B Capital 2025 Review: Everything You Need to Know

Executive Summary

This b capital review presents a comprehensive analysis of B Capital. B Capital is a multi-stage investment firm that operates in multiple capacities within the financial services sector. Established in 2015 as B Capital Group and with additional operations dating back to 2008 for their forex brokerage services, B Capital manages over $6 billion in capital commitments. The firm maintains strategic partnerships with Boston Consulting Group.

B Capital positions itself as an investment company focusing on technology, healthcare, and climate sectors. The company also provides portfolio management, private equity, and multi-family office services. The firm's substantial capital base and strategic partnerships suggest a robust operational foundation. However, our analysis reveals significant gaps in publicly available information regarding specific trading conditions, regulatory oversight, and detailed service offerings.

This review finds B Capital suitable primarily for high-net-worth individuals and institutional investors seeking portfolio diversification and private equity services. However, the lack of comprehensive regulatory information and specific trading condition details presents challenges for potential retail clients. These clients seek transparent forex brokerage services.

Key Keyword: This b capital review aims to provide clarity on the firm's offerings despite limited publicly available operational details.

Important Notice

This evaluation is based on available information from public sources and company materials. It's important to note that specific regulatory information, detailed trading conditions, and comprehensive service terms were not extensively detailed in available sources. Readers should conduct independent verification of all claims. They should also seek updated information directly from B Capital before making investment decisions.

The analysis methodology employed focuses on publicly available information. Some critical details regarding cross-regional regulatory differences may not be fully represented in this assessment.

Rating Framework

Based on available information, here are our ratings across six key dimensions:

Note: Ratings marked as N/A indicate insufficient publicly available information for accurate assessment.

Broker Overview

B Capital operates as a multi-faceted financial services organization with two primary operational entities. B Capital Group was established in 2015. It functions as a venture capital and investment firm specializing in technology, healthcare, and climate-focused enterprises. The organization manages substantial capital commitments exceeding $6 billion and maintains strategic relationships with major consulting firms, particularly Boston Consulting Group.

The firm's business model centers on multi-stage investment strategies. It supports companies across various sectors including fintech, healthcare, and enterprise solutions. B Capital's approach combines traditional venture capital methodologies with strategic consulting insights. This positioning allows them to support portfolio companies beyond mere financial investment.

B Capital Forex Broker has been operational since 2008. It provides additional services including portfolio management, private equity solutions, and multi-family office services. This division appears to cater to sophisticated investors requiring comprehensive wealth management solutions rather than traditional retail forex trading services.

According to available sources, the firm's investment philosophy focuses on supporting visionaries shaping tomorrow's business landscape. This indicates a forward-looking approach to investment selection and portfolio management. However, specific details regarding trading platforms, asset classes, and regulatory oversight remain limited in publicly available documentation.

This b capital review finds that while the firm demonstrates substantial capital backing and strategic partnerships, the lack of detailed operational information may present challenges. Potential clients seeking comprehensive service transparency may encounter difficulties.

Regulatory Status

Available sources do not provide specific information regarding regulatory oversight. Licensing details for B Capital's operations across different jurisdictions are also not provided.

