Is BTCUSDT safe?

Pros

Cons

Is BTCUSDT Safe or a Scam?

Introduction

BTCUSDT is a forex broker that has emerged in the trading landscape, positioning itself as a platform for both forex and cryptocurrency trading. With the rise of online trading, the influx of brokers has led to an urgent need for traders to evaluate their options carefully. This is especially critical in the forex market, where the lack of regulation can expose investors to significant risks. In this article, we will delve into the safety of BTCUSDT by examining its regulatory status, company background, trading conditions, customer fund security, customer experiences, platform performance, and overall risk assessment. Our investigation is based on a thorough review of various sources, including regulatory databases, user reviews, and expert analyses.

Regulation and Legitimacy

The regulatory status of a broker is paramount in determining its legitimacy and safety. BTCUSDT claims to offer a range of financial services, but it lacks proper regulatory oversight, which raises significant concerns. Below is a summary of its regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

BTCUSDT operates without any valid regulatory license, which is a major red flag for potential investors. The absence of regulation means that traders have no legal recourse in case of disputes or fraudulent activities. Moreover, previous warnings from financial authorities, such as the FCA and AMF, have classified BTCUSDT as an unregulated entity. This lack of oversight can lead to high risks for traders, making it imperative to question: Is BTCUSDT safe? The answer appears to lean towards caution, as the firm does not comply with industry standards or regulations that protect investors.

Company Background Investigation

BTCUSDT Investment Limited, the company behind the trading platform, presents a questionable background. The firm claims to have been established in 2018, but its website was registered in September 2020, raising doubts about its operational history. Furthermore, there is a lack of transparency regarding the ownership structure and management team. The absence of identifiable executives or a clear corporate structure makes it difficult to assess the company's credibility.

The company's claims of being based in the United States are also dubious, as investigations suggest that this information may be false. The lack of verifiable details about the company's operations and ownership raises significant concerns about its legitimacy. Thus, potential investors must consider whether BTCUSDT is safe to trade with, especially given the opaque nature of its operations.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is crucial. BTCUSDT provides a variety of trading services, but it does not disclose comprehensive information about its fee structure. This lack of transparency can lead to unexpected costs for traders. Below is a comparison of BTCUSDT's trading costs against industry averages:

| Cost Type | BTCUSDT | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2.0% |

The absence of clearly defined fees and commissions could potentially lead to issues for traders, as they may encounter hidden costs that are not immediately apparent. This lack of clarity raises questions about the broker's integrity and whether BTCUSDT is safe for trading.

Customer Fund Security

The safety of customer funds is a critical aspect of any trading platform. BTCUSDT does not provide sufficient information regarding its fund security measures, such as whether it employs segregated accounts or offers negative balance protection. The absence of these safeguards can expose traders to significant financial risks.

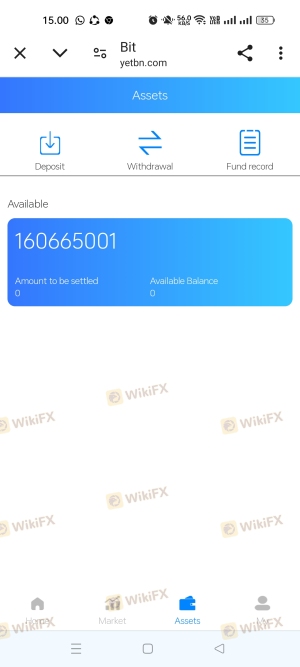

Additionally, there have been reports of withdrawal issues and disputes from users, further highlighting the potential dangers of trading with BTCUSDT. Without robust protections in place, the question remains: Is BTCUSDT safe? Given the lack of transparency and reported issues, it is prudent for traders to consider alternative options that prioritize fund security.

Customer Experience and Complaints

Customer feedback is invaluable in assessing the reliability of a broker. Review analysis reveals a pattern of negative experiences associated with BTCUSDT. Common complaints include issues with withdrawals, unresponsive customer service, and aggressive sales tactics. Below is a summary of the major complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Customer Service Quality | Medium | Slow Response |

| Misleading Information | High | No Clarification |

Several users have reported that their withdrawal requests were either delayed or denied, often citing vague reasons. This raises significant concerns about the broker's trustworthiness. As such, potential investors should ask themselves: Is BTCUSDT safe? The prevalent negative feedback suggests that it may not be a reliable choice for traders seeking a trustworthy platform.

Platform and Trade Execution

The trading platform provided by BTCUSDT is essential for assessing its usability and performance. However, user reviews indicate that the platform may experience stability issues, leading to execution delays and slippage. These problems can significantly impact trading performance, as timely execution is crucial in the fast-paced forex market.

Moreover, any signs of platform manipulation or unfair practices can further erode trust in the broker. The question of whether BTCUSDT is safe for trading remains a serious concern, particularly given the reported execution issues and overall user dissatisfaction.

Risk Assessment

Using BTCUSDT involves several risks that potential traders should consider. Below is a summary of the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Lack of transparency and safeguards |

| Customer Service Risk | Medium | Frequent complaints about support |

| Trading Execution Risk | Medium | Reports of slippage and delays |

To mitigate these risks, traders should conduct thorough research and consider alternative brokers that offer better regulatory oversight and customer support.

Conclusion and Recommendations

In conclusion, after evaluating all aspects of BTCUSDT, it is evident that the broker presents several red flags that warrant caution. The absence of regulation, lack of transparency regarding company operations, and numerous customer complaints indicate that BTCUSDT is not safe for trading.

For traders seeking reliable platforms, it is advisable to consider alternatives that are regulated by reputable authorities and have a proven track record of customer satisfaction. Brokers such as [insert recommended brokers] could provide safer trading environments with better protection for your investments. Always prioritize safety and transparency when choosing a broker to ensure a secure trading experience.

Is BTCUSDT a scam, or is it legit?

The latest exposure and evaluation content of BTCUSDT brokers.

BTCUSDT Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BTCUSDT latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.