Is Banyan safe?

Pros

Cons

Is Banyan Safe or Scam?

Introduction

Banyan is a forex broker that has garnered attention in the trading community for its various offerings. As a player in the forex market, it positions itself as a platform for traders looking to engage in currency trading. However, the landscape of forex trading is fraught with potential pitfalls, making it essential for traders to exercise caution when choosing a broker. The importance of thorough evaluations cannot be overstated, as the right broker can significantly impact trading success, while the wrong choice can lead to financial losses or even scams.

In this article, we will investigate whether Banyan is a safe trading option or if it raises any red flags that traders should be aware of. Our research methodology includes analyzing regulatory compliance, company background, trading conditions, customer safety measures, and user experiences. Through a structured assessment, we aim to provide a comprehensive overview of Banyan's credibility in the forex market.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its legitimacy. A regulated broker is typically subject to strict oversight, which can provide a layer of security for traders. In the case of Banyan, the regulatory landscape appears to be concerning. According to various sources, Banyan operates with a suspicious regulatory license and has been flagged for having low scores on verification platforms like WikiFX.

Core Regulatory Information

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | Unauthorized | United States | Low Score |

| ASIC | Suspicious Clone | Australia | Low Score |

Banyan's lack of solid regulatory backing raises questions about its operational legitimacy. The absence of a reputable regulatory framework could expose traders to risks such as fraud and mismanagement of funds. Furthermore, the historical compliance record of the broker is unclear, which adds to the concerns about its safety.

Company Background Investigation

Understanding the company behind a forex broker is crucial for assessing its trustworthiness. Banyan's history and ownership structure provide insights into its operational practices. While specific details about its founding and development are scarce, the company appears to have been around for several years, indicating some level of stability. However, the lack of transparency regarding its ownership and management team is concerning.

The management teams background is critical in evaluating the broker's credibility. A team with extensive experience in finance and trading can often indicate a more reliable operation. Unfortunately, there is limited information available about the professionals leading Banyan, which raises questions about their qualifications and the overall transparency of the firm.

Trading Conditions Analysis

Examining the trading conditions offered by Banyan is essential for understanding the costs associated with trading on its platform. The overall fee structure is a key aspect that can significantly impact a trader's bottom line. Reports suggest that Banyan employs a model that may include hidden fees or unusual charges, which can be detrimental to traders.

Core Trading Costs Comparison

| Fee Type | Banyan | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Model | Unclear | Transparent |

| Overnight Interest Range | Varies | Standard |

The potential for high spreads and unclear commission structures suggests that traders may encounter unexpected costs when trading with Banyan. This lack of clarity in the fee structure is a significant red flag, as it can lead to confusion and disputes over trading costs.

Customer Funds Safety

The safety of customer funds is paramount when evaluating a forex broker. Banyan's measures for ensuring the security of client funds will be scrutinized. Reports indicate that Banyan employs certain safety measures, but the effectiveness of these measures is questionable.

Traders must be aware of how their funds are managed. Are they held in segregated accounts? Is there investor protection in place? Furthermore, Banyan's policies regarding negative balance protection need to be assessed. A broker that does not offer such protections can leave traders vulnerable to substantial losses.

Customer Experience and Complaints

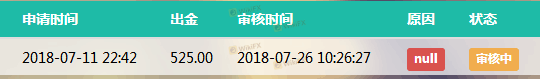

Customer feedback is a valuable resource for assessing a broker's reliability. Reviews suggest that Banyan has received mixed feedback from users, with some praising its features while others report significant issues. Common complaints include difficulties in withdrawing funds and poor customer service.

Major Complaint Types

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Service Quality | Medium | Unresponsive |

Typical cases of withdrawal issues can severely impact a trader's experience and raise concerns about the broker's operational integrity. The slow response from customer service also indicates a lack of support for traders facing problems.

Platform and Execution

The trading platform's performance and execution quality are critical factors for traders. Banyan's platform has been reported to have stability issues, which could lead to delays in trade execution. Additionally, concerns about slippage and order rejections have been raised, indicating that the platform may not be functioning optimally.

A broker that fails to provide a reliable trading environment can significantly hinder a trader's ability to execute strategies effectively. Therefore, assessing the platform's performance is essential for determining if Banyan is safe for trading.

Risk Assessment

Trading with any broker involves inherent risks. A comprehensive risk assessment of Banyan will help traders understand the potential pitfalls associated with using this platform.

Risk Scorecard

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of solid regulation |

| Financial Risk | Medium | Unclear fee structure |

| Operational Risk | High | Platform stability issues |

Traders should be aware of these risks and consider implementing risk mitigation strategies, such as setting strict stop-loss orders and only investing what they can afford to lose.

Conclusion and Recommendations

In conclusion, the evidence suggests that traders should exercise caution when considering Banyan as their forex broker. The concerns regarding its regulatory status, unclear fee structure, and customer complaints indicate potential risks that may not be worth taking.

For traders seeking reliable alternatives, it may be prudent to consider brokers with solid regulatory backing, transparent fee structures, and positive customer feedback. Options such as brokers regulated by the FCA or ASIC may provide a safer trading environment. Ultimately, thorough research and careful consideration are essential for making informed trading decisions.

In summary, while Banyan may offer some appealing features, the potential risks associated with trading on its platform warrant careful scrutiny. Is Banyan safe? The answer remains uncertain, and traders are advised to proceed with caution.

Is Banyan a scam, or is it legit?

The latest exposure and evaluation content of Banyan brokers.

Banyan Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Banyan latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.