Is BloomsMarkets safe?

Business

License

Is Blooms Markets A Scam?

Introduction

Blooms Markets is a forex brokerage that has recently entered the trading scene, positioning itself as a platform for both novice and experienced traders. With the allure of competitive trading conditions and a variety of financial instruments, it aims to attract a diverse clientele. However, the rise of unregulated brokers has made it imperative for traders to carefully evaluate the legitimacy and safety of their chosen trading platforms. This article will delve into the various aspects of Blooms Markets, assessing its regulatory standing, company background, trading conditions, customer experiences, and overall risk profile. Our investigation is based on a comprehensive analysis of multiple sources, including user reviews, regulatory databases, and expert assessments.

Regulation and Legitimacy

The regulatory status of a brokerage is crucial for ensuring the safety of traders' funds and the integrity of the trading environment. Unfortunately, Blooms Markets operates without any regulatory oversight, which raises significant concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that Blooms Markets is not subject to any external authority monitoring its activities or enforcing compliance with industry standards. This lack of oversight can lead to a higher risk of fraudulent activities, including misappropriation of funds and market manipulation. Furthermore, unregulated brokers often do not provide investor protection mechanisms, leaving traders vulnerable to financial losses without recourse. Thus, the question of is Blooms Markets safe becomes increasingly pertinent when considering the potential risks involved in trading with such a platform.

Company Background Investigation

Blooms Markets claims to have been established in the United Kingdom, with its headquarters purportedly located in London. However, upon further investigation, it appears that the information provided regarding its establishment is misleading. The company‘s domain was created in 2015, contradicting its claims of being operational since 2003. This discrepancy raises red flags about the authenticity of the broker’s history and its overall transparency.

The ownership structure of Blooms Markets remains unclear, with little information available regarding its management team or their qualifications. The lack of transparency about key personnel and their professional backgrounds further diminishes confidence in the brokers reliability. A reputable brokerage typically provides clear information about its leadership and operational practices, fostering trust among its clients. In this case, the absence of such disclosures makes it difficult to ascertain the credibility of Blooms Markets, reinforcing the notion that is Blooms Markets safe is a question that requires serious consideration.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. Blooms Markets offers a variety of trading instruments, including forex pairs, commodities, and cryptocurrencies. However, the specifics of its fee structure are not clearly outlined on its website, which is a common tactic employed by less reputable brokers to obscure potentially unfavorable terms.

| Fee Type | Blooms Markets | Industry Average |

|---|---|---|

| Spread on Major Pairs | Not disclosed | 1.0 - 1.5 pips |

| Commission Model | Not disclosed | Varies by broker |

| Overnight Interest Range | Not disclosed | 0.5% - 2.0% |

The lack of transparency regarding spreads, commissions, and overnight fees raises concerns about hidden costs that could significantly impact trading profitability. Additionally, the absence of a clear commission structure may lead to unexpected charges for traders, further complicating their trading experience. This lack of clarity in trading conditions prompts further scrutiny into whether is Blooms Markets safe for potential investors.

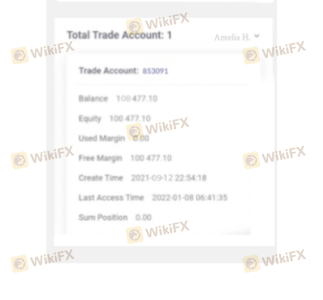

Customer Fund Safety

The safety of customer funds is a paramount concern when choosing a broker. Blooms Markets does not provide information on whether it maintains segregated accounts for client funds, a critical feature that protects traders in the event of the brokers insolvency. Furthermore, the absence of investor protection mechanisms, such as compensation schemes, leaves clients exposed to potential financial risks.

Historically, unregulated brokers have faced allegations of misappropriating client funds, which underscores the importance of selecting a brokerage with robust security measures in place. Given the lack of information regarding Blooms Markets fund safety policies, it is essential for potential traders to carefully consider the implications of investing with a broker that does not prioritize customer fund security. Thus, the question of is Blooms Markets safe looms large in this context.

Customer Experience and Complaints

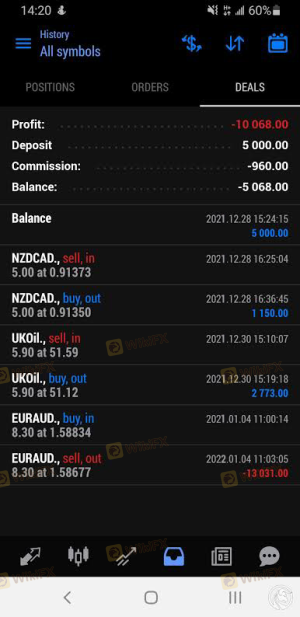

Analyzing customer feedback is vital for understanding the overall experience provided by a broker. Unfortunately, Blooms Markets has received numerous negative reviews from users, with common complaints revolving around withdrawal issues, poor customer service, and difficulties in executing trades.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Locking | High | Poor |

| Customer Service | Medium | Poor |

Many users have reported being unable to withdraw their funds, often citing excessive fees or being pressured to pay additional taxes before their withdrawals could be processed. Such practices are alarming and indicative of a potentially fraudulent operation. Additionally, the companys lack of responsiveness to complaints raises further concerns about its commitment to customer support. These issues contribute to the growing sentiment that is Blooms Markets safe is a question that should be answered with caution.

Platform and Trade Execution

The performance of a trading platform is a critical factor for traders. Blooms Markets claims to utilize the popular MetaTrader 5 (MT5) platform; however, users have reported issues with platform stability and execution quality. Concerns about slippage and order rejections have also been raised, which can significantly affect trading outcomes.

Moreover, any signs of platform manipulation, such as preventing trades from executing at market prices, can further erode trust in the broker. A reliable trading platform should provide seamless execution and real-time data, enabling traders to make informed decisions. Given the reported issues with Blooms Markets, it is essential for prospective clients to weigh the risks carefully when considering whether is Blooms Markets safe for their trading activities.

Risk Assessment

Trading with Blooms Markets poses several risks that potential clients should be aware of. The lack of regulation, transparency, and customer support raises significant red flags.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from financial authorities. |

| Financial Risk | High | Potential for fund misappropriation. |

| Operational Risk | Medium | Issues with platform stability and support. |

To mitigate these risks, it is advisable for traders to conduct thorough due diligence before engaging with Blooms Markets. Seeking out regulated alternatives with clear fee structures, robust customer support, and positive user reviews can provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that is Blooms Markets safe is a question that leans towards a negative response. The lack of regulatory oversight, transparency issues, and numerous complaints from users indicate a high level of risk associated with trading on this platform. Potential traders should exercise extreme caution and consider alternative, regulated brokers that prioritize customer security and offer clear trading conditions. For those seeking reliable options, brokers with established reputations and regulatory compliance should be prioritized to ensure a safer trading experience.

Is BloomsMarkets a scam, or is it legit?

The latest exposure and evaluation content of BloomsMarkets brokers.

BloomsMarkets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BloomsMarkets latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.