Anytrades 2025 Review: Everything You Need to Know

Summary: The overall evaluation of Anytrades reveals significant concerns regarding its legitimacy and regulatory status. Most sources classify it as an unregulated broker, raising serious red flags about safety and user experience. Key findings include a high minimum deposit requirement and dubious promotional practices.

Note: It is essential to recognize the varying entities operating under the Anytrades name across different regions, which adds complexity to its evaluation. This review aims for fairness and accuracy by consolidating information from multiple credible sources.

Ratings Overview

How We Rated the Broker: Ratings are based on comprehensive analyses of user experiences, expert opinions, and factual data from multiple reviews of Anytrades.

Broker Overview

Founded in 2016, Anytrades claims to be a provider of Contracts for Difference (CFDs) across various asset classes, including forex, shares, indices, futures, and commodities. However, it operates under a license from the Vanuatu Financial Services Commission (VFSC), which is often criticized for its lax regulatory standards compared to more reputable authorities like the FCA in the UK or ASIC in Australia. Notably, Anytrades does not support popular trading platforms such as MT4 or MT5, opting instead for a proprietary web-based platform.

Detailed Section

Regulatory Status

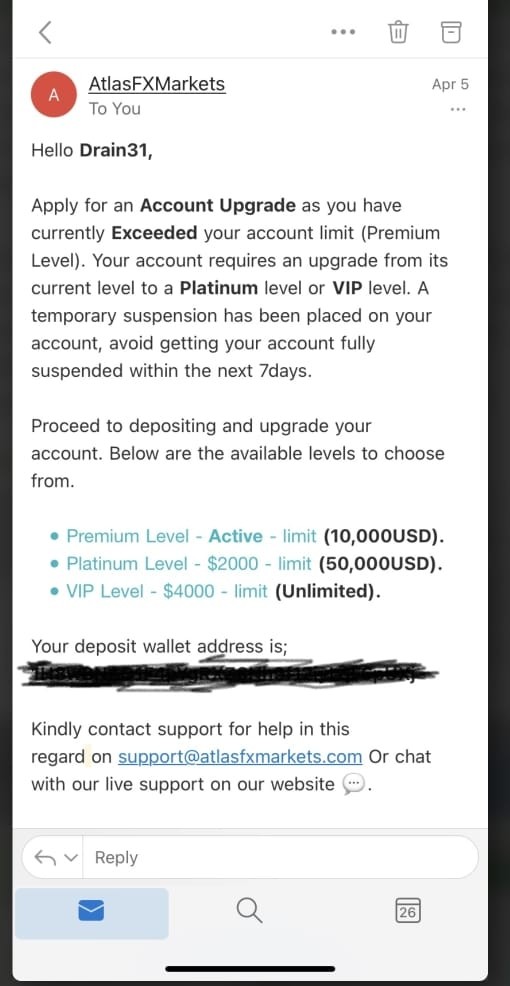

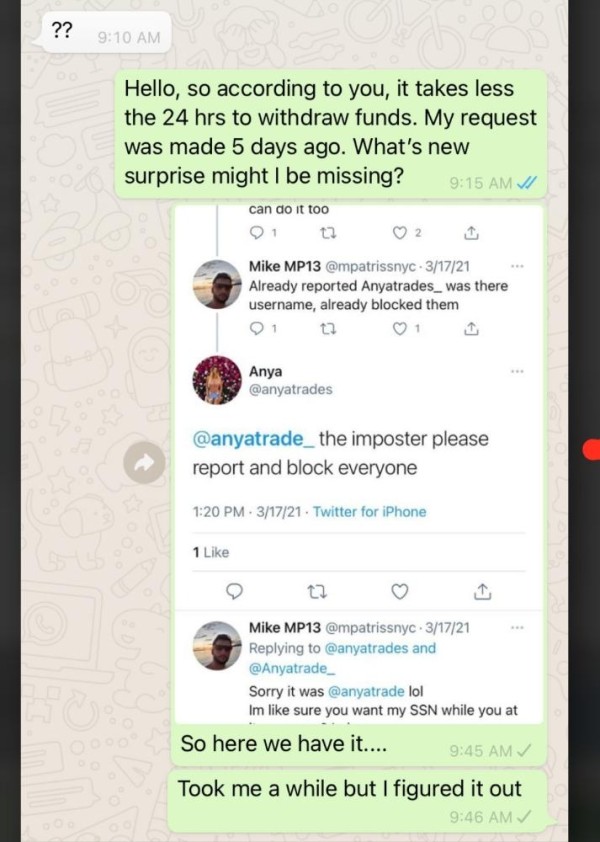

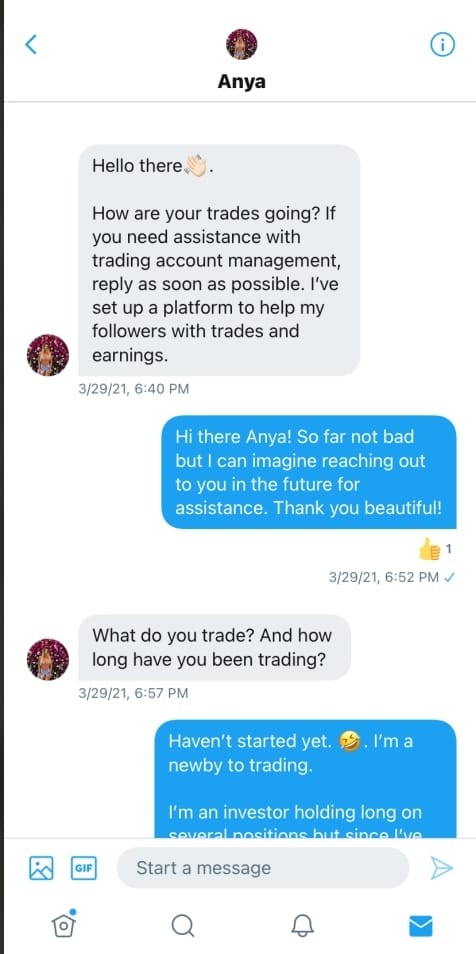

Anytrades operates under the VFSC, which has been deemed insufficient by many experts and regulatory observers. The lack of stringent oversight raises significant concerns about the safety of user funds. The Central Bank of Ireland and the UK's Financial Conduct Authority (FCA) have issued warnings against Anytrades, indicating that it is not a legitimate broker. This lack of credible oversight is a major red flag for potential traders.

