Is MORSE safe?

Pros

Cons

Is Morse Safe or a Scam?

Introduction

Morse is a forex broker that has positioned itself in the competitive landscape of online trading, particularly focusing on the retail forex market. Established in 2018 and based in Seychelles, Morse offers trading services through the MetaTrader 5 platform. However, the rapid growth of the forex market has also led to an increase in fraudulent activities, making it essential for traders to carefully evaluate the legitimacy of brokers before committing their funds. This article aims to provide an objective assessment of Morse, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our evaluation is based on a thorough analysis of various online resources, user reviews, and regulatory databases.

Regulation and Legitimacy

The regulatory framework within which a broker operates is critical to its legitimacy. A well-regulated broker is subject to strict oversight, ensuring that it adheres to industry standards designed to protect traders. Unfortunately, Morse does not appear to be regulated by any recognized financial authority, which raises significant concerns about its operations.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Seychelles | Not Regulated |

The absence of regulation means that Morse does not have to comply with the rigorous requirements that licensed brokers must adhere to, such as maintaining client funds in segregated accounts and providing a transparent trading environment. This lack of oversight increases the risk for traders, as they may have no recourse if issues arise, such as withdrawal problems or disputes over trades. Furthermore, the Seychelles jurisdiction is often viewed as a less stringent regulatory environment, attracting brokers that may not meet the standards of more reputable regulatory bodies. Therefore, the question remains: Is Morse safe? The answer leans toward caution, as traders should be wary of engaging with unregulated brokers.

Company Background Investigation

Morse was founded in 2018, which means it is relatively new in the forex trading space. While a newer broker is not inherently a scam, it does come with its own set of risks, particularly regarding its operational history and reputation. The company's ownership structure is not clearly disclosed, which can be a red flag for potential investors. A lack of transparency regarding the management team also raises concerns about the broker's accountability and operational integrity.

The management team's background is crucial in assessing the broker's credibility. Unfortunately, there is limited information available about the individuals behind Morse, making it difficult to evaluate their experience and qualifications in the financial industry. This lack of transparency can lead to skepticism about the broker's intentions and operational practices. Furthermore, the absence of a clear corporate history may indicate a lack of commitment to long-term service and reliability.

Trading Conditions Analysis

Morse's trading conditions are another critical area of evaluation. A broker's fee structure and trading costs can significantly impact a trader's profitability. For Morse, the overall fees seem to be competitive but lack clarity, particularly regarding hidden charges or unusual fee policies.

| Fee Type | Morse | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies | 1.0 - 2.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | 2% - 5% |

The spread on major currency pairs can vary, and while some traders may find it acceptable, others may consider it high compared to industry averages. The lack of a commission model may seem attractive, but it is essential to verify whether this could lead to hidden costs elsewhere. Additionally, the overnight interest rates can be a significant factor for traders who hold positions overnight; hence, understanding these rates is crucial for effective risk management.

Client Funds Security

The security of client funds is paramount when evaluating any broker. Morse's approach to safeguarding client funds raises several questions, particularly given its lack of regulation. Without a regulatory body overseeing its operations, it is unclear what measures Morse has in place to protect client funds.

Typically, reputable brokers maintain segregated accounts for client funds, ensuring that traders' money is kept separate from the broker's operational funds. However, there is no evidence to suggest that Morse follows this practice, which could put client funds at risk in the event of financial difficulties or insolvency. Moreover, the absence of investor protection schemes further exacerbates these concerns, leaving traders vulnerable to potential losses.

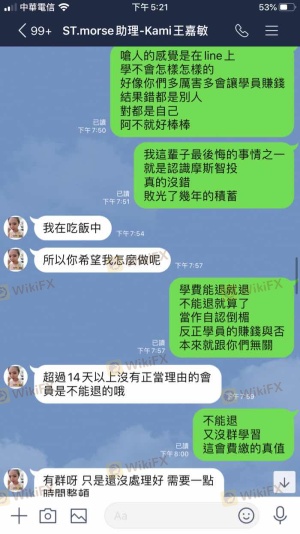

Customer Experience and Complaints

Customer feedback is an invaluable resource when assessing a broker's reliability. Reviews of Morse reveal a mixed bag of experiences, with several users expressing dissatisfaction with the broker's customer service and withdrawal processes.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support | Medium | Limited Availability |

Common complaints include difficulties in withdrawing funds and inadequate customer support. These issues can significantly impact a trader's experience and raise questions about the broker's operational integrity. One notable case involved a user who reported that after placing an order, the broker's support team became unresponsive, leading to a significant financial loss. Such incidents highlight the potential risks associated with trading through Morse.

Platform and Execution

The trading platform offered by Morse is MetaTrader 5, a well-regarded platform in the industry. However, user experiences suggest that the platform may not perform optimally at all times. Traders have reported issues with order execution, including slippage and occasional rejections of orders.

The overall stability of the platform is crucial for traders, as any downtime or lag can result in missed opportunities. Furthermore, the absence of any notable indicators of platform manipulation is a positive aspect; however, the reported execution issues raise concerns about the reliability of trading through Morse.

Risk Assessment

When considering whether to trade with Morse, it is essential to evaluate the associated risks. Given the broker's unregulated status, the potential for fund security issues, and the mixed customer feedback, the overall risk profile appears elevated.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight |

| Financial Risk | High | Lack of fund protection measures |

| Operational Risk | Medium | Mixed reviews on customer service and execution |

Traders should approach Morse with caution and consider implementing risk mitigation strategies, such as limiting exposure and diversifying investments across multiple brokers.

Conclusion and Recommendations

In conclusion, the evidence suggests that Morse may not be a safe choice for traders. The lack of regulation, mixed reviews regarding customer experiences, and unclear trading conditions raise significant red flags. While Morse may offer competitive trading conditions, the potential risks associated with trading through an unregulated broker outweigh the benefits.

For traders seeking a more secure trading environment, it is advisable to consider brokers that are well-regulated and have a proven track record of reliability. Alternatives such as brokers regulated by the FCA, ASIC, or CySEC may offer better protection and transparency. Ultimately, traders should prioritize their safety and security when choosing a broker, and given the current evidence, Morse does not appear to meet these essential criteria.

Is MORSE a scam, or is it legit?

The latest exposure and evaluation content of MORSE brokers.

MORSE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MORSE latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.