Is HMCL safe?

Pros

Cons

Is HMCL Safe or Scam?

Introduction

In the ever-evolving world of forex trading, selecting a trustworthy broker is crucial for both new and experienced traders. HMCL, or Harvey Madison Capital Pty Ltd, has emerged as a player in this competitive market, but questions regarding its legitimacy and safety have sparked concern among potential clients. Given the financial stakes involved in trading, traders must approach broker evaluations with caution, ensuring they are not falling victim to scams. This article investigates whether HMCL is a safe option for traders or if it raises red flags that warrant concern. Our investigative approach is rooted in thorough research, utilizing regulatory databases, industry reports, and user feedback to provide a comprehensive assessment of HMCL's credibility.

Regulation and Legitimacy

Regulatory oversight is a cornerstone of broker credibility, as it ensures that firms adhere to strict operational standards designed to protect investors. In the case of HMCL, the regulatory landscape appears murky. According to various sources, HMCL is labeled as a "suspicious clone," indicating that it may not be operating under legitimate regulations. The following table summarizes HMCL's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Suspicious Clone |

The lack of a valid license from a reputable regulatory body like the Australian Securities and Investments Commission (ASIC) raises significant concerns about HMCL's operational integrity. Moreover, the designation as a "suspicious clone" suggests that HMCL may be imitating a legitimate broker without proper authorization. This lack of regulatory oversight is a critical factor for traders to consider when assessing if HMCL is safe or a potential scam.

Company Background Investigation

Understanding a broker's history and ownership structure is essential in evaluating its trustworthiness. HMCL, registered as Harvey Madison Capital Pty Ltd, is relatively new to the forex market. While specific details about its founding and development are scarce, the company's website claims to offer various trading services. However, the absence of transparent information regarding its ownership and management team raises questions about its operational legitimacy.

A thorough background check reveals that HMCL's management team lacks publicly available professional experience in the forex industry, further complicating the assessment of its reliability. Transparency in operations and information disclosure is vital for establishing trust, and HMCL appears to fall short in this regard. The opacity surrounding its corporate structure and management team contributes to the skepticism regarding whether HMCL is safe for traders.

Trading Conditions Analysis

A broker's trading conditions, including fees and spreads, significantly impact a trader's experience. HMCL's fee structure has been described as unconventional, with various reports indicating potential hidden costs. Below is a comparative analysis of HMCL's core trading costs:

| Cost Type | HMCL | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | 0.5-1.5% |

The lack of specific data regarding HMCL's spreads and commission structure raises concerns about transparency. Traders should be wary of brokers that do not clearly disclose their fee structures, as this can lead to unexpected costs that may erode profits. Given these uncertainties, it is prudent for traders to question if HMCL is safe or if it could potentially impose unfavorable trading conditions.

Client Fund Security

The security of client funds is paramount for any forex broker. HMCL's approach to safeguarding client assets has come under scrutiny due to its lack of clear policies on fund segregation and investor protection. A reliable broker should maintain client funds in segregated accounts to prevent misuse. However, HMCL's transparency in this area is lacking, and there are no clear indications of investor protection measures or negative balance protection policies.

Historically, brokers without stringent security measures have faced significant issues, including insolvencies that jeopardized client funds. Without robust safety protocols, traders may find themselves at risk of losing their investments. Therefore, the absence of detailed information on HMCL's security measures raises red flags regarding whether HMCL is safe for traders.

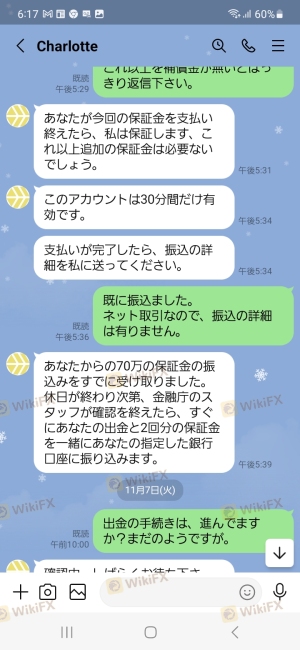

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. A review of user experiences with HMCL reveals a mixed bag, with several complaints surfacing about withdrawal delays and unresponsive customer service. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Average |

| Misleading Information | High | Poor |

Two notable cases involve clients reporting significant delays in fund withdrawals, which is a major concern for any trader. These complaints suggest that HMCL may not prioritize customer service, leading to frustration among clients. The overall sentiment from traders further complicates the question of whether HMCL is safe or if it poses risks that should deter potential clients.

Platform and Trade Execution

The trading platform's performance is critical for a smooth trading experience. HMCL claims to offer a user-friendly interface, but reviews indicate mixed performance regarding stability and execution quality. Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

A reliable broker should ensure timely execution and minimal slippage to maintain trust among its clients. However, reports of execution issues at HMCL raise concerns about the platform's reliability. These factors contribute to the overall assessment of whether HMCL is safe for traders, as a problematic trading environment can lead to financial losses.

Risk Assessment

When evaluating HMCL, it is essential to consider the associated risks. The following risk scorecard summarizes the key risk areas:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of legitimate oversight |

| Financial Risk | Medium | Unclear fee structures and policies |

| Operational Risk | High | Complaints about withdrawal delays |

| Security Risk | High | Insufficient client fund protection |

Given these factors, traders should exercise caution when considering HMCL as a trading option. To mitigate risks, it is advisable to conduct thorough research and potentially seek alternative brokers with established reputations and clear regulatory compliance.

Conclusion and Recommendations

In conclusion, the evidence points to significant concerns regarding HMCL's legitimacy and safety. The lack of regulatory oversight, transparency in trading conditions, and numerous customer complaints suggest that traders should approach HMCL with caution. While it may not be outright classified as a scam, the potential risks associated with trading through HMCL warrant serious consideration.

For traders seeking reliable alternatives, it is recommended to explore brokers regulated by recognized authorities, such as the FCA or ASIC, which have proven track records of protecting investor interests. By prioritizing safety and regulatory compliance, traders can make more informed decisions and enhance their trading experiences.

In summary, the question "Is HMCL safe?" leans toward a cautious "no," and traders are advised to look for more reputable options in the forex market.

Is HMCL a scam, or is it legit?

The latest exposure and evaluation content of HMCL brokers.

HMCL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HMCL latest industry rating score is 1.41, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.41 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.