DK Trade 2025 Review: Everything You Need to Know

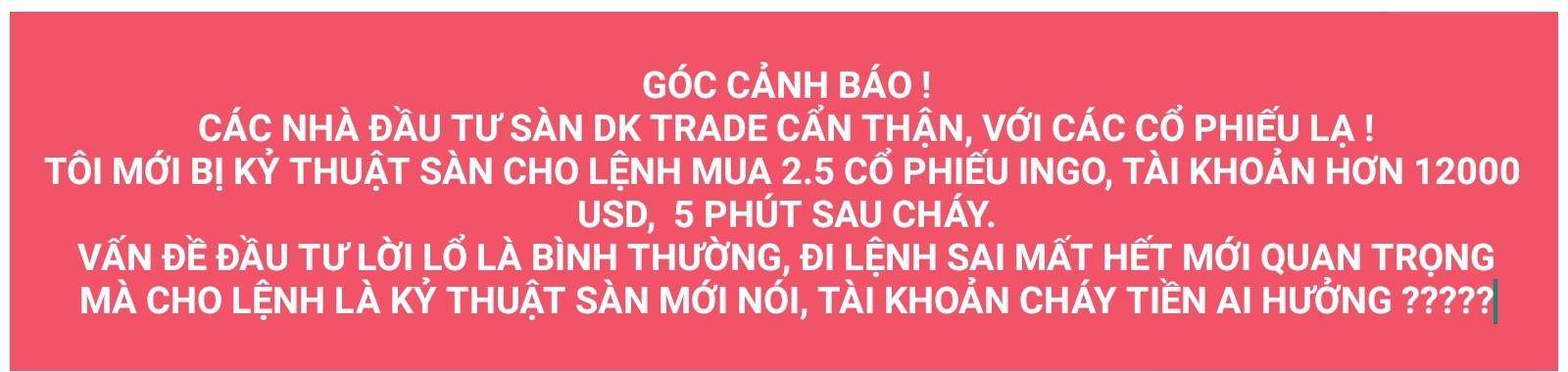

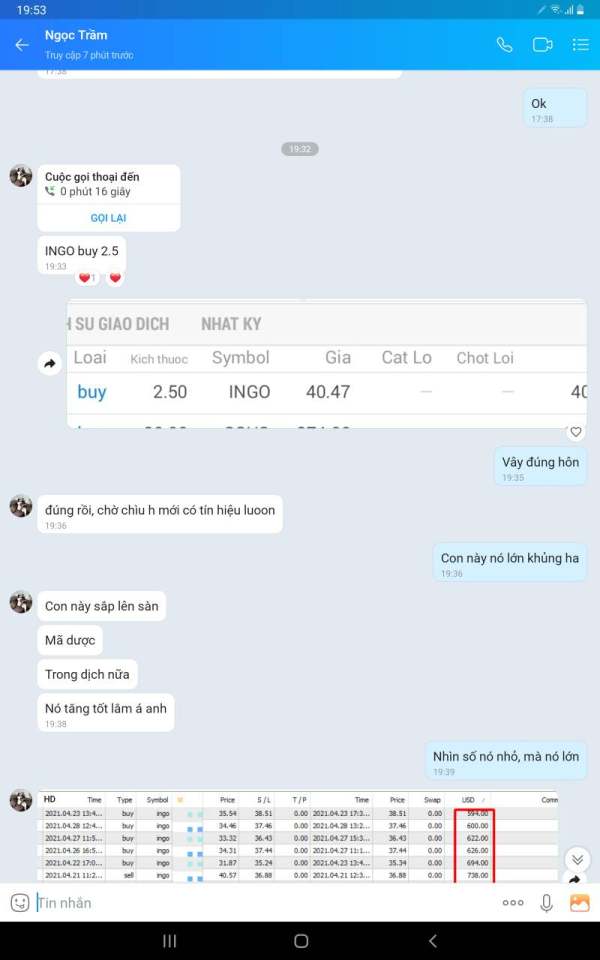

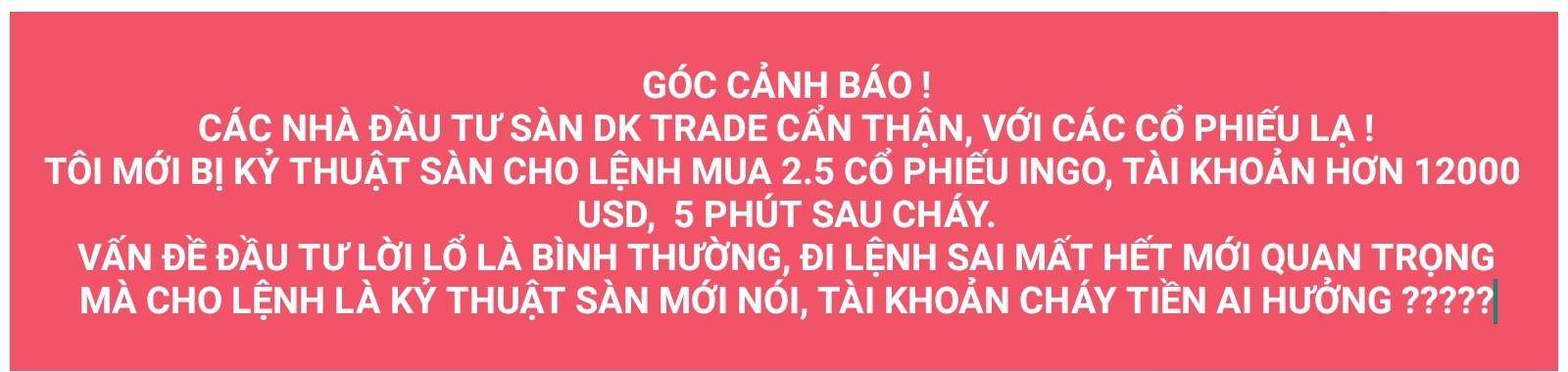

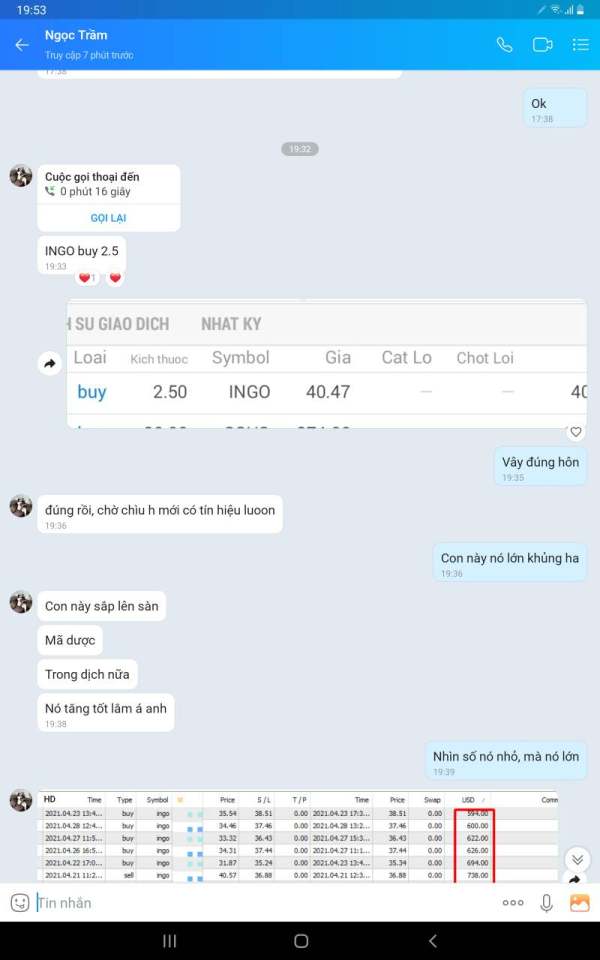

In the ever-evolving landscape of forex trading, DK Trade emerges as a broker that has drawn significant attention, both positive and negative. This review synthesizes various sources to provide a comprehensive overview of DK Trade's offerings, user experiences, and expert opinions. The consensus leans heavily towards caution, with numerous reports indicating potential issues regarding its legitimacy and regulatory standing.

Note: It is crucial to understand that DK Trade operates in a region with varying regulatory standards, which may affect user experiences. This review aims for fairness and accuracy by considering multiple perspectives.

Rating Overview

How We Rate Brokers: Our ratings are based on a comprehensive analysis of user feedback, expert opinions, and factual data regarding the broker's offerings.

