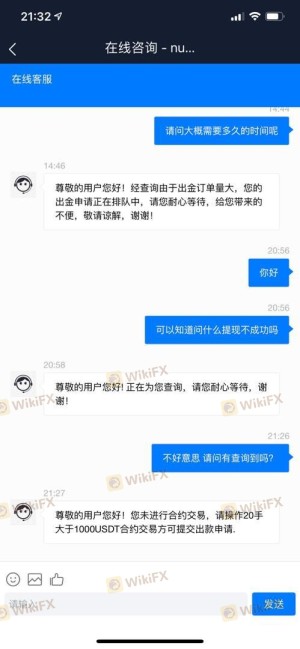

Analyzing customer feedback is vital in understanding the overall experience traders have with a broker. Numerous reports indicate that clients have faced significant issues with Hengda, including difficulties in withdrawing funds and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Customer Service Issues | Medium | Poor |

Common complaints about Hengda include clients being unable to access their funds after making deposits, which is a serious concern for any trader. The lack of effective customer service channels exacerbates these issues, as clients are left without support or guidance when faced with problems. The negative feedback from clients and the reported complaints highlight the potential risks associated with trading with Hengda, raising further doubts about its safety and reliability.

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. Traders need a reliable and efficient platform that ensures fast order execution and minimal slippage. Unfortunately, there is limited information available regarding Hengda's platform performance, leading to uncertainty about its reliability.

Traders have reported issues with order execution quality, including significant slippage and instances of order rejections. These problems can severely impact trading outcomes and profitability, making it essential for traders to consider the execution quality of a broker before committing their funds. The lack of positive feedback regarding Hengda's platform performance raises concerns about potential manipulation or inefficiencies within their trading system.

Risk Assessment

Using Hengda as a forex broker presents several inherent risks that traders should be aware of. The combination of unregulated status, unclear trading conditions, and negative customer experiences contribute to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight |

| Fund Security Risk | High | Lack of fund protection measures |

| Customer Service Risk | Medium | Poor response to client complaints |

| Platform Performance Risk | High | Issues with execution and slippage |

To mitigate these risks, traders should conduct thorough research before engaging with Hengda. It is advisable to consider alternative brokers that offer better regulatory oversight, transparent trading conditions, and stronger customer support.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Hengda may not be a safe option for traders. The lack of regulation, unclear trading conditions, and negative customer experiences raise significant red flags about the broker's legitimacy. Traders should exercise extreme caution when considering Hengda as their forex broker and thoroughly investigate alternative, regulated options that prioritize transparency, security, and accountability.

For those seeking reliable alternatives, brokers with established regulatory frameworks and positive customer reviews are recommended. Overall, it is crucial for traders to prioritize their safety and security in the forex market, and to remain vigilant against potential scams.

Is Hengda a scam, or is it legit?

The latest exposure and evaluation content of Hengda brokers.

Hengda Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Hengda latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.