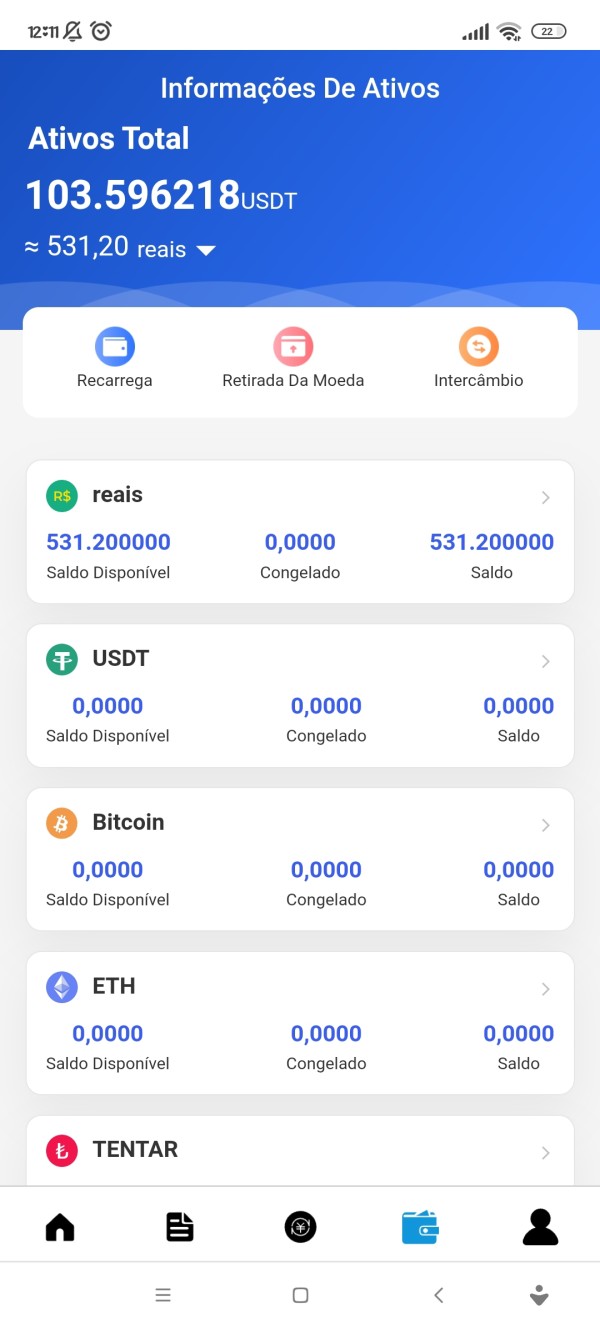

Deposit and Withdrawal Methods

Specific information about deposit and withdrawal options is not detailed in available sources. Processing times and associated fees are also not specified.

Minimum Deposit Requirements

The minimum deposit requirements for various account types and services are not specified. This information is not available in publicly available materials.

Information regarding promotional offers, bonuses, or incentive programs is not available. Current sources do not provide these details.

Tradeable Assets

Based on the firm's business model, B Capital appears to focus on equity investments, private placements, and portfolio management services. The firm does not emphasize traditional forex or CFD trading.

Cost Structure

Detailed information about spreads, commissions, management fees, or other cost structures is not provided. Available sources limit transparency for potential clients.

Leverage Ratios

Specific leverage ratios or margin requirements are not mentioned. Publicly available documentation does not include this information.

Information about trading platforms, software options, or technological infrastructure is not detailed. Current sources do not provide these specifications.

Regional Restrictions

Geographic limitations or regional availability restrictions are not specified. Available materials do not include this information.

Customer Service Languages

The languages supported by customer service teams are not mentioned. Publicly available sources do not provide this detail.

This b capital review highlights the significant information gaps that potential clients may encounter. These gaps appear when evaluating the firm's services.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of B Capital's account conditions faces significant limitations. Insufficient publicly available information creates these constraints. Traditional forex brokers typically offer multiple account types with varying minimum deposits, spreads, and features. However, B Capital's specific account structure remains unclear from available sources.

Given the firm's focus on institutional and high-net-worth clients, it's reasonable to assume that account minimums may be substantially higher than typical retail forex brokers. However, without specific documentation, potential clients cannot adequately assess whether the account conditions align with their investment objectives. They also cannot determine if conditions match their capital availability.

The absence of detailed account information represents a significant transparency gap. This includes Islamic account options, special features, or tiered service levels. Professional investors typically require comprehensive understanding of account structures before committing capital. This information deficit is particularly concerning.

For this b capital review, the lack of specific account condition details prevents accurate assessment of this crucial criterion. Potential clients should directly contact B Capital for detailed account information. They should do this before proceeding with any investment decisions.

The assessment of B Capital's trading tools and resources encounters substantial limitations. Insufficient detailed information in available sources creates these constraints. Modern investment firms typically provide comprehensive analytical tools, research resources, and educational materials to support client decision-making.

While B Capital's partnership with Boston Consulting Group suggests potential access to high-quality research and strategic insights, specific details about available tools remain unclear. Analytical platforms and research resources are not outlined in publicly available materials.

Educational resources are increasingly important for investor development. However, these are not detailed in current sources. Similarly, information about automated trading support, algorithmic trading capabilities, or advanced analytical tools remains unavailable.

