Is Access Direct safe?

Pros

Cons

Is Access Direct Safe or a Scam?

Introduction

Access Direct is a forex and CFD brokerage that positions itself as a facilitator for traders looking to engage in the financial markets. In an industry rife with potential pitfalls, the need for traders to carefully evaluate the legitimacy and safety of their chosen brokers cannot be overstated. With numerous reports of scams and fraudulent activities in the forex trading space, due diligence is essential. This article aims to investigate whether Access Direct is a safe trading platform or a potential scam. Our assessment is based on a comprehensive review of regulatory compliance, company background, trading conditions, customer feedback, and risk factors.

Regulation and Legitimacy

Regulation is a cornerstone of broker legitimacy, providing a safety net for traders by ensuring that brokers adhere to specific standards and practices. Access Direct claims to operate under the jurisdiction of the Financial Services Commission (FSC) of Mauritius. However, many sources indicate that this claim may be misleading, as Access Direct is not listed among the regulated entities by the FSC.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Commission (FSC) | Not Listed | Mauritius | Not Verified |

The absence of a valid regulatory license raises significant concerns about Access Direct's credibility. A broker's regulatory status is vital; it not only assures traders of compliance with industry standards but also provides avenues for recourse in case of disputes. The lack of regulation can lead to issues such as difficulty in withdrawing funds and inadequate customer service. Thus, the question remains: Is Access Direct safe? The evidence suggests that traders should exercise caution.

Company Background Investigation

Access Direct is operated by Access Direct Markets Ltd., which claims to be based in Mauritius. However, the opacity surrounding its actual location and ownership structure is troubling. There is limited information available about the company's history and the backgrounds of its management team. A well-established broker typically provides transparency regarding its ownership and operational history, which fosters trust among potential clients.

The lack of clear information about the management team raises further red flags. A competent and experienced management team is crucial for any brokerage's credibility. Without identifiable leadership and operational transparency, potential investors may find themselves in a precarious situation. Overall, the insufficient disclosure of company information contributes to the skepticism surrounding Access Direct's safety.

Trading Conditions Analysis

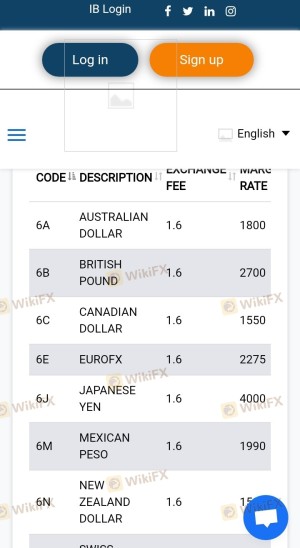

When evaluating a broker, understanding the trading conditions is critical. Access Direct offers various account types, each with different minimum deposit requirements. However, the overall fee structure is not as transparent as one would hope. Traders have reported unexpected fees and commissions that are not clearly outlined on the website.

| Fee Type | Access Direct | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.5 pips | 1.2 pips |

| Commission Structure | Varies | Varies |

| Overnight Interest Range | High | Moderate |

The spreads offered by Access Direct are slightly higher than the industry average, which could impact a trader's profitability. Moreover, the commission structure lacks clarity, potentially leading to confusion among clients. This ambiguity in fee disclosure raises concerns about the broker's transparency and fairness, prompting further inquiry into whether Access Direct is safe for traders.

Client Fund Safety

The safety of client funds is a paramount concern when choosing a broker. Access Direct claims to have measures in place to protect client funds, such as segregated accounts. However, the absence of regulation significantly undermines these claims. Without a regulatory authority overseeing these measures, there is little assurance that funds are genuinely protected.

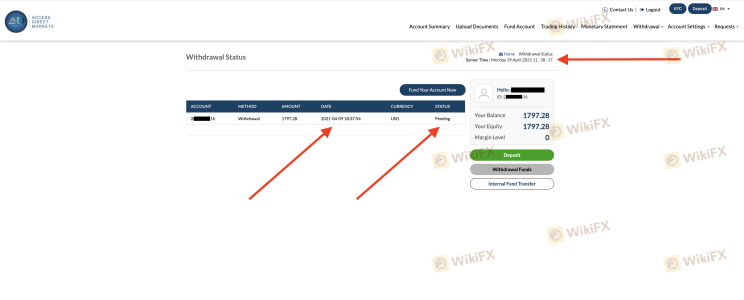

Additionally, there have been reports of difficulties in withdrawing funds, which is a common issue with unregulated brokers. The potential for losing access to ones funds is a critical risk factor that traders must consider. Therefore, the question of Is Access Direct safe? remains unanswered, as the lack of regulatory oversight casts doubt on the effectiveness of their fund protection measures.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. A review of various forums and trading platforms reveals a pattern of complaints against Access Direct. Users have reported issues such as poor customer service, difficulties in fund withdrawals, and a lack of response to inquiries.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or No Response |

| Customer Service | Medium | Unresponsive |

| Fee Discrepancies | Medium | Inconsistent |

One notable case involved a trader who faced significant delays in withdrawing their funds, ultimately leading to frustration and loss of trust in the broker. Such experiences highlight the potential risks involved in trading with Access Direct. The accumulation of negative feedback raises serious concerns about whether Access Direct is safe for traders looking for a reliable brokerage.

Platform and Execution

Access Direct uses popular trading platforms like MetaTrader 4 and 5, which are known for their user-friendly interfaces and robust functionality. However, the performance of these platforms can vary significantly based on the broker's infrastructure. Reports from users indicate issues such as slippage and order rejections, which can severely impact trading outcomes.

The quality of order execution is crucial for traders, particularly in a fast-moving market. Any signs of market manipulation or poor execution could indicate deeper issues within the broker's operations. Thus, the overall user experience raises questions about the reliability of Access Direct's trading environment.

Risk Assessment

Using Access Direct presents several risks that traders should be aware of. The lack of regulation, combined with a history of customer complaints and concerns about fund safety, creates a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated, raising concerns about legitimacy. |

| Fund Safety Risk | High | Potential difficulties in fund withdrawals. |

| Customer Service Risk | Medium | Reports of unresponsive support. |

To mitigate these risks, traders are advised to conduct thorough research and consider alternative brokers with established regulatory oversight and positive user reviews.

Conclusion and Recommendations

In conclusion, the investigation into Access Direct reveals several red flags that suggest it may not be a safe trading platform. The lack of regulatory oversight, combined with a history of customer complaints and transparency issues, raises significant concerns. Therefore, it is prudent for traders to approach Access Direct with caution.

For those seeking reliable trading options, it is advisable to consider brokers that are well-regulated, have a solid reputation, and demonstrate transparency in their operations. Brokers such as IG, OANDA, or Forex.com could serve as safer alternatives for traders looking to navigate the forex market without unnecessary risks. Ultimately, the question of Is Access Direct safe? leans towards a negative response, urging traders to prioritize their security and financial well-being.

Is Access Direct a scam, or is it legit?

The latest exposure and evaluation content of Access Direct brokers.

Access Direct Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Access Direct latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.