Is DK Trade safe?

Pros

Cons

Is DK Trade A Scam?

Introduction

DK Trade positions itself as an online trading platform catering to forex, commodities, indices, and equities. Established in Saint Vincent and the Grenadines, it claims to offer a unique trading experience with a variety of instruments and competitive trading conditions. However, the rise of online trading has also seen an increase in fraudulent activities, making it essential for traders to evaluate the legitimacy of brokers like DK Trade. In an environment rife with scams, traders must exercise caution and conduct thorough research before committing their funds. This article investigates DK Trade's regulatory status, company background, trading conditions, customer experiences, and overall safety to determine whether it is a safe trading platform or a potential scam.

Regulation and Legitimacy

The regulatory framework surrounding a trading platform is crucial for ensuring the safety of traders' funds and maintaining fair trading practices. DK Trade claims to be regulated by the Financial Services Authority (FSA) of Saint Vincent and the Grenadines. However, this jurisdiction is known for its lenient regulatory environment, raising questions about the effectiveness of such oversight.

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| FSA | N/A | Saint Vincent and the Grenadines | Unverified |

The FSA of Saint Vincent and the Grenadines has publicly stated that it does not oversee forex trading or brokerage activities, which means DK Trade operates without significant regulatory oversight. This lack of credible regulation is a red flag for potential investors, as it implies that there are minimal protections for client funds. Furthermore, the absence of a robust regulatory framework raises concerns about DK Trade's compliance history and operational integrity.

Company Background Investigation

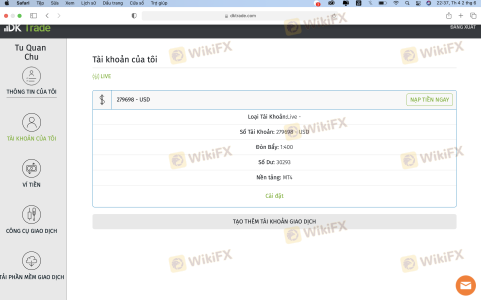

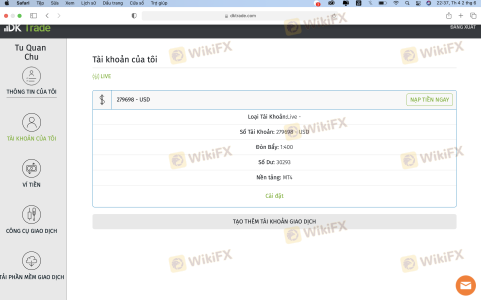

DK Trade's history and ownership structure are essential to understanding its credibility. The broker claims to be a boutique brokerage that focuses on client satisfaction. However, the details surrounding its ownership and management team are vague. A lack of transparency regarding the individuals behind DK Trade can be alarming for potential clients.

While the company has been operational for over a decade, its actual track record in the industry remains unclear. The absence of a well-documented history or recognizable leadership team raises concerns about the broker's reliability. Without a clearly defined management team with a proven track record in finance or trading, investors may find it challenging to trust DK Trade with their funds.

Trading Conditions Analysis

When evaluating whether DK Trade is safe, it is vital to consider its trading conditions, including fees and spreads. DK Trade advertises a low minimum deposit requirement and high leverage options, which may appear attractive to novice traders. However, the overall cost structure and any hidden fees should be scrutinized.

| Fee Type | DK Trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.4 pips | From 1.0 pips |

| Commission Structure | $10 per round lot (Zero Account) | $5 per round lot |

| Overnight Interest Range | Variable | Variable |

The spreads offered by DK Trade are on the higher end compared to industry standards, particularly for major currency pairs. Additionally, the commission structure for the Zero Account may deter traders looking for cost-effective trading options. While the broker claims to offer competitive conditions, the reality may not align with these assertions, prompting further investigation into the overall trading environment.

Customer Fund Safety

The safety of customer funds is paramount when considering whether DK Trade is safe. The broker claims to implement various security measures, but the lack of regulatory oversight raises significant concerns.

One of the key safety measures to look for is the segregation of client funds. This practice ensures that traders' money is kept separate from the broker's operational funds, providing an additional layer of protection. However, given DK Trade's regulatory status, there is no guarantee that such practices are in place. Furthermore, the absence of investor protection schemes means that traders may have little recourse in the event of financial losses or broker insolvency.

Customer Experience and Complaints

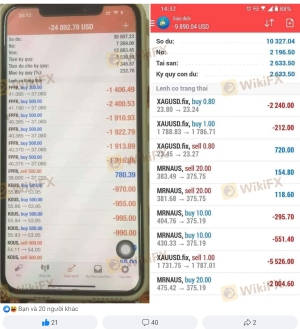

Analyzing customer feedback is essential for understanding the overall experience with DK Trade. Many reviews suggest that traders have faced difficulties, particularly regarding withdrawal requests. A common complaint is the inability to withdraw funds, which raises significant red flags about the broker's reliability.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or unresponsive |

| Poor Customer Support | Medium | Inconsistent |

| High Spreads | Low | Standard explanation |

Several users have reported that their withdrawal requests were delayed or ignored, leading to frustration and financial loss. Such patterns indicate a concerning trend that potential investors should consider before deciding to engage with DK Trade.

Platform and Trade Execution

The trading platform's performance is another critical factor in determining whether DK Trade is a scam. The broker offers popular platforms like MetaTrader 4 and 5, which are widely recognized for their functionality and user-friendliness. However, the execution quality, including slippage and order rejection rates, must also be evaluated.

Reports of slippage and rejected orders can significantly impact a trader's experience and profitability. If DK Trade's platform shows signs of manipulation or inefficiencies, it may further indicate that the broker is not safe for trading.

Risk Assessment

Using DK Trade comes with inherent risks that potential investors should be aware of. The lack of regulation, combined with customer complaints and withdrawal issues, creates a precarious trading environment.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated environment |

| Withdrawal Risk | High | Complaints of inability to withdraw funds |

| Transparency Risk | Medium | Lack of clear ownership and management |

To mitigate these risks, potential traders should consider safer, regulated alternatives and carefully assess their financial exposure when trading with DK Trade.

Conclusion and Recommendations

In summary, the investigation into DK Trade raises significant concerns about its legitimacy. The lack of credible regulation, coupled with numerous customer complaints and withdrawal issues, suggests that DK Trade may not be a safe trading platform. While it offers attractive trading conditions, the potential risks far outweigh the benefits.

For traders seeking a reliable and safe trading environment, it is advisable to explore well-regulated alternatives with proven track records. Brokers regulated by reputable authorities such as the FCA or ASIC provide better security for client funds and a more trustworthy trading experience. In light of the findings, it is prudent for traders to exercise caution and consider other options before investing with DK Trade.

Is DK Trade a scam, or is it legit?

The latest exposure and evaluation content of DK Trade brokers.

DK Trade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DK Trade latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.