The firm's focus on venture capital and private equity suggests that their tools and resources may differ significantly from traditional forex brokers. They potentially emphasize fundamental analysis, market research, and strategic consulting rather than technical trading tools.

Customer Service and Support Analysis

The evaluation of B Capital's customer service capabilities is severely limited. The absence of specific information regarding support channels, availability, and service quality metrics creates this limitation. Professional financial services firms typically provide multiple communication channels including phone, email, and potentially live chat support.

Response time expectations, service level agreements, and escalation procedures are not detailed in available sources. For institutional and high-net-worth clients, prompt and knowledgeable customer service is typically crucial. This helps maintain business relationships and address complex inquiries.

Multi-language support capabilities are important for international clients. However, these are not specified in current documentation. Similarly, customer service hours, regional support teams, and specialized support for different service categories remain unclear.

The lack of customer service information represents a significant transparency gap. This may concern potential clients, particularly those requiring ongoing support for complex investment strategies or portfolio management services.

Trading Experience Analysis

The assessment of B Capital's trading experience faces fundamental challenges. Limited information about platform performance, execution quality, and user interface design creates these challenges. Traditional forex brokers typically provide detailed specifications about order execution speeds, platform stability, and trading environment characteristics.

Platform reliability metrics, server uptime statistics, and execution quality data are not available in current sources. For active traders or institutions requiring consistent platform performance, this information gap presents significant evaluation challenges.

Mobile trading capabilities are increasingly important for modern investors. However, these are not detailed in available documentation. Similarly, information about platform customization options, advanced order types, or trading automation features remains unavailable.

Given B Capital's apparent focus on longer-term investment strategies rather than active trading, their platform requirements may differ significantly from traditional forex brokers. However, without specific information, this b capital review cannot adequately assess the trading experience quality.

Trust and Security Analysis

The evaluation of B Capital's trustworthiness and security measures encounters significant limitations. Insufficient regulatory and security information in available sources creates these constraints. Trust assessment typically relies on regulatory oversight, financial transparency, and established industry reputation.

While the firm's substantial capital commitments and strategic partnerships suggest operational credibility, specific regulatory licenses remain unclear. Oversight mechanisms and compliance frameworks are not detailed in publicly available materials.

Fund security measures, segregation policies, and client asset protection protocols are not specified in current sources. For institutional and high-net-worth clients, understanding these security measures is crucial. This understanding supports risk assessment and due diligence processes.

The absence of detailed regulatory information, third-party audits, or industry certifications limits the ability to conduct comprehensive trust assessment. This represents a significant concern for potential clients requiring high security standards.

User Experience Analysis

The assessment of B Capital's user experience faces substantial limitations. Insufficient information about client satisfaction, interface design, and operational processes creates these constraints. User experience evaluation typically encompasses registration procedures, platform usability, and overall client satisfaction metrics.

Account opening procedures, verification requirements, and onboarding processes are not detailed in available sources. For sophisticated investors, streamlined yet thorough onboarding processes are typically important. These help establish business relationships efficiently.

Client satisfaction surveys, testimonials, or independent reviews are not prominently featured in available materials. This limits insight into actual user experiences. Similarly, information about common client concerns, resolution procedures, or service improvement initiatives remains unavailable.

The lack of comprehensive user experience information prevents accurate assessment of client satisfaction levels and service quality. This represents a significant evaluation gap for potential clients.

Conclusion

This b capital review concludes with a neutral overall assessment. Significant information limitations regarding essential service details, regulatory oversight, and operational transparency create this neutral stance. While B Capital demonstrates substantial capital backing with over $6 billion in managed commitments and strategic partnerships with established consulting firms, the lack of comprehensive publicly available information presents challenges for thorough evaluation.

B Capital appears most suitable for institutional investors and high-net-worth individuals seeking private equity exposure and portfolio management services. The firm does not focus on traditional retail forex trading. The firm's strengths include substantial financial backing and strategic industry partnerships. However, weaknesses center on limited transparency regarding specific service conditions, regulatory status, and operational details.

Potential clients should conduct direct due diligence with B Capital to obtain detailed information. They should gather details about account conditions, regulatory compliance, fee structures, and service specifications before making investment decisions.