Regarding the legitimacy of BitmaX forex brokers, it provides CYSEC and WikiBit, .

Is BitmaX safe?

Pros

Cons

Is BitmaX markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Safecap Investments Ltd

Effective Date:

2008-07-28Email Address of Licensed Institution:

info@safecapltd.comSharing Status:

No SharingWebsite of Licensed Institution:

www.markets.com/enExpiration Time:

--Address of Licensed Institution:

10 Simonides Street, Cypress Tower, 2nd & 3rd floors, Strovolos, 2046, Nicosia, CyprusPhone Number of Licensed Institution:

+357 22 278 853Licensed Institution Certified Documents:

Is Bitmax A Scam?

Introduction

Bitmax is a cryptocurrency trading platform that has emerged as a player in the volatile forex market, primarily focusing on digital assets. As the popularity of cryptocurrencies continues to rise, traders are increasingly drawn to platforms like Bitmax, which promise high returns and a wide range of trading options. However, with the influx of brokers in the market, it is crucial for traders to exercise caution and thoroughly evaluate the credibility of these platforms. This article aims to provide a comprehensive analysis of Bitmax, addressing its regulatory status, company background, trading conditions, client safety measures, and user experiences to determine whether Bitmax is safe or a potential scam.

To conduct this investigation, we have utilized various sources, including user reviews, regulatory databases, and expert opinions. The evaluation framework focuses on key aspects that are vital for assessing the safety and reliability of a trading platform, ensuring that traders have all the necessary information to make an informed decision.

Regulation and Legitimacy

The regulatory environment in which a broker operates is a critical factor in determining its legitimacy. Regulation helps ensure that brokers adhere to specific standards that protect traders' interests. In the case of Bitmax, there are significant concerns regarding its regulatory status.

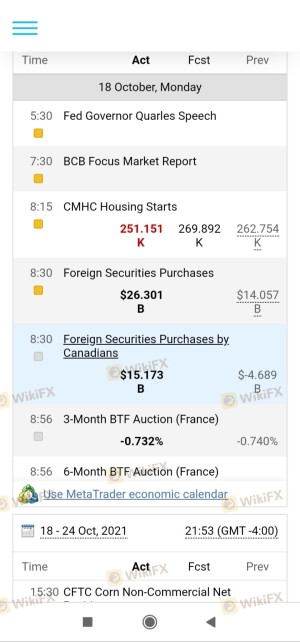

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 092/08 | Cyprus | Suspected Clone |

Bitmax claims to be regulated by CySEC; however, this license is deemed suspicious and is categorized as a "clone" license. This means that while Bitmax may present itself as a regulated entity, the actual regulatory oversight may be non-existent or minimal. The absence of a robust regulatory framework raises red flags, indicating that Bitmax may not be safe for traders looking to protect their investments.

Moreover, the importance of quality regulation cannot be overstated. High-quality regulators such as the FCA (UK) or ASIC (Australia) impose strict requirements on brokers, including capital adequacy, regular audits, and client fund protection measures. In contrast, the regulatory environment in Cyprus has been criticized for being lenient, making it a haven for untrustworthy brokers. Therefore, the lack of credible regulation for Bitmax necessitates caution.

Company Background Investigation

Understanding the company behind the trading platform is crucial for assessing its credibility. Bitmax's history and ownership structure reveal a lack of transparency that is concerning for potential investors. The broker claims to be operated by Safe Cap Investments Limited, a company based in Cyprus. However, information regarding its establishment, ownership, and operational history remains vague and unverified.

The management team behind Bitmax is also not well-documented, which raises questions about their qualifications and experience in the financial services industry. A robust management team typically brings credibility to a broker, but the anonymity surrounding Bitmax's leadership may indicate a lack of accountability.

Furthermore, the overall transparency of the company is questionable. Traders should be able to access clear information about the broker's operations, management, and financial health. However, Bitmax's limited disclosures make it difficult for potential clients to evaluate its legitimacy.

Trading Conditions Analysis

When evaluating a broker, the trading conditions offered are of utmost importance. This includes the fee structure, spreads, and overall trading costs. Bitmax claims to provide competitive trading conditions; however, a closer examination reveals potential issues.