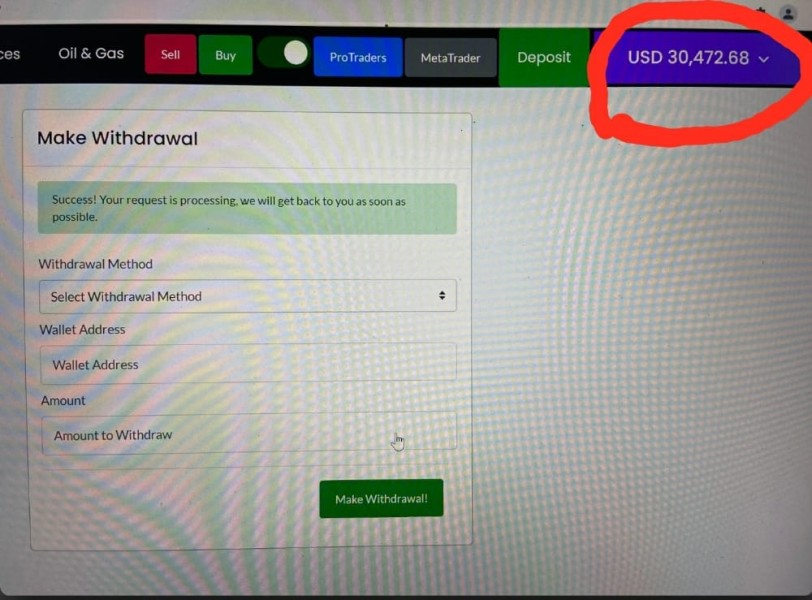

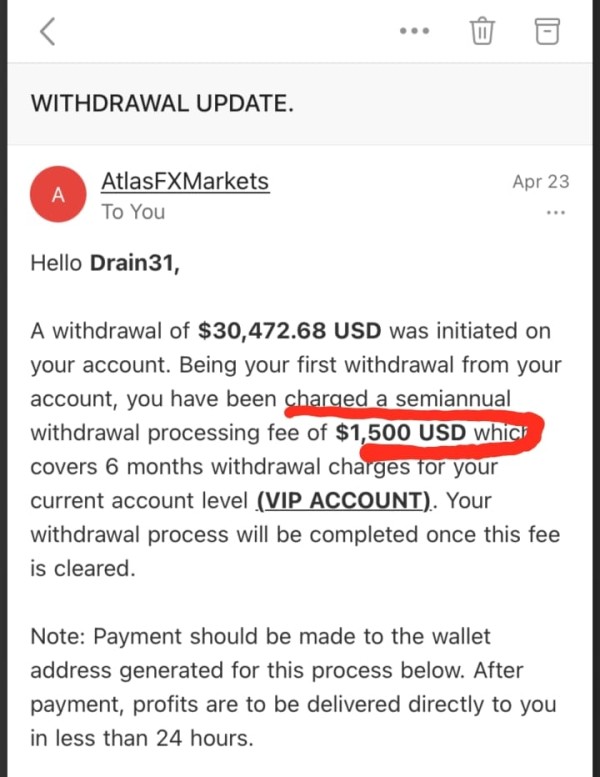

Deposit/Withdrawal Methods

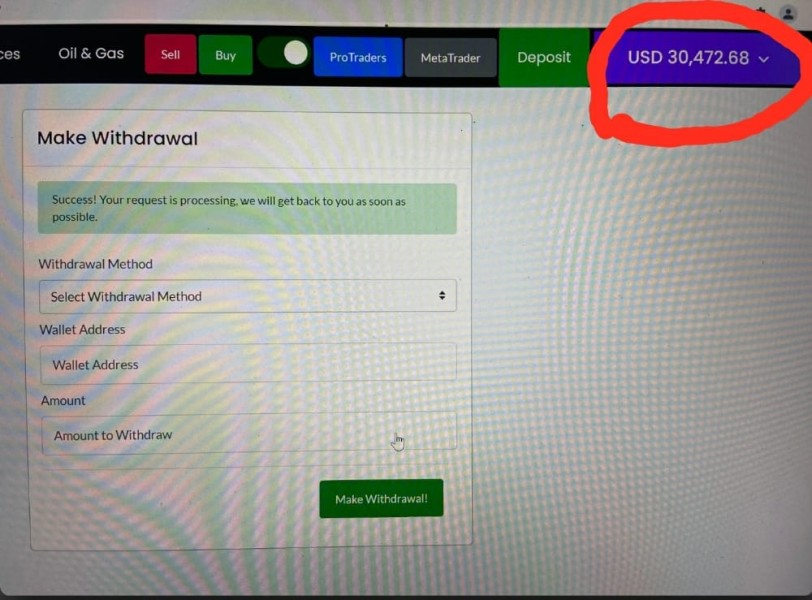

Clients can deposit and withdraw funds using standard methods such as Visa, MasterCard, bank wire transfers, and e-wallets like Skrill. However, the minimum deposit requirement is notably high at $500, which is above the industry standard. Additionally, Anytrades imposes conditions on withdrawals, particularly for accounts that benefit from bonus promotions—traders must achieve a specific trading volume before being eligible to withdraw their funds.

Minimum Deposit

The minimum deposit of $500 is considered excessive compared to many other brokers that allow entry with deposits as low as $250 or even $10. This high threshold may deter new traders from trying out the platform and raises questions about the broker's intentions.