Broker Overview

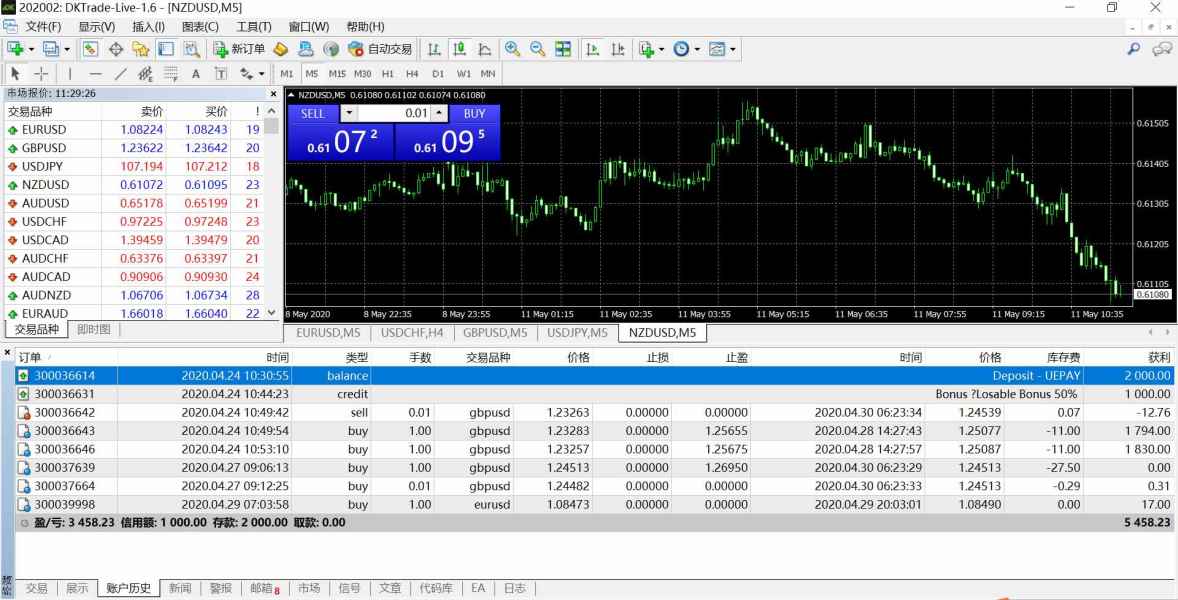

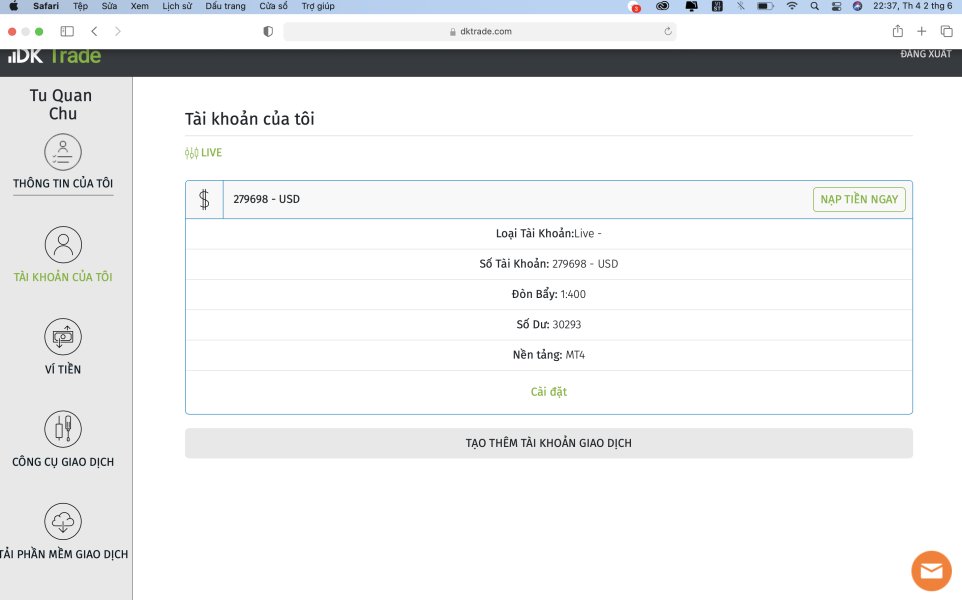

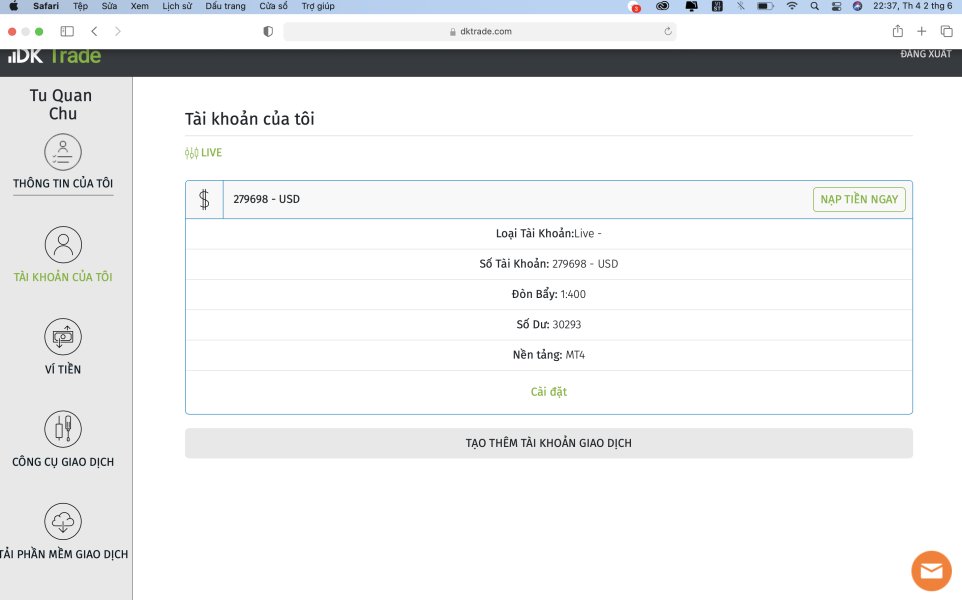

Founded in 2003, DK Trade is an online trading broker operating from Saint Vincent and the Grenadines. The broker claims to offer a range of trading platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5). However, it operates without credible regulatory oversight, raising significant concerns about the safety of client funds. The available asset classes include forex pairs, commodities, indices, and equities, but the lack of a reputable regulatory body overseeing its operations is a major red flag.

