Is IAL safe?

Pros

Cons

Is IAL Safe or a Scam?

Introduction

IAL is a relatively new player in the forex market, established in 2020 and based in Switzerland. As an online trading broker, it offers a range of financial products, including forex, stocks, and commodities, primarily through the widely-used MetaTrader 5 platform. Given the increasing number of scams in the trading industry, it is crucial for traders to carefully evaluate the legitimacy of brokers like IAL. This article aims to provide a comprehensive assessment of IAL's safety and reliability by examining its regulatory status, company background, trading conditions, customer experiences, and more.

To conduct this investigation, we analyzed multiple sources, including user reviews, regulatory information, and expert analyses. Our evaluation framework focuses on key aspects that affect the safety and trustworthiness of a broker, including regulatory compliance, financial practices, customer service, and overall market reputation.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its safety. A regulated broker is subject to oversight by financial authorities, which can provide a layer of protection for traders. Unfortunately, IAL does not appear to be regulated by any recognized financial authority. This lack of regulation raises significant concerns regarding its legitimacy and the safety of client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulatory oversight means that IAL is not obligated to adhere to any specific standards or practices designed to protect traders. This situation can lead to higher risks, as unregulated brokers may engage in practices that could jeopardize client funds. Moreover, the lack of historical compliance records further complicates the assessment of IAL's trustworthiness. In the forex market, brokers that are not licensed often lack the transparency required for safe trading, making it imperative for traders to approach such platforms with caution.

Company Background Investigation

IAL was founded in 2020, and its operational history is relatively short compared to established brokers. The company's ownership structure and management team remain obscure, which raises additional concerns about transparency. A broker's management team often plays a crucial role in its operations, and a lack of information about their backgrounds can be a red flag.

The absence of detailed disclosures about the company's leadership and operational practices can lead to questions about its reliability. Transparency in a broker's operations is vital for building trust among potential clients. Without clear information, traders may find it challenging to assess the broker's credibility. As such, the limited information available on IAL's management and ownership further complicates the evaluation of its safety.

Trading Conditions Analysis

When considering whether IAL is safe, it is essential to analyze the trading conditions it offers. IAL claims to provide competitive trading costs, including tight spreads and high leverage. However, the absence of a transparent fee structure raises concerns about potential hidden costs that could affect traders' profitability.

| Fee Type | IAL | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.7 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | N/A | Varies |

While the advertised spreads appear attractive, the lack of clarity regarding commissions and overnight fees can be problematic. Traders may find themselves facing unexpected charges that could diminish their trading returns. Additionally, the high leverage of up to 1:400 offered by IAL could pose risks, especially for inexperienced traders who may not fully understand the implications of such leverage.

Customer Fund Security

The safety of customer funds is paramount when evaluating a broker's reliability. IAL's lack of regulatory oversight raises questions about its fund security measures. A reputable broker typically implements measures such as segregated accounts to protect client funds and investor compensation schemes to offer additional security.

Unfortunately, there is little information available regarding IAL's fund protection policies. The absence of such measures can leave traders vulnerable to potential losses, especially if the broker encounters financial difficulties. Historical issues related to fund security can also be a concern; however, there is no publicly available information indicating any past incidents involving IAL.

Customer Experience and Complaints

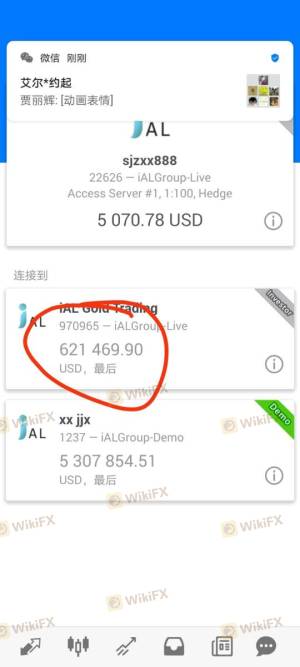

Customer feedback is a valuable resource for assessing a broker's performance and reliability. Reviews and testimonials from current and former clients can provide insight into the quality of service, responsiveness, and overall satisfaction. However, IAL has received several complaints regarding withdrawal issues and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Communication | Medium | Average |

For instance, some users have reported difficulties in withdrawing their funds, with claims of long delays and unfulfilled promises. This pattern of complaints raises significant concerns about IAL's operational integrity and customer support capabilities. Traders should be cautious when dealing with a broker that has a history of unresolved complaints, as it may indicate deeper issues within the company's practices.

Platform and Trade Execution

The trading platform's performance is another critical aspect to consider when evaluating whether IAL is safe. IAL utilizes the MetaTrader 5 platform, which is known for its reliability and user-friendly interface. However, the overall execution quality, including slippage and order rejection rates, is vital for traders.

While MT5 is generally well-regarded, there have been reports of execution issues with IAL, including instances of slippage during high volatility periods. These issues can significantly impact trading outcomes and raise concerns about the broker's commitment to fair execution practices.

Risk Assessment

Evaluating the risks associated with trading through IAL is essential for making an informed decision. The lack of regulation, unclear trading conditions, and negative customer experiences contribute to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Lack of fund protection measures |

| Operational Risk | Medium | Complaints regarding withdrawals |

To mitigate these risks, traders are advised to conduct thorough research, avoid investing large sums of money, and consider using a demo account to test the platform before committing real funds.

Conclusion and Recommendations

In conclusion, the evidence suggests that IAL presents several red flags that warrant caution. The absence of regulatory oversight, coupled with a lack of transparency and numerous customer complaints, raises significant concerns about its safety. Traders should be wary of engaging with IAL, as the potential for issues related to fund security and customer service could outweigh any potential benefits.

For those seeking reliable alternatives, it is advisable to consider brokers that are regulated by reputable authorities, offer transparent fee structures, and have positive customer feedback. By prioritizing safety and reliability, traders can better protect their investments and enhance their trading experience.

Is IAL a scam, or is it legit?

The latest exposure and evaluation content of IAL brokers.

IAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IAL latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.