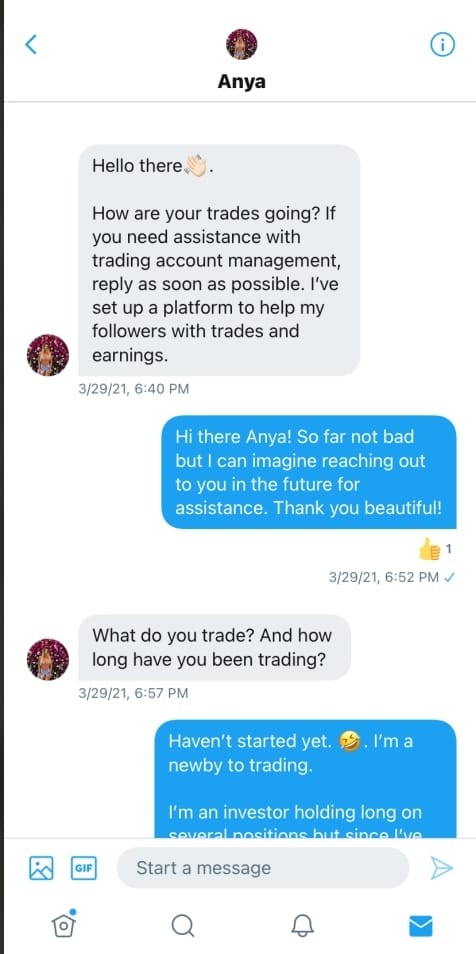

Anytrades offers promotional bonuses, but these are often viewed as traps, as clients must meet high trading volumes to withdraw their funds. This practice is common among unregulated brokers and typically signals a lack of transparency in their operations.

Trading Asset Categories

Anytrades claims to provide a diverse range of trading assets, including forex, commodities, indices, and shares. However, the absence of cryptocurrency trading options may limit its appeal to a broader audience, especially as digital currencies gain traction in the trading community.

Costs (Spreads, Fees, Commissions)

The spreads offered by Anytrades are reported to be relatively high, starting at around 2.1 pips, which could significantly impact profitability for active traders. The lack of clarity regarding additional fees further complicates the cost structure, making it difficult for traders to gauge the true cost of trading with this broker.

Leverage

Anytrades offers leverage up to 1:100, which is higher than the regulated limits in Europe (1:30). This could attract traders looking for higher risk/reward scenarios, but it also increases the potential for significant losses, particularly for inexperienced traders.

Anytrades does not support popular trading platforms like MT4 or MT5, which are favored by many traders for their advanced features and tools. Instead, it offers a proprietary web-based platform that lacks the robustness and reliability of established trading software.

Restricted Regions

While Anytrades accepts clients from various regions, including the US and EU, it operates without the necessary regulatory approvals in many of these jurisdictions, which raises legal concerns for potential traders.

Available Customer Service Languages

Anytrades offers customer support in multiple languages, which may provide some level of accessibility for international clients. However, the effectiveness and responsiveness of this support remain questionable given the broker's overall reputation.

Repeat Ratings Overview

Detailed Breakdown

- Account Conditions: The high minimum deposit and restrictive withdrawal conditions significantly undermine the attractiveness of Anytrades.

- Tools and Resources: Limited resources and the absence of popular trading platforms like MT4 or MT5 detract from the overall trading experience.

- Customer Service and Support: While available in multiple languages, the effectiveness of customer support is unverified and could be lacking.

- Trading Setup (Experience): The proprietary platform may not meet the expectations of traders accustomed to more sophisticated trading environments.

- Trustworthiness: The lack of credible regulation and multiple warnings from authorities severely impact Anytrades' trustworthiness.

- User Experience: Overall user reviews suggest dissatisfaction, primarily stemming from withdrawal issues and high deposit requirements.

In conclusion, the findings from various sources strongly suggest that traders should exercise caution when considering Anytrades as their broker. The combination of high deposit requirements, unregulated status, and questionable promotional practices paints a concerning picture for potential investors.