Detailed Breakdown

Regulatory Status and Geographic Coverage

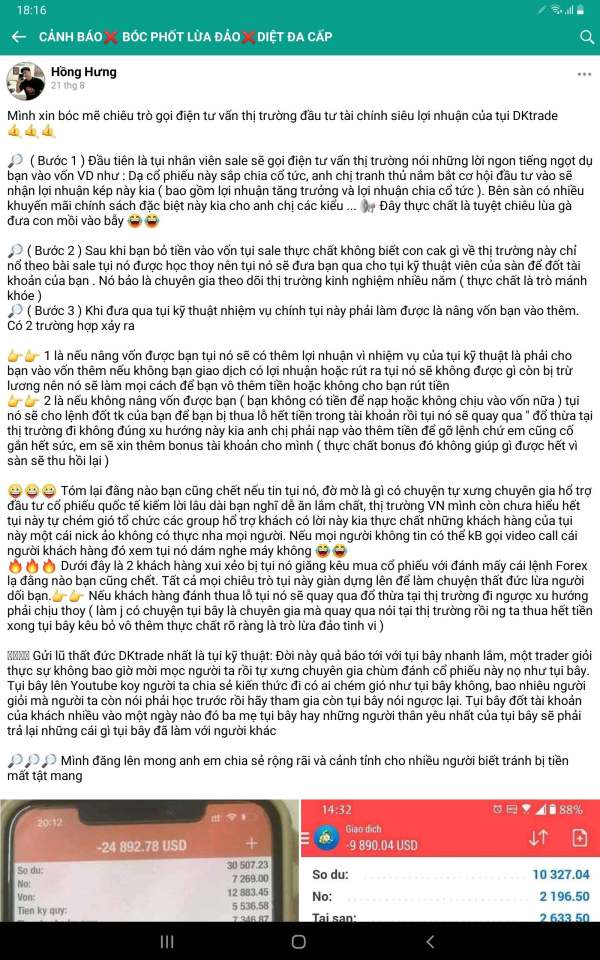

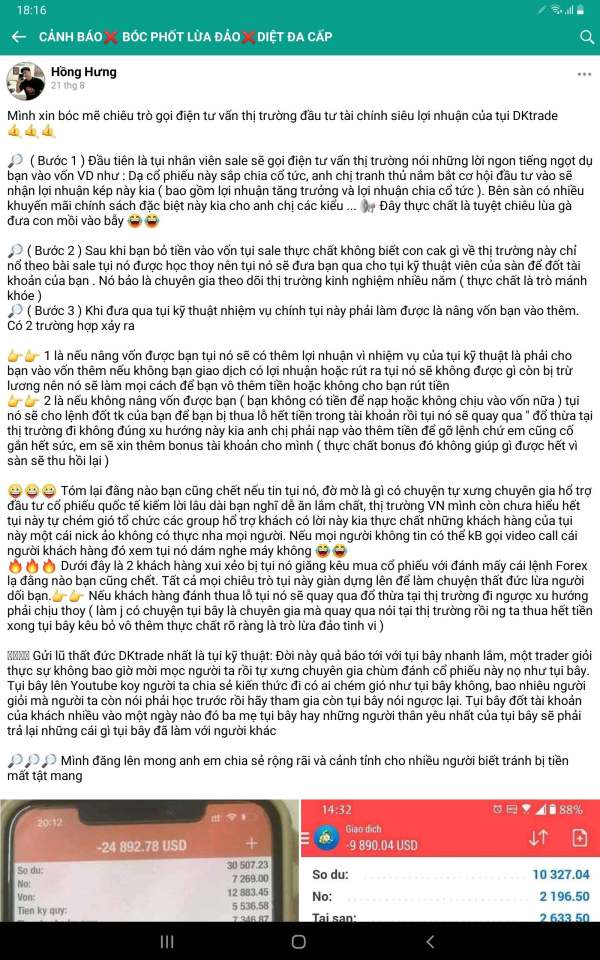

DK Trade is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lax regulatory framework. The Financial Services Authority (FSA) of SVG does not issue licenses for forex trading, leaving traders without any protection or recourse in case of disputes. This lack of regulation is a significant concern highlighted across multiple reviews, with many experts advising potential investors to steer clear of unregulated brokers.

