Is COWTRADING safe?

Business

License

Is Cowtrading Wealth Safe or a Scam?

Introduction

Cowtrading Wealth is an online trading platform that positions itself within the forex market, offering a range of trading services including forex, commodities, and indices. As the popularity of online trading continues to rise, it becomes crucial for traders to evaluate the legitimacy and reliability of the brokers they choose. The forex market is often targeted by unscrupulous entities, making it imperative for traders to conduct thorough due diligence before committing their funds. This article aims to provide an objective analysis of Cowtrading Wealth by examining its regulatory compliance, company background, trading conditions, customer experience, and overall safety. The evaluation is based on a comprehensive review of online sources, customer feedback, and regulatory information.

Regulation and Legitimacy

The regulatory status of a trading broker is a fundamental aspect that determines its legitimacy and reliability. Cowtrading Wealth operates without regulation from any recognized financial authority, raising significant concerns about its credibility. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict guidelines designed to protect investor funds. The absence of regulation can lead to increased risks, including potential fraud and mismanagement of funds. Below is a summary of Cowtrading Wealth's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of a regulatory framework means that Cowtrading Wealth does not undergo regular audits or compliance checks, which are essential for maintaining operational integrity. Furthermore, there are reports suggesting that the broker may have made false claims regarding its regulatory status, which is a common tactic employed by fraudulent brokers to gain the trust of unsuspecting traders. The absence of regulatory oversight is a significant red flag, indicating that traders should proceed with caution when considering Cowtrading Wealth as a trading option.

Company Background Investigation

Cowtrading Wealth was established in the United Kingdom and claims to offer a variety of trading services. However, the companys history and ownership structure raise questions about its legitimacy. There is limited information available regarding the management team and their qualifications, which is concerning as reputable brokers typically provide transparency about their leadership. The lack of disclosure regarding the team behind Cowtrading Wealth further diminishes the broker's credibility.

Additionally, the company's website is poorly designed and lacks essential information, such as contact details and a clear explanation of its services. This opacity can lead to mistrust among potential clients, as transparency is a key indicator of a broker's reliability. Without a clear understanding of the company's operations and management, it is difficult for traders to assess the level of trust they can place in Cowtrading Wealth.

Trading Conditions Analysis

When evaluating a trading broker, understanding the costs associated with trading is essential. Cowtrading Wealth boasts competitive spreads and high leverage options, which may initially appear attractive to traders. However, a closer examination of the fee structure reveals potential issues. Below is a comparison of Cowtrading Wealth's trading costs against industry averages:

| Fee Type | Cowtrading Wealth | Industry Average |

|---|---|---|

| Spread on Major Pairs | Varies | 1.0 - 2.0 pips |

| Commission Structure | None | $5 - $10 per lot |

| Overnight Interest Range | Not Specified | Varies |

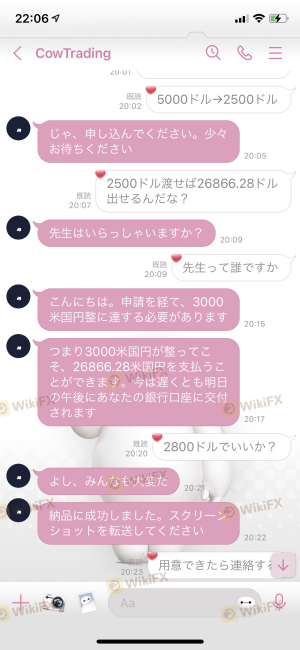

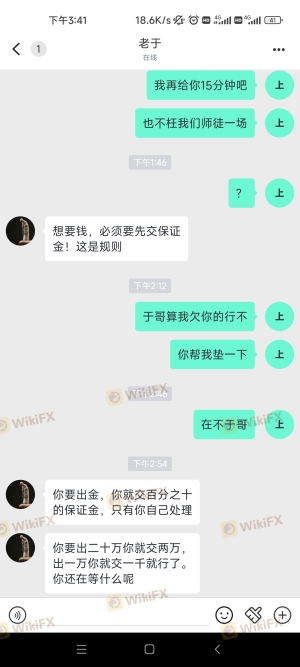

While the absence of commissions may seem appealing, traders should be wary of hidden fees that often surface during the withdrawal process. Reports from users indicate that Cowtrading Wealth employs various tactics to delay withdrawals, including imposing unexpected fees that must be paid before funds can be released. This practice is a hallmark of many scam brokers, further underscoring the need for caution when dealing with Cowtrading Wealth.

Customer Funds Security

The security of customer funds is a critical consideration for any trading platform. Cowtrading Wealth does not provide clear information regarding its fund protection measures. The absence of segregation of client funds and investor protection schemes raises serious concerns about the safety of traders' investments. Without proper safeguards, traders risk losing their entire investment if the broker were to mismanage funds or become insolvent.

Additionally, there have been reports of withdrawal issues, where users have faced significant delays or outright refusals when attempting to access their funds. Such incidents are alarming and suggest a lack of commitment to safeguarding client money. Traders should always prioritize brokers that demonstrate robust security measures, including fund segregation and negative balance protection, to ensure their investments are adequately protected.

Customer Experience and Complaints

Customer feedback is an invaluable source of information when assessing a broker's reliability. Reviews for Cowtrading Wealth are predominantly negative, with many users reporting difficulties in withdrawing their funds. Common complaints include poor customer service, lack of responsiveness, and allegations of fraudulent practices. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Inadequate |

| Misleading Information | High | None |

Several users have shared their experiences, detailing instances where they were unable to withdraw their funds after being asked to pay additional fees. One user reported being pressured to deposit more money before they could access their existing balance, a classic tactic used by scam brokers to extract more funds from clients. These patterns of complaints highlight the significant risks associated with trading through Cowtrading Wealth and raise serious questions about the broker's operational integrity.

Platform and Trade Execution

The trading platform offered by Cowtrading Wealth is another crucial factor to consider. Users have reported mixed experiences regarding the platform's performance, with some indicating that it is prone to glitches and lacks essential features commonly found in reputable trading platforms. The quality of order execution is also a concern, as traders have experienced slippage and rejected orders during critical trading moments.

These issues can severely impact a trader's ability to execute their strategies effectively and may result in financial losses. Additionally, there are no indications of platform manipulation, but the overall user experience suggests that the platform may not be reliable enough for serious traders.

Risk Assessment

Engaging with Cowtrading Wealth carries inherent risks due to its unregulated status and poor customer feedback. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation, increasing fraud risk. |

| Withdrawal Risk | High | Numerous complaints regarding fund access. |

| Customer Service Risk | Medium | Inadequate support leading to unresolved issues. |

To mitigate these risks, traders should consider using regulated brokers that offer robust protections and transparent operations. It is also advisable to start with a small investment and thoroughly test the platform before committing larger amounts.

Conclusion and Recommendations

In conclusion, the evidence suggests that Cowtrading Wealth is not a trustworthy brokerage. The lack of regulation, combined with numerous negative reviews and reports of withdrawal issues, indicates a high risk of potential fraud. Traders should be particularly cautious when dealing with this broker, as the likelihood of encountering problems is significant.

For traders seeking reliable alternatives, it is recommended to consider well-regulated brokers that demonstrate transparency and a commitment to customer service. Some reputable options include brokers regulated by the FCA, ASIC, or CySEC, which offer a safer trading environment and better protections for client funds.

In summary, is Cowtrading Wealth safe? The overwhelming consensus is that it is not, and traders should exercise extreme caution if they choose to engage with this broker.

Is COWTRADING a scam, or is it legit?

The latest exposure and evaluation content of COWTRADING brokers.

COWTRADING Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

COWTRADING latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.