Is GUOSEN SECURITIES safe?

Pros

Cons

Is Guosen Securities Safe or Scam?

Introduction

Guosen Securities, a prominent player in the forex market, has established itself as a significant financial services provider, particularly within China and Hong Kong. Founded in 1994, Guosen offers a range of services including securities brokerage, investment banking, and asset management. However, the increasing number of fraudulent schemes in the financial sector necessitates a cautious approach when evaluating forex brokers. Traders must be diligent in assessing the credibility and safety of their chosen platforms, as the consequences of engaging with a scam can be dire, resulting in significant financial loss.

This article aims to provide an objective analysis of Guosen Securities, addressing key aspects such as regulatory compliance, company background, trading conditions, customer experiences, and overall risks. Our investigation is based on a thorough review of available data, including regulatory information, user feedback, and historical performance metrics. By employing a structured evaluation framework, we aim to answer the critical question: Is Guosen Securities safe?

Regulatory and Legitimacy

Regulatory oversight is a cornerstone of financial safety, and Guosen Securities operates under the jurisdiction of reputable regulatory bodies. The company's regulatory status is a critical factor in determining its legitimacy and reliability in the forex market. The following table summarizes the core regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CSRC | N/A | China | Verified |

| SFC | AUI 491 | Hong Kong | Verified |

Guosen Securities is regulated by both the China Securities Regulatory Commission (CSRC) and the Hong Kong Securities and Futures Commission (SFC). This dual regulatory framework is significant, as it provides a layer of oversight that can enhance the trustworthiness of the broker. The SFC, for instance, is known for its stringent compliance requirements, which include regular audits and reporting obligations. However, it is essential to note that regulatory compliance does not guarantee complete safety. Historical issues, such as a hefty fine imposed by the SFC in 2019 for anti-money laundering violations, raise concerns about the broker's adherence to regulatory standards.

Company Background Investigation

Guosen Securities has a rich history that dates back to its establishment in 1994. Initially part of the Shenzhen International Trust and Investment Company, it has grown to become one of the leading financial services firms in China, with a significant presence in the Hong Kong market. The company is state-owned, which adds a layer of stability; however, it also means that it is subject to government influence and policies.

The management team at Guosen is composed of experienced professionals with backgrounds in finance and investment banking. This expertise is crucial for maintaining the integrity of the firm's operations. Transparency is another critical aspect; Guosen Securities provides detailed information about its services and operations on its website. However, the extent of information disclosure can vary, and potential clients are encouraged to conduct thorough due diligence before engaging with the broker.

Trading Conditions Analysis

When assessing whether Guosen Securities is safe, understanding its trading conditions is vital. The broker offers a competitive fee structure, but it is essential to scrutinize any unusual or problematic fees that could impact profitability. Below is a comparison of core trading costs:

| Fee Type | Guosen Securities | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Structure | 0.25% - 0.03% | 0.2% |

| Overnight Interest Range | 1.5% - 3.0% | 1.0% |

While Guosen offers relatively low trading commissions, the spreads on major currency pairs are slightly higher than the industry average, which could affect trading performance. Additionally, the overnight interest rates may vary significantly, which traders should consider when holding positions overnight.

Customer Fund Safety

The safety of customer funds is paramount in determining whether Guosen Securities is safe. The broker employs several measures to ensure the protection of client assets. Funds are typically kept in segregated accounts, which helps to safeguard client money in the event of financial difficulties. Furthermore, Guosen Securities is expected to adhere to investor protection regulations, which may include negative balance protection policies.

However, past incidents, such as the aforementioned fines for regulatory breaches, raise questions about the broker's commitment to maintaining high standards of fund security. Traders should remain vigilant and continuously monitor the broker's compliance with safety regulations.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing the overall reliability of a broker. Reviews of Guosen Securities reveal a mixed bag of experiences. While some clients praise the platform's features and customer service, others have reported issues regarding withdrawals and responsiveness. The following table outlines the primary complaints and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

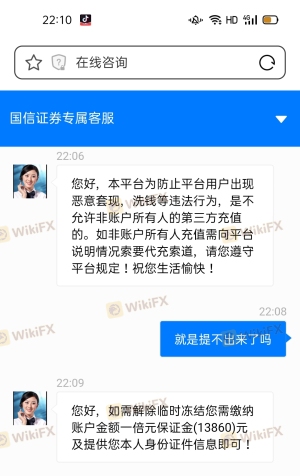

| Withdrawal Issues | High | Slow Response |

| Platform Stability | Medium | Average Response |

| Customer Service Quality | Medium | Generally Positive |

Common complaints include difficulties in withdrawing funds and delays in customer support responses. These issues can significantly impact a trader's experience, raising concerns about the broker's operational efficiency.

Platform and Execution

The trading platform offered by Guosen Securities is an important aspect of the overall trading experience. Users have reported that the platform is generally stable and user-friendly, enabling efficient order execution. However, instances of slippage and order rejections have been noted, which could affect trading outcomes. It is essential for traders to evaluate their experiences with the platform to determine if it meets their trading needs.

Risk Assessment

Using Guosen Securities does involve certain risks that traders should be aware of. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Historical fines raise concerns |

| Customer Fund Security | Medium | Segregated accounts in place, but past issues exist |

| Customer Support | High | Complaints about slow response times |

To mitigate these risks, traders are advised to conduct thorough research, maintain clear communication with the broker, and stay informed about any regulatory updates that may affect their trading activities.

Conclusion and Recommendations

In conclusion, while Guosen Securities is regulated and offers a range of financial services, potential clients should approach with caution. The broker's history of regulatory issues and customer complaints raises red flags regarding its overall safety. Therefore, traders must weigh the benefits against the risks before deciding to engage with Guosen Securities.

For those seeking alternatives, brokers with a stronger reputation for customer service and regulatory compliance may be more suitable. It is essential for traders to conduct their own research and consider their individual trading needs when selecting a broker. Ultimately, the question Is Guosen Securities safe? remains complex, and traders should remain vigilant and informed to protect their investments.

Is GUOSEN SECURITIES a scam, or is it legit?

The latest exposure and evaluation content of GUOSEN SECURITIES brokers.

GUOSEN SECURITIES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GUOSEN SECURITIES latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.