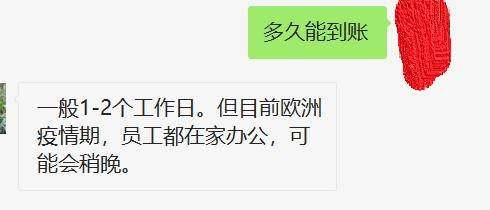

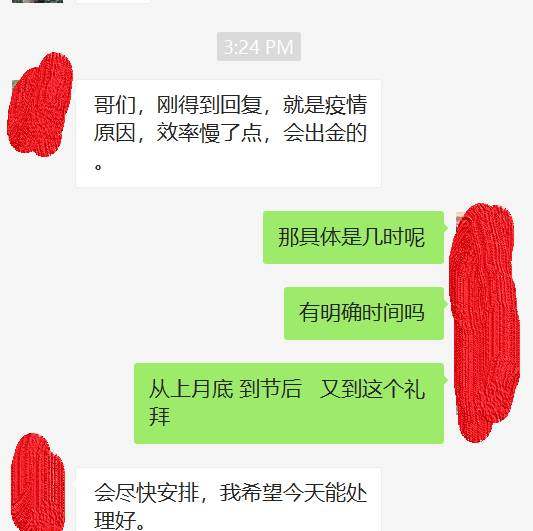

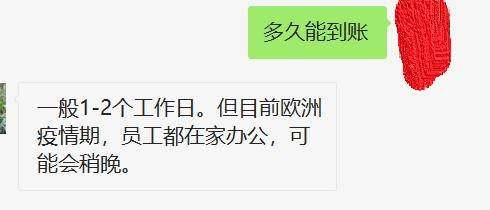

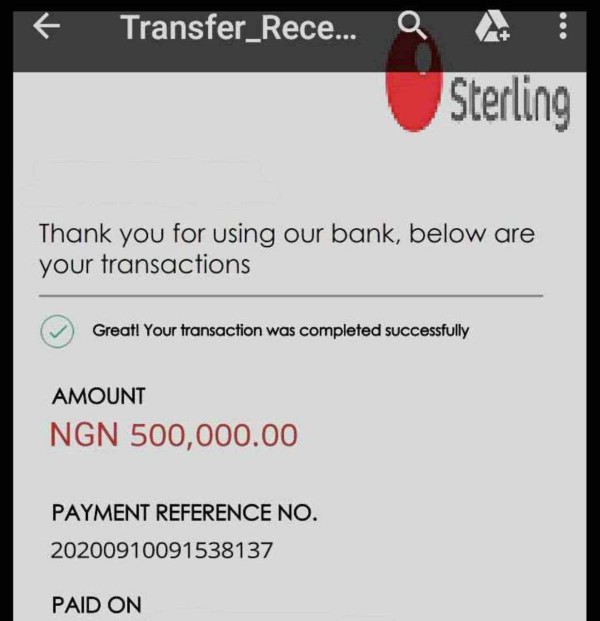

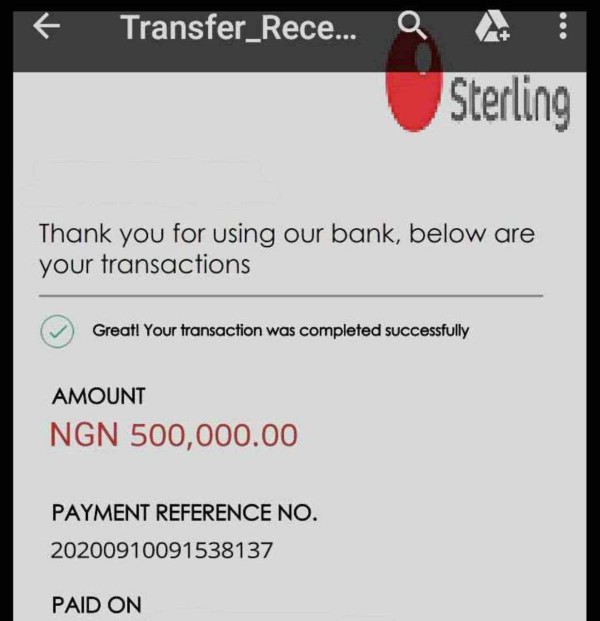

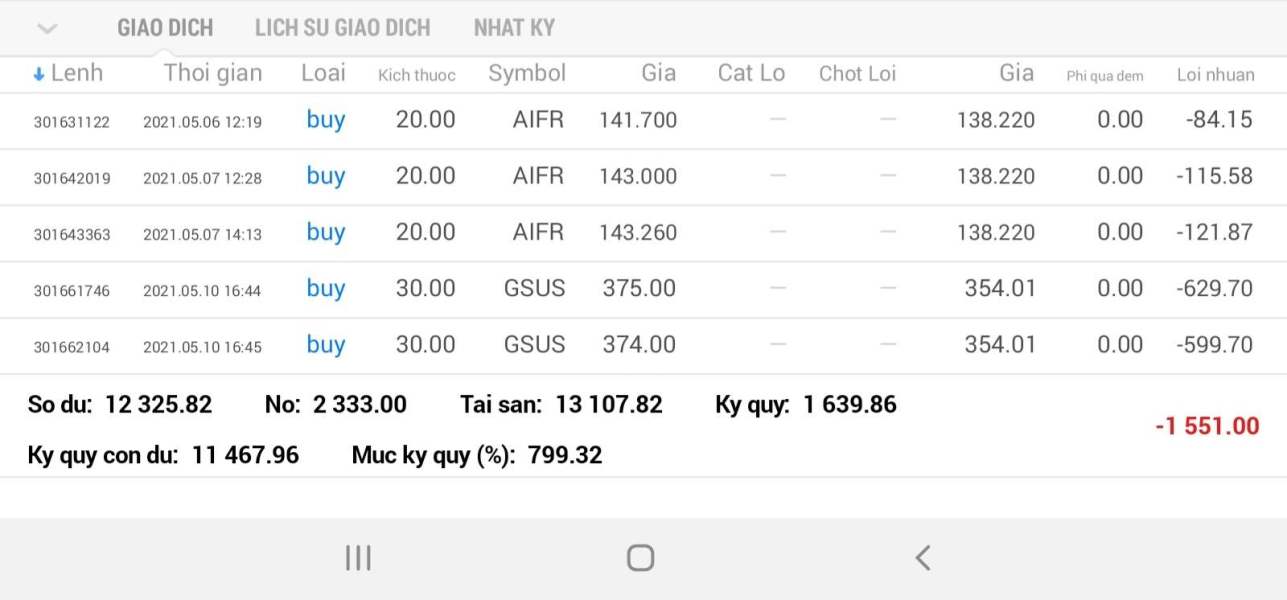

Deposit and Withdrawal Methods

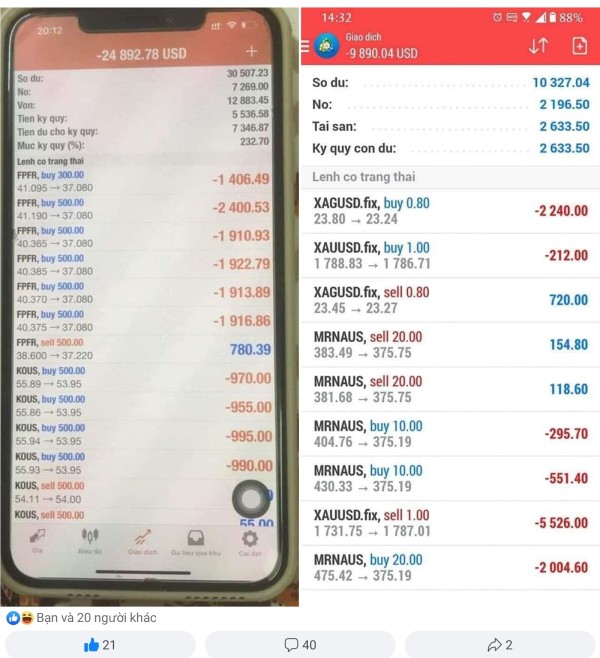

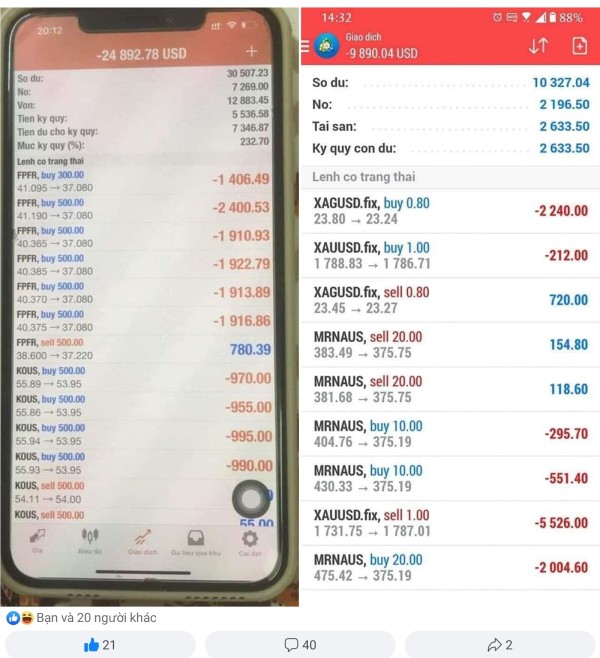

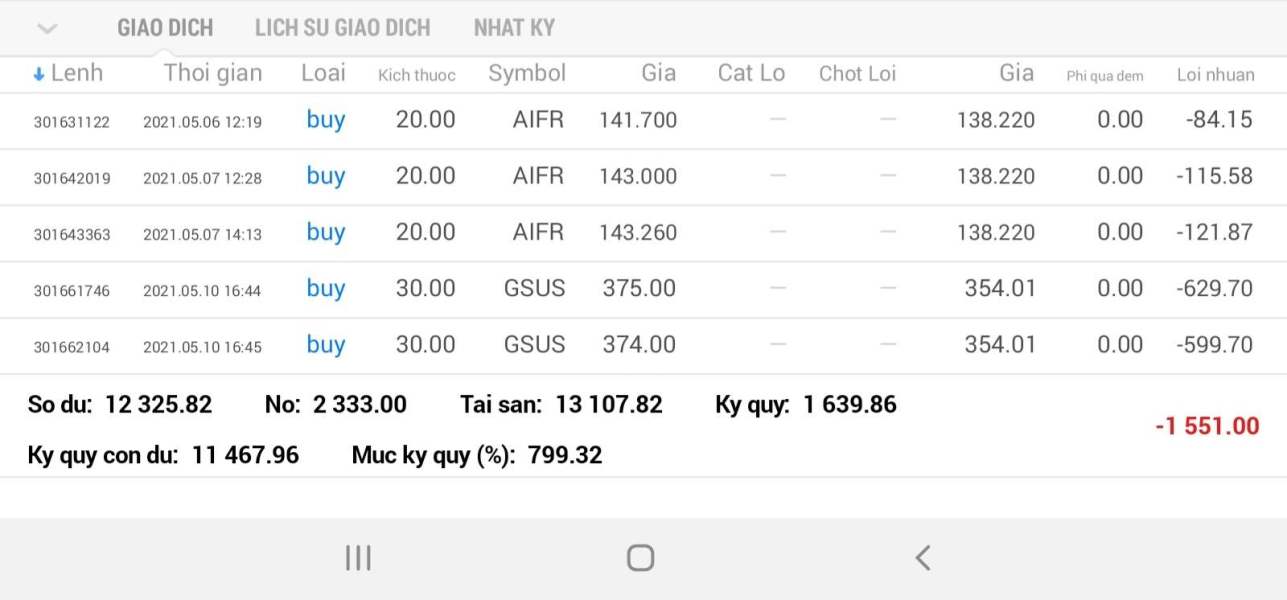

The broker supports various payment methods, including Visa, MasterCard, Skrill, Neteller, and bank wire transfers. However, specific