Is OFMG safe?

Pros

Cons

Is OFMG A Scam?

Introduction

OFMG, or Original Forex Management Group, is a forex brokerage that has emerged in the trading scene since its establishment in 2020. Positioned as a platform for trading various financial instruments, including forex, commodities, and indices, OFMG aims to cater to a diverse clientele. However, in the world of forex trading, it is crucial for traders to exercise caution and conduct thorough evaluations of brokers before committing their funds. The forex market is rife with unregulated entities and scams, making it essential to discern trustworthy brokers from potentially fraudulent ones. This article aims to provide an objective analysis of OFMG, examining its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment, to determine whether OFMG is a safe trading platform or a scam.

Regulation and Legitimacy

One of the primary factors to consider when evaluating the safety of a forex broker is its regulatory status. Regulatory oversight is designed to protect traders and ensure that brokers adhere to industry standards. Unfortunately, OFMG has been noted for its lack of regulation, which raises significant concerns regarding its legitimacy. Below is a summary of the core regulatory information regarding OFMG:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of a regulatory body overseeing OFMG means that traders have no recourse should disputes arise or if the broker engages in unethical practices. Regulated brokers are mandated to follow strict guidelines that include maintaining segregated client accounts, implementing risk management measures, and adhering to anti-money laundering procedures. Without such oversight, OFMG operates in a high-risk environment, leaving traders vulnerable to potential fraud or mismanagement of funds. Furthermore, the lack of transparency surrounding its operations and ownership further compounds the risks associated with trading on this platform.

Company Background Investigation

OFMG was founded in 2020 and claims to be based in the United Kingdom, with its registered address at 15 Bishopsgate, London. However, details regarding the company's ownership structure and management team are sparse, raising red flags about its transparency. A thorough background check reveals that OFMG lacks a verifiable history of compliance with industry standards, and there is little information available regarding the qualifications and professional experiences of its management team. This lack of transparency can be alarming for potential investors, as it makes it difficult to assess the credibility and trustworthiness of the broker.

Moreover, the company's website does not provide adequate information about its operational practices, which is often a hallmark of less reputable firms. A broker that prioritizes transparency and information disclosure is more likely to foster trust among its clients. In contrast, OFMG's vague presentation could indicate an attempt to obscure its true operations and intentions, leading to skepticism about its legitimacy.

Trading Conditions Analysis

When evaluating a forex broker, understanding its trading conditions is crucial. OFMG offers a range of trading instruments, including forex pairs, commodities, and indices, but the details surrounding its fee structure and trading costs are vital for assessing its overall value proposition.

The following table summarizes the core trading costs associated with OFMG:

| Cost Type | OFMG | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2 pips | 1.5 pips |

| Commission Model | $10 per lot | $5 per lot |

| Overnight Interest Range | Varies | Varies |

While OFMG's spreads may appear competitive at first glance, the $10 commission per lot traded is significantly higher than the industry average. This can lead to increased trading costs, which may erode potential profits for traders. Additionally, the lack of clarity regarding overnight interest rates and other potential fees raises concerns about hidden costs that could impact the overall trading experience.

Traders should carefully consider these factors when evaluating whether OFMG provides a fair and transparent trading environment, as brokers with unusual or opaque fee structures may be attempting to capitalize on unsuspecting clients.

Client Fund Safety

The safety of client funds is paramount when selecting a forex broker. OFMG's approach to fund security raises several concerns. There is no comprehensive information available regarding the measures OFMG has in place to protect client funds, such as segregated accounts or investor protection schemes. Segregated accounts are essential as they ensure that client funds are kept separate from the broker's operational funds, providing a layer of security in case the broker faces financial difficulties.

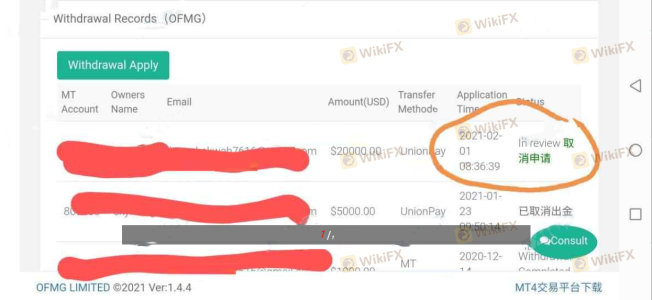

Furthermore, the absence of negative balance protection policies means that traders could potentially lose more than their initial investment if the market moves against them. Historical complaints have also surfaced regarding fund withdrawal issues, with users reporting difficulties in accessing their money. Such incidents are indicative of a lack of financial integrity and could suggest that OFMG may not prioritize the safety and well-being of its clients.

Customer Experience and Complaints

Customer feedback is a critical component in assessing the reliability of a forex broker. In the case of OFMG, numerous complaints have been reported, highlighting significant issues faced by traders. The following table summarizes the main types of complaints received:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Account Deletion | High | No response |

| Poor Customer Service | Medium | Inconsistent |

Many users have expressed frustration over their inability to withdraw funds, with some claiming that their accounts were deleted without warning. These complaints indicate a troubling pattern of customer dissatisfaction and suggest that OFMG may not be responsive to client concerns. The lack of timely and effective communication from the company raises additional red flags about its commitment to customer service.

For instance, one user reported being unable to withdraw funds after multiple attempts, resulting in a prolonged wait without any feedback from the support team. Such experiences can be detrimental to traders, leading to a loss of trust and confidence in the broker.

Platform and Trade Execution

The performance of a trading platform directly impacts the trading experience. OFMG utilizes the popular MetaTrader 4 (MT4) platform, known for its robust features and user-friendly interface. However, the platform's execution quality, including slippage rates and order rejection frequency, must also be evaluated. Traders have reported mixed experiences with order execution on OFMG's platform, with some noting instances of slippage during volatile market conditions.

While slippage can occur with any broker, excessive slippage or frequent order rejections can indicate underlying issues with the broker's liquidity or execution practices. Furthermore, any signs of platform manipulation should be closely scrutinized, as they can severely impact traders' profitability and overall experience.

Risk Assessment

Using OFMG as a trading platform comes with an array of risks that potential traders should be aware of. The following risk scorecard summarizes key risk areas associated with trading on OFMG:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Fund Security Risk | High | Lack of fund protection measures. |

| Customer Service Risk | Medium | Poor responsiveness to client issues. |

| Trading Cost Risk | Medium | Higher-than-average commissions. |

Given the high levels of regulatory and fund security risks, it is essential for traders to proceed with caution. To mitigate these risks, potential clients should consider conducting thorough research and possibly seeking out alternative brokers that offer stronger regulatory oversight and better customer support.

Conclusion and Recommendations

In conclusion, the evidence suggests that OFMG presents significant concerns regarding its legitimacy and safety as a forex broker. The lack of regulation, combined with numerous complaints regarding fund withdrawals and customer service, raises red flags that cannot be overlooked.

Traders should be particularly cautious when considering OFMG as their trading platform, as the potential for scams and unethical practices appears evident. It is advisable for traders to prioritize brokers with reputable regulatory oversight and transparent practices.

For those seeking alternative options, consider exploring well-regulated brokers with strong customer support and a proven track record in the industry. Brokers such as IG, OANDA, and Forex.com are examples of platforms that prioritize client security and regulatory compliance, providing a safer trading environment.

In summary, is OFMG safe? The overwhelming evidence suggests that it is not, and potential traders should seek out more reliable alternatives to safeguard their investments.

Is OFMG a scam, or is it legit?

The latest exposure and evaluation content of OFMG brokers.

OFMG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

OFMG latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.