Is Coral FX safe?

Business

License

Is Coral FX Safe or Scam?

Introduction

Coral FX is a forex brokerage that positions itself as a global trading platform, offering a range of financial instruments including forex, CFDs, commodities, and indices. Established in Hong Kong, this broker has garnered attention in the trading community, prompting potential clients to assess its credibility. In the ever-evolving landscape of forex trading, it is crucial for traders to perform due diligence when evaluating brokers. The forex market is rife with both legitimate firms and unscrupulous entities, making it essential for traders to discern the difference between the two. This article investigates the safety and legitimacy of Coral FX through a comprehensive analysis of its regulatory status, company background, trading conditions, client fund security, customer experiences, and overall risk profile.

Regulation and Legitimacy

One of the primary indicators of a broker's reliability is its regulatory status. Coral FX is currently unregulated, which raises significant concerns regarding the safety of client funds and the overall integrity of its operations. Regulation serves as a protective measure for traders, ensuring that brokers adhere to specific standards and practices. Without proper oversight, clients may find themselves vulnerable to potential fraud or mismanagement of their investments.

Here‘s a summary of Coral FX’s regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Hong Kong | Unregulated |

The absence of regulation means that Coral FX is not obligated to follow any stringent guidelines that govern the forex industry. Regulated brokers typically must meet minimum capital requirements, undergo regular audits, and provide a degree of investor protection. This lack of regulatory oversight is a significant red flag for potential traders. Moreover, unregulated firms can operate with a higher risk of financial malpractice, which is why it is crucial to ask the question: Is Coral FX safe? The answer leans towards caution, as the unregulated status poses a substantial risk to investors.

Company Background Investigation

Coral FX is operated by Coral Market FX Technology Co., Ltd., a relatively new player in the forex market, having been established in 2019. The company is headquartered in Hong Kong, yet specifics regarding its ownership and management structure remain vague. This lack of transparency is concerning; reputable brokers typically provide detailed information about their management team and ownership structure, allowing clients to understand who is handling their funds.

The management teams expertise is a critical factor in assessing a broker's reliability. Unfortunately, Coral FX does not disclose information about its executive team, which raises further questions about its operational integrity. Transparency in operations and management is essential for building trust with clients, and the absence of such information reinforces skepticism regarding the safety of investing with Coral FX. Therefore, it is prudent to inquire: Is Coral FX safe? The answer, based on the company's obscure background, is uncertain at best.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for traders to assess the overall cost of trading. Coral FX provides various financial instruments, but the absence of clear information regarding its fee structure is alarming. Traders must be cautious of hidden fees or unusual commission policies that could erode their profits.

A comparative analysis of trading costs is essential:

| Fee Type | Coral FX | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | $5 per lot |

| Overnight Interest Range | N/A | Varies |

The lack of available data on Coral FXs trading costs makes it difficult for traders to evaluate whether they are receiving competitive rates. Furthermore, unregulated brokers often impose higher fees or unfavorable trading conditions, which can significantly impact trading performance. This raises the question: Is Coral FX safe? Given the opaque fee structure, the answer remains uncertain, and traders should approach with caution.

Client Fund Security

The security of client funds is paramount when selecting a forex broker. Unfortunately, Coral FX does not provide adequate information regarding its fund security measures. Regulated brokers typically offer client fund segregation, investor protection schemes, and negative balance protection. These measures ensure that client funds are kept separate from the broker's operational funds and provide a safety net in case of insolvency.

With Coral FX being unregulated, there is no guarantee of such protections. The absence of information about fund security raises significant concerns regarding the safety of client deposits. Historical issues involving fund security can also be a warning sign; however, there are no publicly available reports of past incidents with Coral FX. This lack of transparency leads to the critical question: Is Coral FX safe? Given the unregulated status and lack of disclosed fund security measures, the answer is a resounding no.

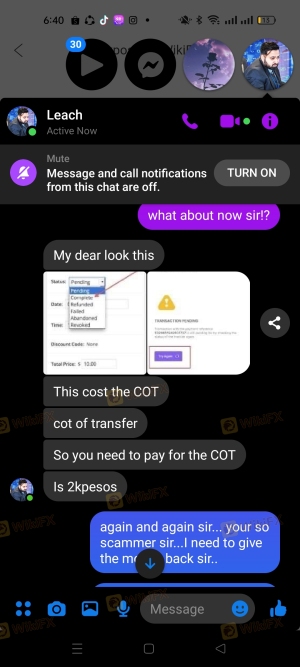

Customer Experience and Complaints

Customer feedback plays a crucial role in assessing a broker's reliability. Coral FX has received mixed reviews, with several traders expressing concerns over its customer service and responsiveness. Common complaints include difficulties in withdrawing funds, lack of transparency regarding fees, and poor communication from the support team.

Heres a summary of the types of complaints received:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Transparency of Fees | Medium | Average |

| Customer Support Availability | High | Poor |

One notable case involved a trader who reported significant delays in fund withdrawals, leading to frustration and distrust. This pattern of complaints raises a critical question: Is Coral FX safe? The prevalent issues with customer service and fund access indicate that potential clients should exercise extreme caution.

Platform and Trade Execution

The performance of a trading platform is another crucial aspect that traders consider. Coral FX offers trading through the MetaTrader 5 platform, which is known for its user-friendly interface and robust features. However, the quality of order execution is vital for successful trading. Reports of slippage and order rejections can signal potential manipulation or inefficiencies within the trading platform.

While there is limited information regarding the specific execution quality at Coral FX, the absence of regulatory oversight raises concerns about potential platform manipulation. Traders must consider whether they can trust the platform to execute trades fairly and efficiently. Thus, the question remains: Is Coral FX safe? The lack of transparency regarding execution quality suggests that traders should be wary.

Risk Assessment

Engaging with any broker involves inherent risks, particularly when dealing with unregulated entities. Coral FX poses several risks that potential clients should be aware of:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases potential for fraud. |

| Fund Security Risk | High | Lack of client fund protection measures. |

| Customer Service Risk | Medium | Poor response to complaints and withdrawal issues. |

To mitigate these risks, traders should consider the following recommendations:

- Avoid depositing large sums until the broker's credibility is established.

- Conduct thorough research on the broker's reputation and client feedback.

- Consider using regulated alternatives to ensure better protection for funds.

Conclusion and Recommendations

In conclusion, the evidence suggests that Coral FX is not a safe option for traders. Its unregulated status, lack of transparency, and numerous complaints concerning customer service and fund withdrawals raise significant red flags. The overarching question remains: Is Coral FX safe? Based on the analysis, the answer is a definitive no.

For traders seeking reliable forex brokers, it is advisable to consider regulated alternatives that provide better transparency, customer support, and fund security. Brokers regulated by reputable authorities like the FCA, ASIC, or NFA offer a higher level of protection and peace of mind. In summary, if you are considering trading with Coral FX, it is prudent to look elsewhere for a safer and more reliable trading experience.

Is Coral FX a scam, or is it legit?

The latest exposure and evaluation content of Coral FX brokers.

Coral FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Coral FX latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.