details regarding deposit fees are scarce, and users have reported difficulties in withdrawing funds. According to user feedback, withdrawal requests often face delays, with some clients claiming they have been unable to access their funds entirely.

Minimum Deposit

DK Trade sets a low minimum deposit requirement of $10, which is appealing for novice traders. However, this low entry point does not compensate for the lack of trustworthiness and regulatory oversight.

The broker currently offers a 50% welcome bonus and a 25% re-deposit bonus, which can be enticing for new traders. However, many reviews caution that such bonuses come with stringent withdrawal conditions that can make it difficult for users to access their funds.

Tradable Asset Classes

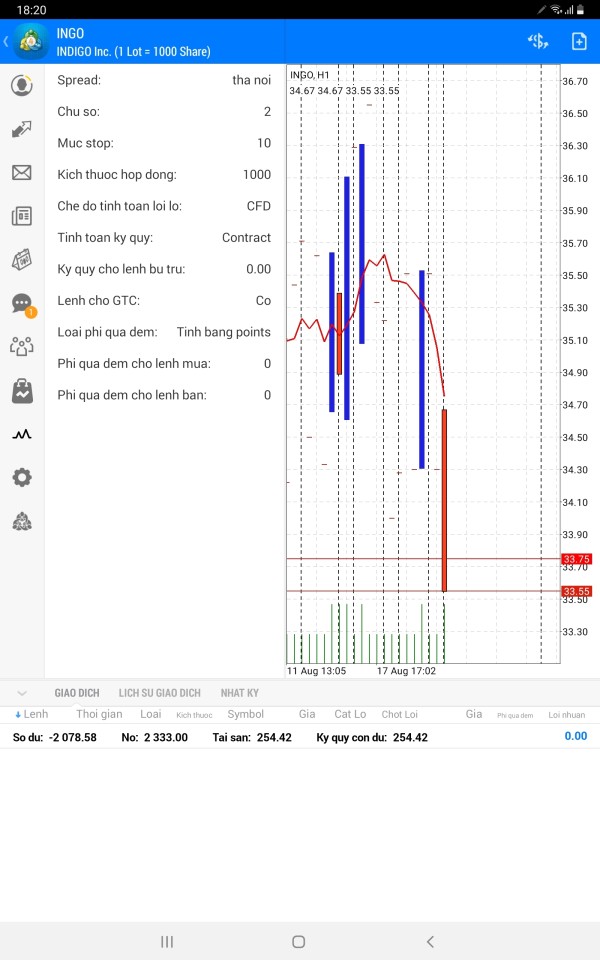

Traders at DK Trade can access a diverse portfolio, including 38 forex pairs, 4 commodities, 20 indices, and over 17 equities. Despite this variety, the overall trading experience is marred by the broker's questionable practices and lack of regulation.

