Is SuperTrader safe?

Pros

Cons

Is SuperTrader Safe or Scam?

Introduction

SuperTrader positions itself as a prominent player in the forex market, offering a range of trading services to both novice and experienced traders. However, the ever-evolving landscape of forex trading necessitates that traders exercise caution when selecting a broker. The potential for scams and unregulated entities means that due diligence is crucial in ensuring the safety of investments. In this article, we will conduct a thorough investigation into SuperTrader, assessing its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our evaluation will be based on a combination of qualitative analysis and quantitative data, drawing insights from various credible sources.

Regulation and Legitimacy

A broker's regulatory status is a cornerstone of its legitimacy. SuperTrader claims to be regulated by several authorities, including the Australian Securities and Investments Commission (ASIC). However, the quality of this regulation is questionable, as there have been reports indicating that SuperTrader may operate as a suspicious clone of a regulated entity rather than a legitimate broker.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 443886 | Australia | Suspicious Clone |

| VFSC | 41698 | Vanuatu | Offshore Regulation |

The table above highlights the regulatory framework surrounding SuperTrader. The presence of a suspicious clone status raises significant concerns regarding the broker's operational integrity. Furthermore, the lack of independent verification of its regulatory claims indicates that traders should approach SuperTrader with caution. Historically, brokers with similar questionable regulatory statuses have been associated with fraudulent practices, emphasizing the need for careful evaluation before engaging with such entities. This leads us to question, is SuperTrader safe for trading?

Company Background Investigation

SuperTrader has been in operation since 2015, with its headquarters located in Australia. The company is reported to have a management team with varying degrees of experience in finance and trading. However, the lack of transparency regarding the ownership structure and the absence of detailed information about key personnel raise red flags.

The company's history is punctuated by allegations of misleading practices, including claims about its regulatory status and trading conditions. This opacity in company operations can create an environment of distrust among potential investors. When assessing whether SuperTrader is safe, it is essential to consider the level of transparency and the quality of information disclosed by the broker. A reputable broker should provide clear and accessible information about its management team, ownership structure, and operational history to instill confidence among its clients.

Trading Conditions Analysis

SuperTrader's trading conditions include various fees associated with trading activities. While the broker advertises competitive spreads and leverage options, there have been concerns regarding hidden fees and unclear commission structures.

| Fee Type | SuperTrader | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 0.5% | 0.3% |

The table above compares SuperTrader's fees with industry averages. The spreads offered by SuperTrader are slightly higher than the industry average, which could impact profitability for traders. Additionally, the lack of clarity regarding commission structures raises concerns about potential hidden costs that could affect overall trading profitability. Therefore, assessing whether SuperTrader is safe for trading requires a critical examination of its fee transparency and competitive positioning within the market.

Client Fund Security

The security of client funds is paramount for any trading broker. SuperTrader claims to implement various measures to safeguard client deposits, including segregated accounts and investor protection policies. However, the effectiveness of these measures remains questionable, especially given the broker's regulatory status.

Traders should be aware that the absence of robust investor protection mechanisms can expose them to significant risks. Historical complaints indicate issues with fund withdrawals and account accessibility, which are critical factors when evaluating the safety of a broker. The lack of clear information regarding fund segregation and the potential for negative balance protection raises further concerns about the overall security of client investments with SuperTrader. Thus, it is imperative to ask, is SuperTrader safe when it comes to protecting your funds?

Customer Experience and Complaints

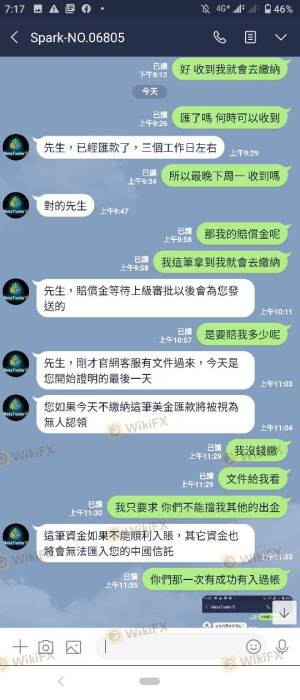

Customer feedback regarding SuperTrader has been mixed, with numerous complaints surfacing about withdrawal issues and unresponsive customer service. Common complaint patterns include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Account Accessibility | High | Unresolved |

| Customer Service Quality | Medium | Inconsistent |

The table above summarizes the primary complaints associated with SuperTrader. Many users have reported being unable to withdraw their funds, which is a significant concern for any trader. Additionally, the company's slow response to inquiries exacerbates the frustration experienced by clients. Typical case studies highlight instances where traders were required to pay additional fees or provide excessive documentation before being permitted to access their funds, raising alarms about the broker's practices. This leads to the question of whether SuperTrader is safe for everyday traders looking to invest their hard-earned money.

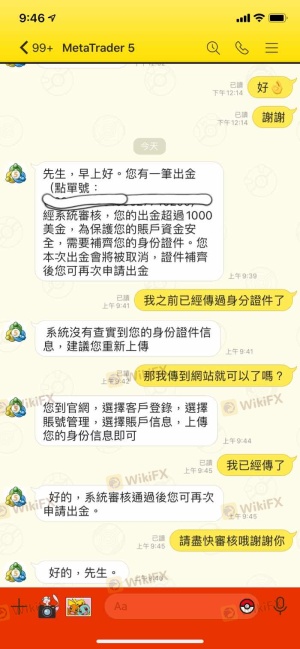

Platform and Execution

The trading platform offered by SuperTrader is based on MetaTrader 5 (MT5), a popular choice among traders for its advanced features and user-friendly interface. However, reviews indicate that the platform has experienced stability issues and occasional downtime, which can significantly impact trading performance.

Moreover, the quality of order execution is critical for successful trading. Reports of slippage and rejected orders have surfaced, raising concerns about the broker's ability to provide a reliable trading environment. When assessing whether SuperTrader is safe, it is essential to consider the platform's performance and the potential risks associated with order execution quality.

Risk Assessment

Using SuperTrader presents various risks that traders should be aware of. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Operates under suspicious regulatory status. |

| Fund Security Risk | High | Lack of clear measures for fund protection. |

| Customer Service Risk | Medium | Slow response times and unresolved complaints. |

The table above highlights the major risks associated with trading with SuperTrader. Traders should be cautious and aware of these risks before committing their funds. To mitigate these risks, it is advisable to conduct thorough research, consider diversifying investments, and utilize risk management strategies.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns about the safety and legitimacy of SuperTrader. The broker's questionable regulatory status, mixed customer experiences, and lack of transparency are critical factors that potential traders should consider. While there are opportunities for trading, the risks associated with SuperTrader may outweigh the potential benefits.

For traders seeking safety and reliability, it is advisable to explore alternatives that are well-regulated and have a proven track record of positive customer experiences. Brokers such as Avatrade, Swissquote, and Hantec Markets offer more robust regulatory frameworks and better customer support, making them safer options for forex trading. Ultimately, the question remains: is SuperTrader safe? The answer leans towards caution, as the potential for scams and unregulated practices could jeopardize traders' investments.

Is SuperTrader a scam, or is it legit?

The latest exposure and evaluation content of SuperTrader brokers.

SuperTrader Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SuperTrader latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.