Is AnyTrades safe?

Pros

Cons

Is Anytrades A Scam?

Introduction

Anytrades is an online forex broker that positions itself as a provider of various trading options, including Contracts for Difference (CFDs) across multiple asset classes such as forex, commodities, and indices. Established in 2016, the broker claims to offer innovative trading solutions and a user-friendly platform. However, the influx of online trading platforms has made it imperative for traders to exercise caution and rigorously evaluate the credibility of such brokers. With numerous reports of scams and fraudulent activities in the forex market, understanding the regulatory status, trading conditions, and overall reputation of Anytrades is crucial for potential investors.

This article aims to provide a thorough investigation into whether Anytrades is a safe trading option or a potential scam. The evaluation framework includes an analysis of regulatory compliance, company background, trading conditions, client fund safety, customer experiences, platform performance, and risk assessment. By synthesizing information from various reliable sources, we aim to present an objective overview of Anytrades.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy and trustworthiness. Anytrades claims to be regulated by the Vanuatu Financial Services Commission (VFSC), which is often criticized for its lenient regulatory standards. The significance of having a robust regulatory framework cannot be overstated, as it provides a layer of protection for traders against potential fraud.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| VFSC | 14691 | Vanuatu | Verified |

While Anytrades does hold a license from the VFSC, it is essential to note that this regulatory body is considered a low-tier authority compared to more reputable regulators like the UK's Financial Conduct Authority (FCA) or Australia's Australian Securities and Investments Commission (ASIC). The VFSC's regulatory oversight lacks the stringent measures found in these higher-tier jurisdictions, raising concerns about the safety of funds and the broker's compliance with industry standards.

Moreover, multiple warnings have been issued against Anytrades by various financial authorities, including the FCA and the Central Bank of Ireland, indicating that the broker may not be operating legitimately. The lack of a strong regulatory framework and the presence of these warnings contribute to the perception that Anytrades may not be safe for potential investors.

Company Background Investigation

Anytrades is operated by a company known as Any Trades Consulting Ltd., which is registered in Vanuatu. The broker claims to have established itself as a significant player in the forex market since its inception. However, details regarding the ownership structure and the management team remain vague, which is a cause for concern regarding transparency.

The management team's background and professional experience are critical in assessing the broker's credibility. Unfortunately, there is limited publicly available information about the individuals behind Anytrades, which raises questions about their qualifications and experience in the financial sector. A lack of transparency in this area can often be a red flag for potential investors, as it may indicate that the broker is not forthcoming about its operations or intentions.

Furthermore, the information disclosure level on the Anytrades website is notably lacking. Essential details about trading conditions, fees, and risk factors are either insufficiently explained or hidden in fine print. This lack of clarity can be detrimental to traders looking to make informed decisions, as it may lead to unexpected costs or unfavorable trading conditions.

Trading Conditions Analysis

The trading conditions offered by Anytrades are another vital aspect to consider when evaluating its legitimacy. The broker has set a minimum deposit requirement of $500, which is relatively high compared to industry standards. This initial investment can be a barrier for many novice traders and raises questions about the broker's accessibility.

In terms of trading costs, Anytrades offers a spread starting from 2.1 pips, which is on the higher side compared to many competitors in the market. The following table summarizes the core trading costs associated with Anytrades:

| Cost Type | Anytrades | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.1 pips | 1.0 - 1.5 pips |

| Commission Structure | None specified | Varies (often $0) |

| Overnight Interest Range | Not disclosed | Varies |

The absence of a clear commission structure and the lack of transparency regarding overnight interest rates further complicate the overall cost assessment for traders. Such opaque policies can lead to unexpected fees, making it challenging for traders to accurately gauge their potential profitability.

Client Fund Safety

The safety of client funds is paramount when evaluating any forex broker. Anytrades claims to implement measures to protect client funds; however, the specifics of these measures are not clearly outlined. The broker does not provide information about segregated accounts, which are crucial for ensuring that client funds are kept separate from the broker's operational funds.

Moreover, the absence of investor protection schemes, such as those offered by top-tier regulators, further exacerbates concerns regarding fund safety. In the event of financial difficulties or disputes, clients may find it challenging to recover their funds, especially with a broker that operates under a lenient regulatory framework.

Historically, Anytrades has faced scrutiny over its fund safety practices, with numerous complaints from clients regarding withdrawal issues and fund accessibility. Such incidents highlight the potential risks associated with trading through this broker, as clients may encounter significant barriers when attempting to withdraw their funds.

Customer Experience and Complaints

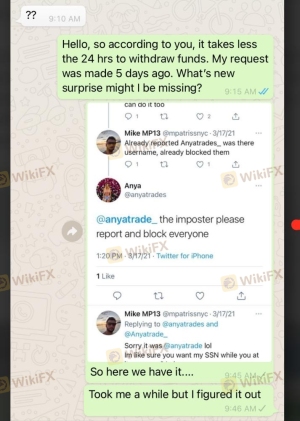

Analyzing customer feedback and experiences provides valuable insights into the reliability of Anytrades. Reviews from current and former clients indicate a mix of experiences, with many users expressing dissatisfaction with the broker's services. Common complaints include difficulties in withdrawing funds, unresponsive customer support, and high trading costs.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support | Medium | Unresponsive |

| High Fees | Medium | No acknowledgment |

For instance, one user reported an inability to withdraw their funds despite multiple requests, leading to frustration and financial loss. Another client mentioned that the customer support team was unresponsive to inquiries, further complicating the trading experience. Such patterns of complaints suggest that potential clients should approach Anytrades with caution.

Platform and Execution

The trading platform offered by Anytrades is a proprietary web-based solution, which lacks the popularity and features of established platforms like MetaTrader 4 or MetaTrader 5. User feedback regarding the platform's performance indicates that it may not be as stable or user-friendly as competitors. Issues such as slow order execution and slippage have been reported, which can significantly impact trading outcomes.

The quality of order execution is crucial for traders, as delays or rejections can lead to missed opportunities and financial losses. Any indications of platform manipulation or unfair practices should raise serious concerns for potential investors.

Risk Assessment

Using Anytrades presents several risks that potential traders should be aware of. The following risk assessment summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Operates under a low-tier regulator |

| Fund Safety Risk | High | Lack of segregation and protection |

| Customer Service Risk | Medium | Frequent complaints about support |

| Platform Risk | Medium | Reports of execution issues |

To mitigate these risks, traders should conduct thorough due diligence before engaging with Anytrades. It is advisable to start with a minimal investment and closely monitor trading conditions and customer support responsiveness.

Conclusion and Recommendations

In conclusion, the evidence suggests that Anytrades may not be a safe trading option for prospective investors. The lack of robust regulatory oversight, high trading costs, and numerous customer complaints raise significant red flags. While the broker claims to offer a variety of trading options, the potential risks associated with trading through Anytrades may outweigh the benefits.

For traders seeking reliable alternatives, it is recommended to consider brokers regulated by reputable authorities such as the FCA or ASIC, where investor protection and transparency are prioritized. Options such as OANDA, IG, or Forex.com are worth exploring for those looking for a more secure trading environment.

In summary, while Anytrades may present itself as a viable trading option, the potential for risk and loss makes it imperative for traders to exercise caution and consider more reputable alternatives.

Is AnyTrades a scam, or is it legit?

The latest exposure and evaluation content of AnyTrades brokers.

AnyTrades Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AnyTrades latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.