Is DE GRANOS SA safe?

Business

License

Is De Granos SA Safe or a Scam?

Introduction

De Granos SA is a forex broker that has emerged in the trading landscape, primarily focusing on commodity trading. As the forex market continues to grow, it becomes increasingly crucial for traders to thoroughly evaluate the brokers they choose to work with. The potential for scams and fraudulent activities in the forex industry is significant, making it essential for investors to perform due diligence. This article aims to investigate the safety and legitimacy of De Granos SA by examining its regulatory status, company background, trading conditions, client feedback, and overall risk profile.

To assess whether De Granos SA is safe or a scam, we will utilize various sources, including regulatory databases, user reviews, and expert analyses. The evaluation framework will encompass key aspects such as regulatory compliance, company history, trading conditions, client fund security, and customer experience.

Regulation and Legitimacy

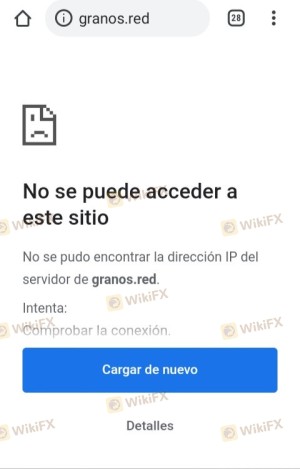

The regulatory status of a forex broker is one of the most critical factors in determining its safety. A lack of regulation can expose traders to significant risks, including the potential for fraud and loss of funds. Unfortunately, De Granos SA operates without any valid regulatory oversight, as indicated by multiple reviews. This absence of regulation raises red flags regarding the broker's legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

Without a regulatory framework, traders have limited recourse in the event of disputes or issues with fund withdrawals. The absence of oversight implies that De Granos SA may not adhere to industry standards and best practices, which can significantly increase the risk of financial loss for traders. Furthermore, the lack of transparent regulatory information is a common characteristic of potentially fraudulent brokers.

Company Background Investigation

De Granos SA, based in Argentina, has a relatively obscure history. There is limited information available regarding its founding, ownership structure, and management team. This lack of transparency is concerning, as reputable brokers typically provide detailed information about their history, leadership, and business practices.

The management teams qualifications and experience are essential indicators of a broker's reliability. However, there is little to no publicly available information about the individuals behind De Granos SA. A broker with a transparent and experienced management team is more likely to operate ethically and maintain high standards of service. The lack of such information about De Granos SA further suggests that it may not be a trustworthy option for traders.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is vital. De Granos SA has been reported to have a complicated fee structure, which can be a warning sign for potential clients. While the specifics of its trading costs are not clearly outlined, there are indications of unusual fees that may catch traders off guard.

| Fee Type | De Granos SA | Industry Average |

|---|---|---|

| Spread on Major Pairs | Not Specified | 1-2 pips |

| Commission Model | Not Specified | Varies |

| Overnight Interest Rate | Not Specified | Varies |

The lack of clarity surrounding De Granos SAs fees can be problematic for traders, as unexpected costs can significantly impact profitability. Furthermore, the absence of detailed information about spreads and commissions raises questions about the broker's transparency and fairness.

Client Fund Security

The security of client funds is paramount when assessing a broker's reliability. De Granos SA reportedly lacks adequate measures for safeguarding client funds. This includes the absence of segregated accounts, which are essential for protecting traders' capital in the event of the broker's insolvency. Additionally, there is no indication of investor protection schemes that would typically be in place with regulated brokers.

Moreover, previous complaints have surfaced regarding difficulties in withdrawing funds from De Granos SA. Such issues are often a hallmark of potentially fraudulent brokers, where clients are unable to access their money after depositing it. The combination of inadequate fund security measures and withdrawal complaints raises serious concerns about whether De Granos SA is safe.

Customer Experience and Complaints

Analyzing customer feedback is crucial in determining the overall reliability of a broker. Reports from users of De Granos SA indicate a range of negative experiences, particularly concerning withdrawal issues and customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Support | Medium | Poor |

Many users have reported being unable to withdraw their funds, which is a significant red flag. Additionally, the quality of customer service has been criticized, with many clients stating that their inquiries went unanswered or were met with vague responses. Such patterns of complaints suggest a lack of accountability and support from De Granos SA, further indicating that it may not be a safe choice for traders.

Platform and Trade Execution

The trading platform offered by De Granos SA is another critical factor to consider. Users have reported issues with platform stability and execution quality. Problems such as slippage and order rejections have been noted, which can severely impact trading outcomes.

Moreover, any signs of platform manipulation, where brokers may influence trade execution to their advantage, should raise concerns. While specific evidence of such practices at De Granos SA is limited, the combination of negative user experiences and the broker's lack of regulation suggests that traders should be cautious.

Risk Assessment

Using De Granos SA as a trading platform presents several risks. The absence of regulation, combined with poor customer feedback and fund security issues, indicates a high-risk environment for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No regulation or oversight |

| Fund Security | High | Lack of segregated accounts |

| Customer Support | Medium | Poor response to complaints |

To mitigate these risks, traders should approach De Granos SA with caution. It is advisable to start with a small investment, if at all, and to be prepared for potential withdrawal difficulties.

Conclusion and Recommendations

In conclusion, the investigation into De Granos SA raises significant concerns about its safety and legitimacy. The absence of regulation, combined with numerous customer complaints and a lack of transparency, suggests that this broker may not be a reliable choice for traders.

For those considering trading with De Granos SA, it is crucial to weigh the risks carefully. Traders seeking a safer environment should consider alternatives that are well-regulated and have a proven track record of reliability. Brokers such as [insert reputable brokers] offer a more secure trading experience and are recommended for those looking to invest in the forex market.

Overall, the evidence points to the conclusion that De Granos SA is not safe, and traders should exercise extreme caution when dealing with this broker.

Is DE GRANOS SA a scam, or is it legit?

The latest exposure and evaluation content of DE GRANOS SA brokers.

DE GRANOS SA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DE GRANOS SA latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.