Is Atlas safe?

Pros

Cons

Is Atlas Safe or Scam?

Introduction

In the ever-evolving landscape of the foreign exchange (forex) market, choosing a broker is a critical decision for traders. One such broker that has garnered attention is Atlas. Established with the intention of providing trading solutions, Atlas claims to offer a range of services tailored to both novice and experienced traders. However, as the market is rife with scams and unregulated entities, it is essential for traders to exercise caution and conduct thorough due diligence before committing their funds. This article aims to evaluate the safety and legitimacy of Atlas by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

To ensure a comprehensive analysis, this investigation will rely on data collected from various financial regulatory bodies, user reviews, and industry reports. The assessment framework will include a detailed look at Atlas's regulatory compliance, company history, trading fees, client fund security, and customer feedback, all of which will help determine whether Atlas is a safe choice for traders or if it raises red flags that warrant concern.

Regulatory and Legality

The regulatory status of a broker is one of the most critical factors in assessing its legitimacy. A regulated broker is subject to oversight by a recognized financial authority, which helps ensure compliance with industry standards and protects investors. Unfortunately, Atlas does not appear to be regulated by any top-tier financial authority, which raises concerns about its operations and the safety of client funds.

| Regulator | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of regulation by reputable authorities such as the U.S. Securities and Exchange Commission (SEC) or the Financial Conduct Authority (FCA) is alarming. Brokers regulated by such entities are required to adhere to strict operational guidelines, including maintaining client fund segregation and providing transparent pricing. In contrast, Atlas's lack of oversight suggests a potential risk for traders, as unregulated brokers often operate with minimal accountability. Furthermore, without regulatory backing, clients may find it challenging to recover lost funds in the event of disputes or financial mishaps.

Company Background Investigation

Atlas was founded in 2018, positioning itself as a forex trading platform that aims to provide a user-friendly experience. However, limited information is available regarding its ownership structure and management team, which is often a red flag in the brokerage industry. A transparent broker typically discloses details about its founders and key executives, including their qualifications and experience in the financial sector.

The absence of such information raises questions about the company's commitment to transparency and accountability. Additionally, a lack of historical performance data makes it difficult to assess Atlas's reliability and operational history. Traders typically prefer brokers with a proven track record, as this can indicate stability and reliability in their services. The opaque nature of Atlas's operations further complicates any assessment of its trustworthiness.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is crucial. Atlas claims to offer competitive spreads and various account types to cater to different trading strategies. However, traders should be wary of any unusual fee structures that could impact their overall profitability.

| Fee Type | Atlas | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 2% - 5% |

The lack of specific data regarding spreads and commissions may indicate that Atlas is not fully transparent about its fee structures. Traders should be cautious of brokers that do not clearly outline their costs, as hidden fees can erode profits and lead to unexpected losses. Furthermore, if Atlas imposes excessive fees compared to industry standards, it could be a sign of a broker prioritizing profit over client interests.

Client Fund Security

The safety of client funds is paramount in the forex trading landscape. Regulated brokers are typically required to implement robust security measures, including segregating client funds from company operating funds and providing negative balance protection. Unfortunately, Atlas's lack of regulation raises concerns about its fund security protocols.

While specific details about Atlas's fund safety measures are scarce, traders should be cautious when dealing with unregulated brokers, as they may not have adequate safeguards in place. Historical incidents involving unregulated brokers often reveal a pattern of fund mismanagement and lack of investor protection. Therefore, potential clients should consider these risks seriously before investing their money with Atlas.

Customer Experience and Complaints

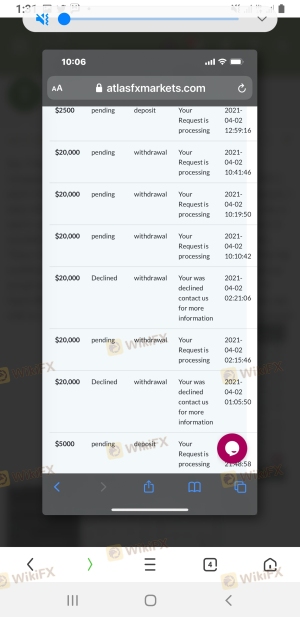

Customer feedback is a valuable source of information when assessing a broker's reliability. Reviews and testimonials from current and former clients can reveal common issues and the overall quality of service provided by the broker. Unfortunately, Atlas has received a mix of reviews, with several complaints regarding withdrawal issues and lack of responsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Communication | Medium | Fair |

| Account Freezing | High | Poor |

Several users have reported that their withdrawal requests were delayed or not processed at all, leading to frustration and distrust. Additionally, complaints about poor communication and unresponsive customer service suggest that Atlas may not prioritize client satisfaction. Such patterns of complaints can indicate deeper systemic issues within the brokerage and should not be overlooked by potential traders.

Platform and Execution

The trading platform's performance and execution quality are vital components of a trader's experience. Traders expect a stable platform that executes orders efficiently without excessive slippage or rejections. While Atlas claims to offer a user-friendly trading environment, there is limited information available regarding the actual performance of its trading platform.

Traders should be cautious of any indications of platform manipulation, such as frequent order rejections or unexplained slippage. A broker's failure to provide reliable execution can significantly impact trading outcomes, leading to losses and frustration. Therefore, it is essential for traders to thoroughly test any platform before committing significant capital.

Risk Assessment

Using Atlas as a trading broker presents various risks that potential clients should consider carefully. The lack of regulatory oversight, unclear trading conditions, and negative customer feedback all contribute to a higher risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No regulation raises concerns |

| Fund Security | High | Insufficient safeguards for client funds |

| Customer Support | Medium | Poor response to complaints |

To mitigate these risks, traders should conduct thorough research and consider using regulated brokers with a proven track record. Additionally, it is advisable to start with a small investment to test the waters before committing larger sums.

Conclusion and Recommendations

In conclusion, based on the evidence presented, Atlas raises significant concerns regarding its safety and legitimacy. The lack of regulatory oversight, unclear trading conditions, and negative customer feedback suggest that traders should approach this broker with caution. While it may offer attractive features, the risks associated with trading with an unregulated entity cannot be ignored.

For traders seeking a reliable and secure trading environment, it is advisable to consider alternative brokers that are regulated by reputable authorities and have a proven track record of client satisfaction. Some recommended alternatives include brokers regulated by the FCA, ASIC, or SEC, which provide robust investor protections and transparent trading conditions. Ultimately, being informed and cautious is crucial in navigating the forex market, and traders should prioritize their safety above all else.

Is Atlas a scam, or is it legit?

The latest exposure and evaluation content of Atlas brokers.

Atlas Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Atlas latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.