Costs (Spreads, Fees, and Commissions)

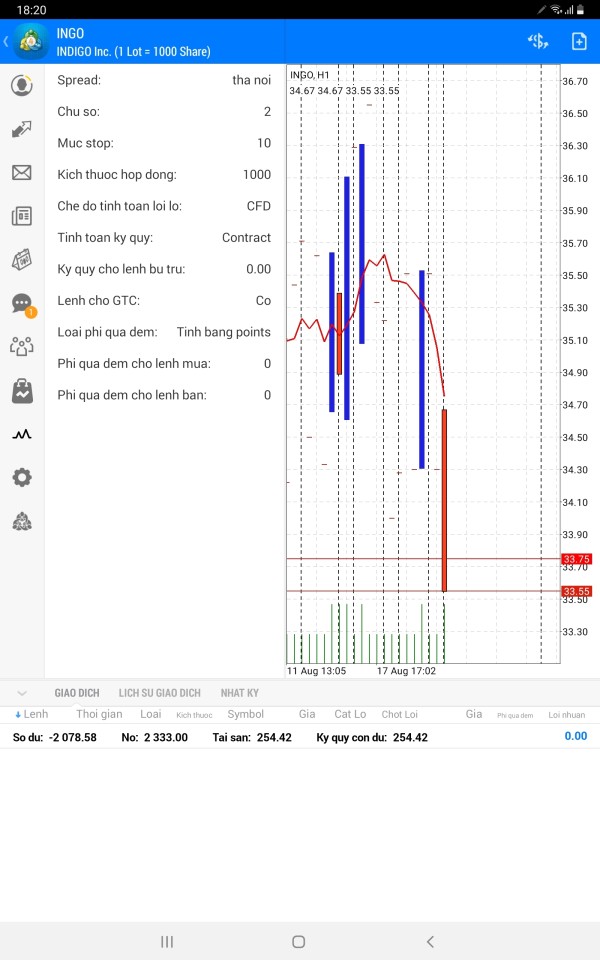

Spreads at DK Trade start at 1.4 pips for variable accounts and 1.5 pips for fixed accounts. For zero accounts, spreads can be as low as 0.4 pips, but these come with commission fees. User reviews indicate that the overall cost structure is not competitive, particularly given the high-risk nature of trading with an unregulated broker.

Leverage

The maximum leverage offered by DK Trade is up to 1:1000, which is significantly higher than many competitors. While this can attract aggressive traders seeking high returns, it also poses substantial risks, especially for inexperienced traders.

DK Trade provides access to MT4 and MT5, both of which are well-regarded in the trading community. However, the absence of a demo account for the web-based platform raises concerns about the broker's transparency and user experience.

Restricted Regions

The broker does not accept clients from the United States, which is common among many offshore brokers. The lack of clarity regarding other restricted regions adds to the uncertainty surrounding DK Trade.

Available Customer Support Languages

Customer support is available in multiple languages, but the quality of service has been criticized. Many users have reported slow response times and a lack of assistance when attempting to withdraw funds.

Final Ratings

Detailed Breakdown of Ratings

-

Account Conditions (4/10): While the low minimum deposit is attractive, the overall account conditions are overshadowed by the lack of regulation and negative user experiences.

Tools and Resources (5/10): DK Trade offers popular trading platforms, but the absence of a demo account for all platforms limits its appeal.

Customer Service and Support (3/10): Users report difficulties in reaching customer support, particularly when trying to resolve withdrawal issues.

Trading Setup (Experience) (4/10): The trading experience is hindered by the broker's reputation and regulatory status, despite offering a variety of asset classes.

Trustworthiness (2/10): The lack of regulation and numerous user complaints significantly impact DK Trade's trustworthiness.

User Experience (3/10): Negative feedback from users about withdrawal issues and customer support contributes to a poor overall experience.

In conclusion, while DK Trade presents itself as an accessible option for traders due to its low minimum deposit and range of available assets, the overwhelming consensus from user reviews and expert opinions suggests that potential investors should exercise extreme caution. The lack of regulatory oversight and numerous reports of withdrawal difficulties raise significant red flags, making DK Trade a broker that many may want to avoid. Always conduct thorough research and consider regulated alternatives before investing your funds.