Is CAPITAL GOLD ASSET safe?

Business

License

Is Capital Gold Asset A Scam?

Introduction

Capital Gold Asset is an international financial company that specializes in investment activities related to trading in financial markets, including forex, cryptocurrencies, and stocks. As the forex market continues to expand, the number of brokers available to traders has also increased, making it essential for potential investors to evaluate the credibility and reliability of these brokers. This necessity arises from the inherent risks involved in trading, including the potential for fraud and the loss of funds. In this article, we will investigate whether Capital Gold Asset is a safe trading platform or if it exhibits characteristics of a scam. Our analysis will be based on regulatory status, company background, trading conditions, client safety measures, customer experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a brokerage is one of the most critical factors in determining its safety and legitimacy. A regulated broker is subject to oversight by financial authorities, ensuring compliance with established standards that protect investors. Unfortunately, Capital Gold Asset is currently unregulated, which poses significant risks for traders. Without regulatory oversight, there is no guarantee that the company adheres to ethical practices or that it will protect clients' funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of a valid regulatory license indicates that Capital Gold Asset operates without any government oversight. This lack of regulation raises concerns about the quality of service and the potential for fraudulent activities. Regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US, enforce strict compliance measures that brokers must adhere to. Capital Gold Asset's failure to secure any such regulation is a red flag, suggesting that traders should exercise extreme caution when considering this broker.

Company Background Investigation

Understanding the companys background is essential for assessing its credibility. Capital Gold Asset claims to have been operational for two to five years, based in the United States. However, there is limited information available about its history, ownership structure, and management team. The lack of transparency regarding these aspects raises concerns about the company's legitimacy.

The absence of a well-defined ownership structure and management team can indicate a lack of accountability, making it difficult for clients to seek recourse in case of disputes. A reputable broker typically provides detailed information about its founders and executive team, showcasing their professional experience and qualifications in the financial industry. Unfortunately, Capital Gold Asset does not provide such transparency, further complicating the assessment of its trustworthiness.

Trading Conditions Analysis

When evaluating a broker, it's crucial to analyze the trading conditions they offer, including fees and spreads. Capital Gold Asset has a high minimum deposit requirement of $300, which could be a barrier for many potential traders. Moreover, the broker's fee structure is not clearly defined, raising questions about hidden charges that could affect traders profitability.

| Cost Type | Capital Gold Asset | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | Varies |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of detailed information on spreads and commissions suggests that traders might encounter unexpected costs. This opacity is concerning, as it can lead to disputes and dissatisfaction among clients. Furthermore, the absence of competitive trading conditions could make it difficult for traders to achieve their financial goals.

Client Fund Safety

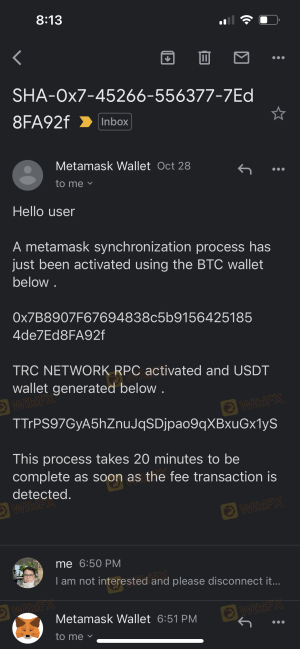

The safety of client funds is paramount when choosing a broker. Capital Gold Asset does not provide sufficient information regarding its fund safety measures, including whether client funds are kept in segregated accounts or if there are any investor protection mechanisms in place. The lack of such safeguards poses a significant risk, as traders may find it challenging to recover their funds in case of financial difficulties faced by the broker.

Historically, unregulated brokers have been associated with numerous fund security issues, including fund misappropriation and withdrawal problems. If Capital Gold Asset has not established robust safety protocols, clients could be at risk of losing their investments. Therefore, it is crucial for potential investors to consider these factors seriously.

Customer Experience and Complaints

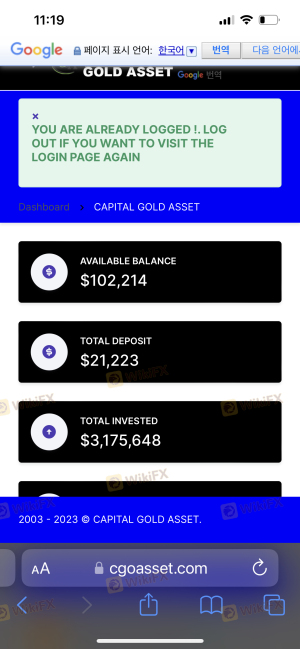

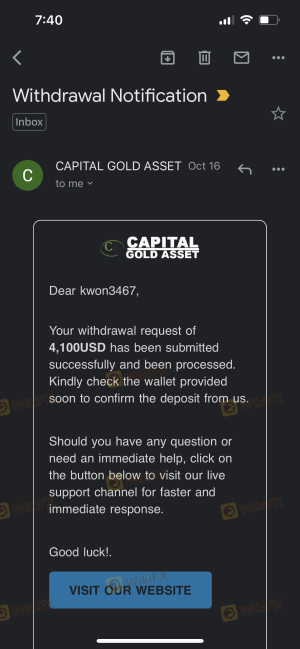

Customer feedback provides valuable insights into a broker's reliability and service quality. Reviews and testimonials about Capital Gold Asset suggest a mixed bag of experiences, with several users reporting difficulties in withdrawing funds and communication issues. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Average |

These complaints highlight a concerning trend that could indicate underlying issues with the broker's operations. For instance, clients have reported delays in processing withdrawals and a lack of responsiveness from customer support. Such experiences can be detrimental to traders, as they may feel trapped and unable to access their funds when needed.

Platform and Trade Execution

The trading platform's performance is another critical factor in assessing a broker's reliability. Capital Gold Asset offers a trading platform, but there are few details available regarding its performance, stability, and user experience. Traders need a platform that is not only user-friendly but also reliable in executing trades without significant slippage or rejections.

Issues such as high slippage rates and frequent order rejections are often signs of a poorly managed trading environment. If Capital Gold Asset exhibits these characteristics, it could negatively impact traders' experiences and financial outcomes. Therefore, potential clients should be wary of the platform's reliability before committing their funds.

Risk Assessment

Investing with any broker carries inherent risks, and Capital Gold Asset is no exception. The absence of regulation, unclear trading conditions, and poor customer feedback contribute to a high-risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Financial Risk | High | Lack of transparency on fees and fund safety. |

| Operational Risk | Medium | Mixed customer experiences and complaints. |

To mitigate these risks, traders should conduct thorough research, consider investing only what they can afford to lose, and explore alternative, more reputable brokers with solid regulatory backing.

Conclusion and Recommendations

In conclusion, Capital Gold Asset raises several red flags that suggest it may not be a safe trading option. The absence of regulation, unclear trading conditions, and negative customer experiences indicate that potential investors should approach this broker with caution. While it may offer a range of trading products, the associated risks could outweigh the benefits.

For traders seeking reliable options, it is advisable to consider well-regulated brokers with transparent fee structures and positive customer feedback. Recommended alternatives include brokers regulated by top-tier authorities such as the FCA or ASIC, which provide a safer trading environment and better investor protection. Always prioritize safety and due diligence when selecting a trading platform to ensure a secure and profitable trading experience.

Is CAPITAL GOLD ASSET a scam, or is it legit?

The latest exposure and evaluation content of CAPITAL GOLD ASSET brokers.

CAPITAL GOLD ASSET Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CAPITAL GOLD ASSET latest industry rating score is 1.41, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.41 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.