Is CONCAP safe?

Pros

Cons

Is Concap Safe or a Scam?

Introduction

Concap, a relatively new player in the forex market, has been gaining attention for its investment advisory services. Established in 2022, it aims to assist clients in achieving financial independence through tailored investment strategies. However, in the volatile world of forex trading, it is crucial for traders to thoroughly evaluate the legitimacy and safety of any broker before committing their funds. This article seeks to provide an objective assessment of Concap by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks. Our investigation is based on a comprehensive review of various credible sources, including regulatory databases and user feedback.

Regulation and Legitimacy

The regulatory environment in which a forex broker operates is paramount in determining its credibility. Regulation serves as a safeguard for investors, ensuring that brokers adhere to stringent standards of conduct. In the case of Concap, the broker operates without any valid regulatory oversight, which raises significant concerns regarding its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that Concap does not have to comply with any external standards, leaving clients vulnerable to potential malpractice. This lack of oversight is a red flag for traders seeking a secure trading environment. Furthermore, the company's registration in Pakistan, a region known for its lax regulatory framework, adds another layer of risk. Without a reputable regulatory body overseeing its operations, traders must exercise extreme caution when considering Concap as their forex broker.

Company Background Investigation

Concap's brief history may contribute to its perceived legitimacy; however, a deeper dive into its ownership structure and management team reveals a concerning lack of transparency. The firm is registered under Continental Capital Management (Pvt.) Ltd., but specific details regarding its founders and operational history remain scarce.

The management team, while claiming to possess significant expertise in financial planning and investment, lacks publicly available profiles that verify their qualifications and experience. This opacity raises questions about the firm's commitment to transparency and ethical practices. A trustworthy broker should provide detailed information about its team and ownership to instill confidence in potential clients.

Moreover, the overall lack of information surrounding Concap's operations and leadership may suggest an attempt to obscure its true nature, further fueling skepticism about its safety. In a market where trust and reliability are paramount, this absence of clarity is a significant drawback.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for traders looking to maximize their profits while minimizing costs. Concap's fee structure appears to be competitive; however, the lack of transparency in its pricing model is concerning.

| Fee Type | Concap | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | Unknown | 1.0 - 2.0 pips |

| Commission Model | Unknown | Varies |

| Overnight Interest Range | Unknown | 0.5% - 2.0% |

The absence of information regarding spreads, commissions, and overnight interest rates makes it difficult for traders to gauge the true cost of trading with Concap. Moreover, any unusual fees or hidden charges could significantly impact a trader's bottom line. The forex market is notorious for its competitive pricing, and brokers that lack transparency may impose excessive costs on unsuspecting clients.

Traders should be wary of any broker that does not clearly outline its fee structure. In Concap's case, the lack of detailed information raises questions about its commitment to fair pricing practices. Therefore, it is crucial for potential clients to seek clarification on these matters before engaging with the broker.

Client Fund Security

The safety of client funds is a top priority for any trader. Concap claims to implement various security measures; however, the absence of regulatory oversight raises concerns about the effectiveness of these measures.

A thorough examination of Concap's fund security policies reveals a lack of information regarding fund segregation, investor protection, and negative balance protection. These elements are vital for ensuring that traders' investments are safeguarded against potential losses.

Historically, brokers operating without regulatory oversight have faced scrutiny for mishandling client funds, leading to significant financial losses for traders. Therefore, potential clients should be cautious when considering Concap, given its ambiguous stance on fund security.

Customer Experience and Complaints

To gauge the reliability of a broker, analyzing customer feedback and experiences is essential. In the case of Concap, user reviews are mixed, with several clients expressing concerns about the lack of responsive customer service and transparency.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Poor Customer Service | High | Slow Response |

| Lack of Transparency | Medium | Limited Information |

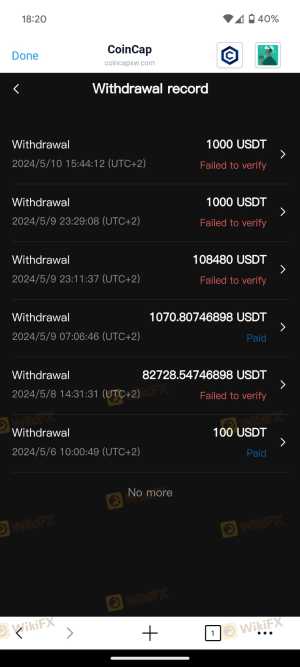

| Withdrawal Issues | High | Unresolved |

Common complaints include difficulties in withdrawing funds and a perceived lack of transparency regarding trading conditions. Such issues can significantly impact a trader's experience and raise questions about the broker's reliability. Furthermore, the company's slow response to customer inquiries exacerbates these concerns, leading to frustration among clients.

A few case studies highlight the challenges faced by users. For instance, one client reported delays in fund withdrawals, while another expressed dissatisfaction with the lack of communication from the support team. These experiences reflect a troubling trend that potential clients should consider before engaging with Concap.

Platform and Trade Execution

The trading platform's performance and execution quality are critical factors in a trader's success. While Concap offers access to popular trading platforms, user reviews indicate mixed experiences regarding platform stability and order execution.

Traders have reported instances of slippage and delayed order execution, which can adversely affect trading outcomes. Additionally, concerns about potential platform manipulation have been raised, further highlighting the need for caution when trading with Concap.

Risk Assessment

Engaging with any broker carries inherent risks, and Concap is no exception. The lack of regulatory oversight, mixed customer experiences, and unclear trading conditions contribute to an elevated risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight |

| Customer Service Risk | Medium | Slow responses |

| Financial Risk | High | Lack of transparency |

Traders must be vigilant and consider these risks when deciding whether to engage with Concap. To mitigate potential issues, it is advisable to conduct thorough research, maintain clear communication with the broker, and consider diversifying investments across multiple platforms.

Conclusion and Recommendations

In conclusion, the evidence suggests that Concap raises several red flags regarding its safety and legitimacy. The absence of regulatory oversight, coupled with limited transparency and mixed customer experiences, indicates a need for caution.

Traders should be particularly wary of engaging with Concap, as the potential for issues related to fund security, trading conditions, and customer service remains high. For those seeking a reliable forex broker, it is advisable to consider alternatives that are well-regulated and have a proven track record of transparency and client satisfaction.

In summary, if you are contemplating whether Concap is safe, the current evidence leans towards skepticism. It is crucial for traders to prioritize their financial security by choosing brokers that adhere to strict regulatory standards and demonstrate a commitment to transparency and customer service.

Is CONCAP a scam, or is it legit?

The latest exposure and evaluation content of CONCAP brokers.

CONCAP Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CONCAP latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.