Regarding the legitimacy of TRULY forex brokers, it provides HKGX and WikiBit, (also has a graphic survey regarding security).

Is TRULY safe?

Pros

Cons

Is TRULY markets regulated?

The regulatory license is the strongest proof.

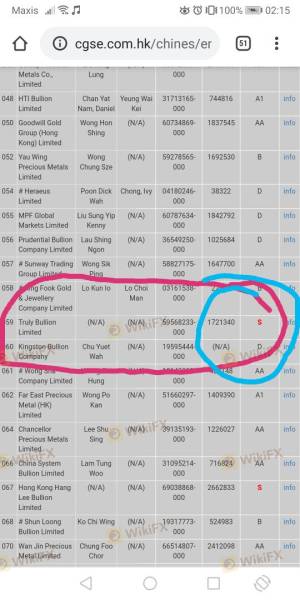

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

UnverifiedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

標準金控股有限公司

Effective Date: Change Record

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

九龍紅磡馬頭圍道116-118號置富商業大廈8樓C室Phone Number of Licensed Institution:

55893945Licensed Institution Certified Documents:

Is Truly a Scam? A Comprehensive Analysis

Introduction

Truly is a relatively new player in the forex market, aiming to provide trading services to a wide range of investors. As the forex trading landscape becomes increasingly competitive, it is essential for traders to conduct thorough due diligence before choosing a broker. The potential for scams in the forex industry is significant, and many traders have fallen victim to unscrupulous brokers. Therefore, assessing the legitimacy and safety of Truly is crucial for anyone considering opening an account. This article will utilize a multi-faceted evaluation framework, examining regulatory compliance, company background, trading conditions, customer security, client experiences, platform performance, and overall risk assessment to determine if Truly is safe or a scam.

Regulation and Legitimacy

One of the most critical aspects of evaluating any forex broker is their regulatory status. Regulation serves as a safety net for traders, ensuring that brokers adhere to strict operational standards and providing mechanisms for recourse in case of disputes. Truly's regulatory status is a significant factor in determining its safety.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CGSE | N/A | Hong Kong | Suspicious Clone |

| DS License | N/A | N/A | N/A |

As indicated in the table, Truly operates under the oversight of the CGSE, but it has been flagged as a "suspicious clone." This raises serious concerns about its legitimacy, as brokers with such designations often engage in deceptive practices. The lack of a solid regulatory framework means that traders might have little recourse should issues arise. Furthermore, the absence of a robust regulatory history indicates that Truly may not have the necessary oversight to protect traders' interests effectively. In summary, the regulatory landscape surrounding Truly raises red flags, suggesting that traders should approach with caution.

Company Background Investigation

Understanding the company behind a forex broker is vital for assessing its reliability. Truly was founded in 2020, positioning itself as a modern brokerage aiming to leverage technology for improved trading experiences. However, its short history raises questions about its stability and long-term viability. The ownership structure of Truly is not entirely transparent, which can further exacerbate concerns regarding accountability.

The management team‘s background is another critical element to consider. While there is limited publicly available information about the qualifications of Truly’s executives, the lack of industry experience could pose risks. A strong management team with a proven track record in finance and trading is often a good indicator of a broker's reliability. In Truly's case, the opacity surrounding its leadership and operational practices makes it difficult to ascertain whether it possesses the expertise necessary to navigate the complexities of the forex market.

Trading Conditions Analysis

When evaluating whether Truly is safe, understanding its trading conditions is essential. The overall cost structure and fee model can significantly impact a trader's profitability. Truly's fee structure appears to be competitive, but potential clients should be wary of any hidden fees or unusual policies.

| Fee Type | Truly | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1.5 pips |

| Commission Model | N/A | $5 per lot |

| Overnight Interest Range | N/A | 2% to 5% |

The table above highlights some areas where Truly's fees may differ from industry standards. However, the lack of specific figures raises questions about transparency. Traders should be cautious if a broker does not provide clear and detailed information about its fees. Moreover, any unusual charges or policies could indicate potential issues. Without transparency in trading conditions, it becomes challenging to trust Truly as a reliable broker.

Client Fund Safety

The safety of client funds is paramount when choosing a broker. Truly's measures for safeguarding client assets are crucial for evaluating its overall safety. A reputable broker typically employs segregated accounts to ensure that client funds are kept separate from the company's operating capital. Additionally, investor protection mechanisms, such as negative balance protection, are essential for minimizing risk.

Truly's policies regarding fund safety remain unclear, which is a significant concern. Without robust measures in place, traders could risk losing their investments in the event of a financial downturn or broker insolvency. Furthermore, any historical issues related to fund security could further tarnish Truly's reputation. Therefore, without clear information on these safety measures, it is challenging to conclude that Truly is safe.

Customer Experience and Complaints

Analyzing customer feedback is a vital component of assessing whether Truly is a scam. Client experiences often reveal underlying issues that may not be apparent from a broker's marketing materials. Reports of unresolved complaints or poor customer service can indicate potential problems.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Account Management | Medium | Slow Response |

| Misleading Information | High | No Resolution |

The table summarizes some of the main complaints associated with Truly. The severity of issues such as withdrawal problems and misleading information raises significant concerns regarding the broker's reliability. Moreover, a lack of timely responses from the company can further exacerbate traders' frustrations. Such patterns of complaints could be indicative of deeper operational issues, suggesting that traders should proceed with caution when considering Truly.

Platform and Trade Execution

The trading platform's performance is a critical factor in evaluating a brokers reliability. Truly's platform should be assessed for stability, user experience, and the quality of trade execution. Traders expect a seamless experience, including quick order execution and minimal slippage.

However, reports of execution issues or platform manipulation can severely impact a trader's experience. Users should be wary if they encounter frequent problems with execution or experience unusual slippage rates. These issues could indicate that Truly is not prioritizing its clients' trading needs, raising further concerns about its legitimacy.

Risk Assessment

Using Truly as a forex broker carries inherent risks that potential clients should understand. A comprehensive risk assessment can help traders make informed decisions.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Lack of solid regulation raises concerns. |

| Fund Safety | High | Unclear safety measures for client funds. |

| Trading Conditions | Medium | Fees and conditions lack transparency. |

| Customer Support | High | Frequent complaints about responsiveness. |

The risk assessment table summarizes the key risk areas associated with Truly. Each category indicates a high level of concern, which suggests that potential clients should be cautious. To mitigate these risks, traders should consider using alternative, well-regulated brokers with transparent practices and positive customer feedback.

Conclusion and Recommendations

In conclusion, the evidence presented raises significant concerns regarding Truly's legitimacy and safety. The combination of regulatory issues, unclear trading conditions, and negative customer experiences suggests that Truly may not be a safe choice for traders. While it is essential to conduct thorough research when selecting a broker, the multiple red flags associated with Truly indicate that traders should exercise extreme caution.

For those seeking reliable alternatives, consider brokers that are well-regulated, transparent about their fees, and have a proven track record of positive customer experiences. By prioritizing safety and reliability, traders can better protect their investments and navigate the complexities of the forex market with confidence. Ultimately, is Truly safe? The answer appears to lean towards caution, and potential clients should be wary of potential scams or fraudulent practices.

Is TRULY a scam, or is it legit?

The latest exposure and evaluation content of TRULY brokers.

TRULY Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TRULY latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.