The overall fee structure of Bitmax appears to be somewhat opaque, with limited information available on spreads, commissions, and overnight fees. This lack of clarity can lead to unexpected costs for traders.

| Fee Type | Bitmax | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | 1-2 pips |

| Commission Model | Not Disclosed | Varies |

| Overnight Interest Range | Not Disclosed | Varies |

The absence of clear information regarding trading costs is a significant concern. Traders may find themselves facing higher-than-expected charges, impacting their overall profitability. Moreover, the lack of competitive spreads compared to industry standards raises questions about the platform's reliability. Therefore, it is essential for traders to consider whether Bitmax is safe in terms of its trading conditions.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Bitmax has stated that it implements various security measures to protect clients' investments. However, the effectiveness of these measures remains uncertain.

Bitmax claims to segregate client funds from its operational funds, which is a standard practice among reputable brokers. This segregation ensures that even in the event of bankruptcy, clients' funds remain protected. Additionally, the broker purports to offer negative balance protection, preventing clients from losing more than their initial investment.

Nevertheless, the historical context of Bitmax's operations raises concerns. There have been reports of withdrawal issues and fund access problems, which suggest that the safety of client funds may not be guaranteed. Traders should be wary of any broker with a history of financial disputes or complaints regarding fund safety, as this could indicate underlying issues that may compromise their investments.

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding the overall experience of users on a trading platform. In the case of Bitmax, user reviews are mixed, with several complaints surfacing regarding withdrawal difficulties and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support | Medium | Limited Availability |

Common complaints include difficulties in withdrawing funds and slow customer support responses. For instance, some users have reported that their withdrawal requests were delayed for extended periods, leading to frustration and distrust. The lack of timely responses from customer support further exacerbates these issues, leaving clients feeling unsupported.

A notable case involved a user who deposited a significant amount but was unable to access their funds for several weeks. This situation highlights the potential risks associated with trading on Bitmax and raises questions about the platform's reliability. Therefore, it is crucial for traders to consider whether Bitmax is safe based on the experiences of others.

Platform and Execution

The performance and stability of a trading platform are critical factors for a successful trading experience. Bitmax claims to provide a user-friendly platform with advanced features. However, user experiences suggest that the platform may not meet expectations.

Traders have reported issues with order execution, including slippage and rejected orders during high volatility periods. These issues can significantly impact trading outcomes, especially for those employing strategies that rely on precise execution. Furthermore, the absence of a widely recognized trading platform, such as MetaTrader 4 or 5, raises concerns about the reliability of Bitmax's proprietary platform.

The lack of robust security measures and potential signs of platform manipulation further complicate the assessment of Bitmax's trading environment. Traders should be cautious and consider whether the platform can provide a reliable and secure trading experience.

Risk Assessment

Using Bitmax comes with inherent risks that traders should be aware of. The combination of regulatory concerns, customer complaints, and platform performance issues creates a challenging environment for potential users.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of credible regulation raises concerns. |

| Fund Safety Risk | Medium | Reports of withdrawal issues and disputes. |

| Platform Reliability | High | Execution issues could impact trading outcomes. |

To mitigate these risks, traders should conduct thorough due diligence before engaging with Bitmax. It is advisable to start with a small investment and test the platform's functionality before fully committing funds. Additionally, traders should explore alternative brokers with stronger regulatory oversight and proven track records.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns regarding the safety and reliability of Bitmax. The platform's lack of credible regulation, coupled with customer complaints about fund access and withdrawal issues, suggests that traders should exercise caution.

While Bitmax may offer attractive trading conditions, the potential risks associated with using the platform cannot be overlooked. Therefore, it is crucial for traders to assess whether Bitmax is safe for their trading needs. For those seeking a more secure trading environment, it may be wise to consider alternative brokers with established reputations and robust regulatory frameworks.

In summary, while Bitmax presents itself as a viable trading option, the risks involved warrant careful consideration. Traders are encouraged to prioritize safety and reliability by opting for brokers that are well-regulated and have demonstrated a commitment to protecting their clients' interests.

Is BitmaX a scam, or is it legit?

The latest exposure and evaluation content of BitmaX brokers.

BitmaX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BitmaX latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.