Is CIBfx safe?

Pros

Cons

Is Cibfx Safe or Scam?

Introduction

Cibfx, officially known as Capital Investment Brokers Ltd, has positioned itself in the forex market as an online trading platform offering a variety of financial instruments, including forex, commodities, and CFDs. Since its inception in 2015, it has attracted attention from traders seeking diverse trading options and competitive conditions. However, the importance of thoroughly evaluating forex brokers cannot be overstated. Traders need to be cautious, as the forex market is rife with potential scams and unregulated entities that can jeopardize their investments. This article aims to provide a comprehensive analysis of Cibfx, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall safety. The investigation is based on a review of various credible sources and user feedback to ascertain whether Cibfx is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor determining its legitimacy and the safety of client funds. Cibfx claims to be registered in Saint Vincent and the Grenadines, a jurisdiction known for its lenient regulatory environment. However, it is essential to note that registration does not equate to proper regulation, as the local financial authority does not oversee forex trading activities.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Not Verified |

Cibfx does not hold any licenses from reputable regulatory bodies such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus). The lack of a valid regulatory framework raises significant concerns about the safety of traders' funds. Without stringent oversight, there are no guarantees for clients regarding the protection of their investments or recourse in the event of disputes. Furthermore, historical compliance issues and warnings from various financial authorities indicate that Cibfx may not operate in a trustworthy manner. Thus, the question of "Is Cibfx safe?" leans towards a negative response due to its unregulated status.

Company Background Investigation

Cibfx was established in 2015 and is operated by Capital Investment Brokers Ltd, which claims to have a presence in both the UK and Saint Vincent and the Grenadines. However, the company's transparency is questionable, with scant information available regarding its ownership structure or the backgrounds of its management team.

The absence of detailed disclosures about the team raises red flags about the firm's accountability. A broker's management team should ideally possess significant experience and credentials in the financial sector, providing clients with confidence in their operations. Unfortunately, Cibfx does not provide such information, which contributes to the skepticism surrounding its legitimacy.

Furthermore, the overall transparency of Cibfx is lacking, as it does not adequately disclose its operational practices, fee structures, or compliance history. This opacity makes it difficult for potential clients to assess the broker's reliability and safety accurately.

Trading Conditions Analysis

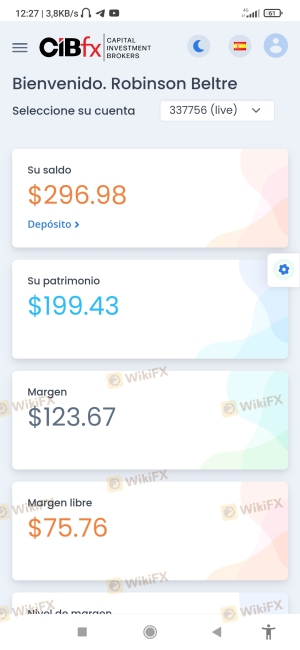

When evaluating a broker's trading conditions, it is crucial to consider the fee structure and any unusual charges that may apply. Cibfx offers various account types, each with different minimum deposit requirements, starting from $500 for a micro account. While the spreads are advertised as starting from 1 pip, the lack of clarity on additional fees can be problematic.

| Fee Type | Cibfx | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | From 1 pip | 0.1 - 0.3 pips |

| Commission Structure | None specified | Varies widely |

| Overnight Interest Range | Not disclosed | Varies widely |

The absence of a clear commission structure may indicate hidden fees, which can significantly impact trading profitability. Additionally, Cibfx's high minimum deposit requirement could deter novice traders, who typically prefer to start with smaller amounts. Such practices are often associated with less reputable brokers, raising further questions about "Is Cibfx safe?"

Customer Funds Security

The safety of customer funds is paramount when choosing a forex broker. Cibfx claims to implement various security measures; however, the lack of regulation means that there are no legal protections for clients. The absence of segregated accounts raises concerns about the safety of traders' funds, as there is no assurance that client deposits are kept separate from the broker's operational funds.

Cibfx does not provide information on investor protection schemes or negative balance protection policies, which are standard features offered by regulated brokers. Historical complaints regarding fund withdrawal issues and unresponsive customer service further exacerbate concerns regarding the safety of client funds. Given these factors, it is evident that Cibfx does not prioritize the security of its clients' investments, leading to the conclusion that "Is Cibfx safe?" is a question that remains unanswered positively.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing the reliability of a broker. Reviews of Cibfx reveal a mixed bag of experiences, with many users expressing dissatisfaction regarding withdrawal processes and customer service responsiveness. Common complaints include delays in fund withdrawals, lack of transparency in fees, and difficulties in reaching support representatives.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Average |

| Customer Support Issues | High | Poor |

Several users have reported being unable to withdraw their funds after multiple requests, leading to accusations of Cibfx operating as a scam. These patterns of complaints raise significant concerns about the broker's integrity and operational practices. The lack of effective resolution for these issues further solidifies the notion that "Is Cibfx safe?" is a question worthy of skepticism.

Platform and Trade Execution

The trading platform offered by Cibfx is MetaTrader 4 (MT4), a widely recognized and user-friendly platform among traders. However, while the platform's capabilities are robust, the quality of trade execution raises concerns. Reports of slippage and order rejections have surfaced, indicating potential issues with trade execution quality.

A reliable trading platform should provide seamless order execution, but the presence of slippage can adversely affect trading outcomes, especially in volatile markets. Furthermore, the lack of oversight raises the possibility of platform manipulation, which can significantly impact trader confidence. Therefore, while the platform itself may be reputable, the question of "Is Cibfx safe?" is complicated by the concerns surrounding execution quality and potential manipulation.

Risk Assessment

Using Cibfx comes with inherent risks that traders must consider. The lack of regulation, high minimum deposit requirements, and reports of withdrawal issues contribute to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status means no legal protections. |

| Fund Security Risk | High | Lack of segregated accounts and investor protection. |

| Customer Service Risk | Medium | Poor response to complaints and withdrawal issues. |

Traders should exercise caution and consider these risks when contemplating trading with Cibfx. It is advisable to implement risk mitigation strategies, such as starting with a demo account or investing only small amounts initially, to gauge the broker's reliability.

Conclusion and Recommendations

In conclusion, the evidence collected raises significant doubts regarding the safety and legitimacy of Cibfx. The lack of regulatory oversight, combined with numerous complaints about customer service and withdrawal issues, suggests that Cibfx may not be a trustworthy broker. Therefore, the question "Is Cibfx safe?" leans heavily towards a negative response.

For traders seeking reliable options, it is advisable to consider brokers that are regulated by reputable authorities, such as the FCA, ASIC, or CySEC. These brokers typically offer better protection for client funds and more transparent operational practices. Some recommended alternatives include FXTM, IC Markets, and eToro, which have established reputations and regulatory compliance.

In summary, potential clients should proceed with caution and conduct thorough research before engaging with Cibfx or any unregulated broker.

Is CIBfx a scam, or is it legit?

The latest exposure and evaluation content of CIBfx brokers.

CIBfx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CIBfx latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.