Is DSTCLOUDS safe?

Business

License

Is dstclouds Safe or Scam?

Introduction

In the fast-paced world of forex trading, selecting a reliable broker is paramount for success. dstclouds, a forex broker that claims to offer a wide range of trading services, has recently come under scrutiny regarding its legitimacy and safety. Traders need to be cautious when evaluating forex brokers, as the market is rife with scams and unregulated entities. To assist traders in making informed decisions, this article conducts a thorough investigation into dstclouds, focusing on its regulatory status, company background, trading conditions, customer experience, and overall safety. Our assessment is based on a combination of qualitative analysis and quantitative data derived from various reputable sources.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its safety. Brokers that are regulated by reputable authorities are more likely to adhere to strict operational standards, providing a safer trading environment for clients. In the case of dstclouds, the broker has been flagged for operating without proper regulation.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | N/A | United States | Unauthorized |

As indicated in the table above, dstclouds does not hold a license from any recognized regulatory body, such as the National Futures Association (NFA) or the Financial Conduct Authority (FCA). This lack of regulation raises significant red flags. The absence of oversight means that traders have limited recourse in the event of disputes or unethical practices. Furthermore, reports suggest that dstclouds may have previously made false claims regarding its regulatory status, further undermining its credibility. Given these factors, it is essential to approach this broker with caution.

Company Background Investigation

Understanding the company behind a forex broker is crucial for assessing its reliability. dstclouds is operated by dst clouds international limited, which has a questionable history and limited transparency. The company claims to provide a variety of trading services, including contracts for difference (CFDs) on multiple asset classes. However, detailed information regarding its ownership structure and management team is scarce.

The lack of transparency raises concerns about the company's operational integrity. Traders should be wary of brokers that do not provide clear information about their management and ownership. A reliable broker typically offers insights into its team, highlighting their experience and qualifications in the financial industry. Unfortunately, dstclouds falls short in this regard, leaving potential clients in the dark about who they are entrusting with their funds.

Trading Conditions Analysis

An essential aspect of evaluating a forex broker is understanding its trading conditions and fee structures. dstclouds advertises competitive trading conditions, but a closer examination reveals potential issues that could affect traders.

| Fee Type | dstclouds | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2 pips | 1.5 pips |

| Commission Model | N/A | $5 per lot |

| Overnight Interest Range | High | Moderate |

As shown in the table, dstclouds offers spreads that are higher than the industry average, which could eat into traders' profits. Additionally, while the broker does not explicitly state its commission structure, anecdotal evidence suggests that traders may incur hidden fees, which are not disclosed upfront. This lack of clarity around costs is concerning, as it may lead to unexpected expenses that can adversely affect trading performance. Overall, while dstclouds promotes attractive trading conditions, the actual costs may not be as favorable as they appear.

Client Funds Security

The safety of client funds is a paramount concern for any forex trader. Brokers that prioritize client security typically implement strict measures to protect deposits. In the case of dstclouds, there are significant concerns regarding its approach to fund safety.

dstclouds reportedly does not have adequate measures in place to safeguard client funds. There is no clear information about whether client funds are held in segregated accounts, a practice that is crucial for ensuring that traders' money is protected in the event of the broker's insolvency. Furthermore, dstclouds has not provided evidence of investor protection schemes, which are essential for safeguarding traders' investments. The lack of transparency regarding these safety measures raises alarm bells about the broker's commitment to protecting its clients.

Customer Experience and Complaints

Analyzing customer feedback is vital for understanding a broker's reputation in the market. A review of user experiences with dstclouds reveals a mixed bag of opinions, with several complaints surfacing about the broker's practices.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

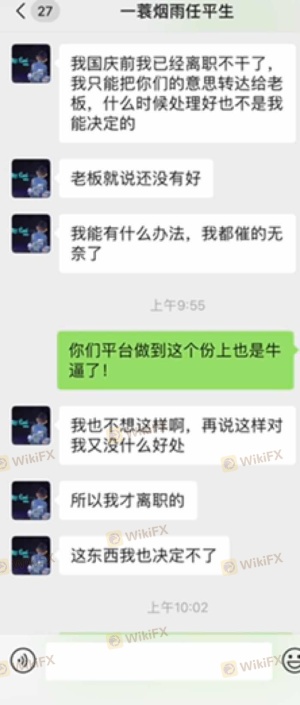

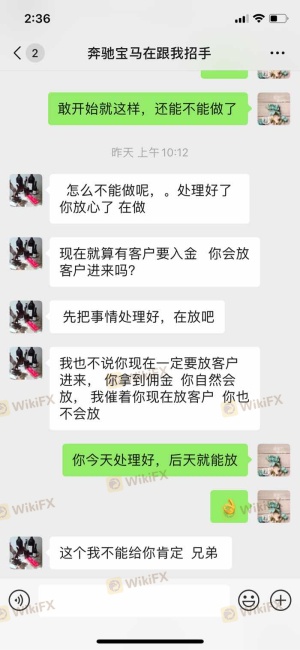

| Withdrawal Issues | High | Slow response |

| Poor Customer Service | Medium | Inconsistent |

| Misleading Information | High | No resolution |

Many users have reported difficulties when attempting to withdraw their funds, citing slow response times from customer support. Additionally, there are complaints regarding poor customer service, with some clients feeling that their concerns were not adequately addressed. The severity of these complaints suggests a troubling pattern that could indicate deeper issues within the broker's operations. Traders should carefully consider these experiences before deciding to engage with dstclouds.

Platform and Trade Execution

The trading platform's performance and execution quality are crucial components of a successful trading experience. dstclouds claims to offer a robust trading platform, but user feedback indicates mixed results.

Traders have reported issues with order execution, including slippage and rejected orders, which can significantly impact trading outcomes. Such problems may suggest underlying issues with the broker's infrastructure or possible manipulation of trades. A reliable broker should provide a stable platform with high execution quality, ensuring that traders can execute their strategies without unnecessary complications.

Risk Assessment

Using dstclouds comes with several risks that traders should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Financial Risk | High | Lack of fund security |

| Customer Service Risk | Medium | Poor support response |

The overall risk associated with trading through dstclouds is high, primarily due to its lack of regulation and transparency. Traders should be cautious and consider these risks seriously before depositing funds. It is advisable to seek brokers with strong regulatory oversight and proven track records to mitigate these risks.

Conclusion and Recommendations

In conclusion, the investigation into dstclouds raises significant concerns regarding its safety and legitimacy. The broker's lack of regulation, transparency issues, and negative customer feedback suggest that it may not be a safe option for traders. While some traders may still consider using dstclouds, it is crucial to approach this broker with caution.

For those seeking reliable alternatives, consider brokers that are regulated by reputable authorities, offer transparent fee structures, and have a proven track record of positive customer experiences. Ultimately, ensuring the safety of your investments should be the top priority when selecting a forex broker.

Is DSTCLOUDS a scam, or is it legit?

The latest exposure and evaluation content of DSTCLOUDS brokers.

DSTCLOUDS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DSTCLOUDS latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.