Is XTR safe?

Pros

Cons

Is XTR Safe or Scam?

Introduction

XTR Brokers has emerged as a notable player in the forex trading landscape, offering a range of trading options including forex, CFDs, and cryptocurrencies. However, the rise of online trading platforms has also led to an increase in fraudulent activities, making it imperative for traders to exercise caution when selecting a broker. This article aims to provide a comprehensive analysis of XTR Brokers, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our investigation is based on a review of various sources, including user feedback, regulatory warnings, and industry reports, to ascertain whether XTR is a safe choice for traders.

Regulation and Legitimacy

One of the most critical aspects of evaluating any forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that the broker adheres to specific operational standards and provides a level of protection for client funds. In the case of XTR Brokers, the situation is concerning. The broker does not appear to be regulated by any major financial authority, which raises significant red flags about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulation means that traders using XTR may not have any legal recourse in case of disputes or issues with fund withdrawals. This lack of oversight can lead to potential fraud, as unregulated brokers often operate with little accountability. Furthermore, reports from the Swedish Financial Supervisory Authority (Finansinspektionen) have flagged XTR as an unlicensed broker, indicating that it is not authorized to provide financial services in Sweden. This situation exemplifies why traders should be wary of engaging with XTR.

Company Background Investigation

Understanding the background of a broker is essential for assessing its trustworthiness. XTR Brokers claims to operate under the jurisdiction of Saint Vincent and the Grenadines, a region known for its lenient regulatory framework. However, the lack of transparency regarding the company's ownership and management raises concerns about its credibility. There is no publicly available information about the individuals behind XTR, which is a significant warning sign.

The management team's experience and qualifications are crucial in determining a broker's reliability. Unfortunately, XTR fails to provide any details about its leadership, which further complicates the assessment of its legitimacy. Transparency is a vital component of trust in the financial industry, and the absence of such information suggests that XTR may not be a safe choice for traders.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. XTR Brokers presents itself as a low-cost trading platform, but a closer look reveals several concerning aspects. The broker's fee structure lacks clarity, and it is essential to scrutinize any unusual or problematic charges.

| Fee Type | XTR Brokers | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2 pips | 1-1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 0.5% | 0.1%-0.3% |

The spreads offered by XTR are higher than the industry average, which may diminish potential profits for traders. Additionally, the broker's commission model is unclear, with reports indicating hidden fees that could catch traders off guard. Such practices are often associated with unregulated brokers, raising questions about the overall transparency of XTR's trading conditions.

Customer Funds Security

The safety of customer funds is paramount when selecting a forex broker. XTR Brokers' lack of regulation raises significant concerns about its funds security measures. Regulated brokers are typically required to implement strict protocols for fund segregation and investor protection, which are crucial for safeguarding client assets.

XTR does not provide any information regarding its fund segregation policies or whether it offers negative balance protection. These are essential features that protect traders from losing more than their initial investment. The absence of such measures indicates that XTR may not prioritize the security of its clients' funds, making it a potentially unsafe option for traders.

Customer Experience and Complaints

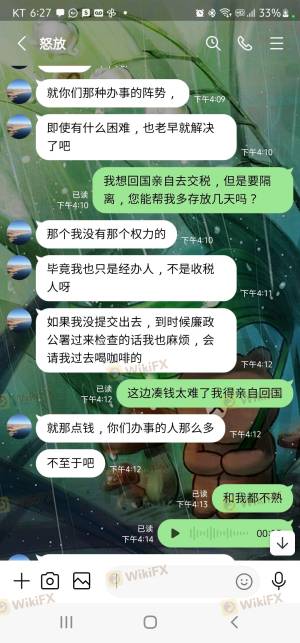

Customer feedback is invaluable for assessing a broker's reputation. Unfortunately, XTR Brokers has garnered numerous negative reviews, with many users reporting difficulties in withdrawing their funds. Common complaints include delayed withdrawal requests, lack of communication from customer support, and aggressive sales tactics.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Quality | Medium | Poor |

| Misleading Promotions | High | Poor |

One notable case involved a trader who attempted to withdraw funds after several months of trading, only to face repeated delays and evasive responses from the support team. Such experiences highlight the potential risks associated with trading on the XTR platform, reinforcing the need for caution.

Platform and Trade Execution

The performance and reliability of a broker's trading platform are critical for a seamless trading experience. XTR Brokers claims to offer popular trading platforms like MetaTrader 4 and 5; however, users have reported issues with platform stability and execution quality. Traders have experienced slippage and order rejections, which can significantly impact trading outcomes.

Additionally, there are concerns about potential platform manipulation, as some users have reported instances where trades were executed at unfavorable prices. This further raises alarms about whether XTR is a safe platform for trading.

Risk Assessment

Using XTR Brokers presents several risks that traders must consider. The lack of regulation, questionable trading conditions, and negative customer experiences contribute to an overall high-risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Fund Security Risk | High | Lack of protection measures |

| Trading Condition Risk | Medium | High spreads and hidden fees |

To mitigate these risks, traders are advised to conduct thorough research before engaging with XTR. It may be prudent to consider alternative brokers with solid regulatory backing and positive user reviews.

Conclusion and Recommendations

In conclusion, the evidence suggests that XTR Brokers is not a safe choice for traders. The lack of regulation, combined with negative customer feedback and questionable trading practices, raises significant concerns about the broker's legitimacy. Traders should exercise extreme caution when dealing with XTR and consider seeking alternatives that offer better security and transparency.

For those looking for reliable trading options, it is recommended to explore brokers that are well-regulated and have a strong reputation in the industry. Always prioritize safety and due diligence when selecting a forex broker, as the risks associated with unregulated platforms like XTR can have serious financial implications.

Is XTR a scam, or is it legit?

The latest exposure and evaluation content of XTR brokers.

XTR Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

XTR latest industry rating score is 1.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.